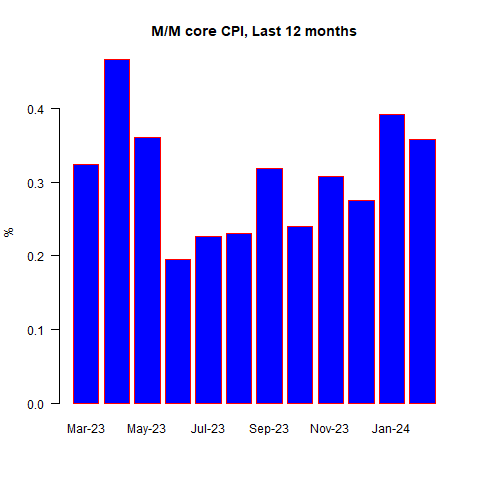

I must say that I didn’t see this one coming. Credit where credit is due, though: while Street economists were just a little low (consensus was +0.40% headline, +0.30% core), the CPI swap market at least got headline right (there being no market for core inflation CPI swaps) by pricing in +0.47%, seasonally adjusted.

The actual print was +0.44% on headline CPI, and a lusty +0.36% on core. I was lower, even though I got the big pieces right. I had some tails going the wrong way. Let’s get into it.

The things which threw me were airfares and used cars. Based on declines in jet fuel, I had anticipated that airfares would be roughly -6% m/m, and I merely got the sign wrong as they were +6.6%. Jet fuel was tighter on the East Coast, and I suspect regional differences there is what caused this wide divergence.

If I’m right, then airfares will underperform jet fuel over the next few months. If, instead, it’s a cost-of-labor or cost-of-equipment thing, or if it’s increased pricing power from airlines because of capacity constraints, then airfares won’t drop back and that would be a bad sign.

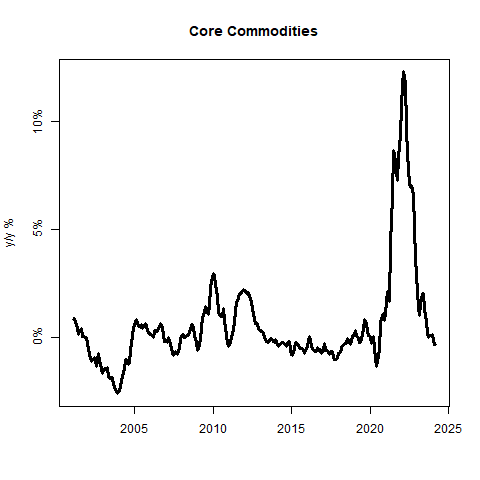

Similarly, Used Cars continues to outperform the Black Book survey. I had penciled in -1%, and Kalshi markets were around -1.5%, but Used Car CPI came in at +0.5%. This is a volatile series, and this miss is only interesting because Used Cars keeps missing a little high compared to the Black Book survey. That could be an issue of sample mix, but I’m not sure. New Cars were -0.10% m/m. Car and Truck Rental was +3.83% after -0.74% last month, so that’s another upper tail. Overall, core goods were steady at -0.3% y/y.

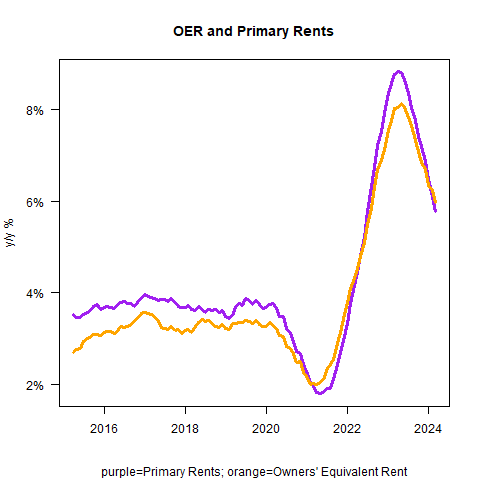

I said I got the big pieces right. I refer to rents. Remember that last month we had a large deviation between Owners’ Equivalent Rent (OER) and Rent of Primary Residence. Normally, these two track pretty closely, but occasionally they deviate and last month OER was 0.2% higher than Primary Rents.

That contributed to the very high median CPI in January, and there was a ton of discussion about whether the BLS had done something weird with the survey – they had, in January 2023, refined the OER weighting method and there was concern that this was a ‘mix’ problem that was going to continue to push OER higher than Primary Rents for a while.

The BLS contributed to this sense of confusion by sending out a blast email that seemed to suggest it was so; they had to walk that back and to their credit did a very nice webinar and have spent a lot of time this month explaining in excruciating detail how the OER survey is conducted.

Bottom line: there’s nothing to see here; sometimes the two series diverge slightly. Moreover, as I’ve pointed out previously, when natural gas prices are declining it tends to mean that the cost of imputed utilities is declining which, since they’re deducted from the rental survey used for OER means OER should be slightly higher than Primary Rents over time. Not 0.2% per month, though, and I expected this aberration would mostly close this month.

It did, with OER +0.44% m/m (was +0.56% last month) and Primary Rents +0.46% m/m (was +0.36% last month). Year over year, they’re about the same but OER has moved slightly above Primary.

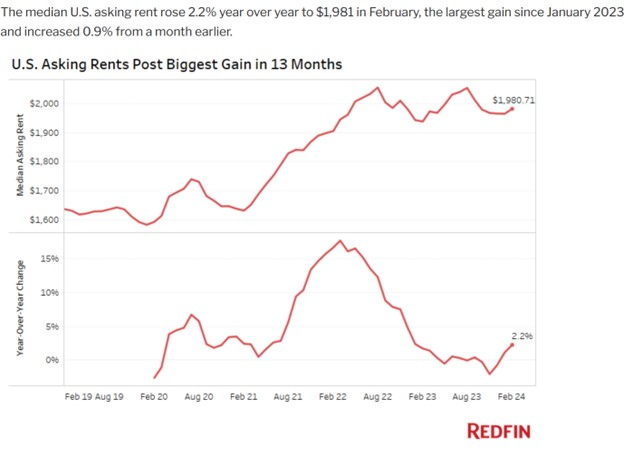

So the surprising part to me was that Primary came up some to help close that gap, not that the gap closed. I continue to expect rents to decelerate, along with everyone else – only, as I will keep saying until I am blue in the face, we are not going to go into rent deflation as so many people have been forecasting (folks seem to be backing off that now!) but rather we should drop into the 2%-3% range y/y before rebounding later this year.

There seems to be evidence of that in the independent rent measures. Below is a chart from a recent Redfin (NASDAQ:RDFN) news release. It bears noting, of course, that these rent measures also all went into deflation and misled all of those economists who lean on these high-frequency-but-low-quality data. (Having said that, Redfin does seem to be better than some others, but it’s still measuring something different than what the CPI is measuring).

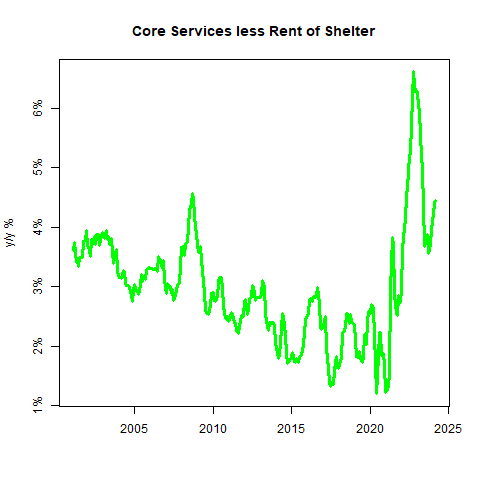

Now, the story starts to become a little clearer, albeit concerning. Core services rose to 5.4% y/y from 5.2% y/y, while core goods was unchanged as I noted above. Rents are coming down, but outside of rents we are seeing some stabilization at higher-than-pre-COVID levels.

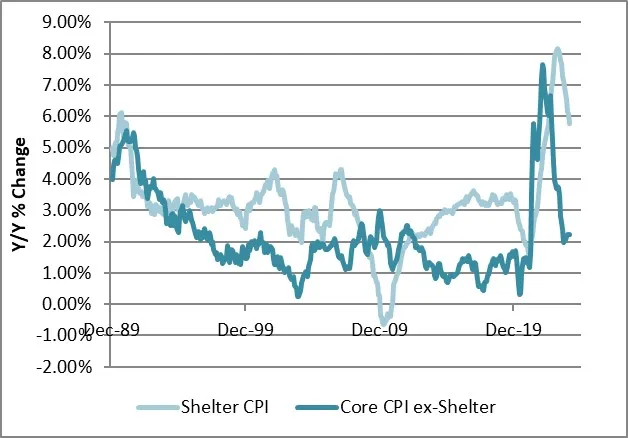

The chart below shows Shelter CPI, and Core CPI ex-Shelter, which has been roughly stable for three months around 2.25%. That sounds great, since 2.25% on CPI is roughly equivalent to 2% on the Fed’s PCE target except that 2.25% is higher than it was pre-COVID. The theme, and we’re seeing it in several places, is inflation being sticky at higher levels than it was pre-crisis.

There were some good parts to the report – notably Food, which was tame m/m for both Food at Home (-0.03% m/m versus +0.37% last month) and Food Away from Home (+0.10%, was +0.47%), although the latter is probably not sustainable given rapidly-rising wages. Still, it’s positive. Unless you’re buying baby food, which is +9.2% y/y!

Actually, babies got a lot more expensive this month. The largest increase in the categories used for Median CPI was Infant/Toddler Apparel. In general, apparel categories were right-tail items this month. But there were not enough of them to explain the high core CPI. Median was +0.39% (my estimate); since that’s right in line with core it says the tails weren’t what moved this number. It’s just that this month, inflation rose at something like a 4.25%-4.75% annualized pace.

With this, and with Core Services ex-shelter (“Supercore”) at +0.47% m/m – which means supercore accelerated to +4.3% y/y – it is inconceivable that the Fed will yet consider cutting rates. It is possible that they may later in the year, but there is far too much exuberance in the bond market about that prospect.

Indeed, there’s far too much exuberance generally. Stocks rose on an inflation report showing that inflation was higher than expected. I’m not saying that equities should crash on this data, but that’s the sort of reaction that you tend to see in bubbles. The market will be semi-reserved going into an economic report, but then rallies afterwards regardless of the data.

I have seen that sort of environment, where such a thing happened regularly, a couple of times in my career and they never ended well. To jump on this data, as if it was in any way positive, says that people were just waiting until after the number to buy, and they were going to buy no matter what. That’s not a healthy market, especially when that happens at high prices rather than low prices.

I continue to expect median inflation to decline to the high-3s, low-4s, maybe dipping a little lower than that in Q3 if rents bottom then as I expect. The bottom line is that we’re near levels where I have been expecting inflation to get sticky, and it seems to be happening. I didn’t see this particular month being sticky, but the general tenor of the data makes sense to me.