The property market has been falling since the RBA increased interest rates in May. Many economists think the worst is yet to come, but there is emerging evidence of a case that the Sydney market could stabilise in January, and other capital cities soon after.

Now six months post first rate rise, we have data to analyse the homebuyer reaction when borrowing power reduces. Analysing that reaction requires making an assessment of:

- How long does it take for an RBA rate rise to impact borrowing power?

- What is the impact of an RBA rate rise on purchasing power?

- When will the rate rises stop and at what level?

1. How long does it take for an RBA rate rise to impact borrowing power?

When you ask a bank for home loan pre-approval, they will use current interest rates (plus an APRA mandated buffer of 3%) to assess your suitability for their loan. If the day after being pre-approved for a home loan, a lender increases their rates due to the RBA rate rise, then some banks will reduce your maximum home loan immediately while others will honour the prior amount. If a bank honours it, then your borrowing capacity will only reduce once the pre-approval expires which is typically in 90 days’ time.

At the same time, homebuyers will adjust their own propensity to borrow by pricing in the increased interest rates into their future repayments and self-regulate by intending to borrow a lower amount.

So some homebuyers will reduce their borrowing power the day after a rate rise, while for others it might take 90 days.

2. What is the impact of an RBA rate rise on purchasing power?

If you use a borrowing capacity calculator and play around with the interest rates, you’ll see your borrowing capacity reduces by approximately -23% when your home loan rate increases by +2.5% (the current amount of RBA rate rises). Many property market analysts assume if your borrowing power reduces by -23%, then your purchasing power also reduces by -23% but that is unlikely to be true.

When you purchase a property, a portion of the money comes from borrowed funds, and the other portion comes from a deposit which is typically saved funds. When this occurs, your purchasing power is only partially impacted by changes to your borrowing capacity.

For example, take buying a $1m property where $500k came from a home loan and $500k came from money in the bank. If your borrowing capacity reduced by -23% from $500k to $385k, then your purchasing power at most would fall to $385k + $500k = $885k, making a fall of -11.5%.

And if originally you could have borrowed far more than $500k, such that even with a -23% fall in borrowing capacity you can still borrow $500k, then your ability to spend $1m on a property hasn’t changed at all.

On the other hand, if your $500k deposit didn’t come from saved funds but rather from proceeds of an upcoming property sale, then both your home loan and deposit are impacted by changes to borrowing capacity, one directly and one indirectly. This would mean that in the prior example, your purchasing power would reduce somewhere between -11.5% to -23%.

What the above demonstrates is that depending on the situation of the homebuyer, the current +2.5% increase in interest rates could impact their purchasing power by anywhere from 0% to -23%. Some homebuyers will be closer to 0% and others closer to -23%.

3. When will the rate rises stop and at what level?

This is the great unknown. The RBA started reducing the monthly rate rises from 50 bps to 25 bps in October. Perhaps there are a few 25 bps to go, perhaps there is only one 25 bps to go, and perhaps there are none.

Let’s use the emerging data to answer these questions

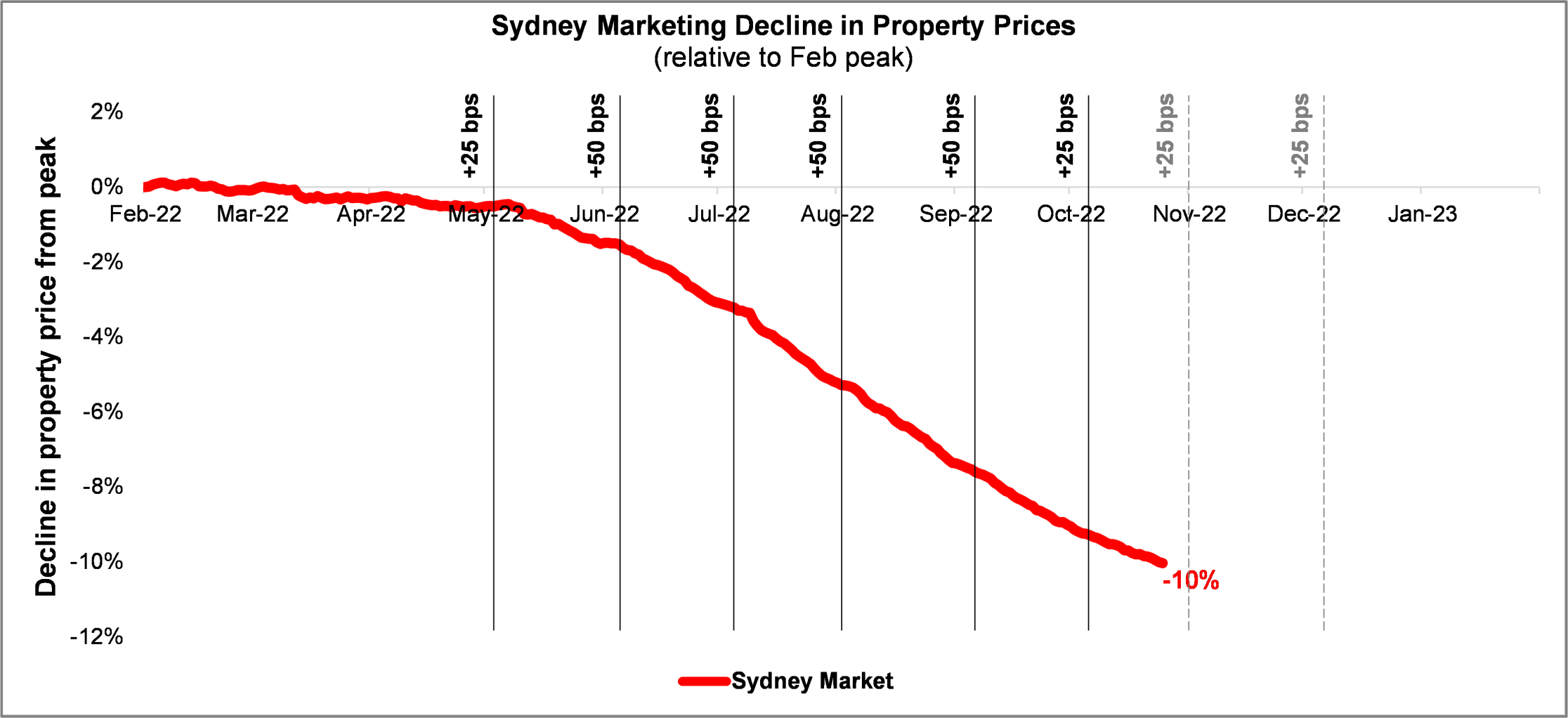

CoreLogic provides daily data on residential property price changes using information collected when a property exchanges contracts – so it’s very much reflective of the current market conditions. The chart below shows how the Sydney property market has fallen in value from the peak in February 2022 alongside when RBA rate rises occurred and by how much.

(Sydney market data source: CoreLogic Daily Indices)

The reaction of the Sydney property market to these rate rises gives insight to answer our first two questions above.

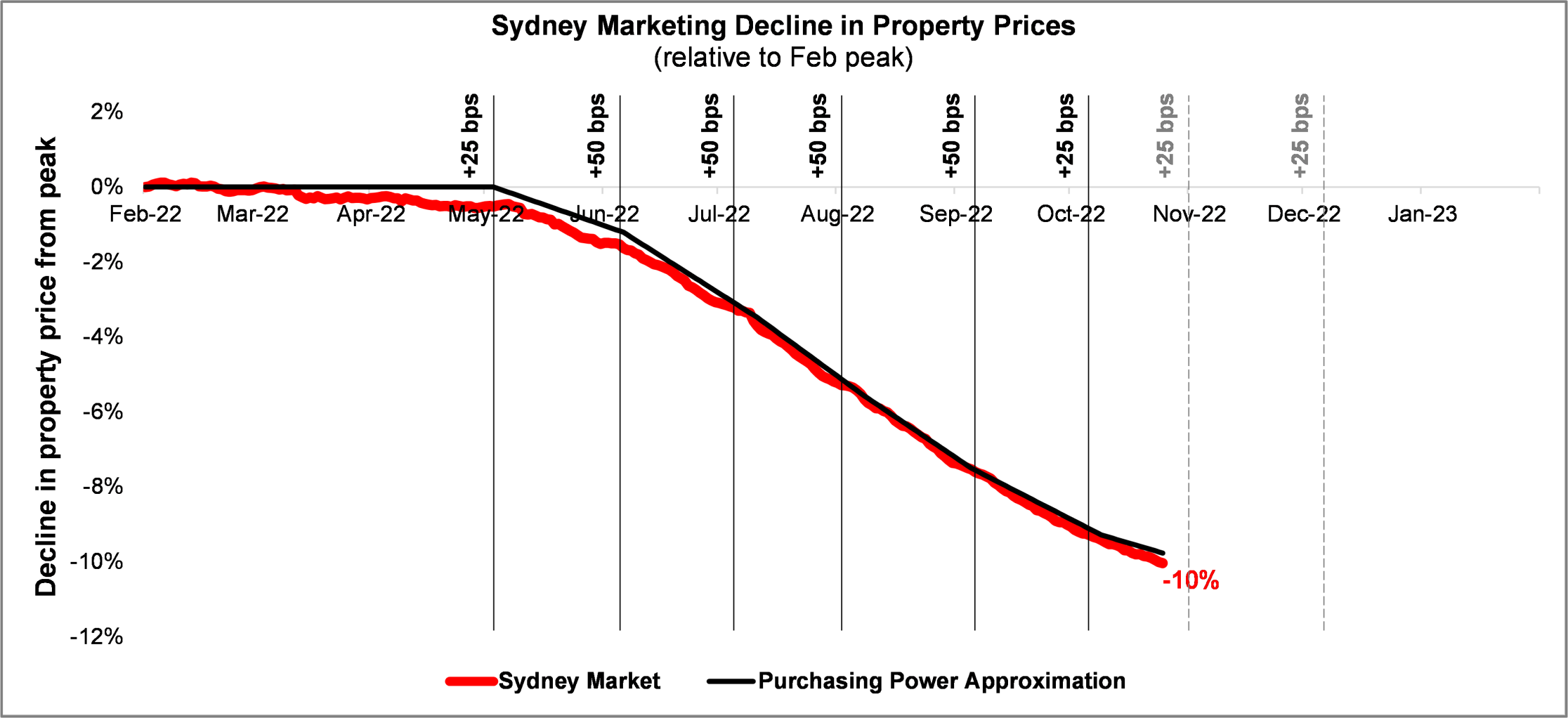

Answering these questions first requires us to represent Sydney market purchasing power as a mathematical equation broken down into borrowing capacity multiplied by the percentage discussed in question (2) and lagged by the delay discussed in question (1). This equation allows us to play with different values for (1) and (2) until we can recreate the reaction of the Sydney property market above:

The purchasing power approximation gives us an initial answer for (1) and (2) as:

- What is the average time it takes for a homebuyer to reduce their borrowing power after an RBA rate rise? 33 days

- How much of the reduction in borrowing capacity from an RBA rate rise flows through into reducing purchasing power? 45%

Let’s project this forward

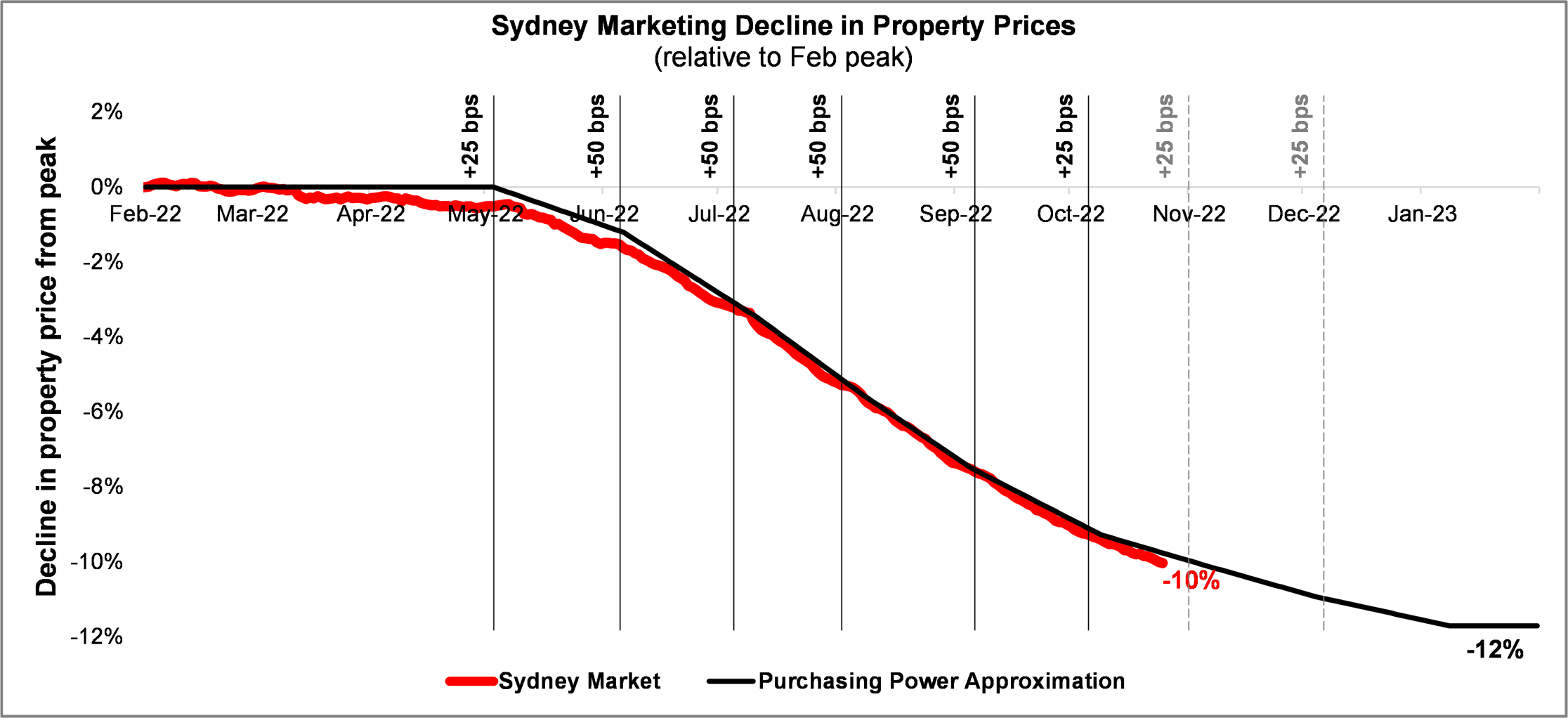

Armed with the above, we can form an opinion on question 3 (how many more RBA rate rises) to project how the Sydney property market might play out!

Economists are currently arguing that rates could stabilise in the short term from anywhere between 2.60 (current rate) to 3.60. The next CPI release is due on 25th January just before the first RBA meeting of 2023 on the 7th February. Let’s assume the January 2023 CPI release shows a reduction in inflation with higher mortgage repayments putting downward pressure on household budgets. In this scenario the most likely outcome would be two 25 bps rate rises in November and December, followed by a pause in further rate rises with the RBA rate landing at 3.10.

It shows the Sydney property market stabilising in January 2023 at a -12% fall from the February 2022 peak.

What can go wrong?

There you have it – the case for how the property market could stabilise in January at an -12% fall in property prices from the peak. But there are many things that could counter this logic, namely:

- Homeowners become forced sellers. The above analysis is only looking at the demand side of the property price equation and assumes homeowners are not forced sellers. If the increase in monthly repayments from rate rises become too much for homeowners, especially if employment conditions worsen, then homeowners could become forced sellers which would trigger a second wave of falling property prices. Given the homeowner optionality of moving to interest only repayments coupled with the low unemployment environment, this scenario feels a while away.

- The RBA implements more rate rises. I was potentially optimistic with rates only increasing to 3.10, but it’s very possible they go further. This model shows if rates increase to 3.60 then Sydney property market will fall -14% from the February 2022 peak.

- The model is wrong, and the Sydney property market is reacting far slower than the model suggests. We all know models can be wrong, especially those retroactively fitting to historical data.

- Consumer sentiment towards the asset-class changes and there is a lag in rebuilding confidence in it.

The Bottom Line

Regardless of where rates finish in 2023, the next 12-18 months is likely to create strong buying opportunities as prices stabilise and then resume their upwards trend.

In times of high leverage the recent rates rises by the RBA are unprecedented and could materially reduce consumer and business spending indicators coming out early to mid next year. If the decline in spending translates into unemployment, then once inflation is under control the likely reaction from the RBA would be a series of rate decreases.

It is very possible this whole sequence unfolds in 2023 which would unlock the next wave of growth for residential property in Australia.

If you're a homebuyer waiting for the market to plateau, now might be a good time to start talking to your bank or mortgage broker about a home loan pre-approval. And if you're short of deposit funds for the home you want, FrontYa may be in a position to boost your deposit.

Disclaimer: The views here are expressed as my own, and not necessarily of FrontYa nor how FrontYa prices in risk. Robert Baskin and FrontYa are Authorised Representatives (AR No. 1296021 and 1296020) of Orion Capital Partners Pty Ltd (AFSL No. 345908).