An impending US Crude Oil Inventories result is being watched eagerly by oil bulls as it could illicit another surge for the commodity. The figure is predicted to post only a 0.97M build but some are hoping for another surprise decrease in the outcome. Furthermore, the rig count data seems to support the argument that the US results could feasibly post a low or negative figure. However, before getting too excited, it’s important to remember that the US is not the only force at play in the global oil markets.

Taking a closer look at recent Baker Hughes Rig Count figures, it is apparent that the US is, in fact, scaling down production. According to the March figures, the US count has fallen by 176 rigs this year which represents 51.76% of the global 340 rig count reduction. Consequently, expectations of a lower US Crude Oil Inventories build this week are more than reasonable. However, a reduction in the US Crude Stocks does by no means signal that the global supply glut is nearing an end.

By adding the Canadian and the United States’ rig count reductions together, it becomes evident that 82.35% of the global reductions come from these two countries. However, these two nations account for only 19.74% of international oil production. This is an important point as it reveals that the countries which produce the remaining 80.26% of global oil supply are responsible for only 17.65% of the reduction in global rig count. As a result, hopes that the rest of the world is following the US example are a touch optimistic and therefore, excess supply could be a problem for a while yet.

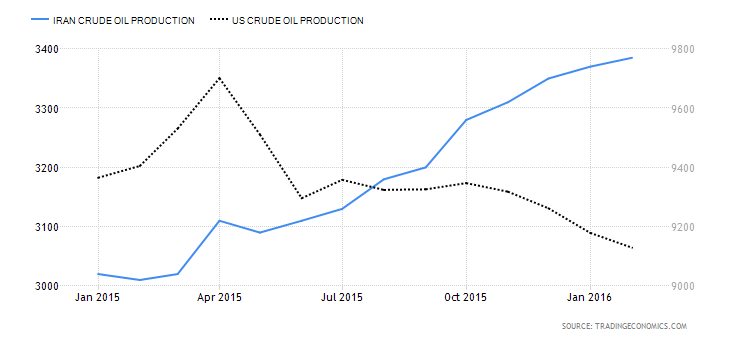

Moreover, reduced US oil production in barrels per day terms can be entirely offset by increases in global production. Looking at the last 12 months of US and Iranian oil production shows that the newly sanction free nation is ramping up production as fast as the US can scale it back. Additionally, increased production is not unique to Iran as Russia has also been accelerating production for the past year. Consequently, after the failed OPEC production freeze there could be a serious uptick in oil output as producers capitalise on the recent price rally.

Furthermore, even if the imminent US Crude Oil Inventories result can inspire another rally, there remains limited scope for oil prices to climb. Ultimately, increasing prices will facilitate the entry of shale producers into the market and subsequently reverse the downtrend in US oil production. Furthermore, this price level could be lower than we have historically seen. Research from Rystad Energy AS has estimated that break-even prices for shale producers could have decreased by as much as 44% in the last three years.

In the end, the global oil supply glut is far from being over and the market should be careful about getting ahead of itself. Whilst the US rig count is falling, reductions in US oil production can, and are, being offset by global increases from Iran and elsewhere. As a result, the long-term recovery of oil prices might be some time coming. Furthermore, weakening US Crude Oil Inventories should be taken with a pinch of salt.