This comes as the quarterly ABS Living Cost Index (LCI) revealed a 2.0% increase in living expenses for employed Australians in the March quarter.

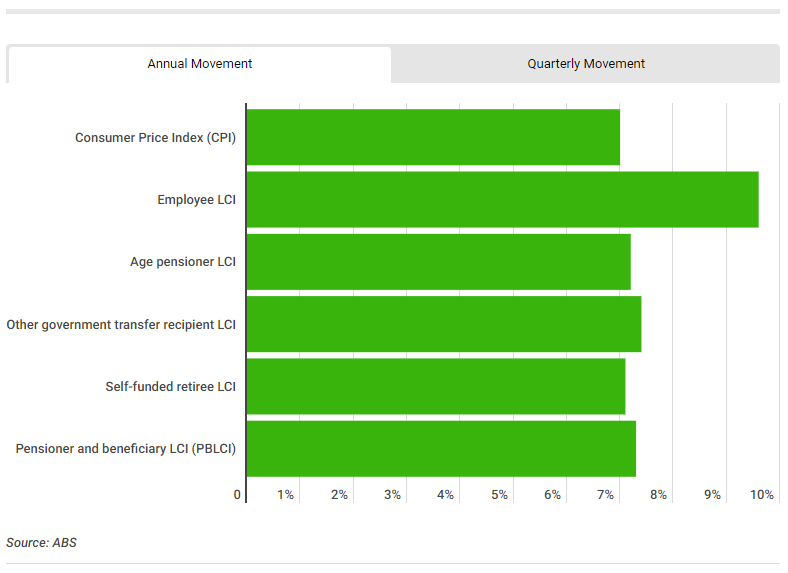

- ABS Living Cost Index (LCI) revealed on an annual scale, employees are the hardest hit by cost of living pressures at a rate of 9.6%.

- The LCI print of 9.6% annually to the March quarter for employed Aussies lies 2.6% above the rate of inflation for the same period.

- Mortgage interest charges and food were the main contributors, increasing 78.9% and 7.9% to the March quarter respectively.

In similar fashion to the December quarter, the LCI for employed Australians from January through March was ahead of the rate of inflation, sitting at 1.4%.

On an annual scale, the LCI for employed Australians to the March quarter rose to 9.6% - 2.6 percentage points ahead of the current rate of inflation.

ABS Head of Prices Statistics Michelle Marquardt said living costs for employee households recorded the largest annual rise of all household types, at 9.6% to mark the largest increase since this series started in 1999.

“The last time the CPI recorded an annual increase of 9.6% was in 1986,” Ms Marquardt said.

“Employee households were particularly impacted by increases in mortgage interest charges, which are a larger proportion of their spending than for the other household types.

“Mortgage interest charges rose 78.9% over the year. This was up from 61.3% in the December 2022 quarter reflecting the Reserve Bank of Australia’s cash rate rises.”

Food was the other contributor to the significant annual cost of living increase for employed Australians, increasing 7.9% to the March quarter.

It’s important to note that the LCI published by the ABS reflects changes over time in the purchasing power of the after-tax incomes of households.

This therefore measures the impact of changes in prices on the out-of-pocket expenses to gain access to a fixed basket of consumer goods and services.

On the other hand, the Australian Consumer Price Index (CPI) is designed to measure price inflation for the household sector as a whole as opposed to the changes in the purchasing power of the disposable incomes of households.

Quarterly living expenses increase across all household types

The ABS revealed all household types aside from self-funded retirees, experienced a quarterly increase in living expenses higher than the rate of inflation, sitting at 1.4%.

Ms Marquardt noted this was due to higher prices for health, housing, food and interest charges contributing to increased living costs for all household types.

“Self-funded retirees recorded the smallest quarterly increase at 1.3% of all household types,” she said.

“These households have a larger proportion of their spending on international holiday travel and accommodation than the other household types.

“As international holiday travel and accommodation prices fell in many destinations due to the start of the off-peak season, this had a bigger impact on self-funded retirees.”

"Cost of living crisis hits employed Australians the hardest" was originally published on Savings.com.au and was republished with permission.