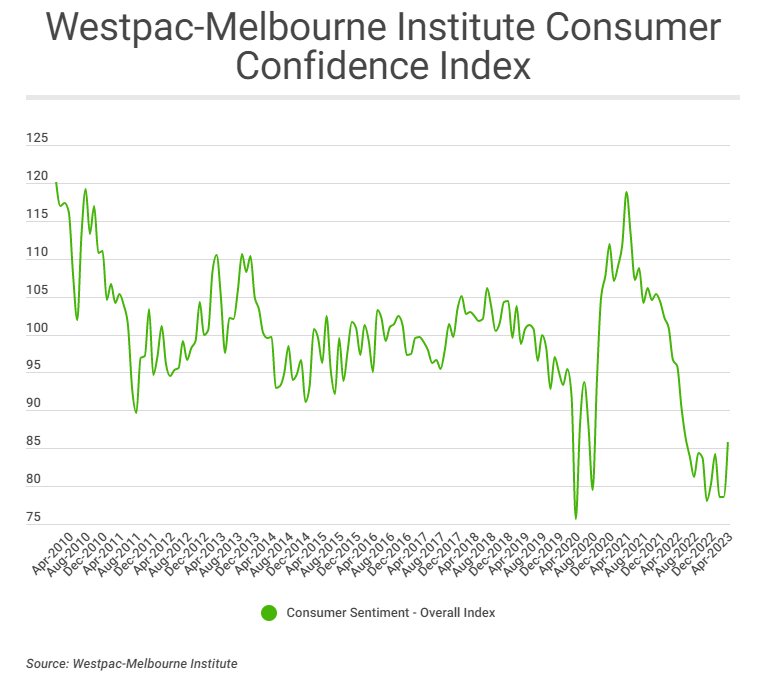

The Westpac-Melbourne Institute Consumer Confidence Index lifted 9.4% to 85.8 in April, with confidence across mortgage holders growing 12.2%.

- Westpac-Melbourne Institute Consumer Confidence Index lifted 9.4% to 85.8 - marking the highest level of consumer confidence since June 2022.

- Outlook for property prices grew 16.7% to remain only 2.8% below the level of April 2022 when the RBA commenced its tightening cycle.

- Confidence in housing is reflected in the CoreLogic Home Value Index which reported 0.6% growth in property prices nationwide in April - the first time a positive result has been recorded in 10 months.

The largest gains in confidence were observed across the outlook for property prices, with the survey recording an uptick of 16.7%.

Westpac Chief Economist Bill Evans noted confidence in the outlook for house prices has boomed.

“The national index of House Price Expectations lifted by 16.7% to 130.31, only 2.8% below its level in April last year, just before the tightening cycle began,” Mr Evans said.

“The index has increased by a remarkable 43% since its recent low in November last year.”

Still, an index rating of 85.8 is still pessimistic by historic standards.

Across the states, confidence in the outlook for property prices lifted in Western Australia by 36%, Queensland by 30%, New South Wales by 16% and Victoria by 9.5%.

The growing confidence surrounding property price expectations comes as CoreLogic’s Home Value Index for April recorded a 0.6% lift in national property prices for the first time in 10 months.

Despite the uptick in confidence, Mr Evans detailed survey respondents are remaining cautious with 34.11% still expecting the Standard Variable Rate to be raised by more than one percentage point over the next year.

“That proportion is certainly down from 44.55% in March and 59.64% in November but still points to considerable apprehension around interest rates on the part of consumers,” he said.

“With underlying inflation still likely to be in the 6.5%–7.0% range and the unemployment rate holding around fifty-year lows the case for extending the pause in May is likely to be challenged.

“The Board’s decision will be to weigh the “here and now “evidence against its two-year forecast.”

"Consumer confidence rebounds 9.4% following RBA’s April pause" was originally published on Savings.com.au and was republished with permission.