Promises, and more promises: the G20 wrapped on Saturday with US President Donald Trump and China's leader Xi Jinping agreeing to agree, at a later date, on a US-China trade pact that would instantly spare Beijing from more Washington tariffs, while Saudi Arabia and Russia concurred on the need for oil output cuts—both developments that, on the surface, seem good for commodities.

But scratch that surface and many questions may emerge.

What certainty is there that the US will not hike duties on Chinese imports three months down the road, if Beijing doesn’t open its markets as promised? Trump certainly threatens to boost the existing 10 percent rate on Chinese tariffs to 25 percent “if the endeavor to negotiate in the next 90 days fails.”

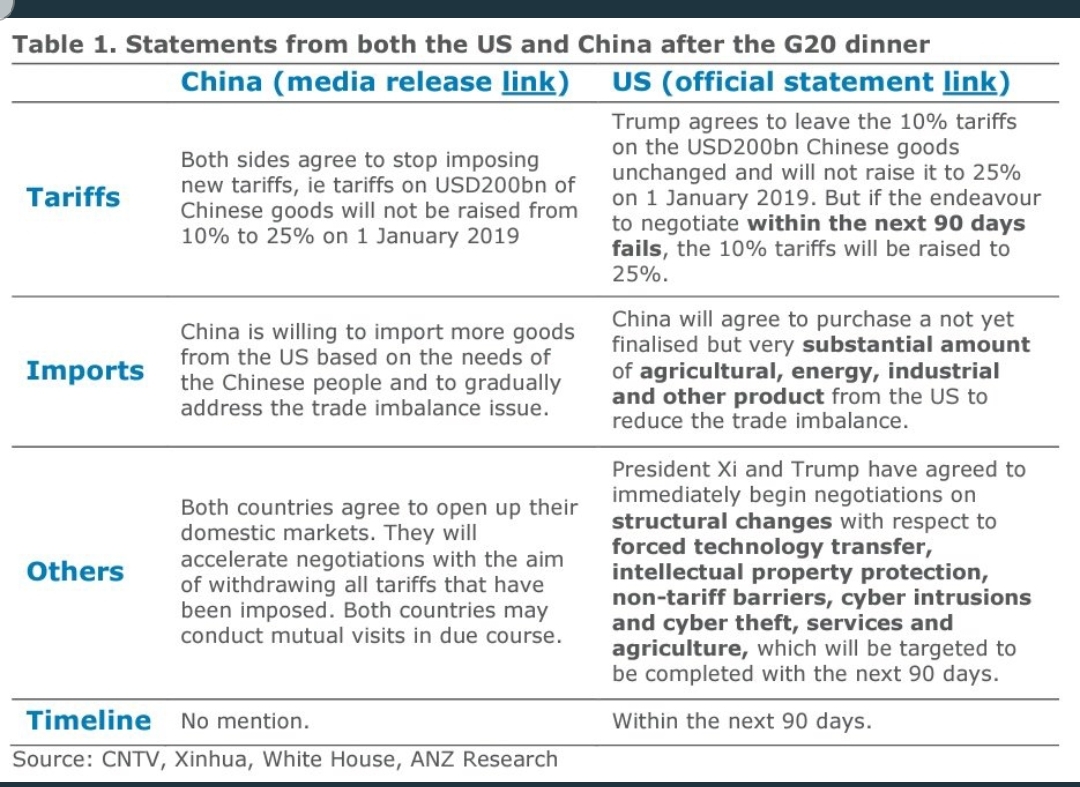

And will China buy “a very substantial amount of agricultural, energy, industrial, and other product from the United States to reduce the trade imbalance,” as the White House announced after the dinner chat held on the sidelines of the G20 by presidents Trump and Xi? This is a particularly important ask as China, in its own announcement, mentions no specific products, agenda or dollar amounts on the so-called commitments cited by the United States (US and China positions compared below for wording).

Will Xi Do As Trump Expects?

Scott Kennedy, a China expert at the Center for Strategic and International Studies, notes in a weekend analysis that ran on Politico that the Chinese president might do a lot less towards a trade deal than Trump expects. Says Kennedy:

“If Xi’s history is any judge, we will just see more of the same and no substantial changes."

Analysts say the best quid pro quo that could be assumed on China’s part is the country once again becoming the top international destination for US soybeans—a position hurt briefly by Beijing’s imposition of retaliatory tariffs on American farm products earlier this year.

Soybeans Could Rally Nevertheless

Expectations of larger Chinese buying could certainly help soybean prices catch a bid. Soy futures on the Chicago Mercantile Exchange have rebounded lately on speculation that a successful outcome to the Trump-Xi talks will open the floodgates for imports of the commodity from America.

CME soybeans posted their largest gain in four months in November—just under 5 percent—despite remaining down 7 percent on the year.

Technical analysts on Investing.com already rate the benchmark January soybean contract on the CME, which settled on Friday at $8.94 per bushel, a “Strong Buy,” without factoring in the possibility of more Chinese demand. Based on the Woodie’s technical pattern, the highest potential resistance for the contract is seen at $9.06 per bushel—meaning a gain of 12 cents per bushel or 1.3 percent from existing levels.

Mohammed bin Salman And Putin Do Their Bit For Oil

What about crude oil? A lower-key meeting—but just as important to oil as the Trump-Xi discussions were to trade—also occurred at the G20 between Saudi Arabia’s Crown Prince Mohammed bin Salman and Russian President Vladimir Putin.

According to the official Saudi Press Agency, the two leaders discussed rebalancing the world's oil market. Putin later told reporters that Russia reached “an agreement to prolong our accords" with Saudi Arabia. Uncoding their statements, they meant the same thing: Moscow will back Riyadh in its quest to announce production cuts when the Organization of the Petroleum Exporting Countries (OPEC) meet between December 6 and 7.

Since hitting four-year highs exactly two months ago, both US West Texas Intermediate and UK Brent crude have lost about a third of their value on oversupply concerns. Of the two, WTI is in a more dire spot, hitting 13-month lows beneath $50 per barrel on Friday.

While Russia isn’t an OPEC member, being the world’s third largest oil producer—with the first and second positions held by the United States and Saudi Arabia, respectively—has made Moscow a willing player in the 15-member cartel’s so-called market rebalancing since 2016. It was Russian-Saudi cooperation that brought WTI back up from lows of nearly $25 per barrel in 2016 during another glut caused by US shale crude. The United States has no national oil company and does not collaborate with OPEC.

Crude Rebound Won’t Last Without Meaningful Cuts

This year, the Russians have stalled on giving Riyadh their outright backing for a cut, though Putin continued to show friendly behavior towards Crown Prince MbS at the G20 despite world leaders ostracizing the young Arab leader for his suspected hand in the murder of his fierce critic, the journalist Jamal Khashoggi. Even then, Putin told reporters there was “no final deal on volumes” to be cut.

Media reports on Friday suggested that OPEC was working on a 1.3 million barrel bpd cut from its October production of 32.9 million barrels.

WTI settled on Friday at $50.93 per barrel. Investing.com’s daily technical outlook calls for a “Strong Sell”, with Woodie’s Level 3 support pegged as low as $47.73—back to September 2017 levels. Brent traded as low as $58.25 before the weekend, also earning a “Strong Sell” call. Level 3 support for the UK crude market is pegged at $55.20—a low going back to October 2017.

Without solid cuts, it might be hard to sustain any rally in either, said Dominick Chirichella, director of trading risk at New York’s Energy Management Institute:

“Unless OPEC and its non-OPEC partners decrease production by 1 million barrels per day or more at the Dec 6 meeting, the market is going to yawn at the meeting and likely send prices lower.”

Meanwhile, Canada’s Alberta province might have done the Saudis a favor ahead of the OPEC meeting by announcing on Sunday that it was cutting its oil output by 325,000 bpd from January, to try and reverse a historic price slide that has caused Canadian crude to sell at significantly lesser prices than WTI.