This article was written exclusively for Investing.com

- Crude oil makes a new multi-year high last week - The next technical target is the gateway to triple-digit crude oil prices

- A perfect bullish storm for crude oil

- Factor one - US energy policy

- Factor two - Inflation

- Factor three - Demand is going nowhere but higher - Look at the price action in two other energy commodities

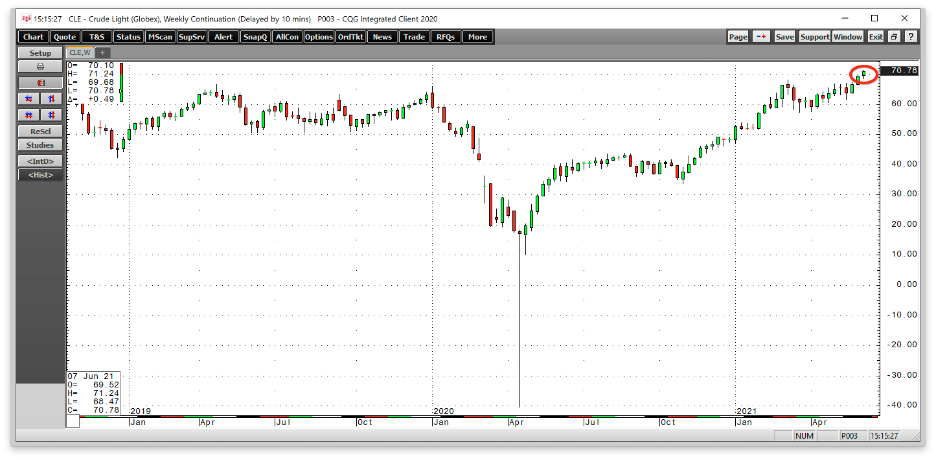

The spike low at negative $40.32 per barrel on the nearby NYMEX crude oil futures contract on Apr. 20, 2020, shocked the oil market and the world. Since crude oil futures began trading at the CME’s NYMEX division in 1983, the price had never declined below $9.75 per barrel. This century, the low was $16.70 before that fateful day.

Crude oil has taken a staircase higher since the April 2020 low. The NYMEX contract settled at $48.42 per barrel at the end of 2020, an amazing comeback from the low. In 2021, the price continued to rally. Crude oil has not traded below $50 per barrel since the first week of this year. It has not been below $60 since a correction took the energy commodity to $57.25 in late March. Last week, the price climbed above $70 per barrel for the first time since October 2018.

We have seen many commodities reach multi-year highs over the past weeks and months. The latest were copper, lumber, and palladium, which made new record peaks in May. Gold traded to its highest price in history in August 2020. Over the past months, many agricultural commodities reached multi-year highs along with other raw materials. While many have pulled back from the highs, last week was oil’s turn to appreciate.

Crude oil has been on a bullish staircase, making higher lows and higher highs over the past 14 months. The trend looks set to continue and take the energy commodity to higher highs over the coming weeks and months.

Crude oil makes a new multi-year high last week - The next technical target is the gateway to triple-digit crude oil prices

Crude oil continued to climb last week, reaching the highest level of 2021 and since October 2018.

Source: CQG

The weekly chart highlights the latest new high at $71.24 on Friday, June 11. Crude oil has been on a steady path of higher lows and higher highs since early November 2020, with the only correction this March. The price briefly probed below the $60 level and eclipsed $70 per barrel last week. Nearby NYMEX crude oil futures closed 2020 at $48.52. The price has not been below the $50 level since the first week of January.

Source: CQG

The monthly chart illustrates the next upside target stands at the October 2018 $76.90 high. The critical technical resistance level could be a gateway to triple-digit prices not seen since 2014.

A perfect bullish storm for crude oil

At the most recent high, nearby NYMEX futures made an incredible recovery from the Apr. 20, 2020 low. Crude oil moved $111.58 higher over the past 14 months.

Commodity prices have been in bullish mode since reaching bottoms in March and April 2020.

The last time the raw materials asset class experienced the current level of consistent price appreciation was following the 2008 global financial crisis, which pushed prices to lows in 2008, which gave way to rallies that took them to multi-year or all-time highs in 2011 and 2012.

So far, in 2020 and 2021, gold, copper, lumber, palladium, and soybean oil have risen to new all-time peaks. Grain and other agricultural commodity prices have risen to multi-year highs.

Last week, while many of the other high-flying commodities were consolidating after recent highs, crude oil took the bullish baton. At least three factors could make the current environment a perfect bullish storm for the crude oil market over the coming months and years.

Factor one - US energy policy

Perhaps the most bullish issue facing crude oil is the retreat of the world’s leading producer, the United States. On his first day in office, President Joseph Biden canceled the Keystone XL pipeline project that carries petroleum from the oil sands in Alberta, Canada, to Steele City, Nebraska, and beyond to the NYMEX delivery point in Cushing, Oklahoma.

More recently, the Biden administration banned fracking and drilling on federal lands in Alaska. The “drill-baby-drill” and “frack-baby-frack” policies under the previous administration are, as the Saudi oil minister said earlier this year, “dead.”

At the peak, in March 2020, the US produced an average of 13.1 million barrels per day. As of June 4, the Energy Information Administration reported that daily output stood at the 11.0 mbpd level, 16% below the high. Meanwhile, Baker Hughes said that the number of oil rigs operating in the US stood at 365 as of June 11, 166 higher than the same time in 2020. While the rig count is rising, production is likely suffering from increasing regulations, weighing on supplies.

As the US addresses climate change, the production of all fossil fuels will decline. The dramatic shift in energy policy comes at a time when inflationary pressures and energy demand are booming. Meanwhile, the oil market’s pricing power has passed from the US back to OPEC and Russia. After years of suffering from low prices because of US shale production, the international oil cartel and Russians are now positioned to squeeze US consumers. OPEC’s mission is to extract the optimal return for producers.

Factor two - Inflation

The US Fed created a tidal wave of liquidity via a Fed Funds rate at zero and quantitative easing to the tune of $120 billion per month. The Fed has said it is not thinking about tapering QE or increasing short-term rates given its “full employment mandate.”

Moreover, the tsunami of trillions of dollars in government stimulus in the US to stabilize the economy during the pandemic has added more inflationary fuel to the fire. After over a year of unprecedented monetary and fiscal policy accommodation, the latest May consumer price index highlights the impact. The CPI rose by 5%, with core inflation excluding food and energy increasing by 3.8%, the highest level in nearly three decades.

Inflation erodes money’s purchasing power and is bullish for raw material prices. Crude oil is no exception, as rising inflation is the wind behind the bull market trend in the energy commodity.

Factor three - Demand is going nowhere but higher - Look at the price action in two other energy commodities

After a year of social distancing and working from home, vaccines creating herd immunity to the virus is sending people back to work. As they travel to the workplace, gasoline demand is rising. Moreover, long overdue vacations will increase the demand for gasoline and jet fuel, both oil products. Energy demand is robust as COVID-19 fades into the rearview mirror.

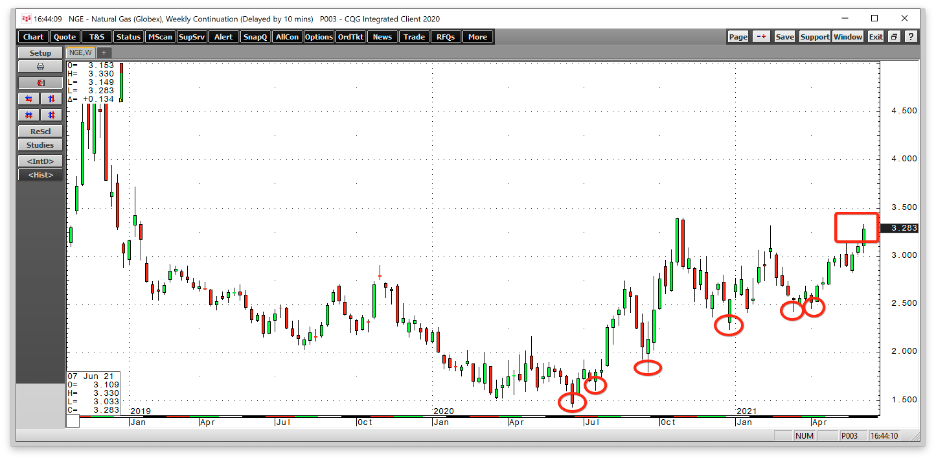

Meanwhile, oil is not the only energy commodity experiencing a bullish trend these days.

Even though the natural gas futures market is in the offseason, where gas slows into storage, the price has been trending higher, making higher lows since June 2020.

Source: CQG

The weekly chart shows that natural gas futures traded to a high of $3.33 per MMBtu on June 11, the highest price of 2021, and double the price last June when it fell to a 25-year low of $1.432 per MMBtu. July natural gas futures settled at the $3.296 level last Friday. The last time the energy commodity traded above that price in June was in 2014.

Source: CQG

Meanwhile, at $2.31 per gallon wholesale, ethanol is trading at its highest price since April 2014. The biofuel has rallied on the back of higher gasoline, corn, and sugar prices. In the US, corn is the primary ingredient in ethanol. In Brazil, sugarcane is the input in the production of the biofuel.

Rising oil demand, the shift in US energy policy, and increasing inflation create an almost perfect bullish storm for crude oil’s price. The next test comes at $76.90 per barrel, which could be a gateway to the levels seen in 2014. Natural gas and ethanol have already hit the highest prices since that year, natural gas from the June perspective, and ethanol from its nominal price. Crude oil could be on its way to join them as the path of least resistance remains higher.