The central bank made the call to increase the cash rate by 25 basis points to 4.35% last Tuesday – the highest it's been in 12 years.

- Three of the big four banks passed the RBA's November hike on in full to new borrowers signing on to variable home loans

- Existing borrowers must be given 21 days notice before their repayments change

- ING, Bendigo Bank, and Macquarie also passed on the hike in full this week

While some banks were quick off the mark, increasing home loan interest rates within days of the rate hike, many more – including three of the big four banks – waited until this week to do so.

If you hold a variable mortgage, you’ll likely have some leeway.

Banks and lenders must give existing borrowers at least three week’s notice before changing their repayments.

However, if you’re in the market for a new home loan, here’s a breakdown of the biggest interest rate changes you’ll want to know about.

Big four banks passing on rate hike in full to home loan customers

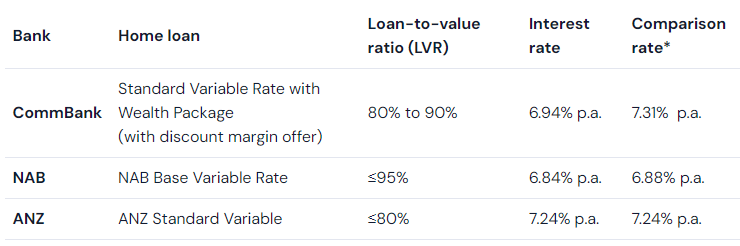

From today, CommBank, NAB, and ANZ will each increase the interest rates offered on variable home loan products by the full 25 basis point hike.

Westpac customers won’t be sitting out the hike. The final member of the quartet will hike its variable rates early next week.

The new standard variable rates offered to owner-occupiers making principal and interest (P&I) repayments by today’s movers include:

CommBank’s standard variable interest rate has also been hiked by 25 basis points to 8.80% p.a. for owner-occupiers or 9.38% p.a. for investors.

Meanwhile, ANZ's standard variable rate, listed above, includes a discount of up to 1.40% on its new index rate for P&I repayments: 8.64% p.a.

ING hikes variable home loan rates by 25 basis points

Not to be overshadowed by their larger peers, other Aussie banking majors also joined in on the hiking action.

ING was first out of the gates, increasing its variable home loan interest rates by 25 basis points on Tuesday, with changes including:

- Mortgage Simplifier, owner-occupier, P&I, ≤80% LVR: 25 basis point increase to 6.14% p.a. (6.17% p.a. comparison rate*)

- Mortgage Simplifier, investor, P&I, ≤80% LVR: 25 basis point increase to 6.34% p.a. (6.37% p.a. comparison rate*)

Bendigo Bank increases fixed and variable rates by up to 25 basis points

Unlike many others, Bendigo Bank upped both variable and fixed home loan interest rates this week. Some of its new variable rates include:

- Express Variable, owner-occupier, P&I, ≤90% LVR: 25 basis point increase to 5.97% p.a. (6.12% p.a. comparison rate*)

- Complete Home Loan, owner-occupier, P&I, 80% to 90% LVR: 25 basis point increase to 7.49% p.a. (7.71% p.a. comparison rate*)

- Express Variable, investment, P&I, ≤90% LVR: 25 basis point increase to 6.22% p.a. (6.37% p.a. comparison rate*)

Meanwhile, key changes to its fixed home loan interest rates include:

- Express Fixed one year, owner-occupier, P&I, ≤90% LVR: 25 basis point increase to 6.59% (6.18% p.a. comparison rate*)

- Express Fixed three years, owner-occupier, P&I, ≤90% LVR: 25 basis point increase to 6.49% p.a. (6.27% p.a. comparison rate*)

Macquarie Bank ups variable interest rates by 25 basis points

Finally, joining in on the action this week was Macquarie Bank, hiking variable home loan rates by 25 basis points on Friday.

The bank’s new rates include:

- Basic Variable, owner-occupier, P&I, ≤70% LVR: 25 basis point increase to 6.14% p.a. (6.16% p.a. comparison rate*)

- Basic Variable, investor, P&I, ≤70% LVR: 25 basis point increase to 6.34% p.a. (6.36% p.a. comparison rate*)

"CommBank, NAB & ANZ hike home loan interest rates this week" was originally published on Savings.com.au and was republished with permission.