The new version of the CommBank app available in June is said to deliver individually tailored content and new dynamic navigation to make it simpler, better and easier for its 7.7 million Australian users.

- CommBank will introduce new features in version 5.0 of its CommBank app following an update next month.

- New features include CommSec integration, greater security, greater search functionality and profile switching features for business and personal customers.

- Over 7.7 million users utilise the CommBank app in Australia.

CommBank notes the decision to update the app and implement new features comes as customers are using the app in greater numbers and engaging with it more frequently than ever before.

According to CommBank, on average customers are logging in 36 times a month, marking a 20% increase on 2020 figures.

Further, in April 2023 CommBank customers used the app to make an average of 3.3 million payments per day – up 19% compared to a year ago.

CommBank to introduce CommSec integration

CommBank customers will be able to buy, sell and hold Australian shares and exchange traded funds through the app once updated in June.

This feature will be available to CommBank retail customers and existing CommSec customers.

CommBank detailed roughly one in five customers have a CommSec account, with 45% valuing the opportunity to invest in the stock market through their banking app.

Further, CommSec has seen an inflow of more than one million new customers over the past three years as the COVID-19 pandemic drove an acceleration in retail investing.

CommBank CEO Matt Comyn said utilising artificial intelligence and building on the digital investments and advances, CommBank is now able to better understand the needs of our digitally active customers.

“CommSec share trading through the CommBank app is a distinct proposition which is not offered by any other bank in Australia,” Mr Comyn said.

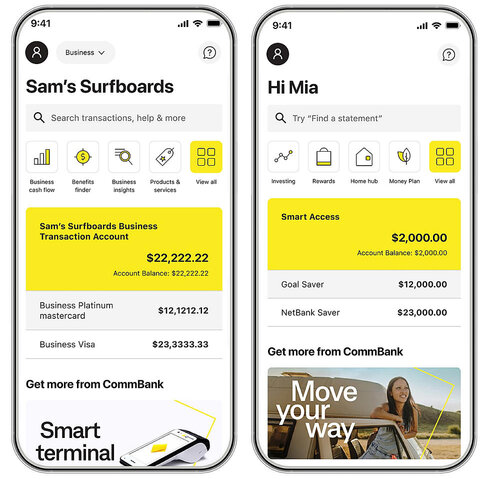

CommBank to allow customers to switch between personal and business accounts

Launching next month, CommBank’s 800,000 business banking customers who are active users of the app will be able to switch seamlessly from their business accounts to their personal accounts.

CommBank notes the challenges of account switching has been one of the main friction points for business customers, with the change allowing customers to better manage their personal and business lives.

“CBA banks more business customers than any other bank and these innovations form part of our strategy to be the leader in business banking with a focus on the best in-person and digital services Australia-wide,” Mr Comyn said.

CommBank Executive General Manager Digital & Customer Meg Bonighton said this is the start of an evolution towards offering an even more integrated and personalised experience.

“The investment we’ve made in our technology stack will allow us to innovate and update faster than before, ensuring we can continue to deliver a superior digital experience even as our customers’ expectations shift,” Ms Bonighton said.

"CommBank announces raft of changes to its banking app" was originally published on Savings.com.au and was republished with permission.