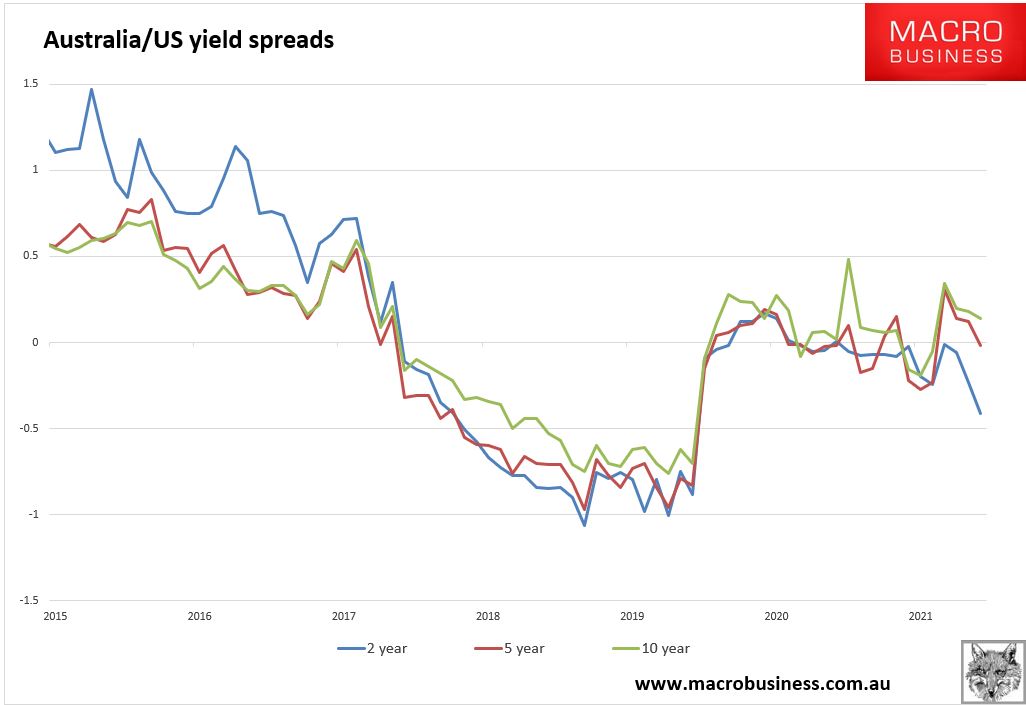

The recent lift in bond yields driven by US inflation has delivered a reprieve for the Australian dollar. US yields have jumped faster than Australian over the past several months so the carry between the two has flipped materially negative at the short end of the curve and narrowed at the long:

Short-end spreads are typically thought of as more important to a currency valuation than long as hot money chases yield.

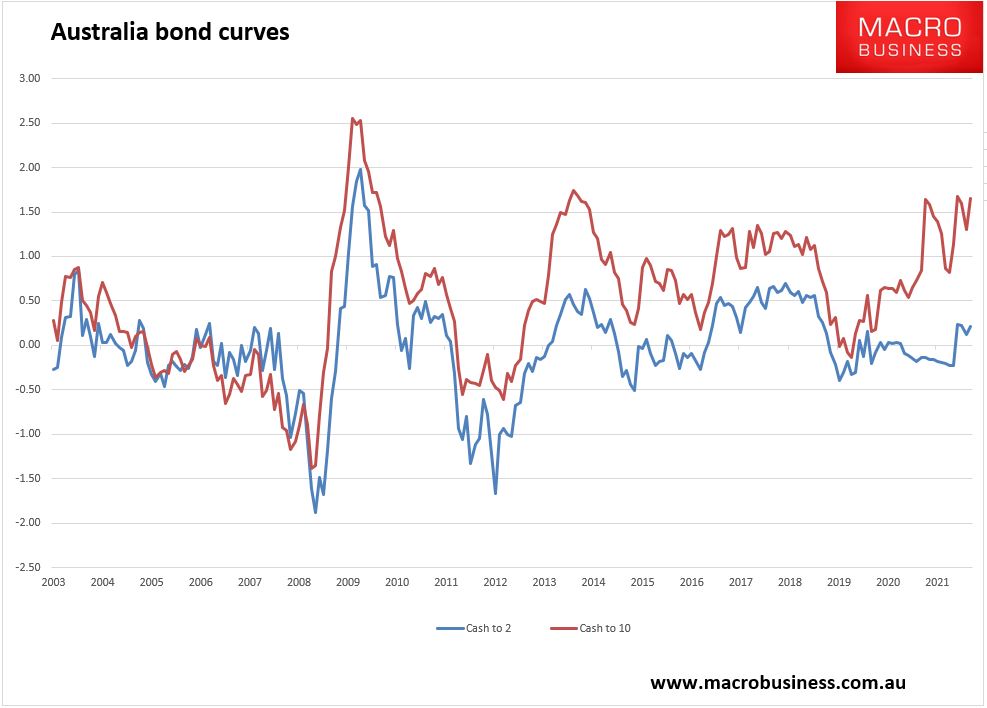

Oddly, at the same time, the Aussie curve has steepened more than the US and now predicts an outright inflationary boom ahead:

I put this down to progressing Chinese stimulus but it is way overdone. Australia will have a decent year as OMICRON fades after Q1 but it will quickly subside into secular stagnation as mass immigration resumes.

That said, the US without Build Back Better will be much the same, so by H2 or sooner I will be looking for flattening curves and a race to the bottom for the yield spread. Goldman isn’t even curve-bullish in the meantime:

Risks around the outlook for shorter term US rates shifted materially into the end of 2021, largely on account of Fed-related developments. With our economists now projecting 3 hikes by the end of 2022 (and a steady 3 hikes per year pace thereafter), we have revised up our forecast for 2y UST yields to 1.35% for YE22 (20bp higher than our prior projection).

Despite the anticipation of stronger upward pressure on 2y yields, we have left our YE22 projections for 5s, 10s, and 30s unchanged at 1.8%, 2.0%, and 2.25% respectively on account of the market’s reluctance to price a higher terminal policy rate this cycle. There are two possible explanations for this reluctance: a widely prevalent low terminal rate view, or that the price signal is distorted by supply/demand imbalance. We believe the latter explanation is the more compelling one, but one that will take time (and some rate hikes) to resolve, leaving the long end relative sticky over the course of the year even as front end yields reprice materially higher, resulting in a reprisal of then Chair Greenspan’s 2004-06 bond market conundrum (albeit at lower levels). We expect most of the selloff in intermediate and longer term rates to be driven by a (relatively parallel) shift higher, and by real yields.

Yep.