- Citigroup is starting a major multi-year transition

- The company is shifting away from retail banking outside the US

- Wealth management and commercial banking are key growth areas

- Wall Street consensus outlook is bullish

- The market-implied outlook to early 2023 is neutral to slightly bearish

Financial services giant Citigroup (NYSE:C) is in the early stages of a major overhaul, and CEO Jane Fraser, who has been in the post since March 2021, has given investors little reason for near-term optimism. Corporate turnarounds are hard and take time. The question is whether it is worth hanging around for the ride.

The company is shutting down retail banking operations in 13 markets in Asia, Europe, the Middle East, and Mexico. Instead, Citi is focusing on wealth management and commercial banking as key sources of growth. In the US, however, Citi will continue to serve its 72 million retail banking clients.

Citi shares have lost 14.4% over the past month and 16% over the past year. After reaching a 12-month high close of $79.86 on June 2, in a rally following strong Q1 2021 earnings, the shares have fallen 31%.

Source: Investing.com

The quarterly earnings over the past year and the earnings outlook over the next couple of years explain why many investors are heading for the doors. While the company delivered a major earnings surprise in Q1 2021, the earnings have fallen substantially since then and the outlook is for continued declines.

Source: E-Trade

I last wrote about C on Aug. 16, 2021. Things were looking up at that time. The company reported strong Q2 earnings on July 14, beating the consensus expected value by 45%. The previous quarter’s earnings were also impressive, with Q1 2021 EPS 39% above expectations. Interest rates were rising and, as I discussed, C tended to perform well when rates go up. The Wall Street analyst consensus at that time was bullish, and the consensus 12-month price target was about 19% above the share price. The forward P/E was the lowest among major banks, as well.

Along with looking at fundamentals and the Wall Street consensus outlook, I rely on the market-implied outlook, which represents the consensus view among buyers and sellers of options. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires.

By analyzing the prices of put and call options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that best reconciles the options prices. This is the market-implied outlook. For those seeking detailed information on this approach, the CFA Institute has an excellent monograph (which can be downloaded at no cost). In August, the market-implied outlook to early 2021 was slightly bullish and the expected volatility was 30%.

Since my post on Aug. 16, C has lost 21%, compared to a 4.8% drop for the SPDR® S&P 500 (NYSE:SPY) and 5.2% decline for the iShares US Financials ETF (NYSE:IYF). The market-implied outlook and the Wall Street analyst consensus underestimated the difficulty of the turnaround effort at Citigroup.

With more than six months since my last analysis, I have updated the market-implied outlook for C through the end of 2022 and compared it with the current Wall Street consensus outlook.

Wall Street Consensus Outlooks For C

Citi hosted its annual investor day on Mar. 2. While a number of analysts have changed their ratings since then, looking at the 90-day consensus will include ratings and price targets assigned prior to investor day. To the extent that investor day provided material information, the consensus outlook may be less meaningful than normal.

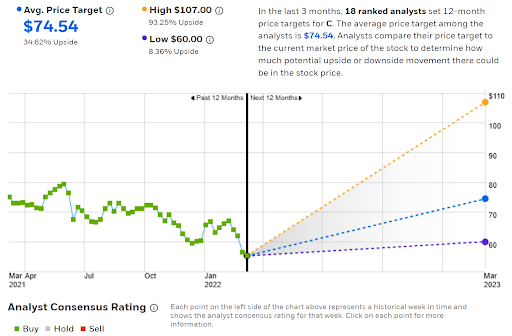

E-Trade calculates the Wall Street consensus outlook for C by aggregating the views of 18 ranked analysts who have assigned ratings and price targets over the past 90 days. The consensus rating is bullish, as it has been for the entirety of the last 12 months. The consensus 12-month price target is 34.6% above the current share price. Even the lowest analyst price target is 8.4% above the current share price.

One note of caution here is that there is a large spread among the price targets, ranging from a low of $60 to a high of $107. High dispersion among the price targets can be a contrary indicator. One study found a negative correlation between the returns implied by the price target and subsequent performance when the spread in the price targets is high.

Source: E-Trade

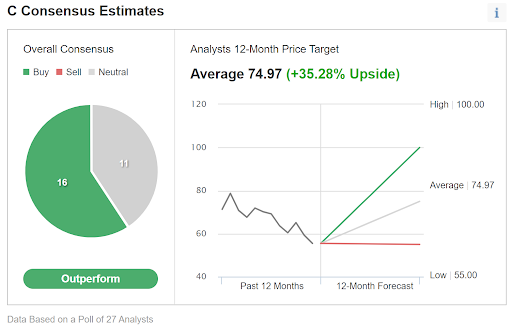

Investing.com calculates the Wall Street consensus outlook based on ratings and price targets from 27 analysts. The consensus rating is bullish and the consensus 12-month price target is 35.3% above the current share price.

Source: Investing.com

The consensus view among Wall Street analysts continues to be bullish for C. Even though the price targets have fallen, the share price has declined even more. As a result, the price appreciation implied by the consensus outlook is higher than it was back in August.

Market-Implied Outlook For C

Options trading on C is very active and the options market can react much more rapidly to news than the analysts. Even if the analysts have not fully processed the implications from investor day, the options market should have.

I have calculated market-implied outlooks for C for the 3.3-month period from now until June 17 and for the 10.4-month period from now until Jan. 20, 2023, using options expiring on each of these dates. The options trading on C is very active for both of these dates.

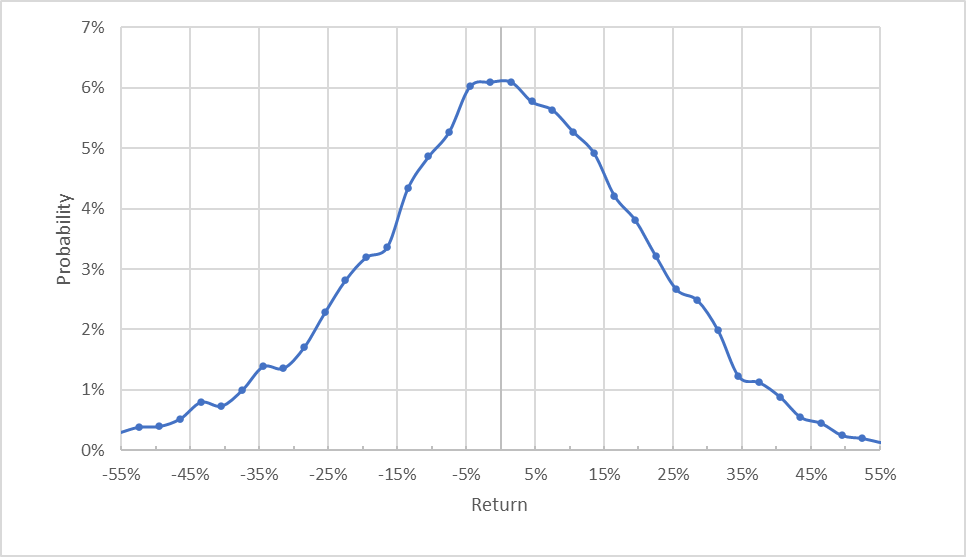

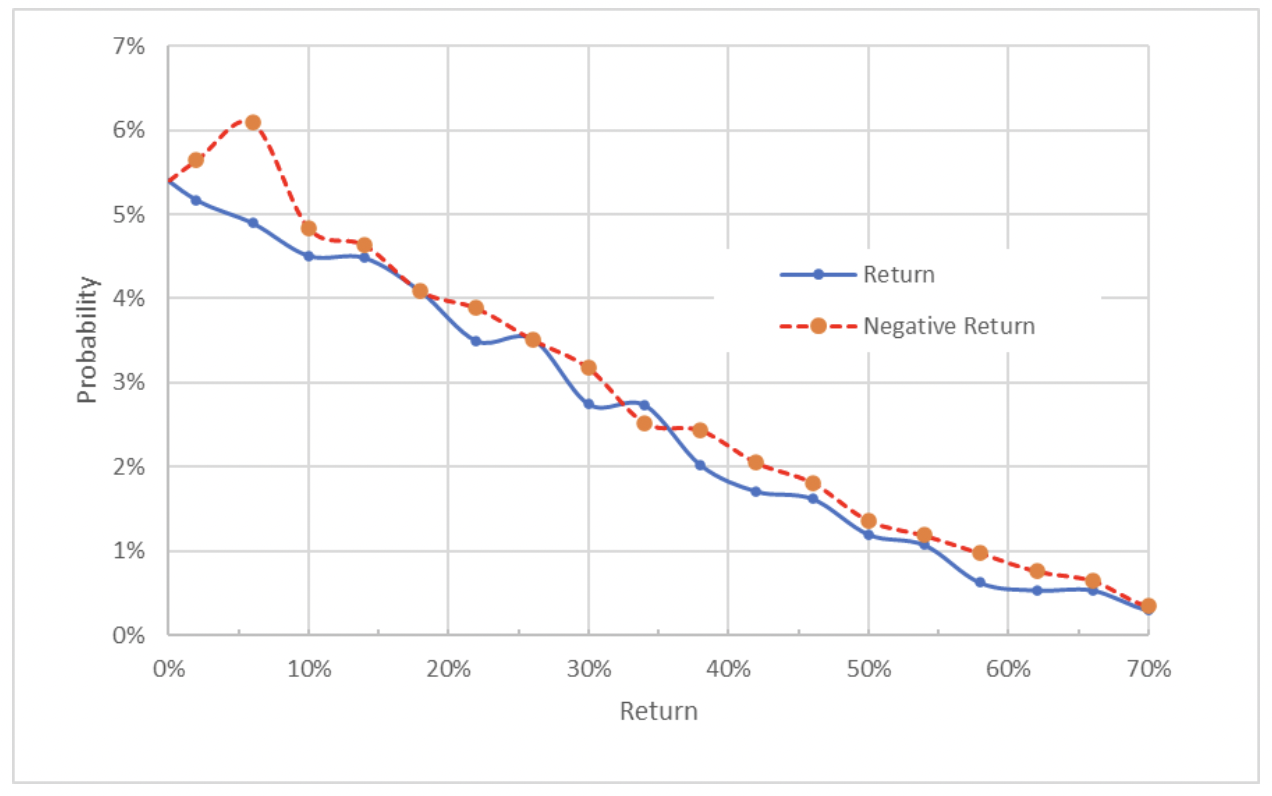

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for the next 3.3 months is generally symmetric, with comparable probabilities of positive and negative returns of the same magnitude. The expected volatility calculated from this distribution is 43% (annualized). This is a significant gain in the market’s estimate of the risk level, as compared to 30% in my August analysis.

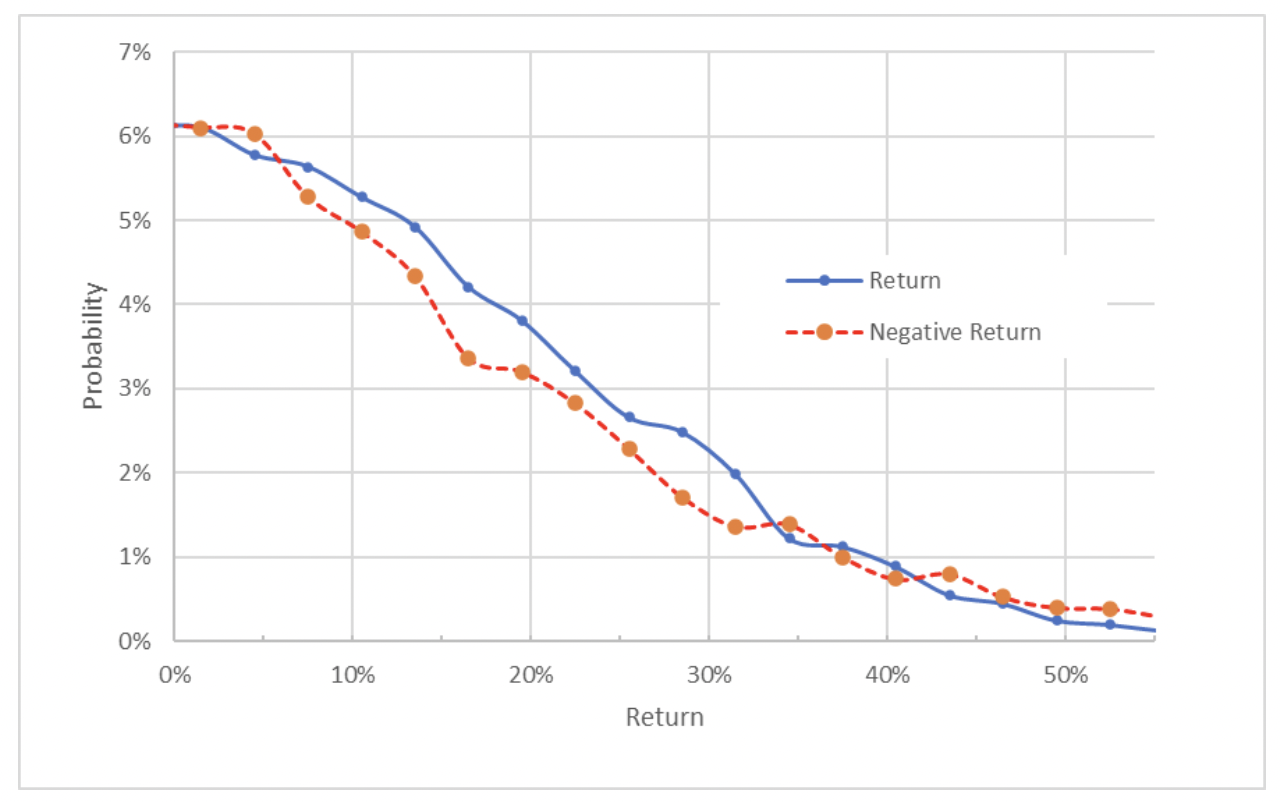

To make a direct comparison of the probabilities of positive and negative returns of the same magnitude easier, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view shows that the probabilities of positive returns are consistently somewhat higher than for negative returns of the same size over a wide range of the most probable outcomes (the solid blue line is above the dashed red line over most of the left two-thirds of the chart). This is a bullish tilt for the market-implied outlook.

Theory suggests that the market-implied outlook will tend to have a negative bias because investors, in aggregate, are risk averse and, thus, tend to overpay for downside protection (put options). While there is no way to directly measure whether this bias exists, the potential for this negative bias reinforces the bullish view.

The market-implied outlook for the next 10.4 months, until Jan. 20, 2023, exhibits a tilt favoring negative returns (the dashed red line is above the solid blue line) and the maximum probability corresponds to a price return of -6%. The annualized volatility calculated from this distribution is 38%. Because of the expected negative bias, I interpret this market-implied outlook as neutral with a slight bearish tilt.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook is moderately bullish to mid-June but neutral to slightly bearish for the 10.4-month period to Jan. 20, 2023. The expected volatility is high, but lower for the longer outlook.

Summary

Citigroup investors have paid a substantial opportunity cost in recent years, as it has lagged competitors and the US financial sector. The company is attempting an overhaul of its business model under (fairly) new CEO Jane Fraser.

The Wall Street analyst consensus has been consistently bullish on the company’s prospects but there is also enormous disagreement between individual analysts. For this reason, I discount the strongly bullish Wall Street consensus.

The market-implied outlook has been more neutral but definitely did not anticipate the magnitude of the company’s challenges. In the recent investor day, management laid out a challenging path for C over the next several years (at least).

The current market-implied outlook is somewhat bullish to mid-year and neutral, with a slight bearish tilt to early 2023. The expected volatility is high, especially for a major bank. While the shares may be oversold, consistent with the bullish outlook to the middle of 2022, the outlook for the next year or so is not especially encouraging. I am changing my rating on C to neutral.