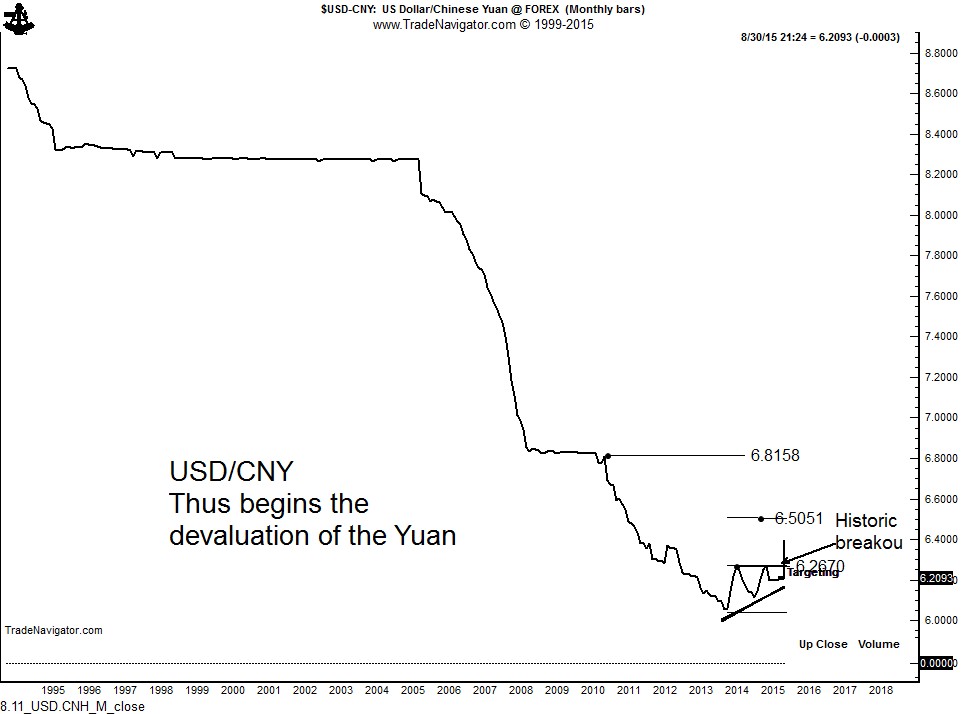

Mark your calendar at August 11, 2015 as the day the USD/CNY reversed its multi-year trend

The Factor Service, which is unabashedly committed to chart analysis, makes some very bad calls under our operating principle of “strong opinions, weakly held” — and I am not hesitant to admit it when wrong. But, we also make some marvelous calls — so I will not be shy when admitting when providence shines its face on us.

For weeks and months the Factor Service has regularly pointed out to research members the massive bottom under construction in the USD/CNY. Accordingly, Factor has been buying this cross-rate. When the IMF recently announced that any move off the peg by the yuan was not to occur soon, we were not persuaded to exit our trade commitment.

Let’s review the charts:

The monthly graph shows that the yuan has been steadily gaining against the USD since the early 1990s, declining from 8.7xxx to the 2014 low at 6.04xx. We have viewed this trend as pure manipulation by the Chinese government.

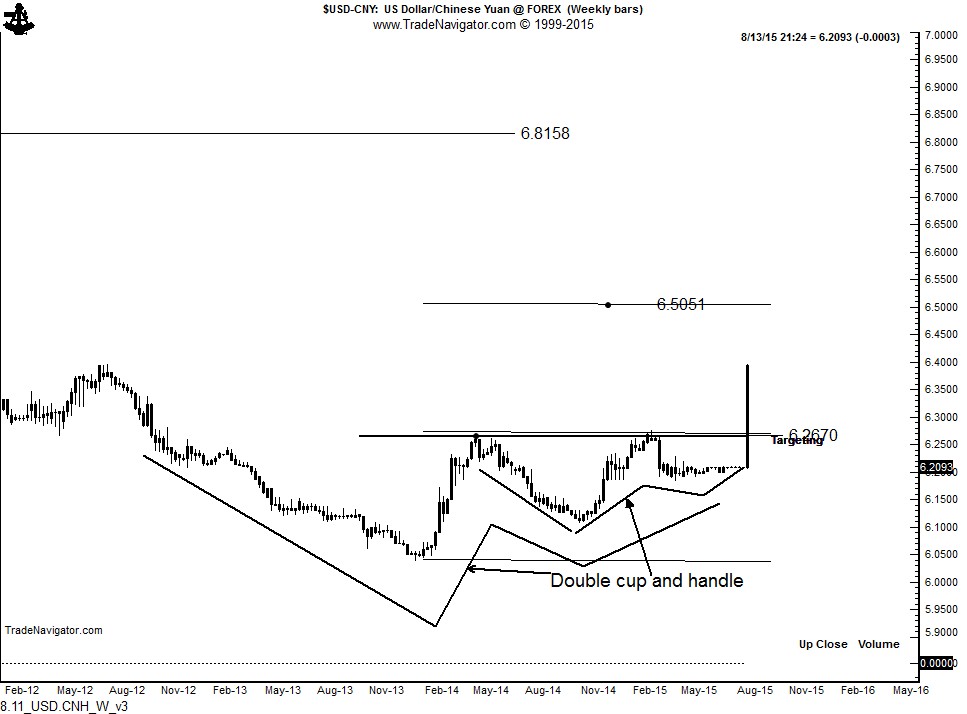

The weekly chart can be read in two ways, depending upon which school of charting one belongs. I have read the bottom as a 19-month ascending triangle, as shown below.

Another reading is that the weekly chart formed a massive 33-month cup and handle whereby the handle was an independent 18-month cup and handle.

In either case, the conclusion is the same — the USD/CNY has completed a massive reversal bottom. There was a sign in recent weeks that the devaluation of the yuan was at hand, despite the insistence of Chinese authorities that the peg would remain in place.

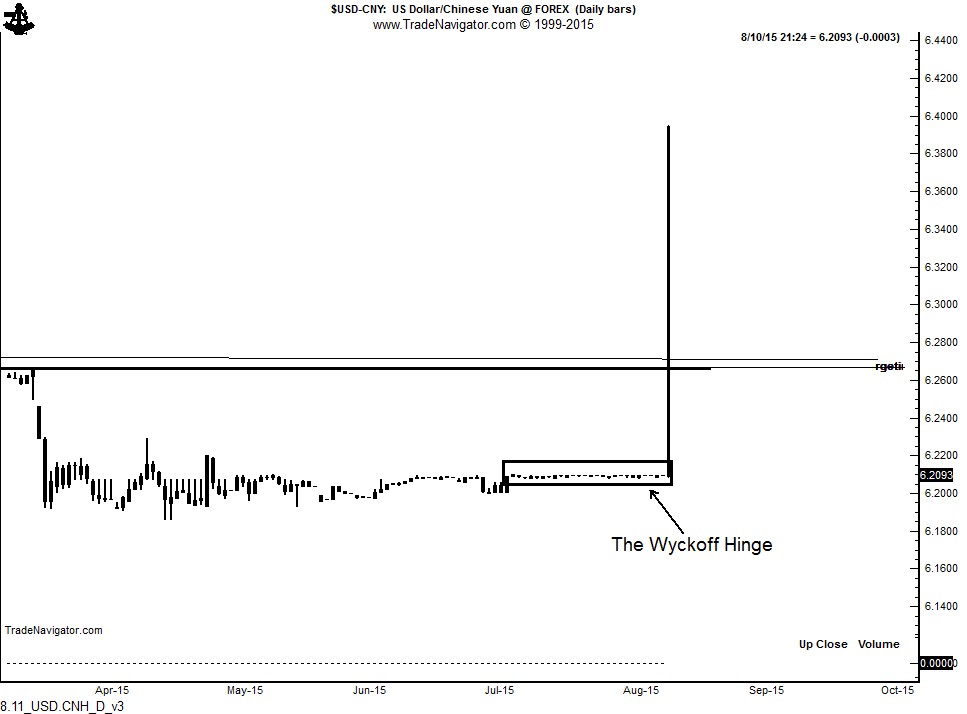

In the 1920s and 1930s, a technical trader named Richard Wyckoff spoke about the concept of the “hinge.” A “hinge” is a sign that a large price thrust is close at hand. A hinge is signified on a price chart by an extreme narrowing of a trading range with reduced volume or turnover. A look at the daily graph of USD/CNY displays a 4-week period of hinge days.

The initial target in the yuan is 6.50xx or so, with a longer term price target of 6.80xx. Ultimately the USDCNY could reverse the entire trend since the 1990s and move to 8.27xx.

Disclosure: Factor is long USD/CNY

Disclaimer: The information in this post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.