Chinese Woes Weigh on Commodities

“Chinese steel now cheaper than cabbage.”

That is the type of headlines we woke up to in Asia this morning. What a glorious time to be alive!

This was one of my favourites, quoted only as ‘trader’ from an almost comedic SMH article this morning: “I would be better off going home to plow the fields rather than try to make money selling steel.”

With a weakness in demand for Chinese steel, comes a weakness in the iron ore price. Something we know hurts the Australian economy and subsequently the price of the AUD when it dips. These are the sort of flow-on effects we have expected to see from the well reported Chinese stock market woes.

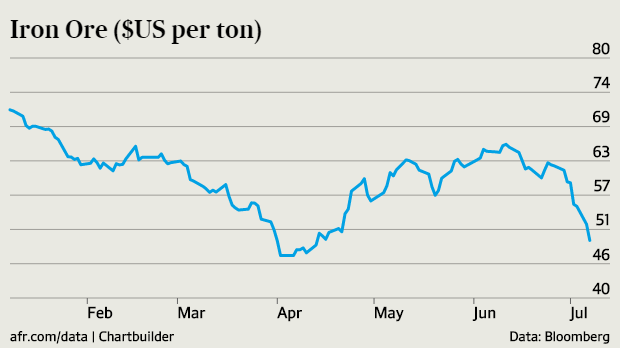

As you can see from the above Bloomberg chart, the price of iron ore has dipped back below the US $50 per tonne level, bringing it back towards swing lows from a few months ago.

AUD/USD Daily:

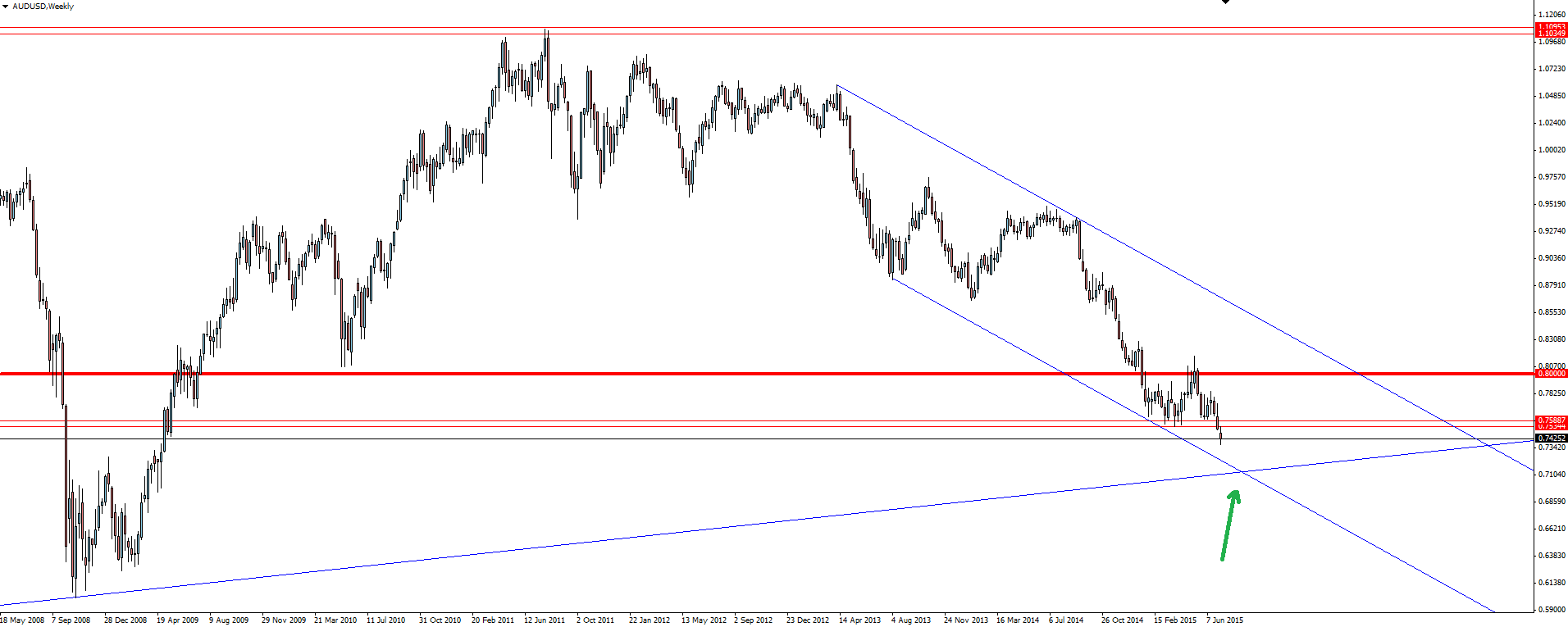

Taking a look at the inevitably effected Aussie dollar, we have a seriously ugly looking AUD/USD daily chart. With price now well below the key psychological 0.7500 support level, the bearish trend looks to be continuing after the last few months of consolidation.

AUD/USD Weekly:

However, as always, it pays to look at the higher time frame charts where price is now primed to test a key confluence of long term trend line and short term channel support around the 0.7100 level. Mark this one up on your charts, there will be some good trades to come from here.

The Fed Still on Track:

With US markets fully digesting the FOMC minutes last night, markets have taken the Fed to have been dovish but have also seen them as ‘it could be worse’. With uncertainty over Greece and China thrown into the domestic growth mix, it could have been much worse in fact.

“Many participants expressed concern that a failure of Greece and its official creditors to resolve their differences could result in disruptions in financial markets in the euro area, with possible spillover effects on the United States.”

Just remember that at the time of meeting, Greece was not yet in default and the PBOC hadn’t yet lost control of the Chinese stock market.

“Members thus saw economic conditions as continuing to approach those consistent with warranting a start to the normalization of the stance of monetary policy.”

But this last quote shows that at least at the time, the Fed is still on track to hike rates this year.

Interestingly, San Francisco Fed President Williams spoke last night at the International Conference of Commercial Bank Economists, in Los Angeles and didn’t back down on his stance that the Fed will hike rates TWICE this year. Williams was of the opinion that things in Europe and China would settle down and with time comes clarity, allowing the Fed to go ahead.

And did you see that? Not one single mention of Greece. Bring on Sunday’s deadline!

———-

On the Calendar Today:

A packed Asian session calendar today see’s employment data out of Australia, followed up by Chinese inflation numbers. Interest rates are also expected to be left on hold in the UK.

Thursday:

AUD Employment Change

AUD Unemployment Rate

CNY CPI

CNY PPI

GBP Official Bank Rate

GBP MPC Rate Statement

USD Unemployment Claims

———-

Chart of the Day:

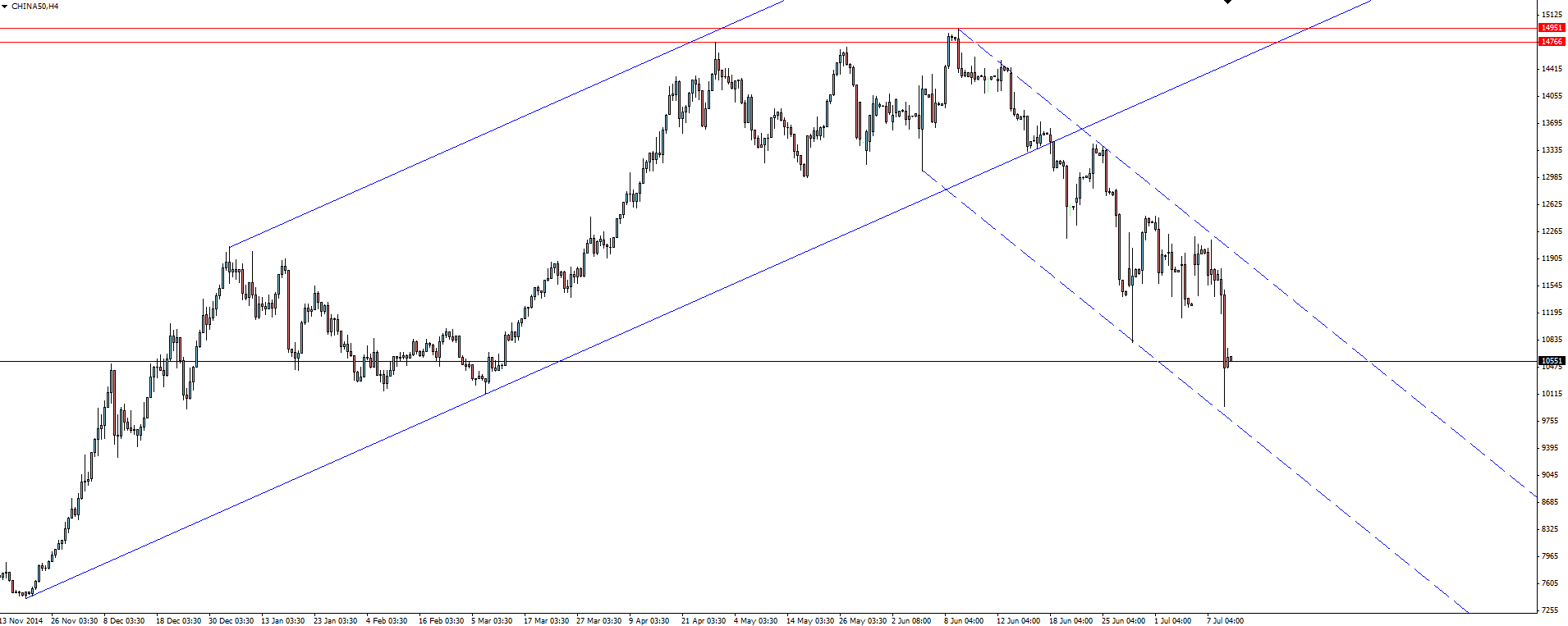

We head back to the world of indices in today’s chart of the day, taking a look at the China A50.

CHINA50 4 Hourly:

Click on chart to see a larger view.

After that major trend line broke down, this chart is nothing but carnage. But what the channels do show is that even the manipulated Chinese markets still follow structures.

CHINA50 channel support and resistance has been well respected over the widely reported drop in Chinese stocks which to me is a key as to whether the market is worth trading or not.