China is the second largest oil consumer in the world. However, unlike the world’s largest oil consumer, the United States, China produces very little of its own oil. This makes China a particularly valuable market for producers, especially during the current period of supply glut.

Why Is Chinese Demand So High?

There are three reasons:

1. China is a heavily industrialized economy that is also transitioning to a consumer economy. Chinese manufacturing continues to consume a great deal of energy, but vehicle traffic is also growing. Despite slightly higher oil prices, China’s industrial production grew in January and February of 2017, by 6.3%. Vehicle sales rose 6.5%.

Vehicle sales suffered a slight downturn in April as a result of increased taxes, but they quickly rebounded the next month. SUV sales were particularly strong, rising 17%.

2. China has been using the opportunity presented by low oil prices to fill its strategic petroleum reserves. In mid-2016, China reported it had 237.5 million barrels of crude oil in its strategic reserves. A halt in imports for strategic reserves could unexpectedly push oil prices down, but this appears unlikely. Satellite photos reveal China is continuing to build more storage facilities to accommodate additional imports for its strategic reserve.

3. China’s independent oil refiners, sometimes called “teapots,” have contributed heavily to China’s increased demand. During the first half of 2017, China’s state refineries kept their runs steady, but China’s independent refineries increased their runs after the government raised their crude oil import quotas. Refinery production in China increased 3% for the first six months of 2017, to 11.1 million bpd.

Who's Winning the Battle for China’s Oil Market?

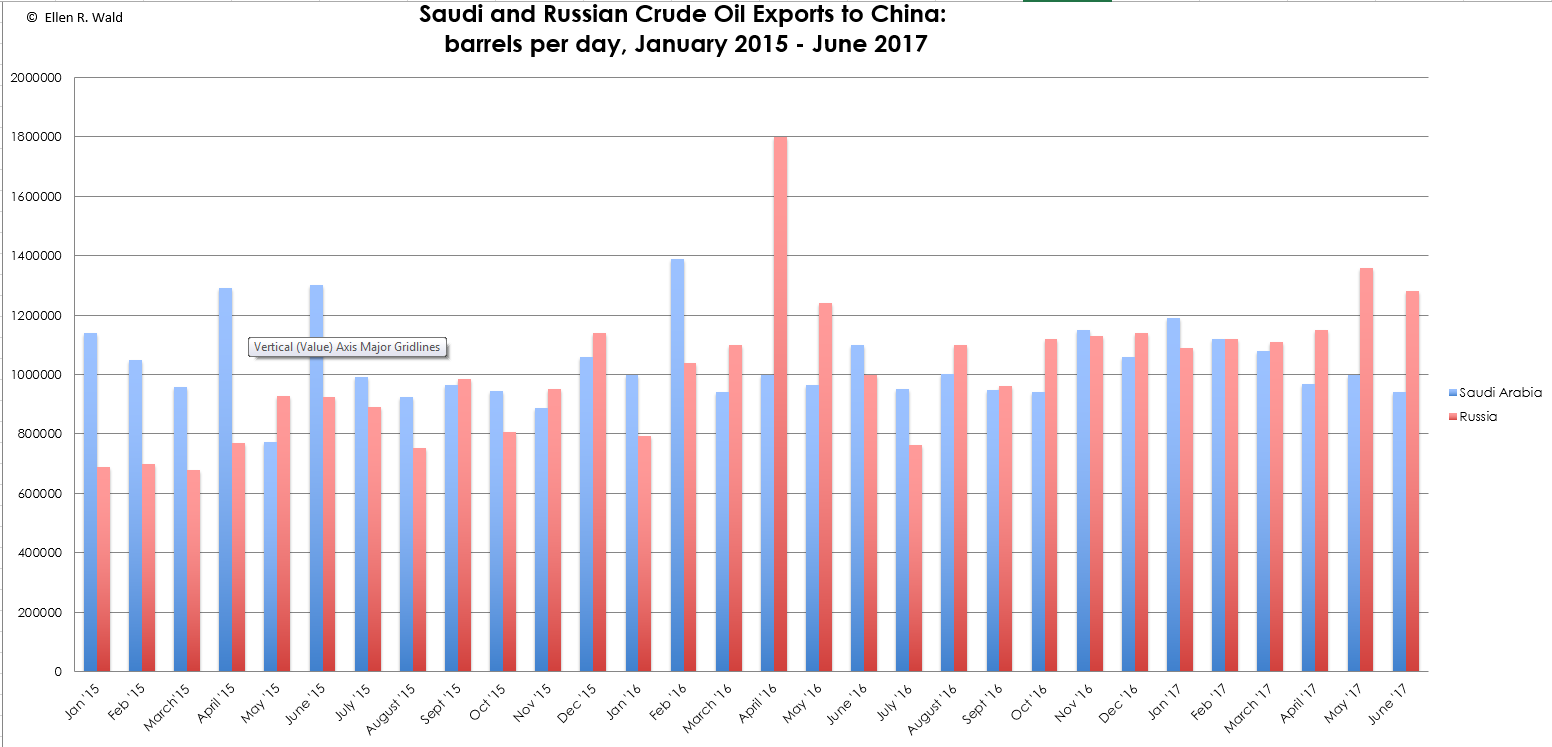

Since January, 2015, Saudi Arabia and Russia have traded positions as China’s top source of crude oil imports. Between January, 2015, and June, 2017, Saudi Arabia exported an average of 1.03 million bpd to China. In that same period, Russia exported an average of 1.02 million bpd. A look at China’s imports from Saudi Arabia and Russia by month reveals that while Russia has increased its supply to China, Saudi Arabia has remained fairly steady. Nevertheless, the top source of oil for China changes frequently.

The trend does appear to favor Russia, which was aided by the opening of an oil pipeline between Siberia and China. Russia has also benefited from its decision to accept payment for oil in yuan, while most oil is traded globally on the dollar.

However, Saudi Arabia’s national oil company, Aramco, maintains long-term contracts with Chinese refineries for its crude oil. It also has extensive investments in Chinese refineries that ensure consistent contracts for Saudi crude oil. In the event that Chinese demand begins to slack, it is unlikely that China will drop Aramco as its supplier before it drops a new supplier, such as Russia.