Investors in search of a higher dividend yield shouldn’t ignore Chevron (NYSE:CVX). After the oil and gas colossus took a severe financial blow during the pandemic, as crude demand collapsed, the U.S. energy giant is getting back on track and returning more cash to investors.

In its latest update, the California-based, integrated energy, chemicals and petroleum firm said it’s reviving its share buyback program from this quarter, with a target of returning between $2 billion and $3 billion a year to investors. Chevron’s repurchasing program comes on top of a dividend increase earlier this year, when it became the only Western oil super-major to lift the payout above pre-pandemic levels.

With the increase, Chevron now pays a $1.34-a-share quarterly dividend, which, at its current share price of $97.84 as of Tuesday's close, translates into a 5.5% annual yield. But before taking a position in CVX stock, it’s important to analyze whether this dividend and share buyback plan is sustainable, especially when oil markets remain volatile amid the globally surging Delta variant.

From management’s perspective, the company is now in a much better position to maintain its cash-return program. After producing the biggest profit since pre-pandemic days in the second quarter, Chevron is maintaining its tight lid on spending with year-to-date capital expenditures down 32% from a year ago.

A Lowest Debt Ratio

Another strength that differentiates Chevron from its rivals: the company entered the pandemic in a stronger financial position, with a low debt burden, suggesting that it will have to spare less cash for its debt-servicing. At 22.4%, Chevron has the lowest debt ratio among its Big Oil peers, which include Exxon Mobil (NYSE:XOM) and British Petroleum (NYSE:BP).

Chief Financial Officer Pierre Breber told Bloomberg last month that the repurchases will be sustained even during periods of lower oil prices.

“I was clear on last quarter’s earnings' call that we would start a buyback when we were confident we could sustain it over the cycle. We’d want to sustain it for multiple years.”

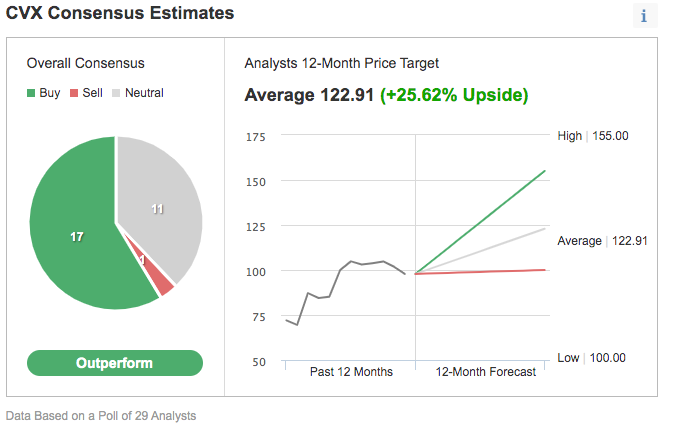

The majority of analysts seem to agree with Chevron management’s view of the company's future outlook. According to a consensus price target of 29 analysts polled by Investing.com, CVX stock has a 26% upside potential in the next 12 months from its current level.

Chart: Investing.com

According to BMO Capital Markets, Chevron stock is undervalued, given the company’s ability to generate significant cash flows over the next 18 months. In a recent note to clients the bank stated:

“We expect Chevron to achieve 2021 and 2022 [cash flow from operations] of $27.1 billion and $33.5 billion, which equate to [free cash flow] of $17.9 billion and $22.6 billion. ...Over the past six months, Chevron shares have lagged other upstream producers despite having similar cash flow leverage to higher oil prices.”

Chevron said in March that it should generate $25 billion of free cash over and above its dividend through 2025 if Brent crude remains at $60. For October settlement, Brent traded at $70.64 on Tuesday. BMO set a price target of $123 per share for Chevron. That is an upside of about 26% from where the stock closed on Tuesday.

Bottom Line

Among the big oil producers, Chevron is in a strong position to return more cash to investors after a year of belt-tightening and dealing with the pandemic-induced slowdown. That bullish outlook makes its stock attractive for investors who are looking to generate passive income through dividends.