Bitcoin plunged a whopping 10 percent yesterday, plummeting to a two-month low. The fall came after Coinrail, a modestly-sized cryptocurrency exchange in South Korea, tweeted over the weekend that it had been hacked.

While this event certainly raises long-standing concerns about cryptocurrency security, it also comes after another, probably worse piece of news for digital currencies. The Wall Street Journal reported on Friday that US regulators are investigating possible price manipulation at four major cryptocurrency exchanges—Bitstamp, Coinbase, itBit and Kraken.

Crypto bulls are all too familiar with government regulators and the power they can wield over the price movement and volatility of digital tokens. Any threats by government bodies to increase scrutiny or limit cryptocurrency issuance or trade has repeatedly posed a threat to the asset class.

As well, previous reports of hacked exchanges have hammered Bitcoin and its sister currencies.

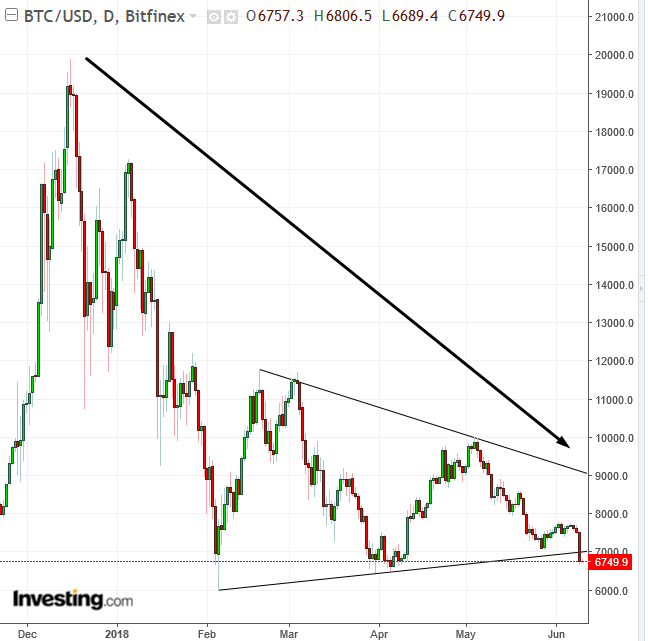

The once mighty Bitcoin, which almost hit $20,000 per token in mid-December 2017, fell an astonishing 70 percent in under two months, till early February’s $6000 low price. Since then, Bitcoin has been trading within a symmetrical triangle pattern, as both buyers and sellers were upping their ante. That is until yesterday, when sellers pushed BTC below the floor of the pattern.

The 5-percent penetration more than satisfied the 3.00 conservative filter to avoid a bear trap. However, as we have pointed out on numerous occasions, this asset does not behave as others do. We've even suggested to multiply filters by 10. If that (arbitrary) filter is any gauge, it renders the current penetration to an unreliable 0.5 percent breakout.

Still, it's a huge, flashing red flag for the asset, and we believe this technical phenomenon is worth following. Here's what to look for depending on your risk tolerance:

Trading Strategies – Short Position Setup

Conservative traders should wait for a 30 percent penetration (conservative 3-percent multiplied by 10, for the asset with the highest fluctuation since Tulip Mania). We recommend traders wait for the filter on a closing basis. At that point, they would wait for a likely return move, to confirm the veracity of the triangle’s resistance, with at least one long red candle, engulfing a previous green candle, or a small candle of any color.

Moderate traders may be satisfied with a 20 percent penetration. Then they may wait for a return move, for a better entry, but not necessarily for proof of trend.

Aggressive traders may enter a short position whenever they feel comfortable with regard to a stop-loss, or even an outright loss. The price may return to the pattern, currently at $7,200.