Investors in cryptocurrencies are in for a wild ride, and so are the stocks associated with this highly volatile asset class.

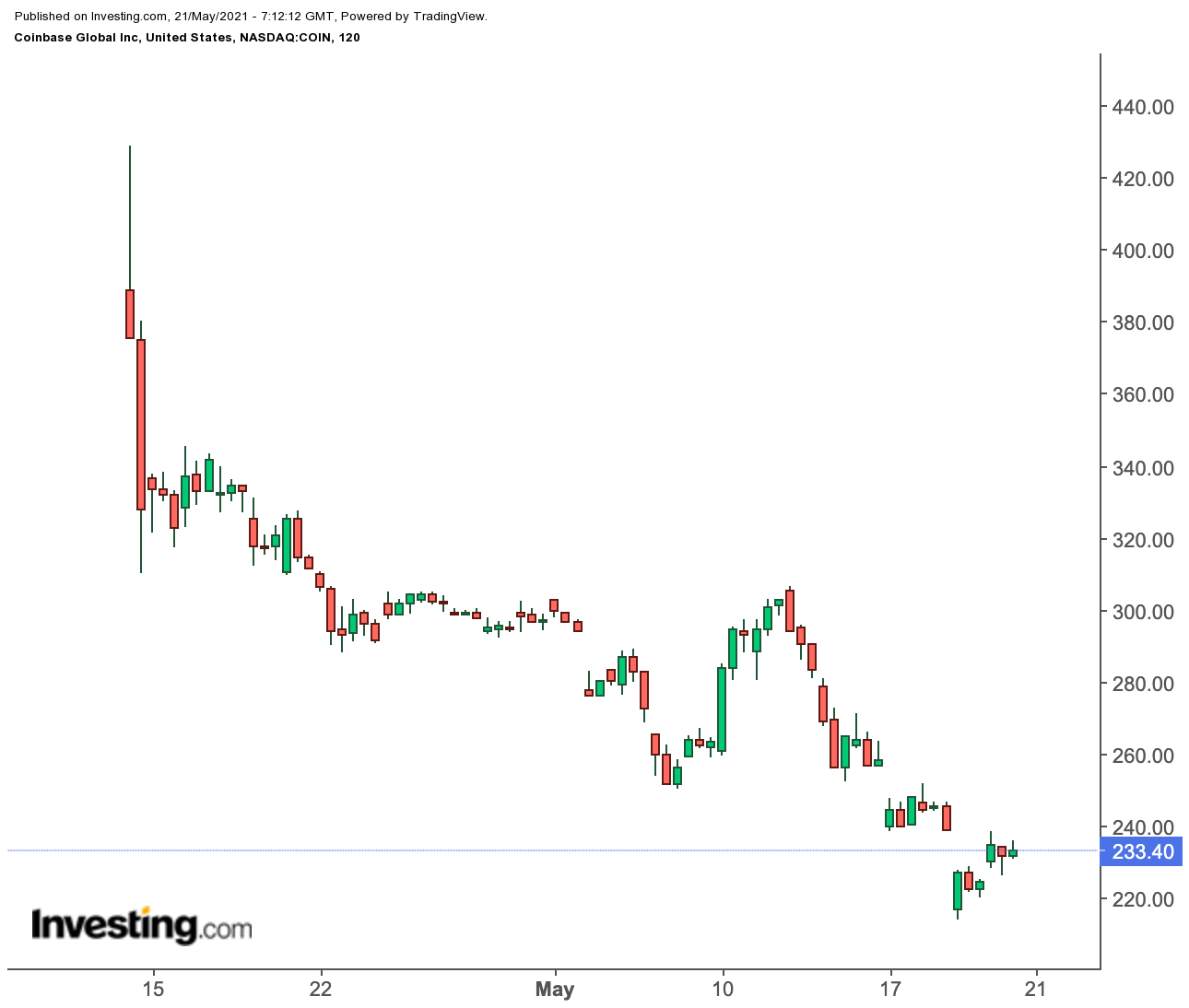

Coinbase Global (NASDAQ:COIN) closed Wednesday at a record low after a wild trading session that saw the price of Bitcoin swing by about $10,000. The largest US cryptocurrency exchange fell as much as 13% before paring the loss to close down 5.9% at $224.80 amid a broader rout in cryptocurrencies. Yesterday, Coinbase gained about 3.8% to close at $233.39.

Since its initial public offering last month, Coinbase has lost more than a third of its value. The decline of this magnitude is prompting some proponents of this asset class to jump in and buy this beaten-down stock.

Ark Invest’s Cathie Wood is doubling down on her Coinbase bet, snapping up more shares of the cryptocurrency exchange as its value declines. Wood has purchased more than $90 million of Coinbase since Monday, according to the firm’s trading wrapper.

The head of Ark Investment Management said in an interview on Bloomberg TV that she still expects the cryptocurrency to reach a price of $500,000.

She said:

“We go through soul searching times like this and scrape the models, and yes our conviction is just as high.”

Sharp moves in cryptocurrencies should not scare investors away from the strong underlying business of Coinbase, according to investment firm Wedbush. Analyst Moshe Katri, while initiating coverage of the stock this week, assigned an “outperform rating” to it with a price target of $275 a share.

According to the note:

“We view COIN as a ‘one stop shop’ platform, enabling roughly 56 million retail users, 8,000 institutions, and 134,000 ecosystem partners in over 100 countries to participate in the crypto economy.”

Bitcoin Bubble Near Bursting?

These bullish calls have some rationale, but retail investors should note that Coinbase’s revenue is built almost entirely on the performance of Bitcoin and Ethereum, which are showing signs of peaking in the current cycle. And if this is the beginning of a bubble being burst, then we still have a long way to go.

Bitcoin has experienced two crashes of more than 80% in its short history. Another such crash will mean reduced profitability for Coinbase, which generates most of its revenue from trading fees. The extreme volatility this week suggests that a crash of this magnitude is still possible.

The recent price fall accelerated after Elon Musk, who has a cult-type following in the speculative trading community, said Tesla (NASDAQ:TSLA) would cease accepting Bitcoin as a payment option for its electric cars, pointing to environmental hazards its mining process creates. That sudden U-turn came after months of bullish comments he made about Bitcoin, Dogecoin and other digital currencies, becoming one of the biggest market movers.

After Musk’s shock came the People’s Bank of China statement that reiterated that digital tokens can’t be used as a form of payment. China has in the past issued other restrictions on cryptocurrencies, but the new ban and the reaction shows the crypto market is still sensitive to regulatory efforts.

Adding to regulatory concerns is the statement made by US Treasury Secretary Janet Yellen in January during her confirmation hearing that many cryptocurrencies are used “mainly for illicit financing, and I think we really need to examine ways in which we can curtail their use.”

Bottom Line

Coinbase stock has become attractive after a sharp pullback, providing long-term investors a chance to buy this name at a much cheaper price than a month ago when its stock was trading above $400.

But the ongoing volatility in the market and the possibility of regulatory actions may hurt the company’s revenue going forward. These uncertainties associated with the crypto market make Coinbase only suitable for investors who have a very high risk tolerance and deep pockets to absorb big losses.