Ten days ago, we found using the Elliott Wave Principle (EWP) for the S&P 500:

“As long as last week’s low at $4098 holds, the index can allow for a more direct rally to ideally $4315-4370, reaching our long-standing target set forth Mid-October last year, see here.”

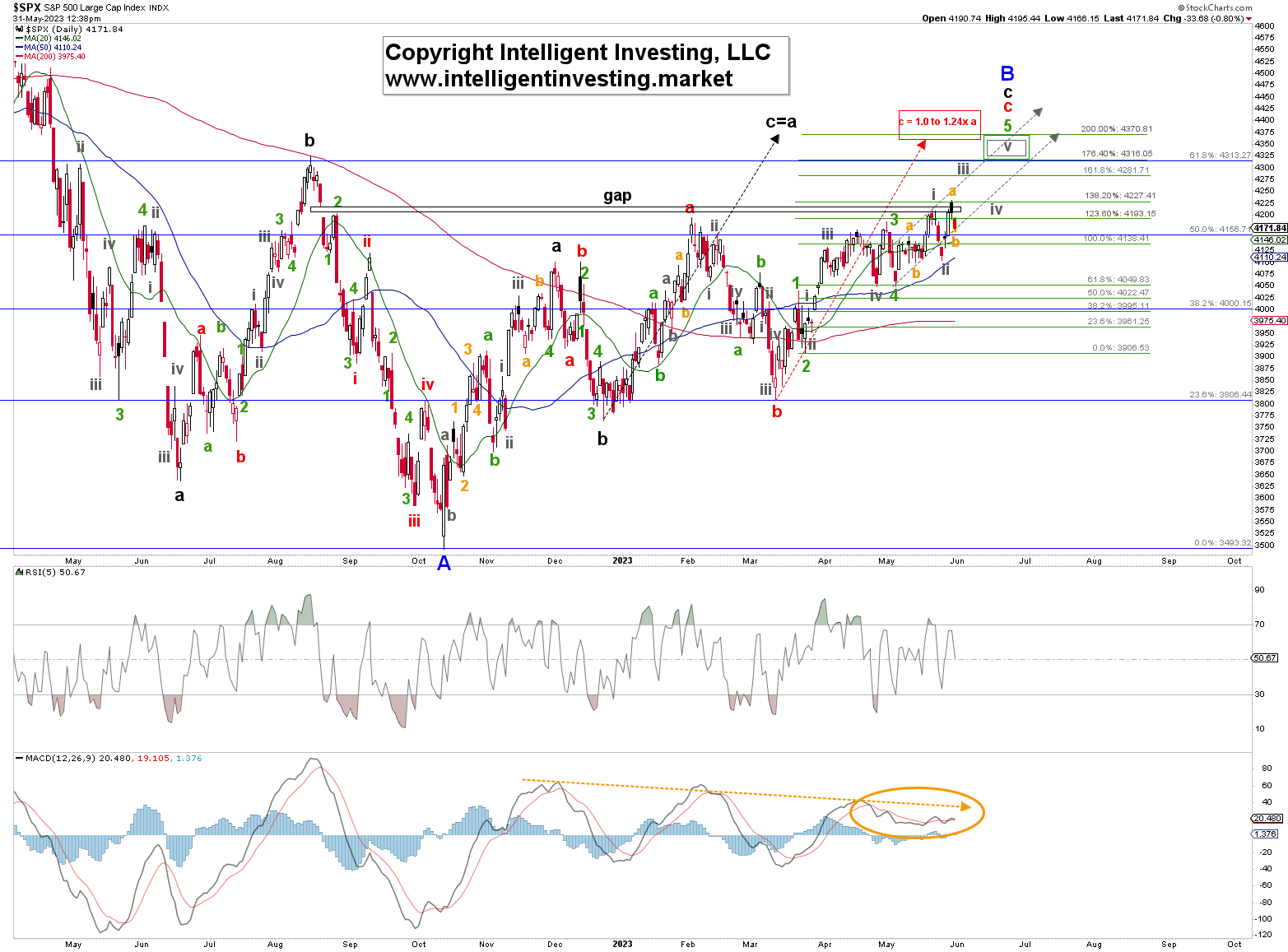

We had tentatively placed a (grey) W-i label on that day, which was only off by one day as the index peaked at $4113 on May 19, and placed a grey W-ii low at around $4125, a grey W-iii at about $4281, etc. See Figure 1 below.

Figure 1

The SPX dropped to $4104 on May 24 and rallied to $4231 yesterday, while the index now sits at $4175. Albeit making higher highs and higher lows, a bullish sequence, it is quite a whipsawing environment. Regardless, we say “so far, so good” as the pattern we are tracking, to ideally $4315-4370, is called an ending diagonal (ED) 5th wave. EDs are overlapping price structures as they consist of a 3-3-3-3-3 (abc-abc-abc-abc-abc) pattern instead of the typical non-overlapping 5-3-5-3-5 impulse pattern.

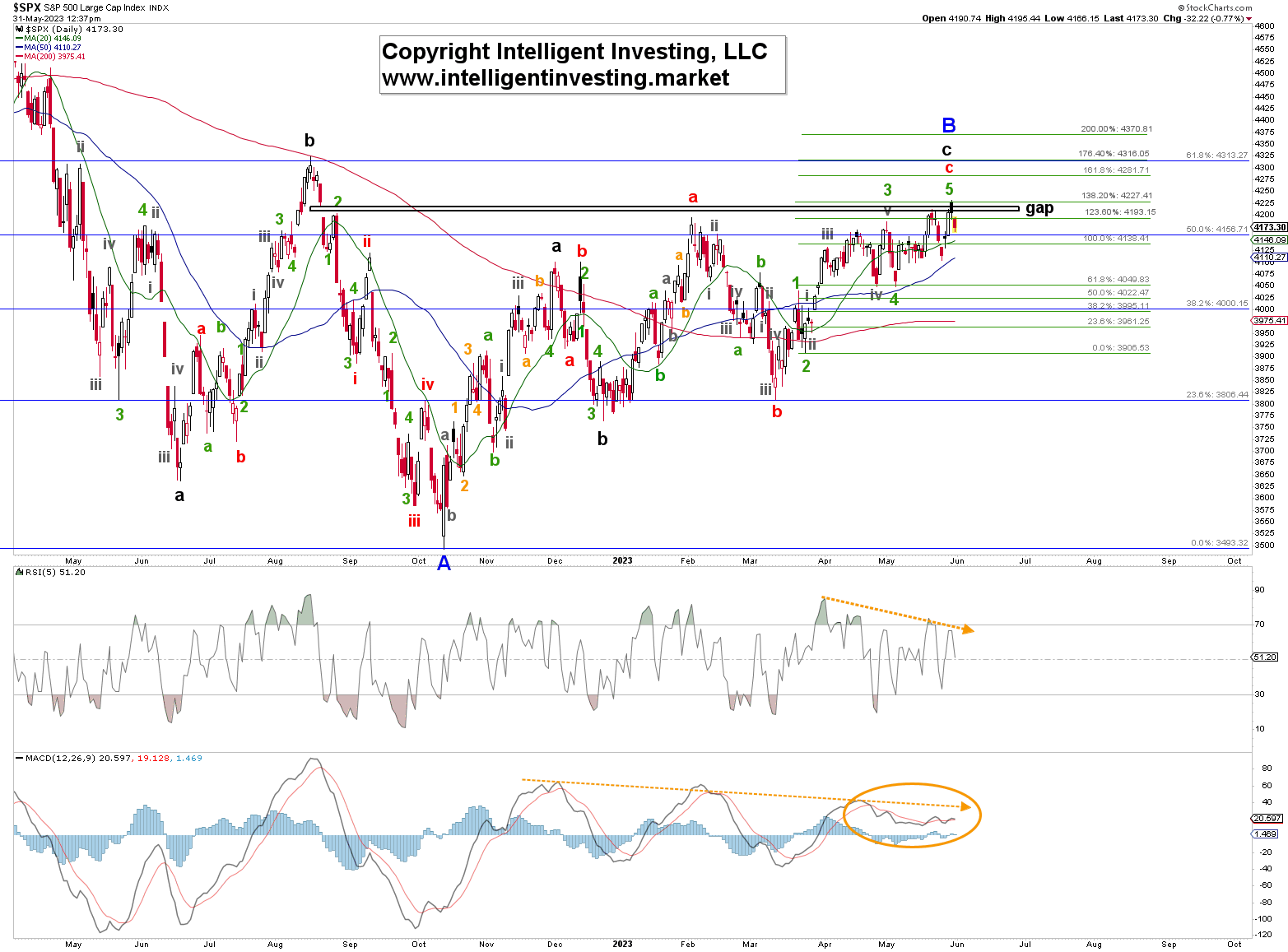

Thus, under that scenario, yesterday’s high was orange W-a, and the current pullback is orange W-b. A W-c to ideally $4180-4190 should follow. Thus, we can raise our cut-off level from $4098 to $4104. Namely, below $4104 will mean a drop below the end of grey W-ii, i.e., the start of grey W-iii, which is not allowed for a 4th wave. Not even in an overlapping ED. If that were to happen, then the alternate EWP count shown in Figure 2 comes into play: the SPX’s counter-trend rally has ended, and a revisit of, at least, the high $2000s should commence.

Figure 2

Note, yesterday, the index closed the August 2022 gap. As such, technically, it has done enough to call it a top and given the negative divergences on the technical indicators (orange dotted arrows). However, our preferred scenario remains for $4315-4370 as that would allow for a more typical 62% retrace (at $4313) of the 2022 decline. But make no mistake; we expect the index to revisit at least the high $2000s from there as well.

Thus, like last, our parameters are set, helping us prevent havoc on our portfolio and allowing us to trade the index objectively.