The Canadian dollar fell strongly overnight, after the hawkish rhetoric from the US Federal Reserve hit the wires, but the venerable CAD now looks set to add an additional bullish leg as price action enters a support zone.

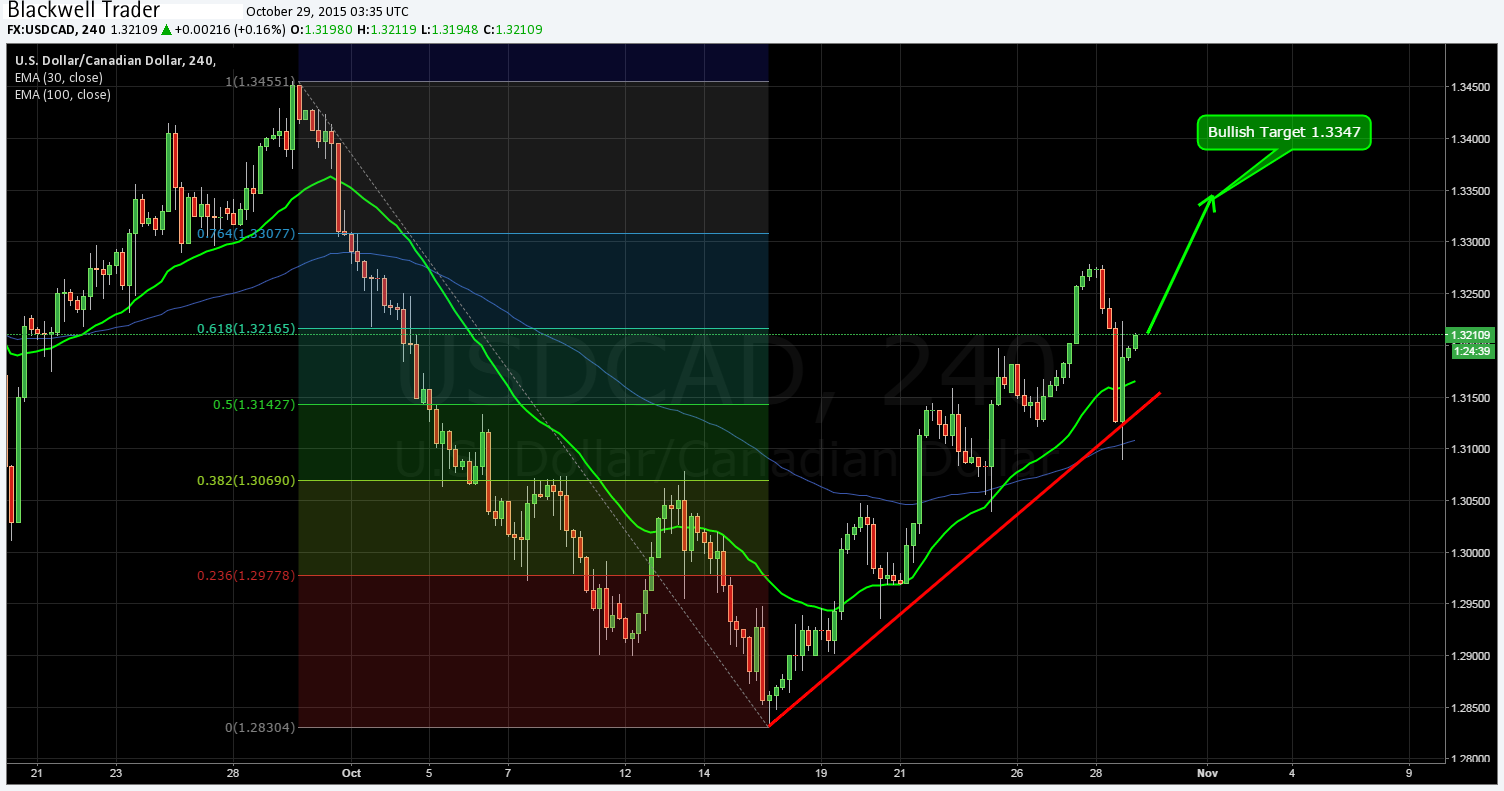

The Loonie has had a torrid 24 hours, as the pair felt the wrath of a resurgent US dollar fuelled by rampant speculation that the Fed will hike rates in December. The pair initially fell sharply but managed to find some support at 1.3173, before recommencing its rise up the supporting trend line, to close the day out yesterday at 1.3206. Despite the slide over the past day, the CAD now resides within a relatively strong support zone that is being keenly watched by traders. Subsequently, the confluence of the bullish trend line and the current support zone provide an excellent base from which a retracement can occur.

Taking a look at the RSI Oscillator shows the key indicator as having retreated strongly from overbought territory and now residing within the neutral zone. Stochastics also indicate a move away from overbought in contrast to the rising price action. This seems to indicate that any bullish move will have plenty of room to move on the upside.

In the near term, the Loonie will need to surmount resistance at 1.3279 to confirm a move higher. This level represents a key swing point and any subsequent breach of this point could see the pair moving sharply to test resistance at 1.3347. The key level to consider for entry is a move beyond the 61.8% Fibonacci level at 1.3218.Either way, any bounce or retracement from this supporting trend line is likely to provide plenty of trading opportunities in the coming days.

On the fundamentals front, monitor today's Canadian Raw Material Price Index (RMPI) result, forecast at 1.3% m/m, as a surprise could put the currency under pressure given the nation's reliance upon commodity revenues. The US Unemployment Claims figures are also due shortly but are likely to come in near estimates at 264k and are therefore unlikely to impact the pair greatly.

Ultimately, the Canadian dollar can be difficult to trade given the currency's exposure to global commodity prices. However, given the strength of the current support zone along with the short term bullish trend, any long biased trade possess an excellent risk reward ratio.