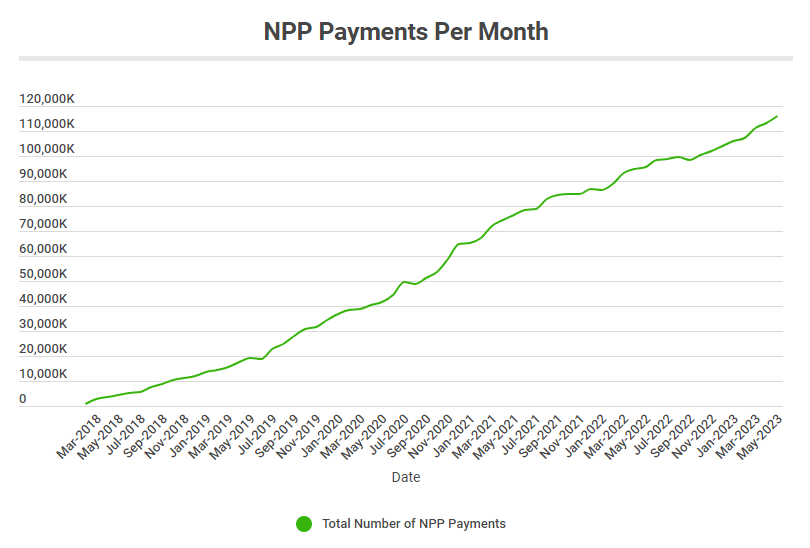

The Covid-19 pandemic saw Aussies take advantage of lockdowns and stay-at-home orders to save and pay down debts, taking credit cards to the sword. However since then, spending has been elevated. Further, since its introduction in 2018, Australians have welcomed Osko and the New Payments Platform to transfer money in near real-time, which is a big benefit over yesteryear's waiting days for funds to clear.

Monthly payments data provided by the ABS and Reserve Bank of Australia (RBA) details a number of insights into how we ultimately tap, swipe and use the pieces of plastic that lie within our wallets.

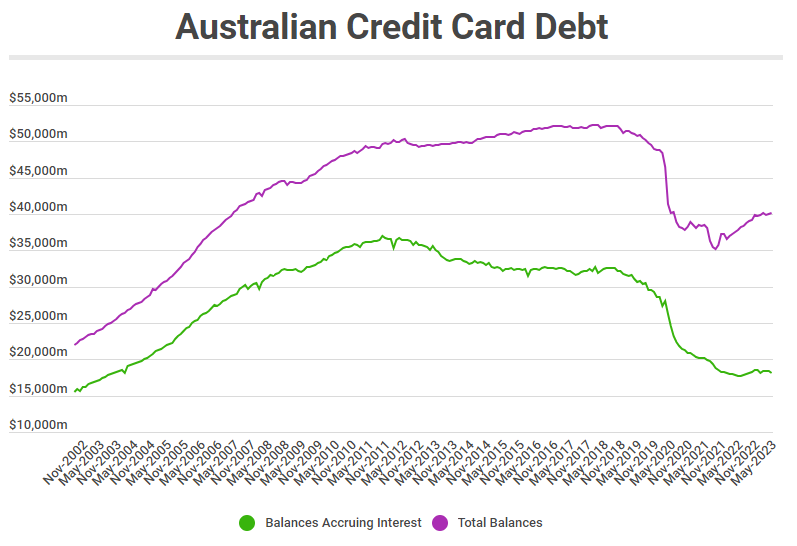

Australian credit card debt

See the total value of Australia’s personal credit card debt, plus the total credit card debt that’s accruing interest.

Since the onset of the COVID pandemic, many Australians sought to take control of their finances, utilising savings to pay off credit card debts.

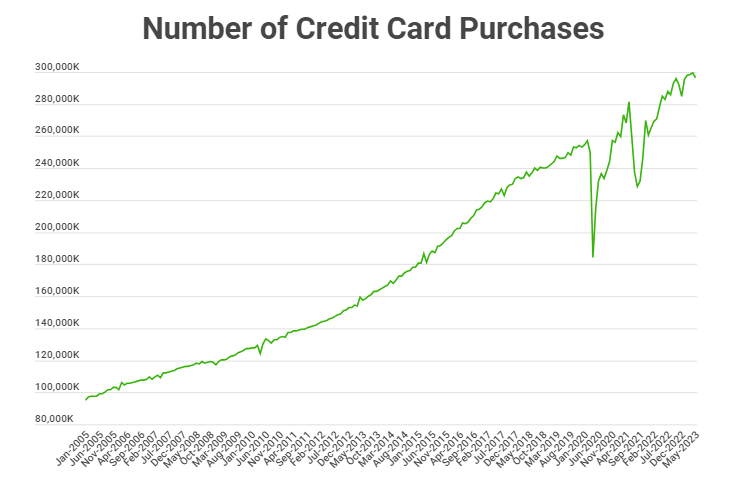

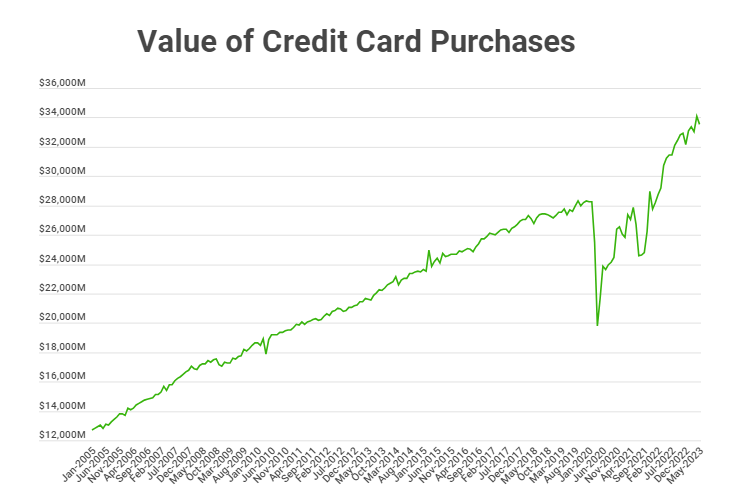

Monthly credit card purchases

Australian's appetite for credit remains strong, with the number and value of credit card purchases not far off record highs, despite the sharp fall in credit card debt.

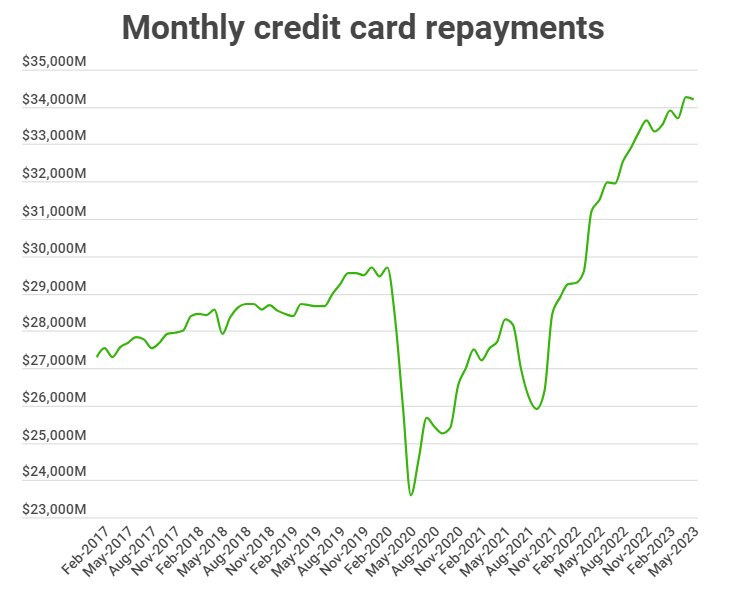

Monthly credit card repayments

See the total value of credit card repayments made each month.

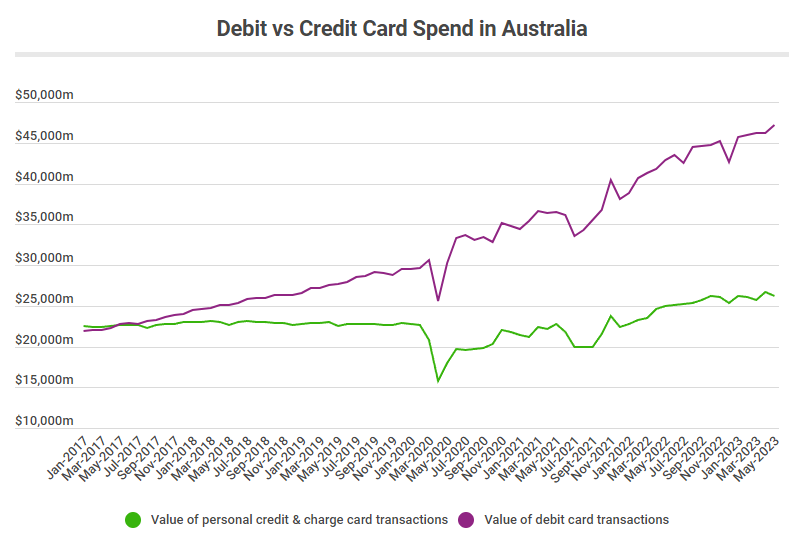

Credit vs debit card spending

Debit card spending continues to outpace credit card spending. Debit card spend first overtook credit card spend in May 2019, before the onset of the pandemic appeared to widen the gap further.

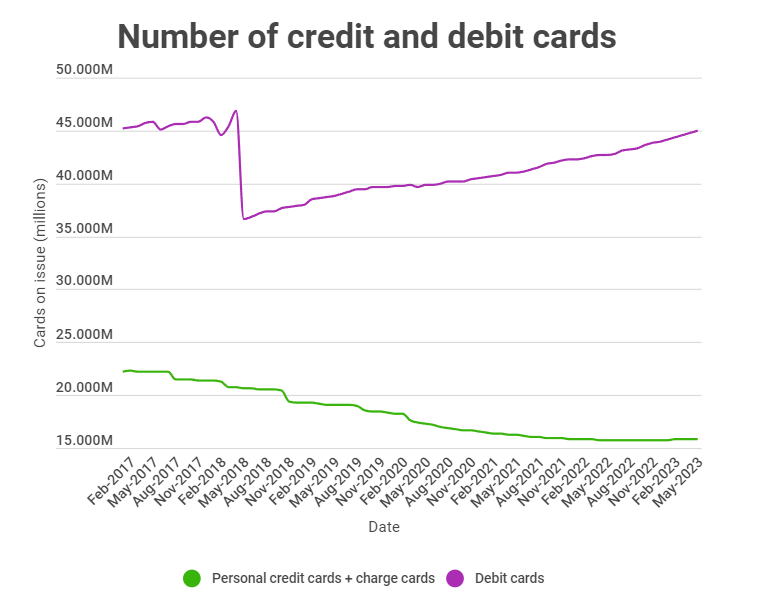

Number of credit cards vs debit cards

The number of active credit accounts continues to decline as Australians look to continue to pay off debts and chop the pieces of plastic held in their wallets in two. Meanwhile, the number of debit cards on issue is steadily rising.

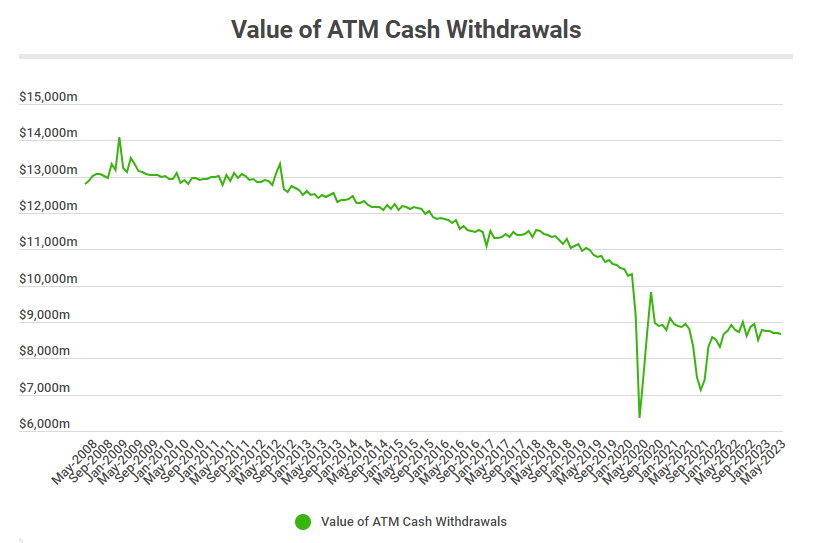

Cash withdrawals

With ATM use dwindling, cash withdrawals have also taken a dive in recent times.

NPP payments

Since launching in 2018, the usage of the New Payments Platform (NPP), which allows instant transfers (e.g. Osko payments), has continued to rise.

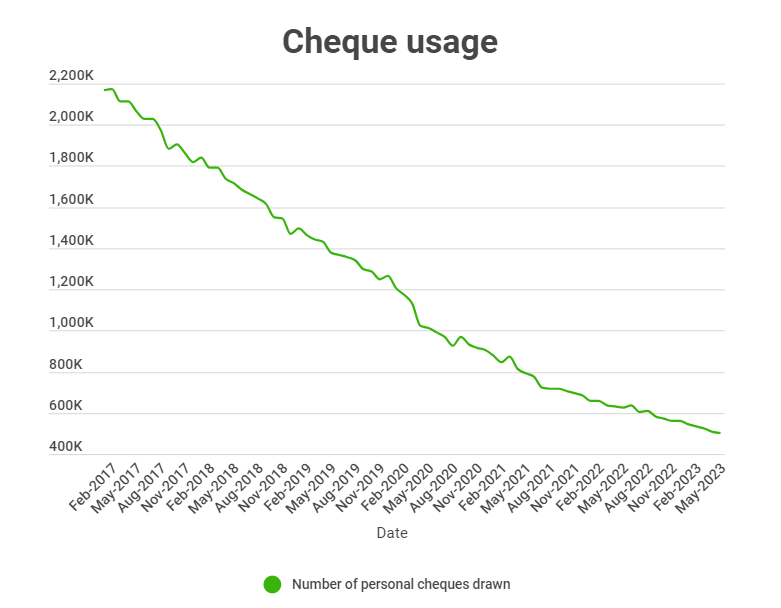

Cheque usage

In an age where digital payments rule the roost, cheque usage continues to decline.

"By the numbers: Australian credit and debit card statistics" was originally published on Savings.com.au and was republished with permission.