DXY has broken out decisively as EUR is bombed:

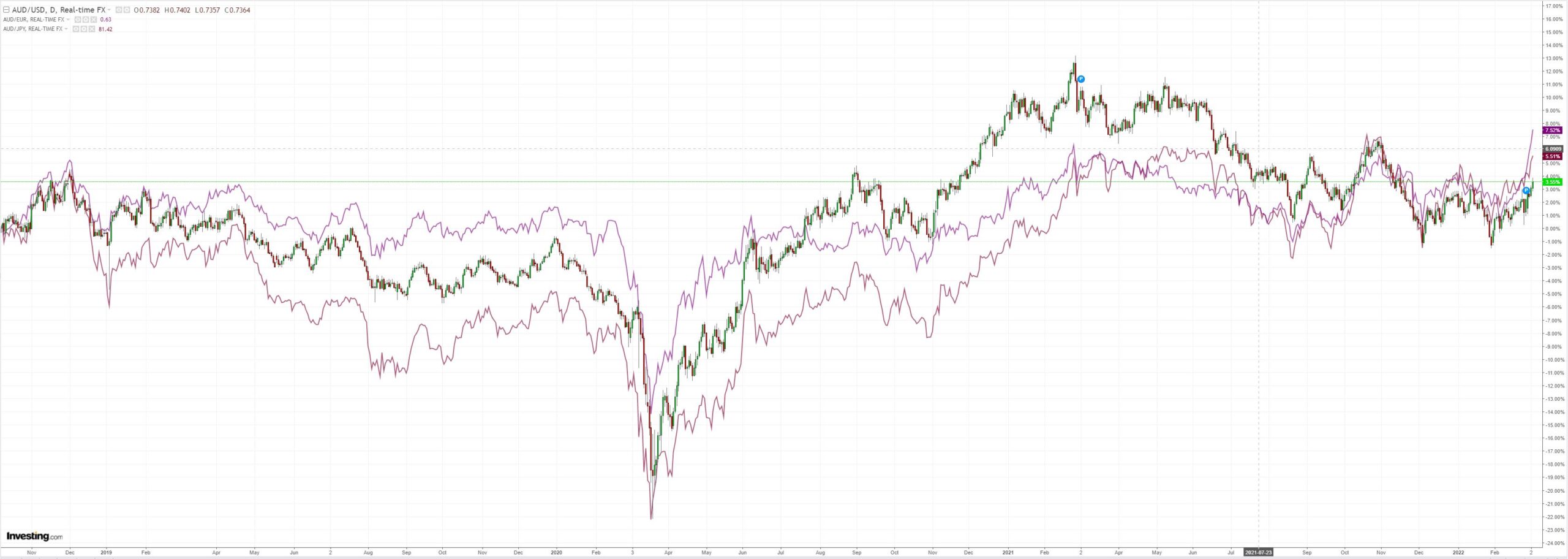

But so as AUD as key commodities skyrocket. This is very unusual:

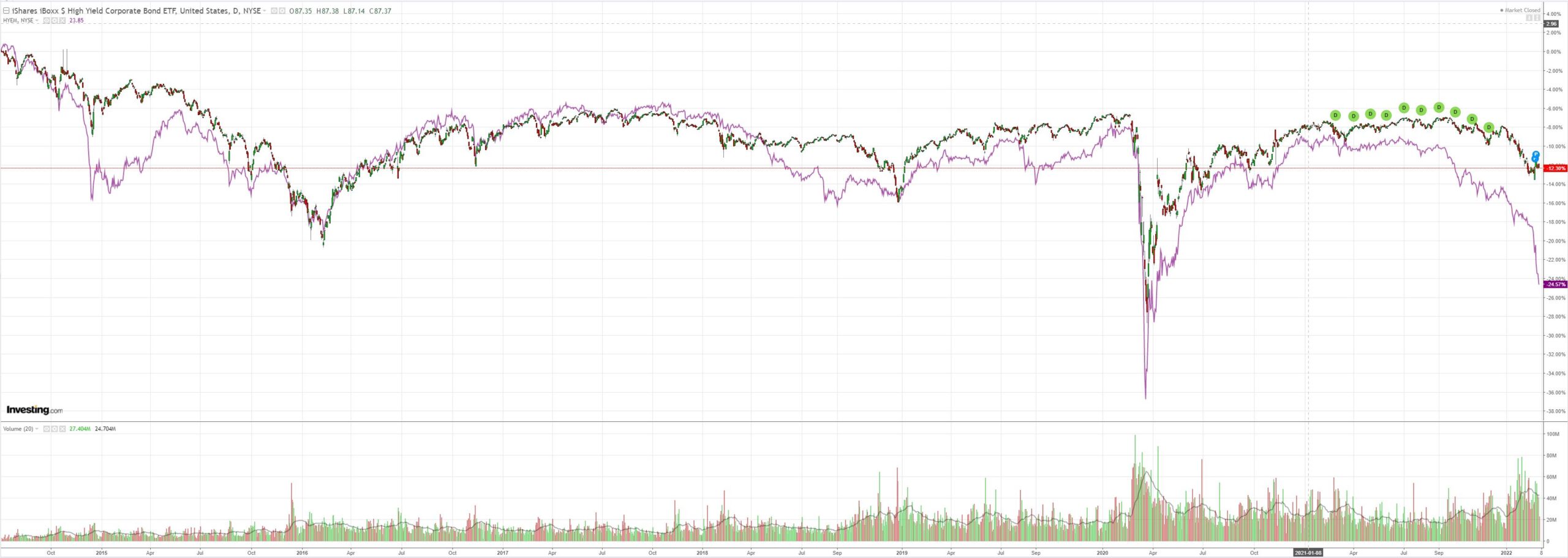

As all things dirt roar, all things dirt producer bust. EM stocks (NYSE:EEM):

And EM spreads (NYSE:HYG):

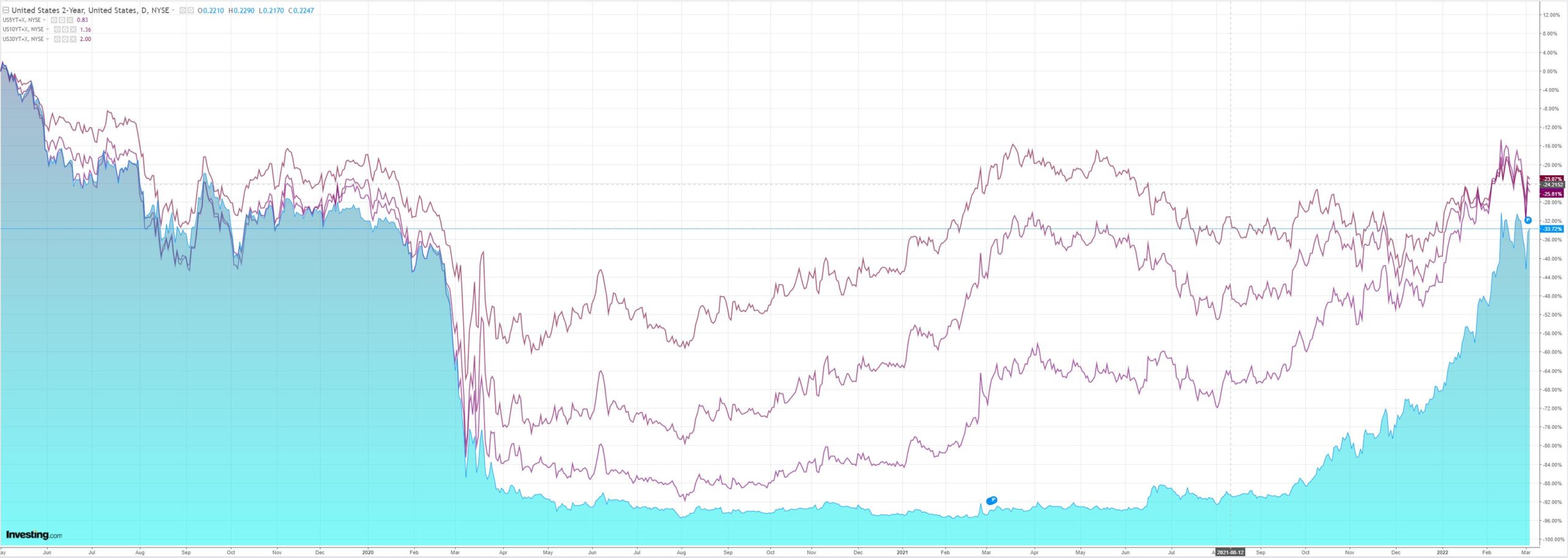

The Treasury curve flattened again:

Stocks fell:

Westpac has the data wrap:

Event Wrap

US ISM services activity survey fell to 56.1 (est. 61.1, prior 59.9). New orders and employment fell, while prices rose. Factory orders in January were stronger at +1.4%m/m (est. +0.7%m/m, Dec. revised to +0.7%m/m from -0.4%m/m). Ex-transport was solid at +1.0%m/m. Weekly initial jobless claims fell to 215k (est. 225k, prior 233k), while continuing claims were higher than expected at 1476k (est. 1420k). Final Q4 unit labour costs rose 0.9%q/q (initial reading was +0.3%q/q).

Fed Chair Powell repeated yesterday’s testimony, this time to Senate, reiterating concerns over higher prices, and that he favoured a 25bp initial hike but would be prepared to tighten more aggressively if needed. He also said that the pace of balance sheet run-off would be set at the following FOMC meeting but did want to cap the run-off in order to avoid volatility in markets.

Bank of Canada Governor Macklem said that broadening global price pressures are a big concern and that higher rates are needed to dampen spending growth. He also said that while quantitative tightening would be used to compliment interest rate rises, the latter would remain the main policy tool.

Eurozone PPI in February posted a further sharp rise 5.2%m/m and +30.6%y/y (est. +2.8%m/m and +27.3%y/y) with energy prices rising +85.6%y/y. Unemployment rate in January improved to 6.8% (est. 6.9%, prior 7.0%).

Event Outlook

NZ: The February ANZ consumer confidence survey should continue to highlight household’s concerns with omicron and inflation.

Eur: Retail sales are expected to rebound in January after the December decline due to omicron (market f/c: 1.5%).

US: Non-farm payrolls are expected to continue reflecting healthy gains in employment growth in February (Westpac f/c: 350k, market f/c: 415k) which should see the unemployment rate push lower (Westpac f/c: 3.9%); if participation is able to lift, risks are in favour of a stronger gain in employment. The historically tight labour market should continue to support average hourly earnings (market f/c: 0.5%). The FOMC’s William is due to speak on the economy.

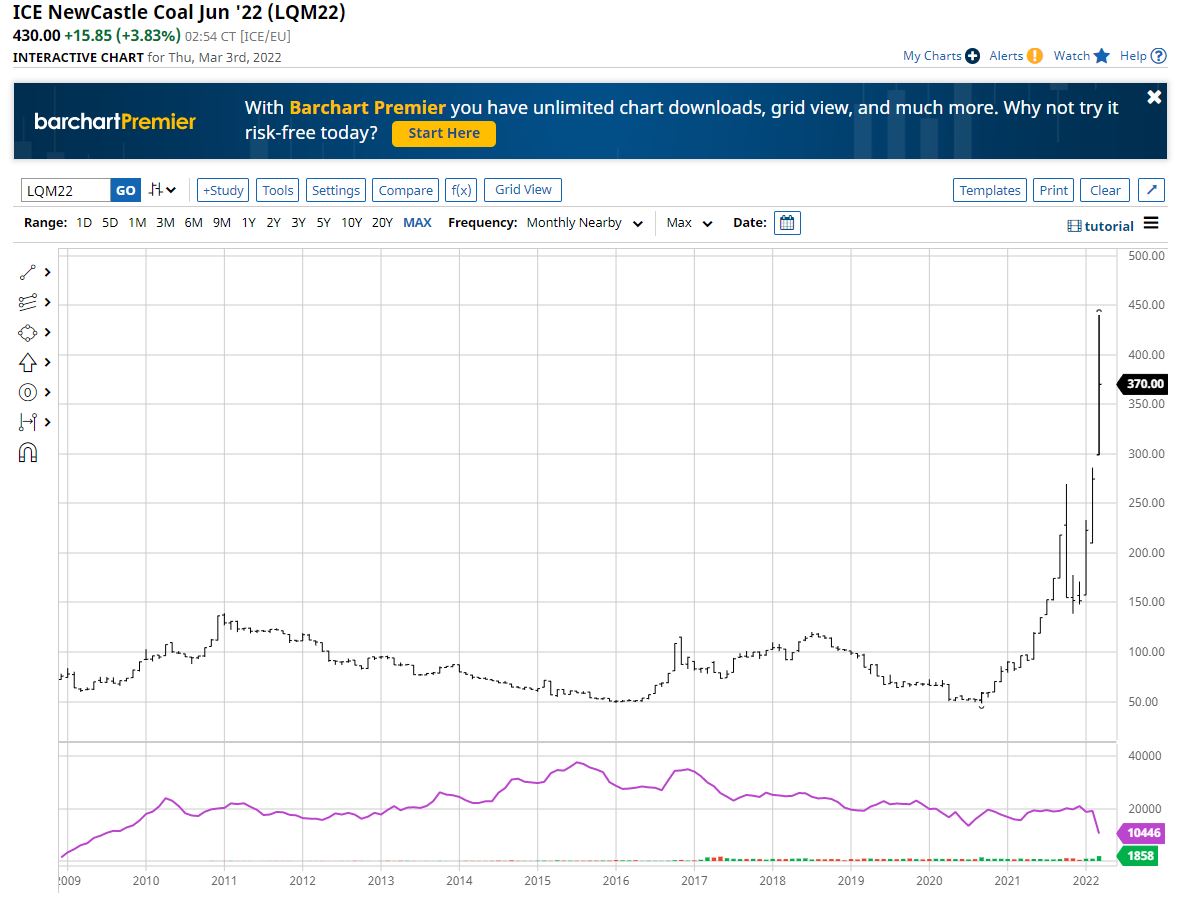

Here is the June contact for thermal coal:

March for coking coal:

LNG for May:

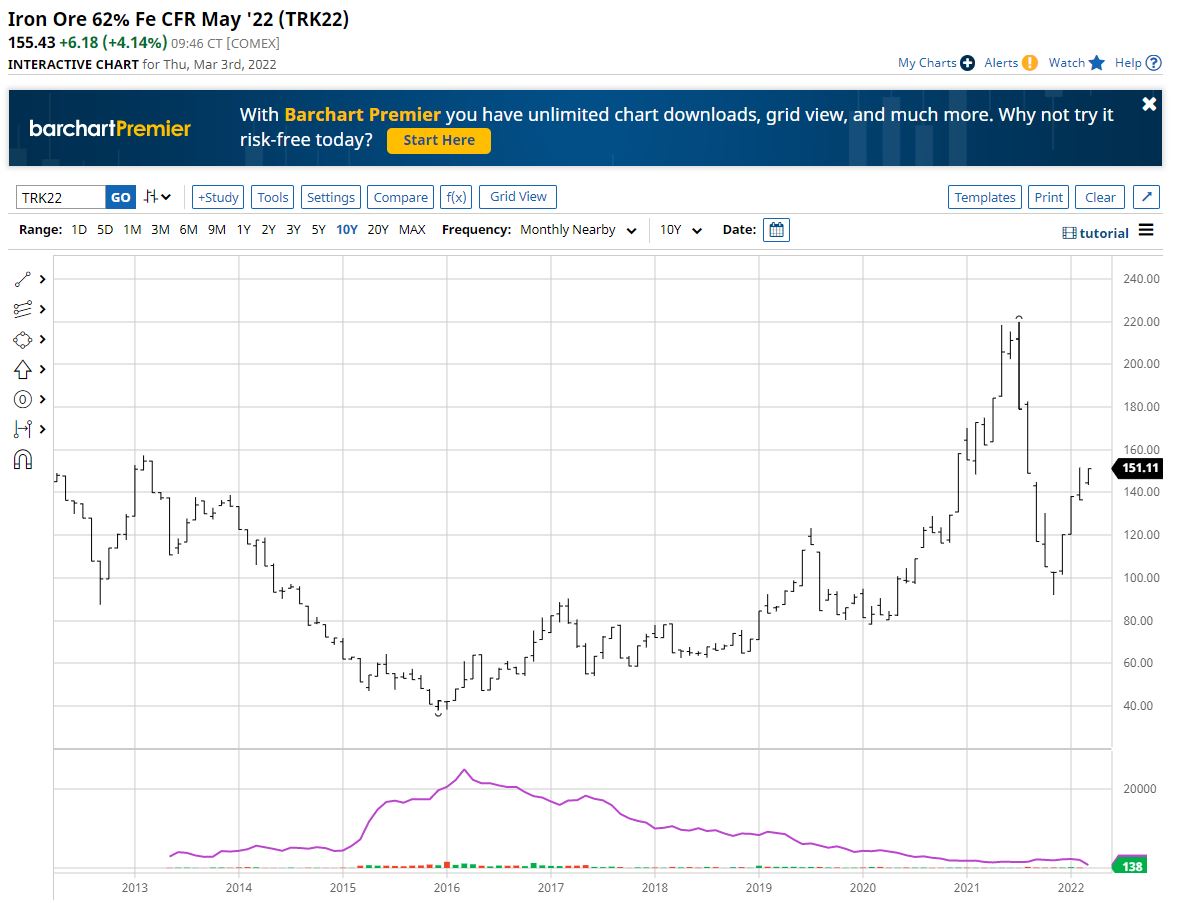

Iron ore for May

The prices surges are not quite as simple as they look:

- Thermal coal is the smallest contributor to the terms of trade at around 8% usually.

- Coking coal is double that so its surge is meaningful.

- Iron ore is still far down from peaks but immensely profitable nonetheless.

- LNG adds nothing to the economy owing to the corrupted taxation regime, domestic cost implications and offset in rising oil.

So, it is less of a total net economic benefit than meets the eye, if still meaningful, but nobody in global markets is worried right now.

The “buy dirt” panic means “buy AUD” and so long as that lasts, for about as long as the war one would suggest, then the AUD will be able to resist the unfolding DXY Bull market.