It was one of those days; as soon as I woke up, I knew it could be a long day because the VIX was up probably more than it should have been for flat futures.

If it feels like Deja Vu, it is probably because I wrote something similar, not that long, ok.

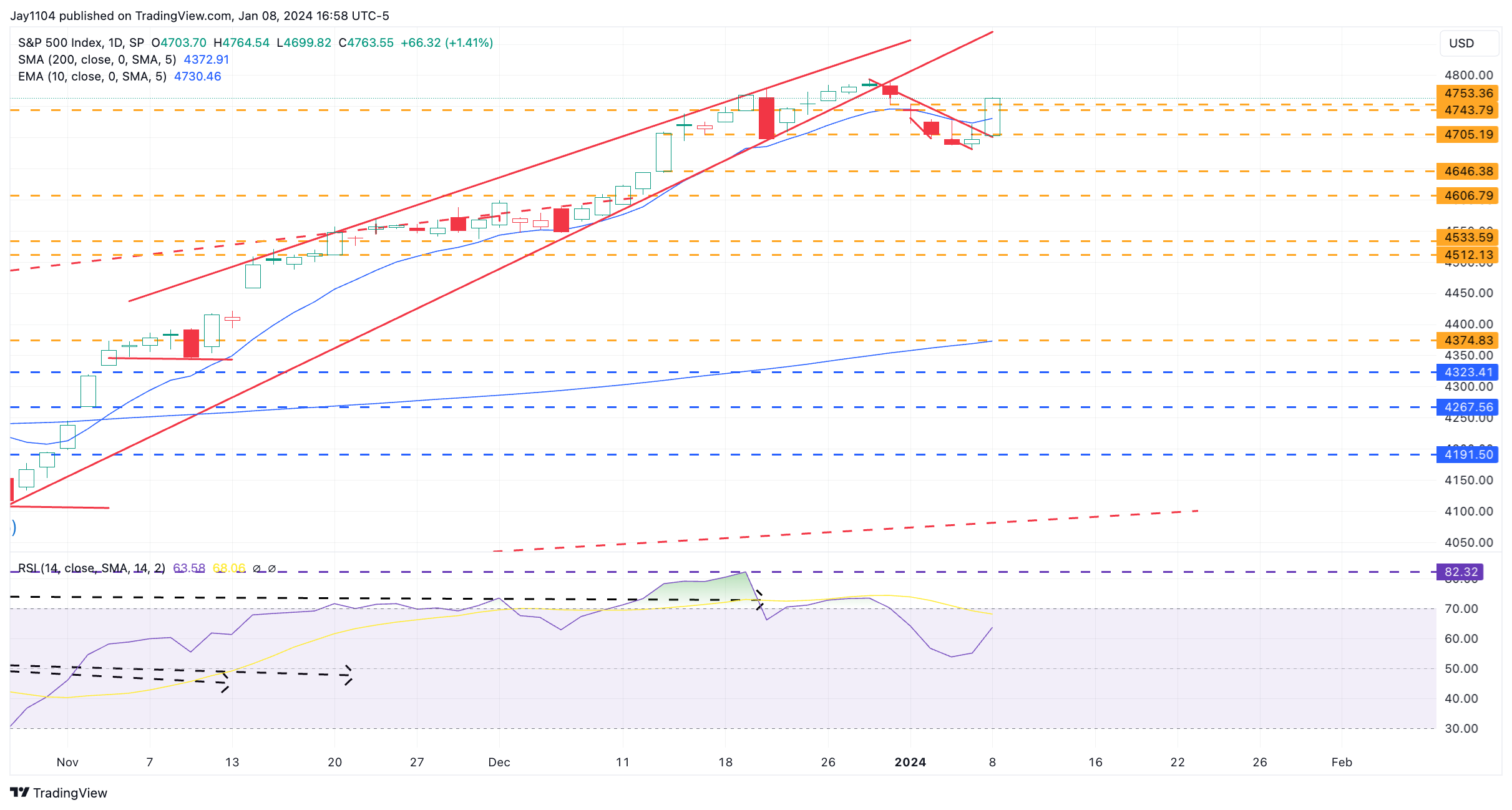

Anyway, the one victory for the bulls is that, at least based on the gamma levels this morning, the index managed to close back in a positive gamma regime, which means that the positive effects of gamma will be volatility dampening.

And that means that if we continue to move higher, it will go back to more of a grind.

The positive is that we broke a downtrend in the S&P 500 and also managed to close above the 10-day exponential moving average, which had served as resistance.

Of course, that will need to be confirmed today, and if there has been a reversal of trend, that 10-day EMA should act as support.

Elsewhere: Rates Struggle to Rise, US Dollar Unchanged, Oil Heads Lower

Meanwhile, rates hardly moved yesterday; initially, they were lower but finished down just two bps on the 10-year Treasury.

Based on this, I would think the move in the equity market was separate from any move witnessed in the bond market, and Fed policy had little to do with any developments from the Fed.

Rates would have been impacted more if there had been Fed-related news. For now, the 10-year struggles to get over the 200-day moving average.

The Dollar Index was hardly changed as well.

This goes more to the point that the move higher yesterday in the S&P 500 was an implied volatility move higher, and I think it had little to do with anything else.

More to the point, oil was down more than 4% daily as the Saudis cut prices due to weak demand.

Nvidia Surges Higher: Could the Rally Sustain?

Nvidia (NASDAQ:NVDA) was also a big part of the move, allowing that big tech component of the market to work on news of a China-compliant chip and more AI mania ahead of this year’s CES.

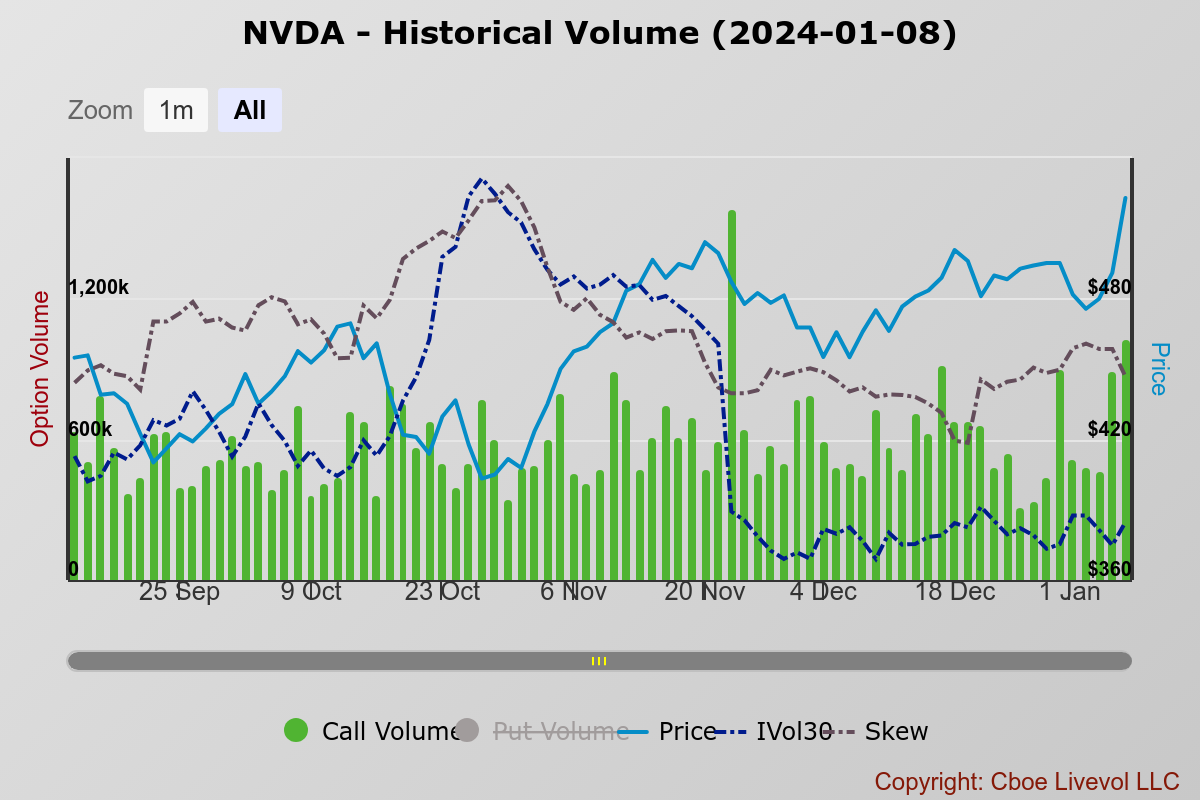

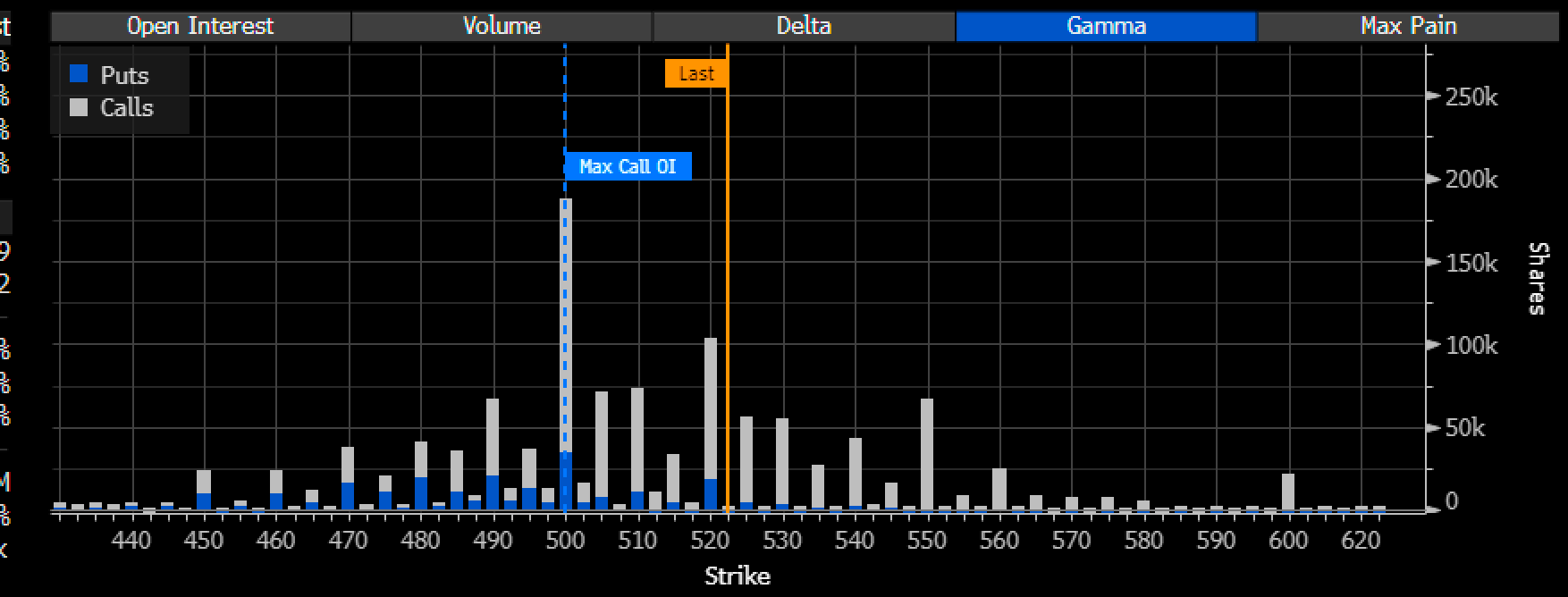

The move has the signature marks of a gamma squeeze, with Skew falling, IV rising, and call volume surging. How far the rally can go depends on how long the gamma squeeze can commence.

There is also some decent gamma level at $520, $525, and $530, which is why the stock probably stalled out just below that most of the day.

What can keep this stock working higher will be the options market, but if calls become too expensive, the rally will fade away quickly.

The skew is already slanted to the calls, which means that calls are already more expensive. That isn’t to say they can’t become more expensive, but that is what appears to have happened yesterday.

Please watch my latest YouTube Video: