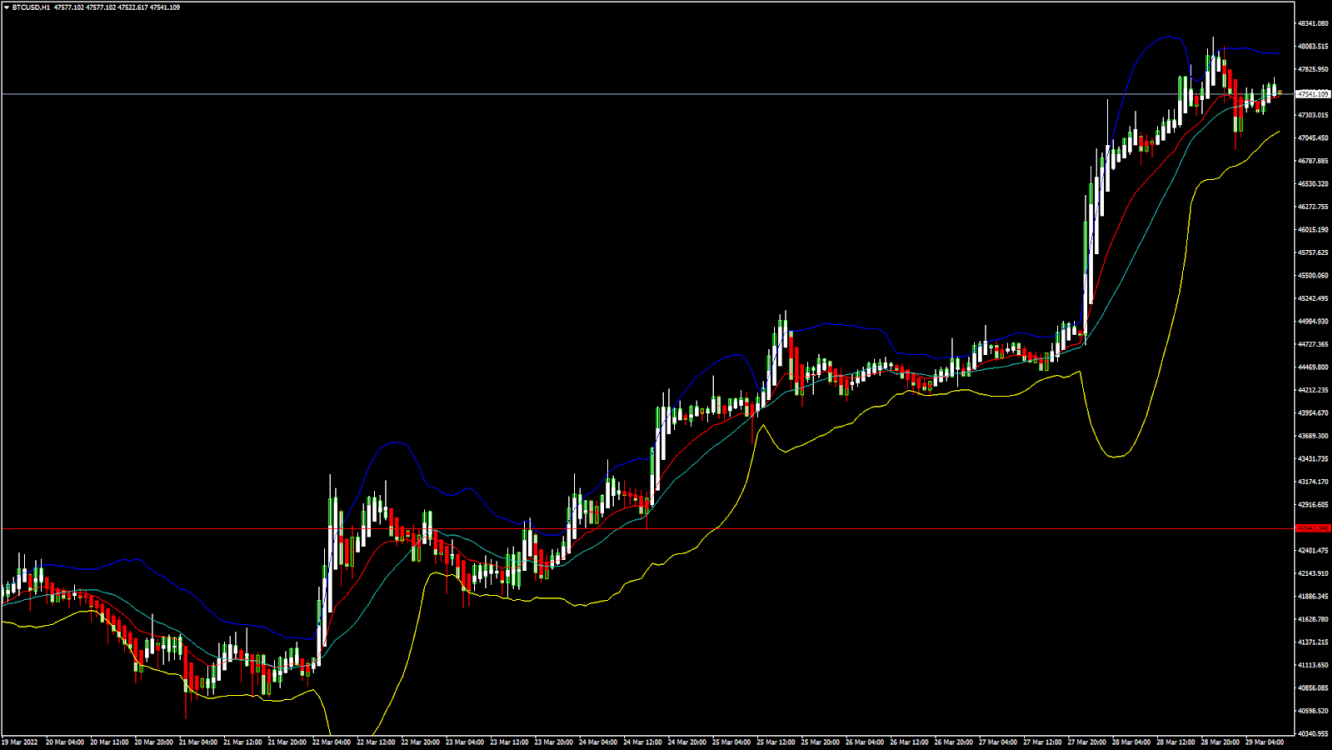

BTCUSD Bullish Engulfing Pattern Above $42,000

We can see continuous appreciation in the price of BTCUSD from last week, and today it has managed to cross the $47,000 handle in the European trading session.

Due to increased buying pressure, the price of bitcoin has been rising for 7 consecutive days, and the upwards growth also suggests that we are aiming for the level of $50,000.

The strong wave of this bullish trend continues, with the price of bitcoin trading above the $47,500 mark in the European trading session today.

We can clearly see a bullish engulfing pattern above the $42,000 handle, which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

The Stoch and Williams percent range are indicating an overbought level, which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 57 indicating a STRONG demand for bitcoin at the current market levels.

Bitcoin is now moving above its 100 hourly simple moving average, and its 200 hourly exponential MA.

All of the major technical indicators are giving a STRONG BUY signal, which means that in the immediate short term, we are expecting targets of 46,000 and 48,000.

The average true range is indicating LESSER market volatility with a strongly bullish momentum.

- A bullish continuation pattern is seen above $42,000

- The StochRSI is indicating an OVERSOLD level

- The price is now trading just below its pivot levels of $47,585

- All of the moving averages are giving a STRONG BUY market signal

Bitcoin: Bullish Continuation Pattern Seen Above $42,000

Bitcoin continues to move in a strong bullish momentum with an upwards projection towards the level of $48,000 in the European trading session today.

In the immediate short term, we are expecting a continuation of this bullish trend with the price ranging between $46,000 and $49,000 as it is due to enter into a consolidation phase.

We can see optimism among bitcoin traders, as it has managed to continue its upwards trend in the short-term range.

The immediate short-term outlook for bitcoin is strongly bullish, the medium-term outlook is bullish, and the long-term outlook remains neutral under present market conditions.

The price of BTCUSD is now facing its classic resistance level of 47,668 and Fibonacci resistance level of 47,726, after which the path towards 48,000 will get cleared.

We can see that the daily RSI is printing at 70 which indicates that in the medium-term prices are expected to appreciate further.

In the last 24hrs BTCUSD has gone UP by 1.39% with a price change of 653$, and has a 24hr trading volume of USD 35.173 billion. We can see an increase of 2.78% in the trading volume as compared to yesterday, which appears to be normal.

The Week Ahead

The price of bitcoin is due to enter a consolidation phase below the level of $48,000. We can see some range-bound movement in its levels between $46,000 to $48,000.On January 24th bitcoin touched a low of $32,950, after which it has managed to rise by more than 41% to its current market level of $47,456.

In the immediate short term, bitcoin’s bullish momentum is expected to continue pushing its levels above the $48,000 handle this week. The price of BTCUSD will need to remain above the important support level of $45,000.

The weekly outlook is projected at $49,000 with a consolidation zone of $46,500.

Technical Indicators:

The relative strength index (14-day): at 56.33 indicating a BUYThe average directional change (14-day): at 29.23 indicating a BUY

Bull/Bear power(13-day): at 72.28 indicating a BUY

The moving averages convergence divergence (12,26): at 275.90 indicating a BUY

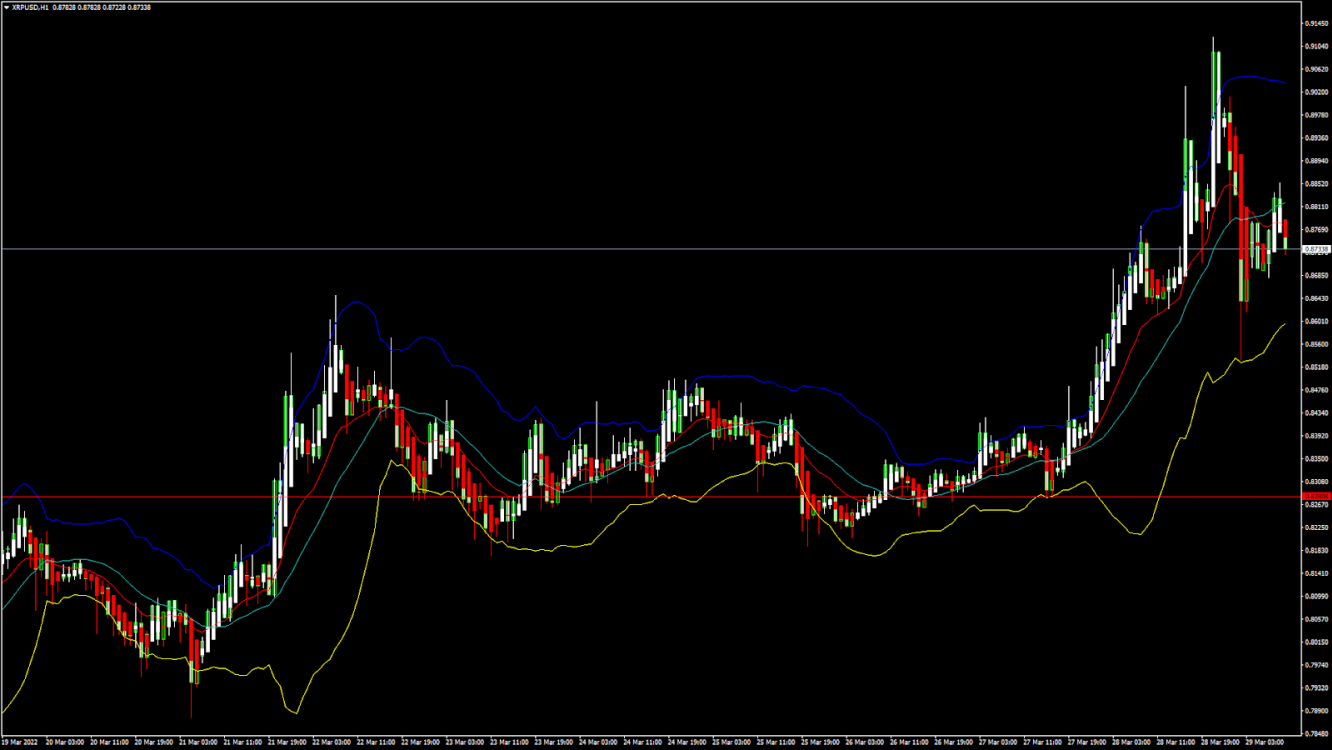

XRPUSD Double Bottom Pattern Above 0.8200

Ripple continues making gains from last week and has managed to cross the levels of 0.9000 in the European trading session today.

The increase in the demand for Ripple is due to its increased usage in international bank settlements.

We can see the formation of a bullish ascending channel which has managed to push its prices above the $0.9000 handle.

The on-chain metrics are also indicating a strongly bullish outlook, leading to increased buying seen across the cryptocurrency exchanges worldwide.

We can clearly see a double bottom pattern above the 0.8200 handle which signifies the end of a downtrend and a shift towards an uptrend.

The short-term outlook for Ripple remains mildly bullish; the medium-term outlook remains bullish; and the long-term outlook is neutral.

The relative strength index is at 64 which signifies a STRONG demand for Ripple at the current market prices and the continuation of buying pressure.

All of the moving averages are giving a STRONG BUY signal at the current market levels of 0.8727.

Ripple is now trading just below its pivot level of 0.8759, and is now facing its classic resistance level of 0.8987 and Fibonacci resistance level of 0.9342 after which the path towards 0.9800 will get cleared.

- All of the technical indicators are giving a STRONG BUY signal

- Ripple continues its bullish momentum above 0.8200

- The StochRSI is giving an OVERBOUGHT signal

- The average true range indicates LESSER market volatility

Ripple: Bullish Momentum Continues Above 0.8200

In today’s European trading session, Ripple has been moving inside a strongly bullish ascending channel at the level above 0.8500.

The price of Ripple is making a strong upwards trend, and we may see levels of 0.9800 and 1.0000 this week.

We can see that XRP has touched a high of 0.9120 in the eaarly Asian trading session, after which the price corrected, and a low of 0.8531 was formed in the European trading session.

The price of XRPUSD has gone UP by 0.87% with a price change of $0.007575 in the past 24hrs and has a trading volume of 3.021 billion USD.

We can see an increase of 57.24% in Ripple’s trading volume compared to yesterday, which is due to the increased buying seen across global crypto markets.

The Week Ahead

The prices of XRPUSD are now moving in a strongly bullish channel above the 0.8500 handle, and the next targets are 0.9500 and 0.9800.

We can see that Ripple is breaching towards the $1.0000 handle this week which if broken will lead to its prices touching $1.1000 next week.

This week, the price of Ripple needs to remain above the crucial support level of $0.8500 after which we may see a progression of the bullish momentum.

The weekly outlook for Ripple is projected at 0.9500 with a consolidation zone of 0.9000.

Technical Indicators:

The moving averages convergence divergence (12,26): at 0.022 indicating a BUY

The average directional change (14-day): at 40.41 indicating a BUY

The commodity channel index (14-day): at 150.73 indicating a BUY

The Williams percent range: at -24.04 indicating a BUY