DXY to the moon:

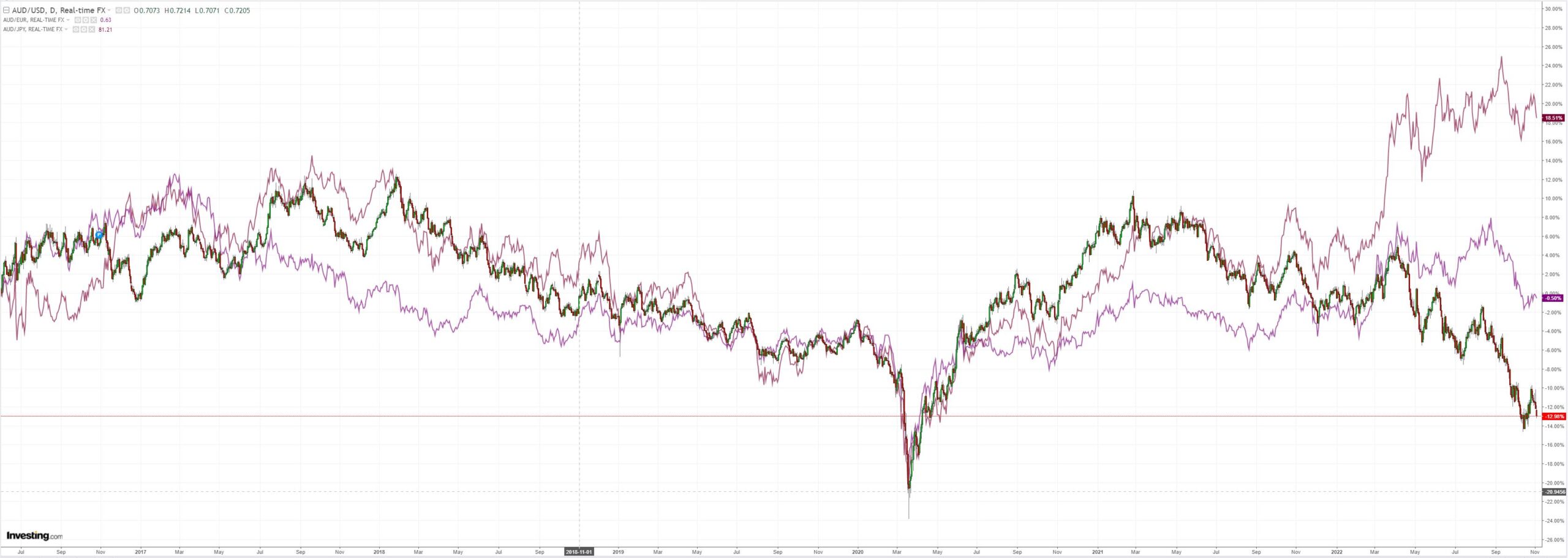

AUD through the floor:

CNY the same:

Commods are hanging on:

And miners (NYSE:RIO):

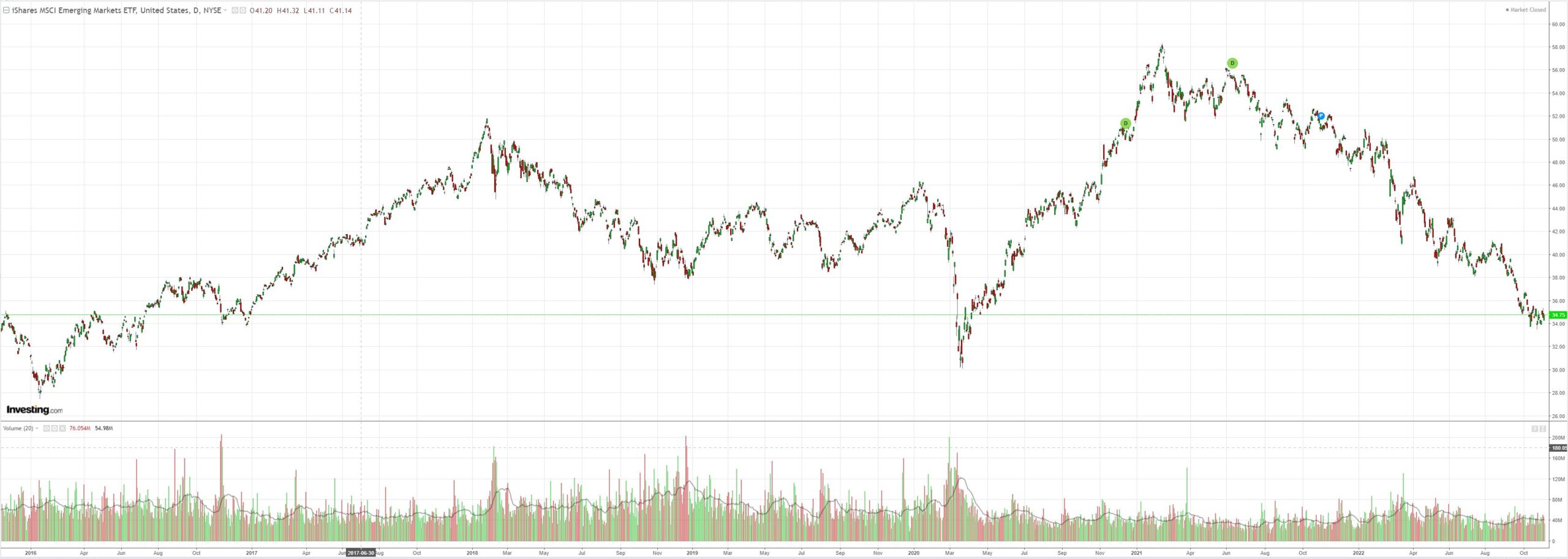

EM stocks (NYSE:EEM) have gone nowhere:

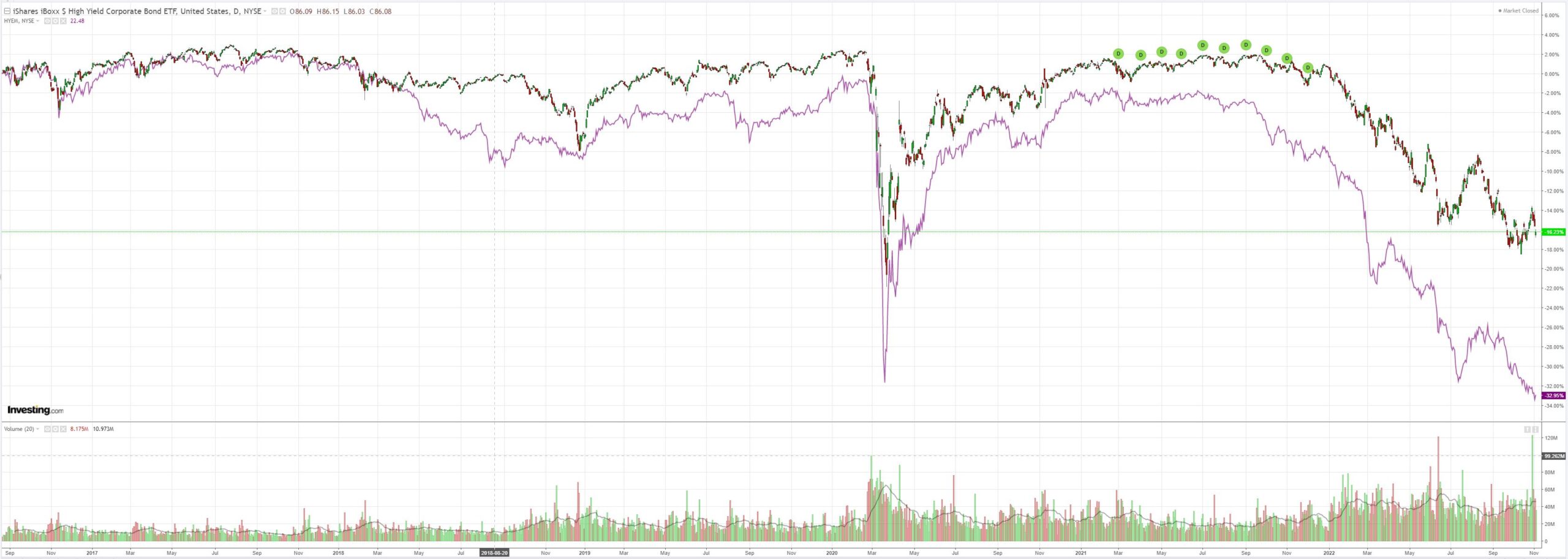

US junk (NYSE:HYG) broke:

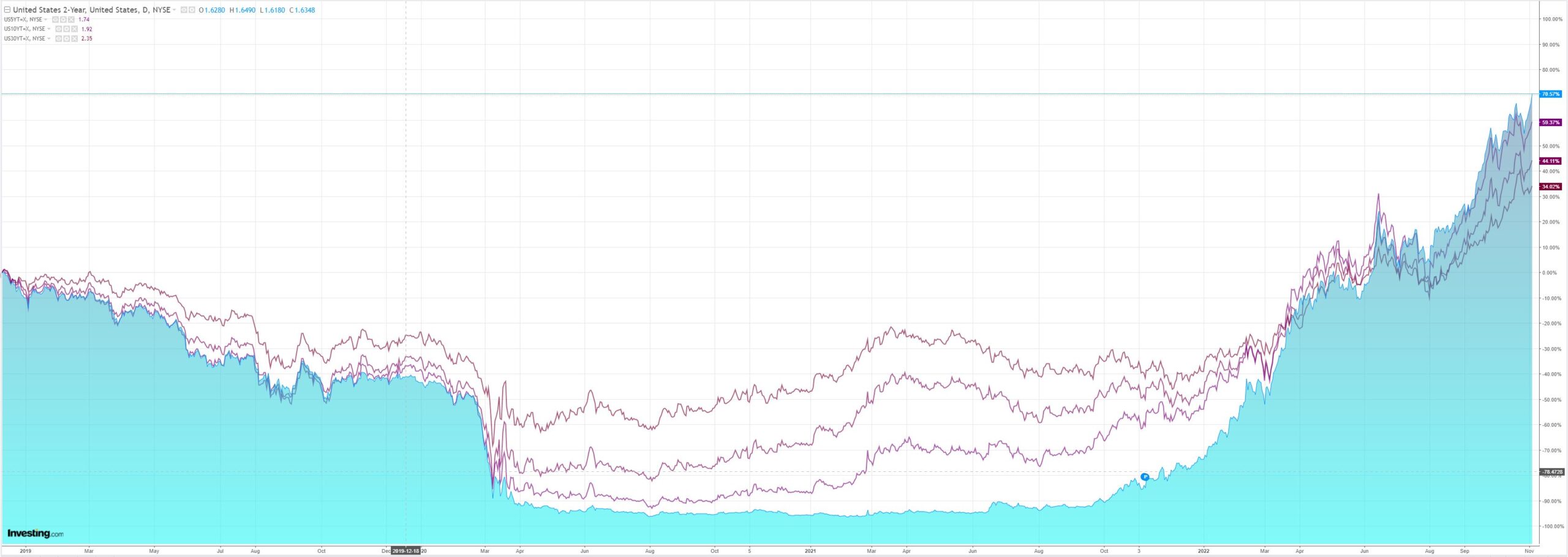

Yields broke out, curve mashed:

Stocks fell:

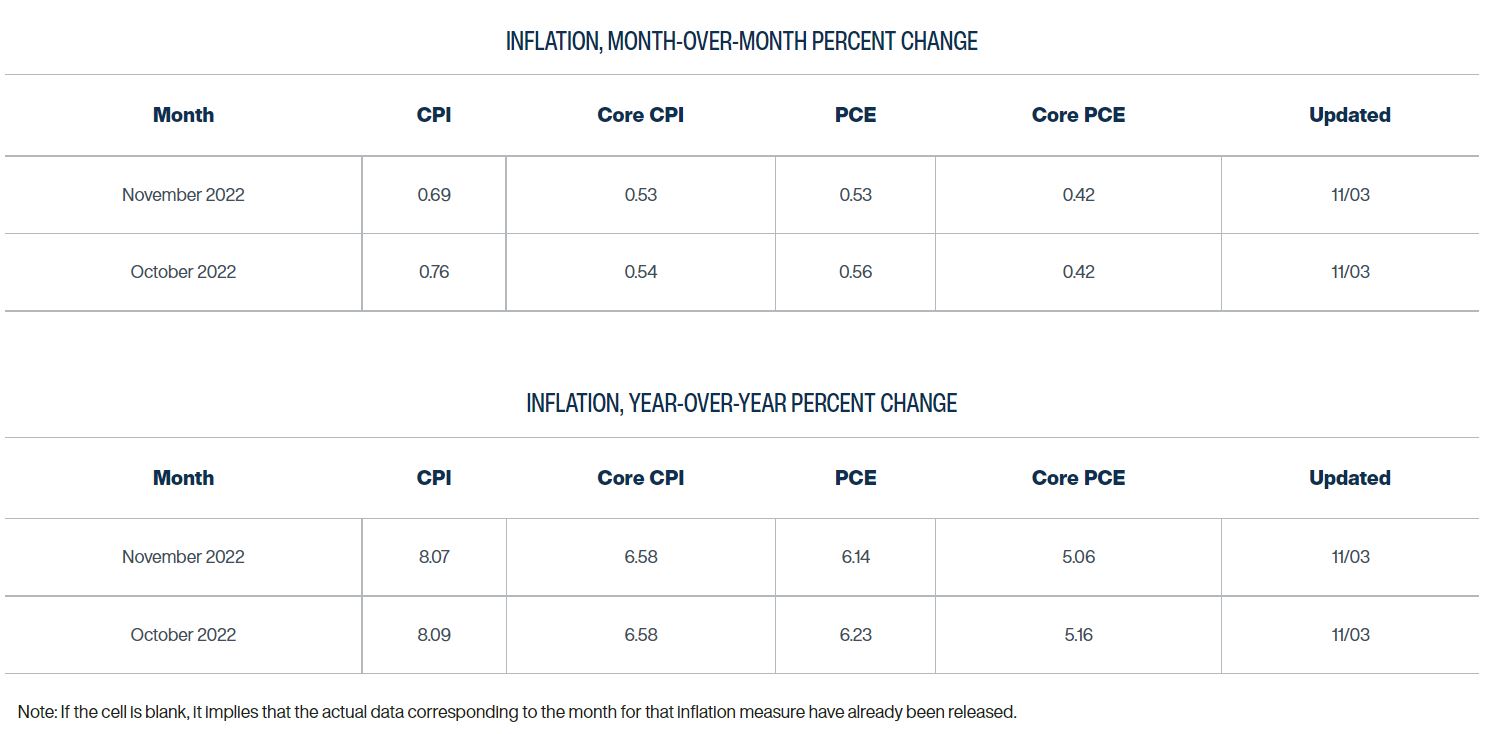

US inflation is still sticky:

The Fed has months ahead of further tightening at 50bps per hit. Remember that rates do not usually peak until they are above inflation. That crossover point is going to be somewhere in the mid-5% range.

The world needs a stronger DXY to break commods, finish off stocks and crush EMs. It is my that it is about to get it.

AUD falling anvil dead ahead.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.