- The Boeing-Airbus rivalry extends beyond business into diplomatic realms, sparked by French Finance Minister Bruno Le Maire's public preference for Airbus due to safety concerns.

- Despite Airbus CEO Guillaume Faury's assurances, Le Maire's stance underscores ongoing unease with Boeing.

- As investors weigh the implications, data from InvestingPro suggests Airbus has capitalized on Boeing's challenges, but analysts foresee potential growth for Boeing if it resolves safety issues.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The rivalry between Boeing (NYSE:BA) and Airbus Group (OTC:EADSF) (EPA:AIR) isn't just about business - it's also taking on diplomatic dimensions.

The spark was ignited by French Finance Minister Bruno Le Maire. During a conference in Berlin, he made it clear that he and his family prefer flying Airbus over Boeing saying 'they prioritize safety.'

The minister's statement was rooted in concerns about Boeing's most recent debacles, including incidents like faulty doors this year and the tragic crashes of two 737 Max planes in 2018 and 2019, which claimed 346 lives.

But Boeing's troubles aren't necessarily beneficial for Airbus either. CEO Guillaume Faury intervened to emphasize that technical issues affecting Boeing hurt the entire aerospace industry's reputation, stressing that safety and quality are paramount.

Despite Faury's reassurance, Le Maire remains steadfast in his preference for Airbus, especially given the French government's significant stake in the company.

This backdrop raises investors a question: Are Airbus shares now a safer bet for investors than Boeing shares? Let's analyze both stocks using data from InvestingPro to find out.

Take advantage of a special discount on InvestingPro+. Find more details at the bottom of this article.

Boeing Vs. Airbus: Which Stock Is the Better Bet?

Five years ago, Boeing faced its biggest scandal ever, which drastically affected its standing in the market. Meanwhile, its European rival, Airbus, experienced a surge in its stock value.

Comparing data from the past five years, on March 23, 2019, shortly after the second plane crash involving Ethiopian Airlines Flight 302, Boeing's stock was priced at $353.69 per share, while Airbus shares were at $124.10 each.

Since then, Boeing's stock has almost halved in value, dropping to $181 per share as of Monday, March 19. In contrast, Airbus shares have surged by nearly 50%, reaching a substantial parity with Boeing at $182 per share.

Five years ago, there was a stark contrast between the two companies, but today, Airbus has not only closed the gap but surpassed Boeing, with a market capitalization of $142 billion compared to Boeing's $110 billion.

Airbus's stock is now more stable than Boeing's, with recent events having a significantly negative impact on Boeing's financial health.

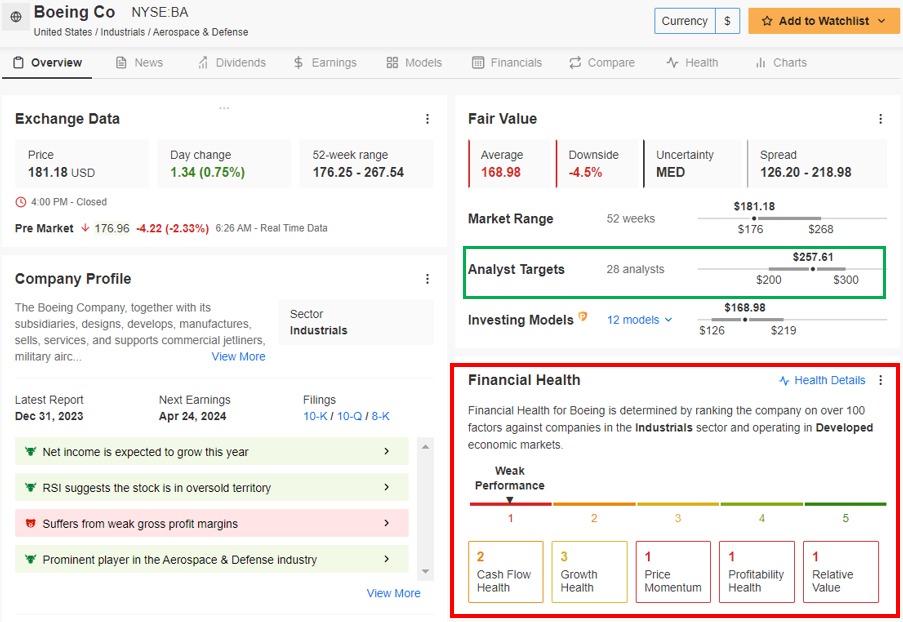

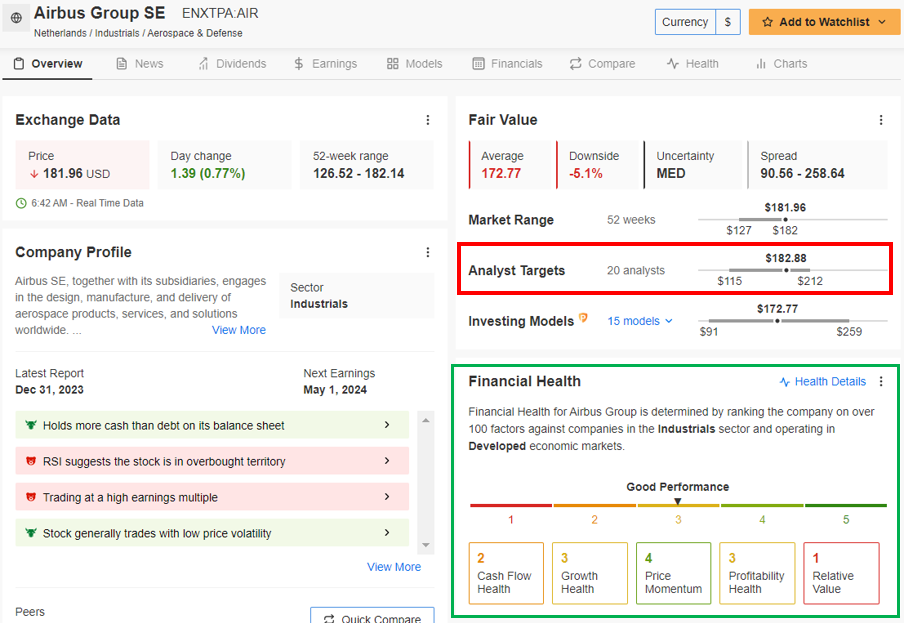

Source: InvestingPro

The U.S. manufacturer's performance is weak, scoring only 1 out of 5. In contrast, the European competitor is currently stronger with a score of 3 out of 5.

However, the Scenario Could Change Going Forward

Looking ahead, prospects matter more to markets than past performance.

According to 28 analysts surveyed by InvestingPro, Boeing's shares are believed to be undervalued. The average target price is set at $257.61, which is more than 42% higher than the closing price on March 19.

On the other hand, analysts surveyed by InvestingPro believe that Airbus' stock is nearly at its target price of $182.88, with only a slight difference from the current level.

Source: InvestingPro

In short, InvestingPro's data clearly shows that Airbus has capitalized on Boeing's challenges in recent years, putting it in a better position than its rival.

However, analysts suggest that Boeing's stock has greater potential for growth in the future, provided the U.S. company resolves its safety issues.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,485% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Remember the 10% discount on the annual Investingpro+ subscription with the code "proit2024." Click on the green banner above, and when paying, enter the code.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.