During FY21 BluGlass (ASX:BLG) continued the transition from an equipment sales and licensing business to a direct-to-market components operation focused on rapidly expanding opportunities in the laser diode industry. While the launch of its first laser diodes has been delayed by reliability issues relating to third-party processing steps, management notes that the fund-raising activities this June and July should provide a cash runway through to initial customer revenues from laser diode sales.

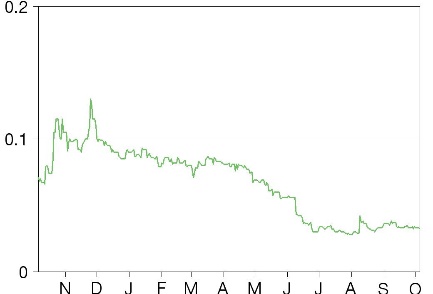

Share Price Performance

Fully funded to laser diode commercialisation

Revenues from customers, which were entirely attributable to epitaxy services, fell by 45% year-on-year during FY21 to A$0.4m because orders were delayed by coronavirus related lockdowns and the company was focused on laser diode development. Costs widened, reflecting high levels of R&D activity on laser diodes and investment in the US operation, which was set up to manage the sequence of third-party processing steps required once the laser diode epitaxy has been manufactured in the group’s Australian manufacturing facility. Adjusted EBITDA losses consequently widened by A$1.0m to A$4.6m. The year-end balance sheet had A$4.2m cash and a A$2.0m short-term loan, which was repaid following an oversubscribed entitlement offer and private placing collectively raising A$6.4m (gross) in July 2021. Management notes that these fund-raising activities should provide a cash runway through to initial customer revenues from laser diodes.

On the cusp of revenue growth

BluGlass had hoped to start shipping samples of its first-generation laser diodes by the end of FY21 (June 2021). The product launch has been delayed until problems in the post-epitaxial processing steps carried out by third parties have been resolved. The company is currently working with multiple vendors and expert fabrication specialists with established production capabilities to solve this issue.

Valuation: Aiming to secure 6–10% of global laser diode market

While management has not provided formal guidance, it aims to secure 6–10% of the global laser diode market by 2026, which it estimates will then total US$658m (A$849m). This represents annual revenues of around A$60–90m. This level of market penetration is dependent on BluGlass successfully completing the development of the second generation of higher-performance laser diodes using its remote plasma chemical vapour deposition (RPCVD) technology. Our scenario analysis calculates this level of revenues would generate EBITDA of A$14.1–21.6m.

Y21 performance

Revenues still attributable only to epitaxy services

Revenues up to this point have been derived entirely from epitaxy services. Revenues from customers fell by 45% year-on-year during FY21 to A$0.4m because EpiBlu foundry orders were delayed by coronavirus related lockdowns in Europe and the United States and the company was highly focused on laser diode development.

Click on the PDF below to read the full report:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI