I just returned from an invigorating week in hot and humid Miami, Florida, where I was privileged to present at the Mining Disrupt conference. This annual event attracts the who's who of the digital asset mining industry, including top players, enthusiastic investors and Bitcoin advocates alike.

Undeterred Optimism Amid the Ongoing Bitcoin Bear Market

My fellow presenters and attendees were all incredibly bullish on Bitcoin, despite the ongoing bear market that has seen the digital asset retreat from its all-time high of nearly $69,000 in November 2021.

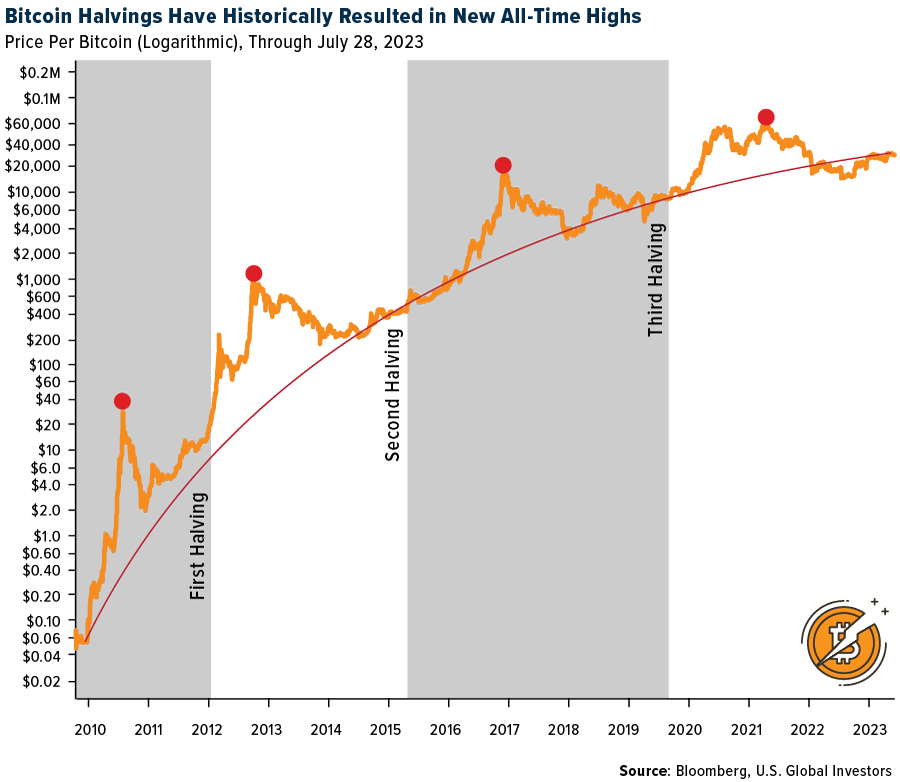

The conference coincided with Bitcoin crossing a significant milestone: the successful mining of the 800,000th block. This landmark event teases the upcoming fourth Bitcoin halving event, projected to happen when block 840,000 is mined in less than nine months from now. The halving process, which occurs approximately every four years, cuts the rewards for Bitcoin miners in half, thereby limiting new supply and creating scarcity.

Historically, every new cycle has resulted in a fresh, record-high price for Bitcoin. This phenomenon is attributed to the realization among investors that the asset’s supply is capped at 21 million coins, a factor that could spur the price to visit new highs.

Bitcoin in Need of Regulatory Clarity

Many presenters and panelists at the conference centered their message on the need for regulatory clarity in the mining space. Among the most esteemed speakers was Dennis Porter, co-founder and CEO of the Satoshi Action Fund, whose mission is to educate legislators and policymakers across the U.S. on Bitcoin's varied benefits.

During his presentation, Dennis drew interesting parallels between Bitcoin and the cannabis industry, both of which have had to lobby for state-level acceptance and legislation, even as they continue to face federal-level restrictions. He touted his group’s success in getting Montana and Arkansas to pass the Right to Mine law, which protects Bitcoin miners and prohibits energy producers from imposing discriminatory rates on them. The Fund was also instrumental in moving the Texas legislature to kill a proposed anti-mining bill.

Democratic presidential candidate Robert F. Kennedy Jr. also participated at Mining Disrupt via Zoom, representing one of four current candidates who expressly support Bitcoin-friendly policies, the others being entrepreneur Vivek Ramaswamy, Florida governor Ron DeSantis and Miami mayor Francis Suarez, who opts to take his mayoral salary in Bitcoin.

Kennedy, who recently disclosed purchasing two bitcoins for each of his seven children, reaffirmed his intention to back the U.S. dollar with Bitcoin and exempt the asset from capital gains taxes if elected president, saying that such exemptions should primarily benefit small investors and businesses.

A Legislative Milestone for Digital Assets?

Meanwhile, in Washington, a bipartisan bill that aims to provide a regulatory framework for cryptocurrencies was advanced by a key congressional committee last week. This legislation, endorsed by the House Financial Services Committee, was in response to last year's sudden collapses of several crypto firms, including Celsius and Voyager. It defines a cryptocurrency's status as either a security or a commodity, expands the Commodity Futures Trading Commission’s (CFTC) oversight of the industry and clarifies the Securities and Exchange Commission’s (SEC) jurisdiction.

Despite some opposition, the bill received support from committee Republicans and some Democrats, marking a major legislative moment for the digital asset sector.

Make no mistake, the bill has been met with opposition, primarily from Rep. Maxine Waters, the leading Democrat on the Financial Services Committee, who believes the bill would cause confusion and reduce protections for consumers and investors. Similar concerns have been raised in the Democratic-led Senate.

However, many in the crypto industry remain optimistic, asserting that with bipartisan support, the bill could stand a chance in the Senate. The debate continues over whether these assets should be treated as securities or commodities, highlighting the need for regulatory clarity in this evolving sector.

Spot Bitcoin ETFs and Their Potential Approval

I also want to highlight the possibility of a spot Bitcoin ETF being approved in the U.S. At the Mining Disrupt conference, there was guarded optimism that this may happen soon, following repeated rejections in the past. I believe a spot ETF would be a significant catalyst for Bitcoin, potentially streamlining access for both institutional and retail investors and driving up demand and price.

Applications for such an ETF from multiple firms, including BlackRock (NYSE:BLK), Fidelity, Invesco, VanEck and WisdomTree, have been published in the Federal Register, moving them one step further in the SEC's approval process. The official journal of the U.S. government now has a window to accept, reject, extend or open these applications for public comments.

With the Bitcoin network inching closer to the next halving event and the simultaneous evolution of the ecosystem and regulatory landscape, the world is keeping a watchful eye on the digital asset’s progress. Here's to the fascinating journey ahead!

***

Disclaimer: Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Digital Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE. Effective 8/31/2018, Frank Holmes serves as the interim executive chairman of HIVE.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.