It’s been a month, see here, since we last presented our Elliot Wave Principle (EWP) update for Bitcoin, as it barely moved until October 16. But that all changed that day. Namely, in our last update, we found,

“If BTC stays above $26,004 and especially the 9/11 low at $24,919, it can try to establish an impulse move higher (Waves 1 through 5 from the 9/11 low). BTC is [then] ready to target around $30-33K before we see the next buyable pullback. Regardless, based on BTC’s past cycles, made up of four more minor phases, it is currently in the accumulation phase and thus close to the next Bull run, which can target $100-200+K.”

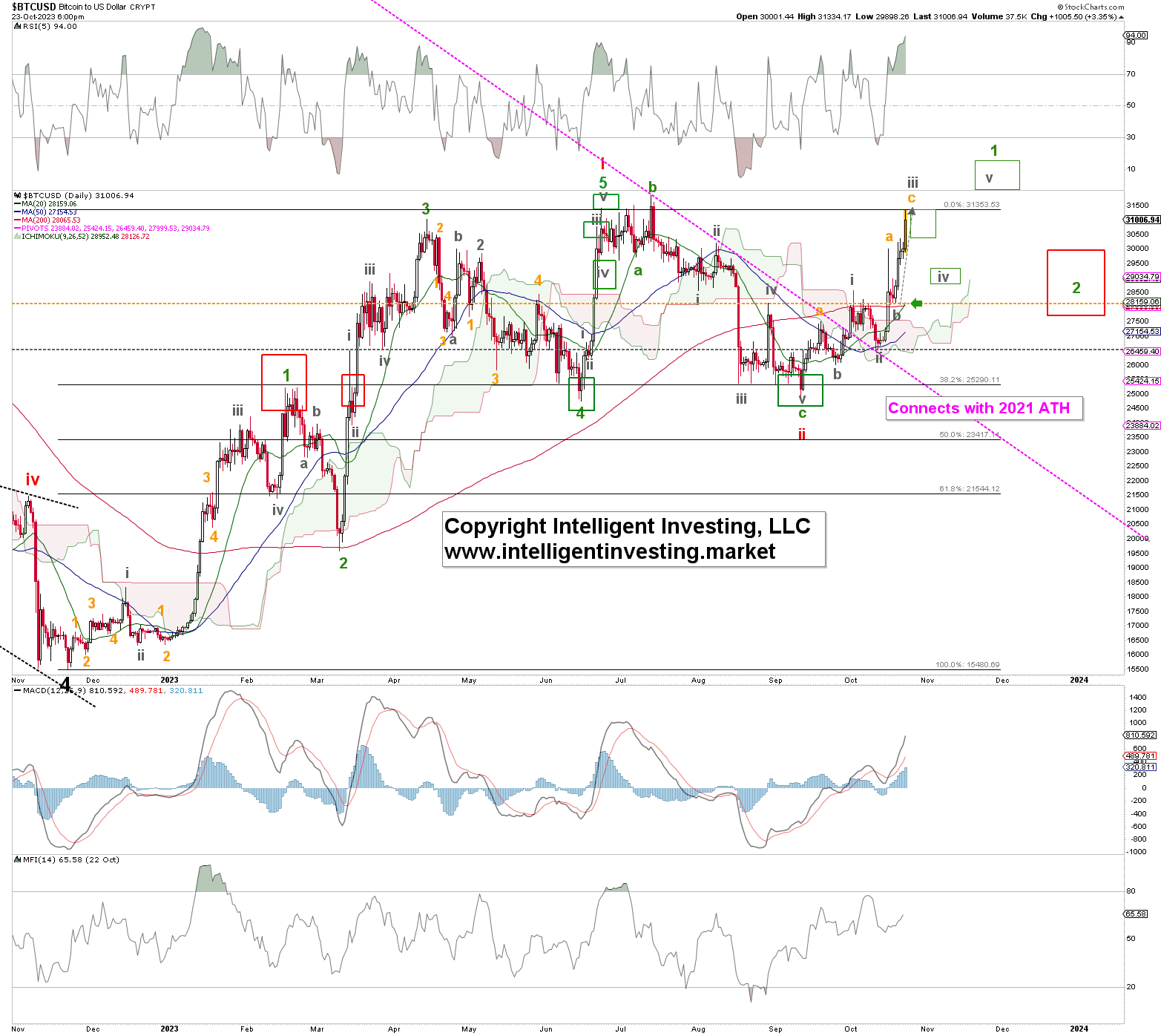

Fast forward, and BTC held above its 9/11 low and broke out above its (red) 200-day Simple Moving Average (200d SMA) on October 16 (green horizontal arrow). See Figure 1 below.

Figure 1. The daily chart of BTC with several technical indicators

Since then, it has moved steadily higher and should now be in grey W-iii of green W-1. Moreover, in early October, BTC broke out above the purple trend line that connects the bounce highs in 2022 with the all-time high (ATH) made in 2021—a significant development. Thus, as you can see, a lot can happen in two weeks. It, therefore, pays to stay informed more frequently than only once every other week because that breakout made us even more Bullish.

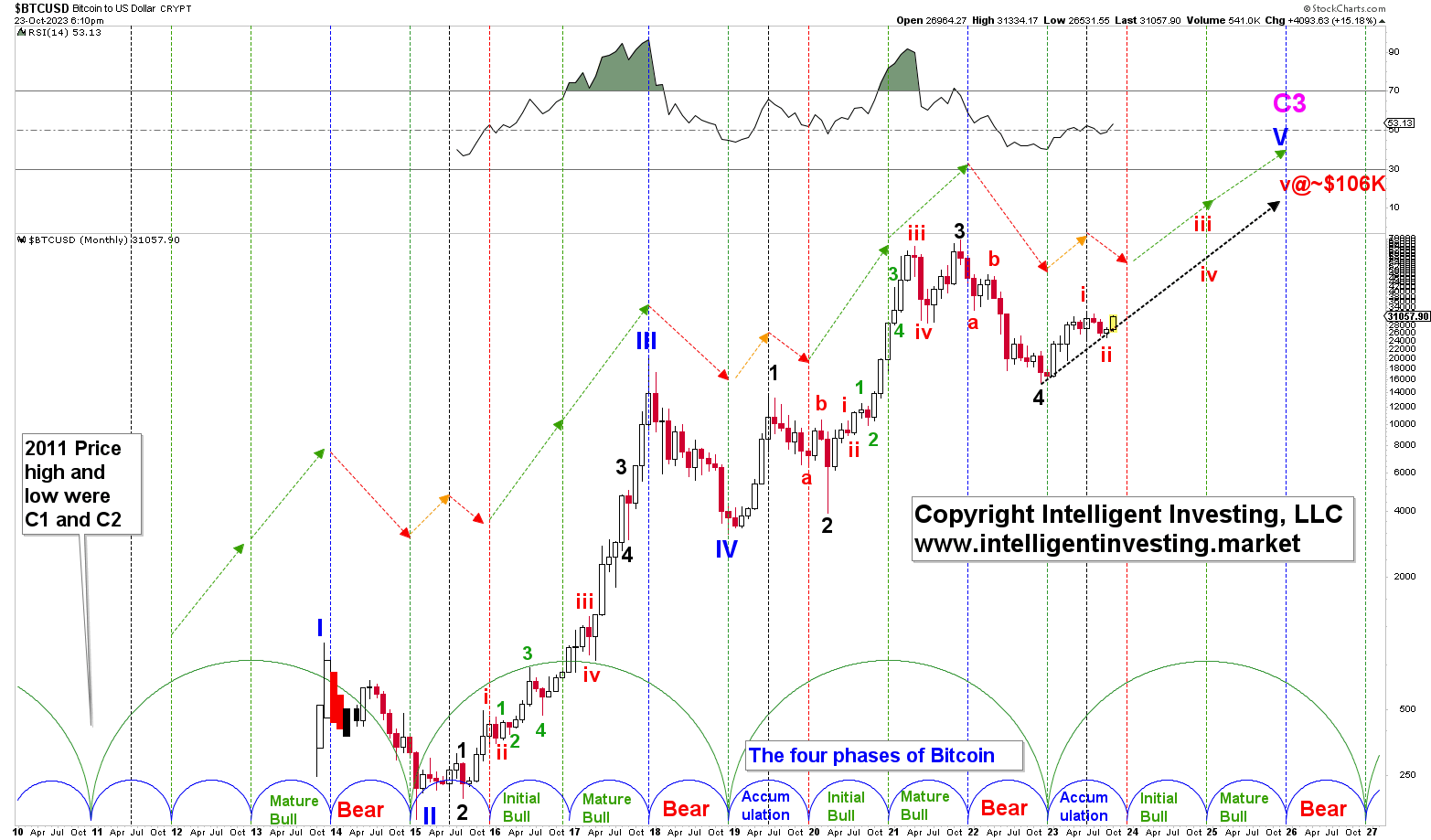

Bigger picture-wise, BTC should now be in red W-iii of black W-5 of Blue W-V of Purple Cycle-3, targeting ideally ~$106K. See Figure 2 below.

Figure 2. The monthly chart of BTC with several technical indicators, 4-year cycles, and 1-year phases

However, based on BTC’s logarithmic growth curve, we could see well over $200K by the end of 2025. However, we can fine-tune those targets when we get closer as, for now, the order of the day is to track five waves up. If those fill in, the next pullback (green W-2) will be a low-risk buying opportunity.

Regardless, we have not changed our overall, longer-term POV, which BTC is proving more and more correct for each day that passes in that,

“Based on BTC’s past cycles, made up of four more minor phases, it is currently in the accumulation phase and thus close to the next Bull run, which can target $100-200+K by the end of 2025.”