by Tanzeel Akhtar

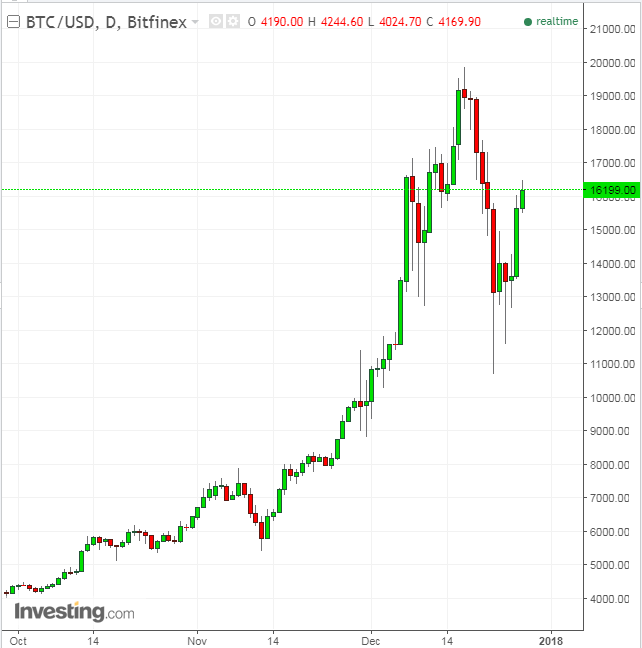

Last week's Bitcoin tumble, which at one point saw the digital currency plunge as much as 30%, as well as continued, head-spinning, daily—even hourly—volatility in cryptocurrency trading has spawned the repeated, mantra-like chant within the crypto investment community of a relatively pungent and very on-point acronym, often posed succinctly as a question: HODL, short for 'Hang on for Dear Life.'

Though Bitcoin has resumed it climb higher as of this writing, does buy and hold still make sense? Or is there some cut-off point, below which alarm bells should start ringing, spurring investors to consider an exit strategy along with a new slogan, 'GTHO,' or get the hell out.

Hardcore Bitcoin aficionados remain convinced there's lots more upside ahead. Their enthusiasm continues undiminished and is arguably even more zealous. The recent dip, they believe, was merely a correction before the alt-currency finally pushes past $20K and beyond. Last week's heart-stopping action, in their view, was just business as usual for the highly volatile asset, nothing to worry about here. Panic-selling when prices crash is simply out of the question. Indeed, one hardcore Bitcoin investor told me, “Bitcoin until I die!”

As interest in Bitcoin investing reaches fever pitch, the chants of HODL on Twitter and chat forums increase. Some have likened it to watching a cult in action. There is no doubt that the game changing technology behind Bitcoin is revolutionary and born out of an ideology. But is HODL-ing really a sound strategy?

Ignore the Daily Prices and HODL

According to Marc Kenigsberg, a Bitcoin and blockchain advocate, when you begin to understand the value of Bitcoin long-term, daily prices no longer matter:

"Holding bitcoin is a long-term strategy that requires resilience and courage of conviction but one that I believe will pay off. In that context price dips mean very little, especially since historically every dip has only strengthened the network and price"

Theo Goodman, a betting expert, says:

"You got to know when to HODL know when to FUD* away and know when to dump, you never count your stack, when your sittin in the slack they’ll be time enough for gloating when the dumpings done."

[*FUD means fear, uncertainty and doubt]

Sergey Shenderov, CEO and co-founder of Mom.life, an app with a strong focus on new technology and human behavior, presents a more measured perspective. He notes that HODL is neither good nor bad. As with any strategy it's a matter of personal outlook. In his view, investing success in capital markets is relative and an investment thesis (and horizon) is the key competitive advantage.

In current, extremely volatile crypto markets which are dominated by non-professional retail investors, there's a herd mentality in effect. Shenderov says investors shouldn't panic and that, as with any other asset, greed can be good, but has to be informed by an understanding of the technology and the pricing history of the asset. An investor's strategy should also be limited by the specific volume of capital they're not afraid to lose.

GTHO, Don't Get In, Or Merely Diversify?

Ami Ben-David, an investor in start-ups and co-founder of SPiCE VC, points out that what we saw last week wasn't any different than Bitcoin's past behavior. There has always been a downturn after a major new high he says. There is no new fundamental reason to change one's belief system about the digital currency at this time.

Ben-David, says:

“If you believe Bitcoin is the new and much improved gold then there is a lot more room for HODL; just sit tight and wait (years). However if you believe it's a worthless bubble - don't get in, because you'll just have sleepless nights and end up selling in panic at a loss. In any case, HODL or not, I always say: don't put in more than you can afford to lose without losing any sleep, and if you have a lot of Bitcoin - diversify, look for crypto alternatives like security tokens that rely on different models to mitigate your risk.”

Is there a line-in-the-sand when an investor should panic and divest?

Ben-David doesn't think so:

“That’s a trick question. As long as there is no external fundamental change, the Bitcoin believers do not panic and do not sell at the bottoms, in fact, many of them won't sell even if there is a negative external fundamental change - and that's the real long term strength of the currency. The non-believers who are just in it for the ride - already sold, maybe at a nice little profit (still at 13K now, it was 7K in November), and will probably buy again at the next high.”

However, he believes it's most effective to be aware of alternatives:

“People should diversify rather than be all in one coin."

Ben-Ami also suggests 'security tokens,' which he says are securities backed against real assets. Though SPiCE VC offers one such token, there are alternatives (the below should not be taken as a recommendation, nor as a solicitation. It's for informational purposes only. Investors should always do their own due diligence before investing in any asset). He says:

I refer to the new wave of regulation-compliant tokens, such as SPiCE VC Tokens, which are securities backed against real assets. In the case of SPiCE, the tokens are backed against the fund's investment portfolio (investors will get their share of future exits), so the tokens can retain their intrinsic value even if Bitcoin goes down. Multiple such tokens are deploying in Q1 for funds, companies and assets (mainly real estate)....“

As the popularity of cryptocurrencies as an asset class builds, a small but growing array of alternative investing opportunities have become available including other digital coins with different protocols; recently instituted futures trading via CME and CBOE; and soon, two NYSE listed Bitcoin ETFs.

Bitcoin remains a high risk proposition and severe downturns are common. But it's clear that there's a mainstream hunger developing for the asset class, and with it, a burgeoning market for safer ways to participate.