There is a rare and powerful trend occurring in bond markets.

History shows that if left unchecked, it can cause serious damage to equity markets and the economy.

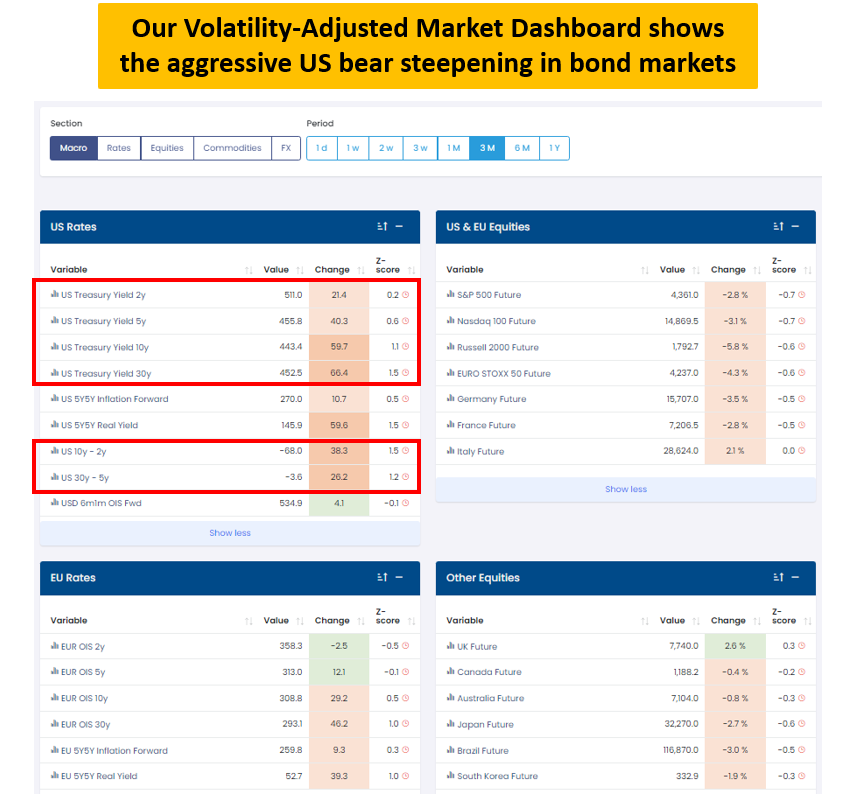

Over the last 3 months, US bond markets have been in an aggressive and prolonged period of bear steepening of the yield curve.

The TMC VAMD shows and color-codes volatility-adjusted moves across asset classes: the darker the color, the more outsized the move in historical context.

Let’s Cover the Basics: What is a Bear Steepening of the Yield Curve and Why Does It Matter in the First Place?

Bear steepening happens when interest rates move higher but it’s long-dated yields that take the lead, hence shifting the entire curve higher but also steeper.

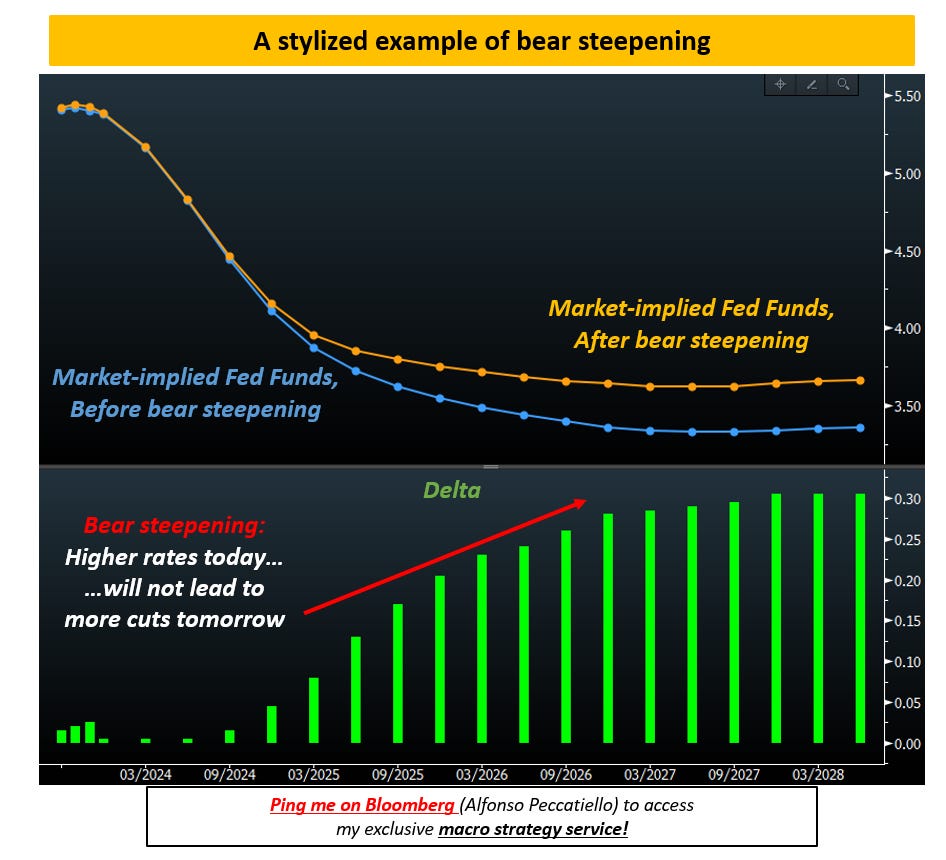

The chart above shows the 10-year market-implied path ahead for Fed Funds before and after bear steepening and the net change in the box below.

To understand it, think of 10-year yields like a strip of all future Fed Funds for the next 10 years discounted to today.

The reason why we didn’t see 10-year Treasury yields breaching 4% until recently is that the prevailing yield curve regime was bear flattening: the Fed would impose higher yields in years 1-2 of the chart above, but the market would discount damage to growth and inflation down the road and price materially lower Fed Funds from year 3-10 with convergence towards a ‘’neutral’’ of 3% over time.

That’s why higher terminal rates at 5%+ didn’t push 10-year yields higher than 4.00%.

But over the last 3 months, the music has changed with the bear steepening.

Recently instead markets priced in a mildly higher terminal rate at 5.45% and most importantly listened to the Fed’s message: no cuts anytime soon.

But while in the past that meant more cuts would be priced in immediately after, the bear steepening move implies that markets believe the economy can handle higher rates for much longer (red arrow).

In a nutshell according to markets not only Fed Funds at over 5% for quarters on end aren’t going to generate a recession, but actually, the economy will barely budge (?)

But Why is Bear Steepening Such a Rare and Dangerous Occurrence?

Bear steepening regimes cause long-dated yields to rise rapidly, and this has a large and rapid tightening effect on the real economy: 30-year mortgage rates and corporate borrowing rates rise rapidly across the curve, financing becomes even tougher and negative mark-to-market effects (see regional banks) are amplified.

The last part is particularly important: a 10 basis point rise in 30-year yields is about 10-12x more powerful than the same increase in 2-year yields from a mark-to-market perspective - this is because long-dated fixed income instruments have more duration and they are way more sensitive to changes in interest rates.

All business models that make large use of long-dated instruments and leverage are vulnerable if their risk management isn’t done properly: pension funds, insurance companies, shadow banking, real estate, and more.

The Key Point: Bear Steepening + Weakenining Economy = Damage

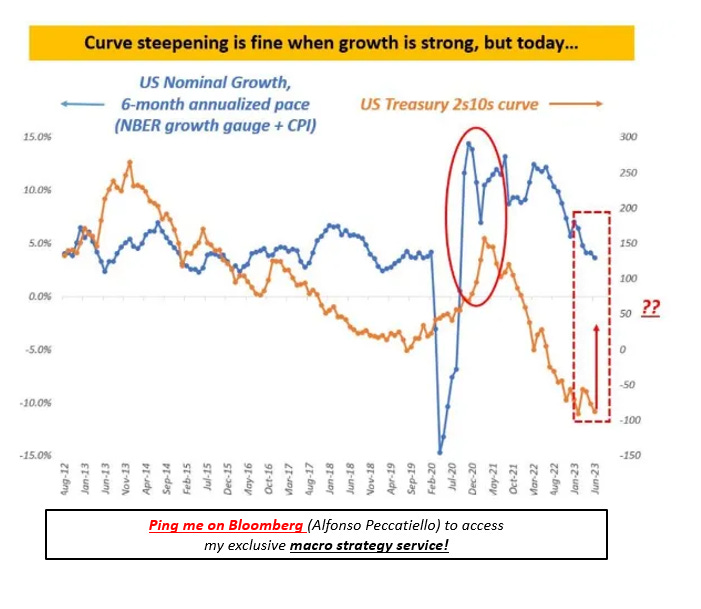

The key point to understand is that higher yields and bear steepening aren’t a problem per se: if the economy is running hot it’s actually healthy to have long-end rates reflect the increase in nominal growth.

That’s not the case today.

The chart above shows the underlying trend in US nominal growth (blue, LHS) against the US Treasury 2-10 year yield curve slope (orange, RHS): notice how in 2021 the yield curve steepened reflecting rapidly accelerating growth from fiscal stimulus and reopenings. No problem at all there.

But now look at today: US nominal growth is falling and yet markets are staging a prolonged bear steepening.

As that’s not reflecting stronger growth, it has to be interpreted as a very late cycle attempt by bond markets to find out where the breaking point is - after all the Fed is preaching higher for longer so let’s go after it and see if it works.

Very similar macro regimes with below-trend growth but recessions failing to materialize and markets pushing a bear steepening regime as people become convinced that ‘’economies can handle higher rates’’ were seen in:

- September to November 2000

- May to June 2007

- September to November 2018

In all three cases above rapid late-cycle bear steepening trends marked the end of the ‘’this time is different’’ experiment and ended up causing severe distress to economies (2001-2008) or markets (Q4 2018).

I don’t think this time will be different.

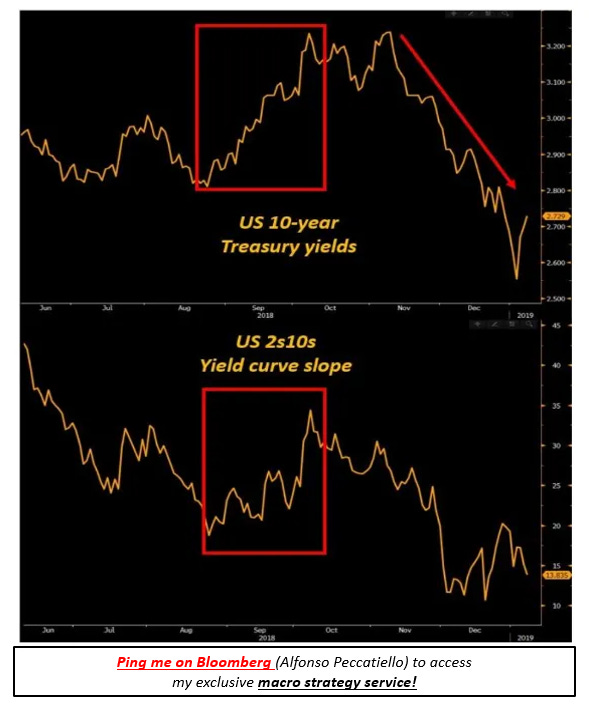

History serves as a useful guide and we just need to travel back in time to 2018 for a concrete example.

The Fed was raising rates and tightening as the economy and inflation had picked up, with markets displaying the usual bear flattening until August 2018.

At that point, the economy seemed to hold on well despite the tightening and the narrative was all about how the Trump tax cuts were gonna support growth for long, how Powell saw neutral rates higher, how the economy could handle higher rates.

And so the curve bear steepened (red boxes) for about 7 weeks straight until early October.

This sustained late-cycle bear steepening was ‘’it’’ for markets, with equities peaking in early October and tanking 23% in less than 3 months.

No, this time wasn’t different: the economy and markets couldn’t structurally handle higher long-end rates.

Why is the bear steepening even more dangerous today?

Back then inflation was 2% and the Fed could rapidly pivot in early 2019 hence repairing the damage: rates fell and the S&P 500 returned over 30% in 2019.

This time inflation is much higher and the Fed’s hands are tied.

***

This article was originally published in The Macro Compass. Come join this vibrant community of macro investors, asset allocators, and hedge funds - check out which subscription tier suits you the most using this link.