- The KBW Bank Index is now down about 20% this year as recession risk increases

- Despite economic uncertainties, it’s hard to make a definitive sell case for lenders this time around

- Banks are in a much better shape than they were when the last recession hit

The fear of a deep recession is turning investors away from the banking sector, which was the best-performing segment of the market last year.

The KBW Bank Index is down about 20% this year as the risk of a prolonged recession increases amid stubbornly high inflation that is forcing the central bank to continue raising interest rates.

Source: Investing.com

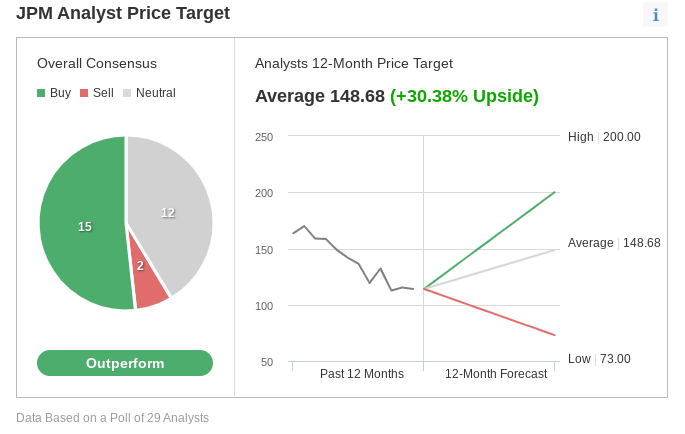

Losses in the group have been led by some of the largest lenders in the U.S., with JPMorgan & Chase (NYSE:JPM) dropping 27% this year and Citigroup (NYSE:C) slipping 18%.

The sell-off in banking stocks comes despite these companies reporting better-than-expected earnings in the recently concluded earnings season. These lenders posted a sharp surge in lending income and margins that had suffered during years of historically low borrowing costs.

Net interest income – revenue from interest-bearing assets minus what’s paid to depositors – boosted the profitability at JPM, Morgan Stanley (NYSE:MS), Citigroup and Wells Fargo & Co. (NYSE:WFC), with some also raising their forecasts for the remainder of the year.

But despite a windfall from interest income, there are other economic headwinds that are gathering pace and could hurt bank earnings. The biggest one is a potential slowdown in demand for credit at a time when consumers are being squeezed by inflation at a four-decade high.

Earnings for the group could get hit by slower loan growth, narrower spreads between 2-year (NASDAQ:UTWO) and 10-year Treasury notes, and rising loan defaults. Over the next few months, according to a Bank of America note, banks may show the impact from “inflation-driven demand destruction” among the U.S. customers that have previously held up well.

While it is possible that some stocks may have bottomed out under a mild recession scenario, the risk of a deeper downturn will probably continue to weigh on the group. According to Bank of America's note:

“The late-cycle investor mindset will be hard to dispel and is likely to weigh on valuation multiples. A deeper recession and/or stickier inflation remain the key risks.”

Hard Landing

The risk of a hard landing for the U.S. economy increased after Fed Chair Jerome Powell told the annual gathering of monetary policy-makers last week that the road ahead will “bring some pain to households and businesses” in the U.S., an “unfortunate cost of bringing down inflation.”

Another setback making bank stocks less attractive in this environment is their reluctance to continue with their share buyback plans when the sailing gets rough.

Both Citi and JPMorgan announced last month that they are suspending their share buybacks to meet higher capital requirements.

Despite the economic uncertainties, bank stocks won’t suffer as badly as they did during the 2008 financial crisis, and their weakness offers a buying opportunity to long-term investors.

Source: Investing.com

First, banks are in a much better shape than they were when the last recession hit, thanks to a far stricter regulatory regime, better underwriting standards and capital levels that have roughly doubled since the 2008 crisis.

Second, there is a good chance that if the recession arrives, it could be quick and shallow, with the job market continuing to show strength. In that scenario, banks will avoid the kind of hit to their loan growth that the market is anticipating and they could rebound quickly.

In a recent note, Oppenheimer analyst Chris Kotowski said the whole sector is too cheap after the 2022 sell-off, explaining:

“Indeed, the bank numbers with very strong loan growth and rising interest rates still indicate a very robust economy. Maybe less is being spent on certain goods, but spending on services and travel and entertainment seems robust.”

“We expect that whenever the next recession does come, the banks’ asset quality will remain considerably better than commonly feared and that the group will re-rate to its historical levels.”

Bottom Line

Banking stocks will likely remain depressed in the current uncertain economic environment. For long-term investors, however, this weakness represents a buying opportunity as banks will likely rebound strongly once the recession is out of the way.

Disclaimer: The writer doesn’t own shares of the companies mentioned in this article.