- U.S. banks are in a tough spot as the economy moves closer to a recession

- Volatile equity and debt markets are taking a hefty toll on investment banking deals

- Net interest income is one bright spot after suffering during years of historically low borrowing costs

What a difference a year has made. After finishing 2021 as one of the best-performing sectors in the S&P 500, the U.S. banking industry is struggling to find footing this year.

The KBW Bank index is down about 28% since January as the risk of a prolonged recession dampens the sector's outlook.

Losses in the group have been led by some of the largest lenders in the country, with JPMorgan (NYSE:JPM) dropping 33.6% this year and Bank of America Corp (NYSE:BAC) falling 31.7%.

Moreover, Morgan Stanley (NYSE:MS) and Goldman Sachs Group (NYSE:GS) said headwinds to profitability are building, highlighting tighter monetary policy and pressure on company margins as key concerns.

Despite growing lending margins in a higher interest rate environment, volatile equity and debt markets put the brakes on transactions that fuel investment banking deals, cutting into one of their top sources of fee revenue.

JPMorgan temporarily suspended share buybacks and reported second-quarter results that fell short of analysts' estimates. Goldman Sachs's investment banking revenue fell 41%, reflecting a sharp drop in underwriting.

Earnings for the group could get hit by slower loan growth, narrower spreads between 2-year and 10-year Treasury notes, and rising loan defaults. Over the next few months, banks may show the impact of slowing consumer spending that has previously held up well.

While some stocks may have bottomed out under a mild recession scenario, the risk of a deeper downturn will probably continue to weigh on the group.

Best Net Interest Income Growth In The Sector

That being said, I find some bank stocks offer a good entry point after considering the current risks and the decline in their share values. Bank of America is one such stock.The U.S.'s second-largest lender is uniquely positioned to benefit from the surging interest rates, shielding its income from other macro headwinds.

Net interest income rose 22% to $12.4 billion in the second quarter on higher rates and loan growth.

According to Chief Financial Officer Alastair Borthwick, NII will continue to increase, climbing by $900 million to $1 billion this quarter. Further growth in the fourth quarter is expected to lift the total increase to more than $2 billion for the remainder of the year, boosting the bank's bottom line.

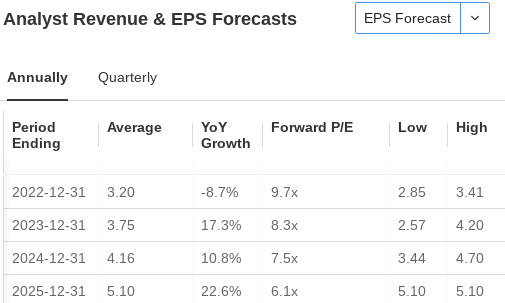

Bank of America's ability to make higher income on its lending portfolio is the main reason that analysts see the bank's earnings per share recovering strongly from the next fiscal year—and getting a major boost in the next three years, according to InvestingPro data.

Source: InvestingPro

Analysts, on average, expect the bank to report $3.20 per share this year and then increase to $3.75 per share in 2023. And that's counting on a hefty economic downturn. If the economy enters a mild recession, Bank of America could earn $4.20 per share in 2023, according to these calculations.

In a note this month, Wells Fargo reiterated Bank of America as overweight, saying the banking giant has "improved industry positioning in terms of interest rates." The note adds:

"BAC is one of the best examples of improved industry positioning in terms of interest rates — best NII (net interest income) growth among the largest banks."

For Evercore ISI analysts, BAC is their top pick in the current challenging economic environment for its ability to generate large free cash flows. Bank of America has an FCF yield of 19.5% and a shareholder return of 8.1% during the last 12 months.

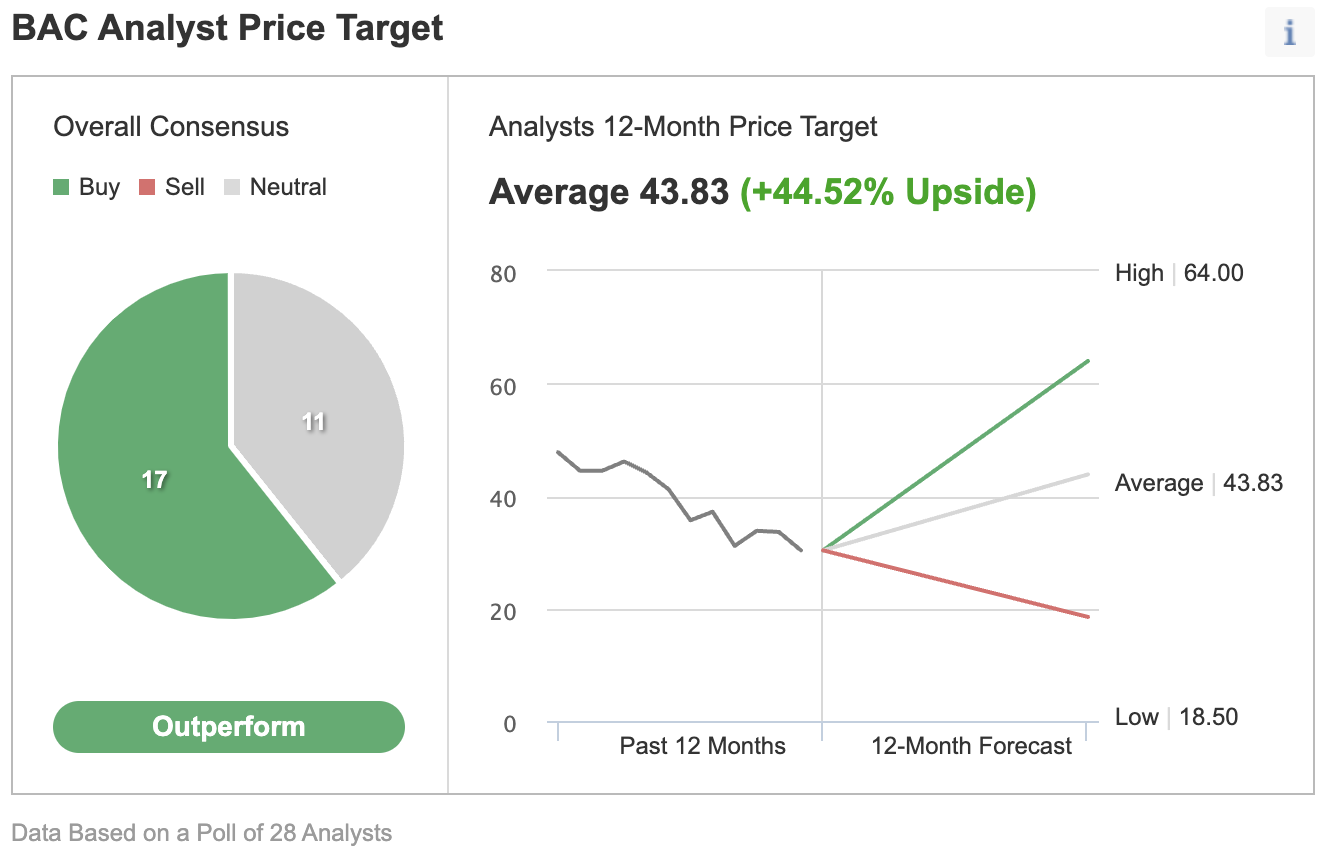

These bullish sentiments are also reflected in an Investing.com poll in which most analysts rate BAC a buy. Their consensus price target shows more than 44% upside potential in the next 12 months.

Source: Investing.com

Bottom Line

Bank stocks will likely remain under pressure as investors avoid the sector due to its exposure to the broad economy and uncertainty around consumer spending behavior.

However, banks are in much better shape this time due to the strength of their balance sheets and much lower exposure to risky mortgage lending. In this group, Bank of America is my favorite pick after its stock went through a significant correction.

Disclosure: At the time of writing, the author is long on BAC. The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.