- 2022 has been one long, painful lesson for investors and traders

- Learning from the best is one way to get through it

- We use InvestingPro+ to find ideas from the world’s best investors

Back-to-school season is here. As children, college students and teachers head back to the classroom, it’s also a time for investors to catch their breath - especially parents who have been juggling work and kids all summer.

2022 has been a bit of a back-to-school moment for investors as well, as volatility, inflation, the Federal Reserve, bear market rallies, and the risk of recession have all reminded us that stock markets can go down. We can’t just blindly invest the way it felt like we could in 2021.

The turn of the season is also an opportunity for us to crack the books and find new investing ideas. The volatile market offers some bargains, but also plenty of risks. So for this article, rather than plunging into the market alone, I’m going to look at a few ideas from some of the most well-known and successful investors in the world, using InvestingPro+. We’re going to learn from the best to fill our portfolio for the school year ahead.

Picking From The Best Of The Best - Combing 13Fs

I’m starting out by going to the Ideas tab on InvestingPro+. The ideas tab pulls in data from 13F forms, which investors with large portfolios are required to file with the SEC. These forms present the raw numbers of how many shares investors like Warren Buffett or Carl Icahn have in their different holdings. InvestingPro+ then tracks the performance of those holdings - just based on what’s in the filings, so it won’t 100% match a given investor or fund’s results - and provides more data on the stocks themselves.

In this case, I’m going to select managers with at least 6% returns in the last year, as a sign of investors who have set up well in a changing market that may remain volatile for the months ahead.

In doing that, five investors or funds stood out for me, along with their stocks’ returns according to InvestingPro+ in the last year, as of August 30th:

Warren Buffett, CEO of Berkshire Hathaway - +11.9%

David Einhorn, Founder/President of Greenlight Capital, a hedge fund - +10.2%

David Tepper, Founder/President of Appaloosa Management, a hedge fund - +7.9%

Carl Icahn, Founder/Manager of Icahn Enterprises and renowned corporate investor - +23.3%

Daniel Loeb, Founder/President of Third Point Capital, a hedge fund - +18.2%

With each of them, InvestingPro+ will not only show me their holdings, but the investing tool will also allow me to sort their holdings by biggest positions, or biggest companies by market cap. For this article, I want to look at their biggest buys in Q2, to see what stood out to them as the market officially hit a bear market level before the recent rebound. So, here’s the biggest buy from each of their portfolios, along with one bonus stock.

Note: Pricing and data are as of August 30th market close.

Warren Buffett/Berkshire Hathaway: Occidental Petroleum

|

Metric Name |

Value |

Source: InvestingPro+ Data Explorer

It’s no surprise for anyone following Berkshire (NYSE:BRKa) (NYSE:BRKb) or Buffett’s buys closely that Occidental Petroleum (NYSE:OXY) is his biggest purchase for Q2. The Berkshire CEO received approval to buy up to 50% of the company as he builds up his exposure to the energy sector. While that might be a mistake Buffett’s experience and position at the head of a giant conglomerate make him tough to bet against.

Occidental has obviously benefited from the rise in oil prices, beating earnings estimates for six straight quarters and posting record revenue and earnings numbers over the last 12 months. That’s also allowed it to reduce net debt by $24 billion in the last three years, solidifying its future outlook. Occidental is still a proxy for the future path of oil, but investors might also get an added upside if Buffett decides that 50% of Occidental is just not enough and makes a buyout play.

Source: InvestingPro+

David Einhorn/Greenlight Capital: Kyndryl Holdings

|

Metric Name |

Value |

|

Source: InvestingPro+ Data Explorer

David Einhorn has had a bit of a comeback year so far in 2022, outperforming the S&P 500 by 3300 basis points in the first half of 2022 (up 13.2% to the S&P 500 being down 20%). And if we focused on his biggest buy in Q2, we’d have another big win, as Atlas Air Worldwide (NASDAQ:AAWW) accepted a buyout proposal . Instead, we’ll move to his second biggest buy of the quarter.

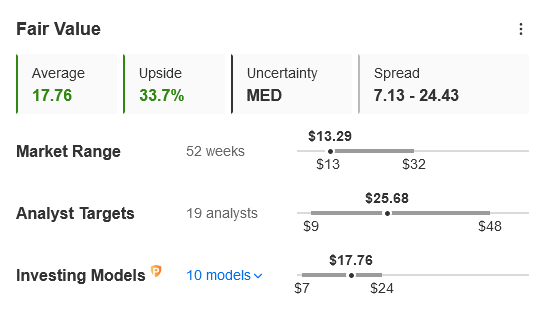

Kyndryl Holdings (NYSE:KD) is a spin-off from IBM (NYSE:IBM), incorporating IBM’s former data center business. Spin-offs are a classic value investing strategy, in part because they are often neglected businesses that, freed from a bulky parent, can fly under the radar and grow independently. IBM is as bulky a parent as it gets. Einhorn opened the position shortly after Kyndryl started trading in late 2021, and more than doubled it in each of the following two quarters.

The business - similar to the other stocks in this article - is a bit of a commodity business, and right now Kyndryl is reporting losses. At a $2.5B market cap and a $3.8B enterprise value compared to guided revenue of $16.3-$16.5B for the year and an adjusted break-even income outlook, it might not take too much trimming or managing of the commodity business for Kyndryl to be another Einhorn win. The question is whether data center usage is on the permanent decline.

Source: InvestingPro+

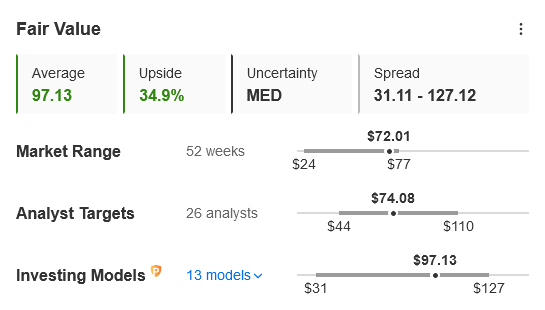

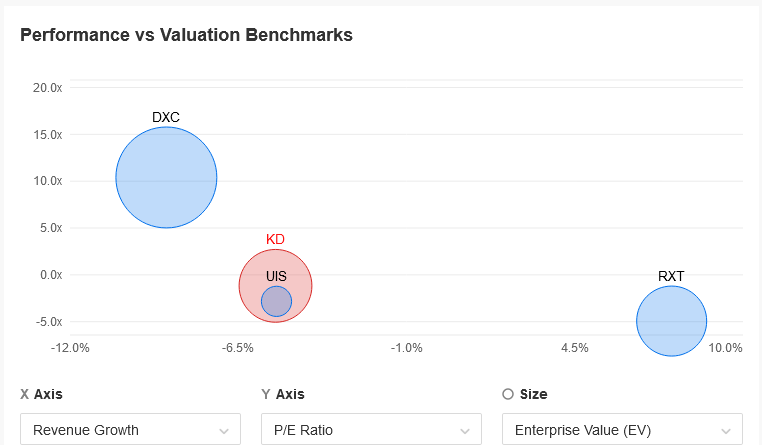

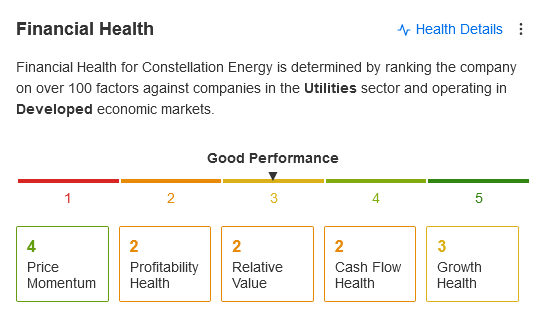

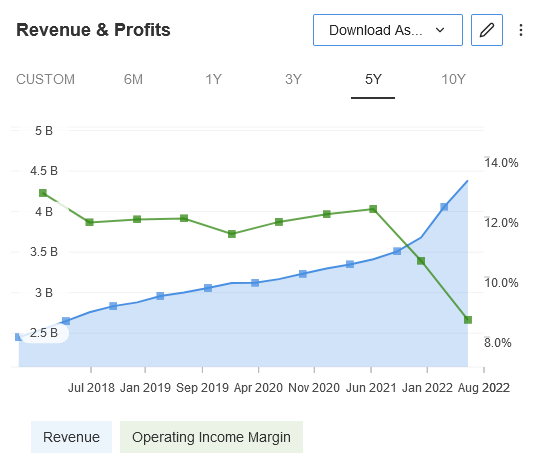

David Tepper/Appaloosa Management: Constellation Energy

|

Metric Name |

Value |

Source: InvestingPro+ Data Explorer

David Tepper, owner of the Carolina Panthers in the National Football League and another prominent investor, enters the picture with an energy and spin-off theme. Constellation Energy (NASDAQ:CEG) was spun off from Exelon (NASDAQ:EXC) a decade after the utility company bought it. It is a nuclear energy company, a segment in the spotlight with the recent Inflation Reduction Act that the U.S. Congress passed. Constellation is up nearly 50% this quarter, so Tepper’s position, which he just added in Q2, has already paid off handsomely, as the company is his fund’s 4th largest position.

The company has a $31B enterprise value - though relatively light on debt, at $4-5B in net debt - and trades at 12x Adjusted EBITDA, which is not a low price when you consider what adjustments might be in there. The company is already touting the tax credits it will receive for nuclear and hydro power production from the new bill, and this may be the exceptional utility that is more of a forward-looking growth play rather than a steady dividend payer.

Source: InvestingPro+

Carl Icahn/Icahn Enterprises: Southwest Gas Holdings

|

Metric Name |

Value |

Source: InvestingPro+ Data Explorer

We’re going to skip Icahn’s buys in his own company, Icahn Enterprises (NASDAQ:IEP), to go to the second biggest add on the list. Icahn has long been an energy bull, so it’s not a surprise that he is buying into a natural gas utility play like Southwest Gas (NYSE:SWX). Icahn didn’t just buy in Q2, but continued to add to his position to the point where his firm owns 8.7% of Southwest.

Looking under the hood, Southwest is setting all-time highs like many of the other commodity associated stocks in this article. This has come as the company resolved a battle with Icahn that led to the previous CEO stepping down, and the new buys could be seen as a vote of confidence in Icahn’s installed CEO, Karen Haller, or perhaps as an early omen of renewed pressure. Given his involvement and previous offer to buy the company just north of the current share price, it seems that there could be more to shake out here.

Source: InvestingPro+

Daniel Loeb/Third Point Capital: Ovintiv Inc

|

Metric Name |

Value |

Source: InvestingPro+ Data Explorer

Dan Loeb makes headlines for his activist letters, and during the pandemic he won a new following on Twitter for his apparent embrace of crypto and growth stocks. Part of his success as a hedge fund manager is his ability to pivot, however, and he has gone back into the oil patch and the energy sector in recent months as the market winds have changed.

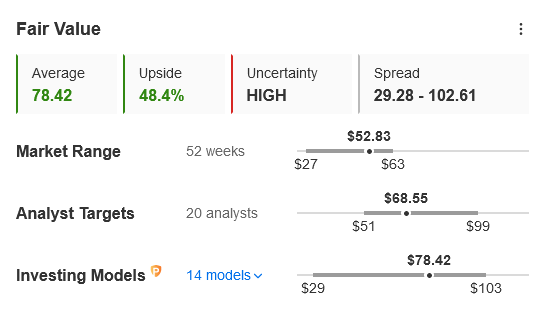

One more oil and gas play rounds out our list, then, as Loeb significantly grew his position in Ovintiv (NYSE:OVV). Like many oil and gas stocks, the company is closer to 52-week highs than not and at all-time high revenues. Its exposure to natural gas and natural gas liquids gives it upside as the European energy situation puts pressure on pricing. This is the winner on our list from InvestingPro+’s standpoint, with the highest fair value upside and a bevy of positive quick facts on the company.

Source: InvestingPro+

Since that is a lot of oil and gas, let’s pick one bonus stock from another leading investor.

Mario Gabelli/GAMCO Investors: Warner Bros Discovery

|

Metric Name |

Value |

Source: InvestingPro+ Data Explorer

Gabelli is another living legend in the investing world, and his fund’s stocks have returned nearly 6% in the last year, which isn’t shabby. While many of the largest holdings are small to mid-cap industrials, his biggest buy last quarter was Warner Bros Discovery (NASDAQ:WBD), the spin-off/merger of AT&T’s Time Warner unit with Discovery Media.

There has been a lot of noise around WBD and around the streaming industry in general. WBD has a lot of debt and the reporting suggests there is not a clear strategy for the combined company. At the same time, the recent Game of Thrones prequel House of Dragon’s strong debut is a reminder of the good “bones” at the company. And going back to our learning from the best theme, many of these investors picked up streaming plays, whether it was David Einhorn also adding WBD to Greenlight Capital’s portfolio - their 3rd biggest buy of Q2 - or David Tepper and Dan Loeb adding Disney (NYSE:DIS) shares, with Loeb sounding the activist horn with a few ideas for how the company could improve. So whether it’s going with the new laggard in WBD or the old stand-by in DIS, there may be a streaming play for investors looking for something outside of energy.

Source: InvestingPro+

Relearning The Portfolio Basics

These are a few ideas from some of the leading investors in the current market, all investors who are figuring out how to adjust to the volatile 2022 environment. These are all just starting points, as each of these professionals has their own reasons for taking positions in the stocks mentioned.

With everyone busy returning from summer and getting back to school or back to work, though, perhaps this will be a nice starting point for some fresh thinking for your portfolio. And if these ideas don’t suit your investing style, there are other investors to learn from on InvestingPro+ as well.

Disclosure: I am long Berkshire Hathaway B shares.