The last couple of months have been eventful for the Australian stock market. First, for reasons unknown, it was was moved by the Brexit referendum result and then as the 2016 Australian Federal Election saga slowly unfolded the market really didn’t do much at all, even-though Malcolm Turnbull almost managed to lose all the seats Tony Abbott had won for the coalition parties in the previous election. Despite these events however the S&P/ASX has gained ground and has edged up to around the 5400-5600 range…again.

At first it may appear that the Australian stock market has posted some decent gains, but we must bear in mid that the ASX 200 was around 5400 in early 2014 and so from a long term point of view the market has actually done very little. Some stocks have of course done very well such as Domino’s Pizza Group Plc (AX:DMP) – but overall there’s not been much to get excited about.

S&P/ASX 200 Index (XJO) 3 Month Chart

There have been market pull-backs during the last 12 months that did present buying opportunities but of course getting the timing right is a lot easier to do in hindsight. However in late 2014 I did outline some trading ranges regarding the ASX 200 (see S&P/ASX 200 Index – Charts & Trading Ranges ) and I believe these are still valid today – namely at around 4600 the market appears oversold and around above 5200 it appears overbought.

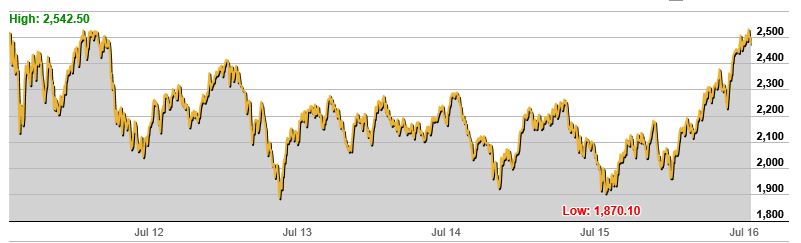

Another useful chart to look at is the ASX Small Ordinaries which I view as the canary in the coal mine in terms of how listed companies are faring. Generally I expect movements in this index to be more pronounced than the ASX 200 Index or All Ordinaries Index due to the more volatile nature regarding trading conditions for smaller companies. As we can see from the chart below the ASX Small Ordinaries Index has been trending down for some years but has recently rallied from around 2000 to 2500. Why?

S&P/ASX Small Ordinaries Index (XSO) 5 Year Chart

I have no good answer to this question. It’s certainly not because the outlook for the Australian economy has improved. The weaker Australian dollar may have helped along with the continuing environment of low interest rates, but neither of these explain the rather sudden rally to 2500. At this stage it appears to me that the XSO is poised for a pull-back and my guess is this also likely to happen to the ASX 200 as well.

My reasoning? Firstly because that’s what the market has been doing for years – reaching towards 6000 then pulling back towards 5400 – 5200 or lower. Secondly I don’t see too many reasons why the Australian stock market should rally. The economy looks to be be running out of luck, the federal government seems unable to reign in spending and share prices in many ASX 200 listed blue-chip companies like Qbe Insurance Group Ltd (AX:QBE) are under pressure.

Qbe Insurance Group Ltd (AX:QBE) 5 Year Stock Price Chart

Of course there are company specific issues affecting the QBE share price but it’s a stock I use as a risk-on/risk-off indicator due to the nature of its business. When the QBE stock price is rising it’s often during a period when the stock market is rising as investors are tempted into riskier/higher return assets like stocks. When the QBE stock price is falling then I look further for signs that the market might be about to give up some gains. Since the QBE share price is now at a multi-year low that suggests to me that we are about to see the Australian stock market move near 5200 or lower again.

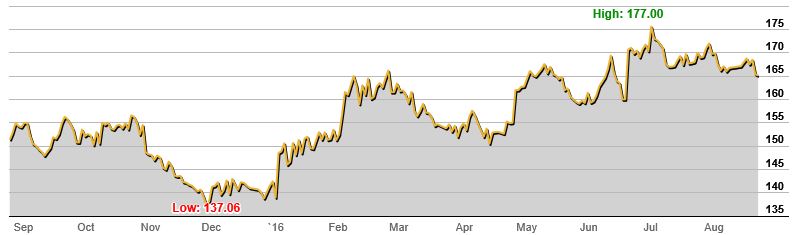

If the mood is shifting from riskier assets then typically we would see defensive assets like gold rise. My usual way of tracking gold in Australian dollars is via the ETF ASX:GOLD and the one year chart is posted below.

ASX All Ordinaries Gold 1 Year Price Chart

Over the last year ETF GOLD has pushed higher but it has fallen since reaching a multi-year high in July. Overall the movement in the gold price I feel is not as useful as an market indicator as it was in years past since Quantitative Easing (QE), Zero Interest Rate Policies (ZIRP) and other government/central banks measures have distorted the markets. One observation I will make however is that the movement in the price of gold suggests that perhaps some investors are hesitantly or cautiously preparing for market correction.

Although I do not have any direct holdings of gold I would place myself in the group of investors who are cautiously preparing for a market correction. I’m certainly not in the “sell everything” camp but the U.S. stock market appears overdue for a significant correction and that will mostly likely also send Australian stocks heading considerably lower before the year is over.