During this COVID-19 pandemic I have purposely avoided writing about the stock market because to do so, would imply I had an insight into how the pandemic would affect our lives, the economy or Australian stock market outlook. Of course in hindsight there were stocks which would have been great investments, but even now as we move further int0 2021 the outlook for the markets is still very unclear.

Back in July 2020 I wrote:

“… we are dealing with uncertainty and this uncertainty is more related to the hard sciences and less to do with the social sciences including economics. Certainly economics is a factor, but probably the next major move will be triggered by news that either the worst of the COVID-19 pandemic is behind us or a promising vaccine has been identified – or both.”

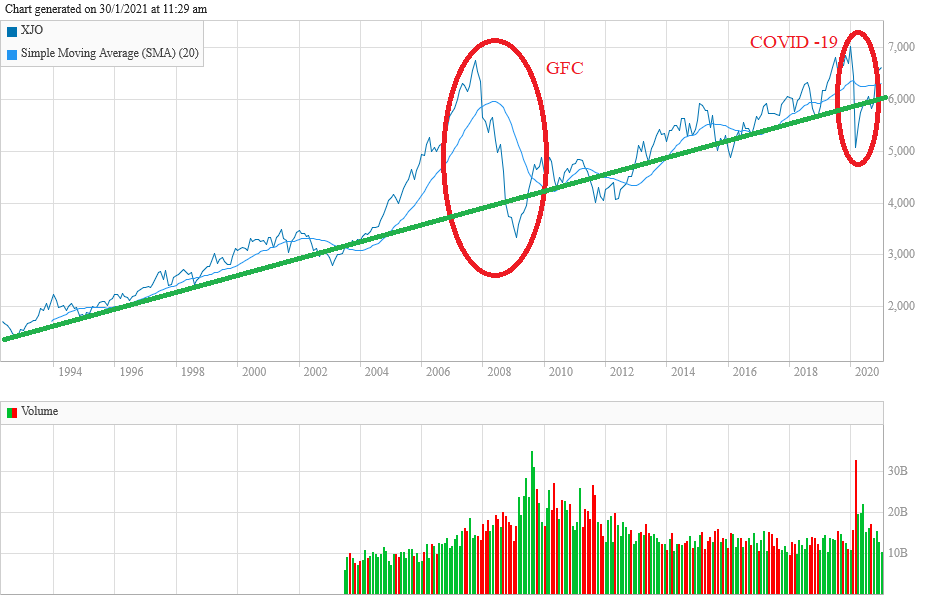

(Extract from: The Australian stock market, COVID-19 and dealing with uncertainty) Now six months later I would suggest that the market has basically moved accordingly to my speculation outlined on that article. As of the end of January, the S&P/ASX 200 Index (XJO) has almost removed back up to pre COVID-19 level as shown in the chart below.

Back in March if we could have been sure that the market was going to recover, then there were many opportunities to buy over-sold ASX listed shares. But spotting the market low is always easy with the benefit of hindsight and at the time the market could have just as easily slipped further. The question now is will the market continue to rally or has a lot of positive news already been priced into it? My guess is that the market is going to struggle to move much higher this year and if the ASX 200 were to close within a range of approximately 6,500 – 7,000, then that would be a good result.

If we look at the long term trading range of the ASX 200 we can put the current level of around 6,607 (as of the end of January 2021) into some perspective. Firstly it’s worth noting the COVID-19 correction was not nearly as severe as the stock market rout caused by the Global Financial Crisis (GFC) and secondly, the market is currently trading around the long term trend-line that I have plotted on the chart. Note that this is a very simple trend-line and it basically factors out the GFC market bubble. If we accept then that this simple trend is more or less correct, then it’s not unreasonable to expect the market will, over the long term, continue to rise gradually along this trend-line. Of course this doesn’t mean there won’t be rallies and corrections along the way and I have stressed many times market corrections are not rare.

Yes governments across the G20 will implement various measures to try and get their economies growing again, but this will send up debt levels further and memories of the GFC and the lessons we should have learnt about mispricing risk will be forgotten. So we can be pretty sure asset bubbles will be created (and some probably exist now) – but identifying them in advance won’t be easy, it rarely is.

So at this point I’m more inclined to be a profit taker rather than moving cash into stocks. Certainly there does appear to be some stocks worth looking at and I’ll cover those in my next article. But for now the market looks a bit over-priced and I suspect we will see a pull-back during the next few months.