DXY is still firming in counter-trend:

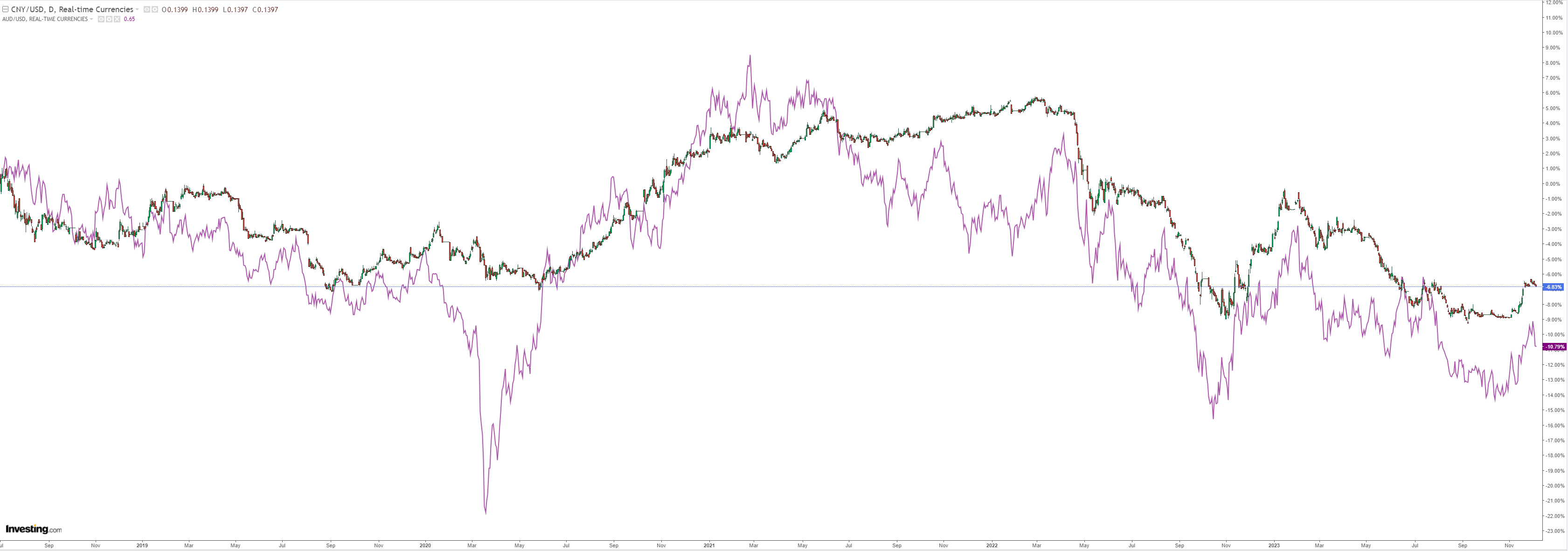

AUD is the mirror image:

CNY will hold back AUD upside:

Oil is in free fall. If it breaks support then $60 comes into view as the global economy lands:

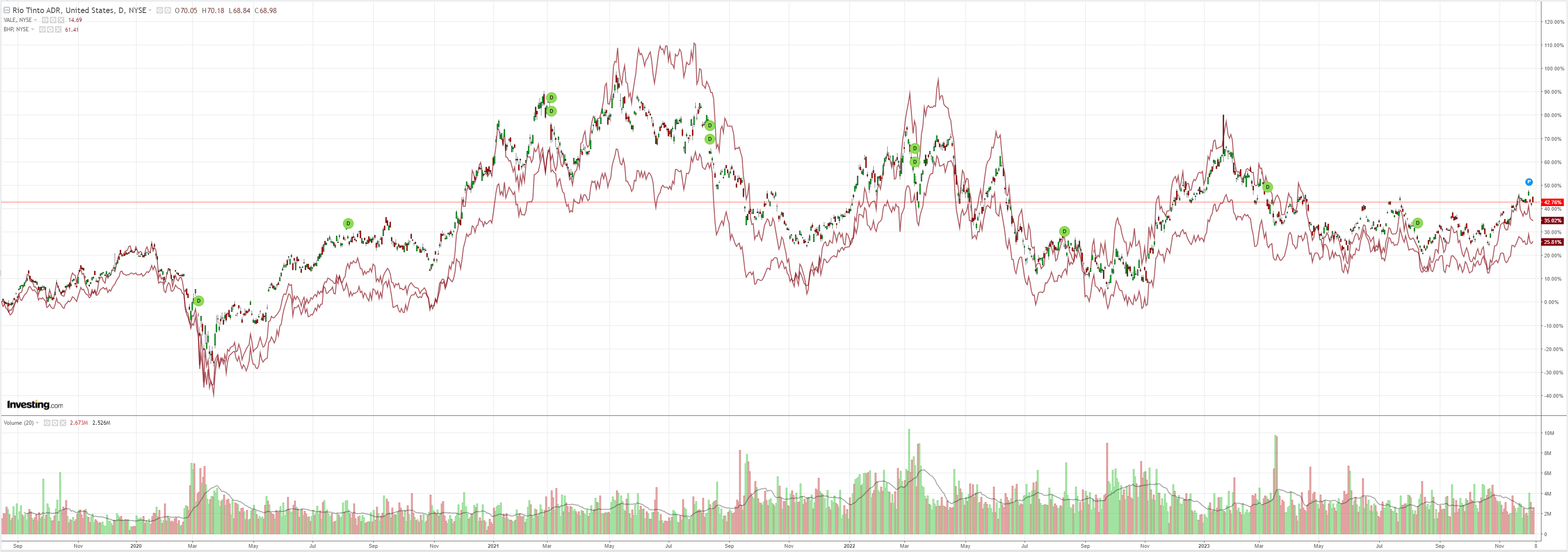

Dirt is failing:

Miners did better:

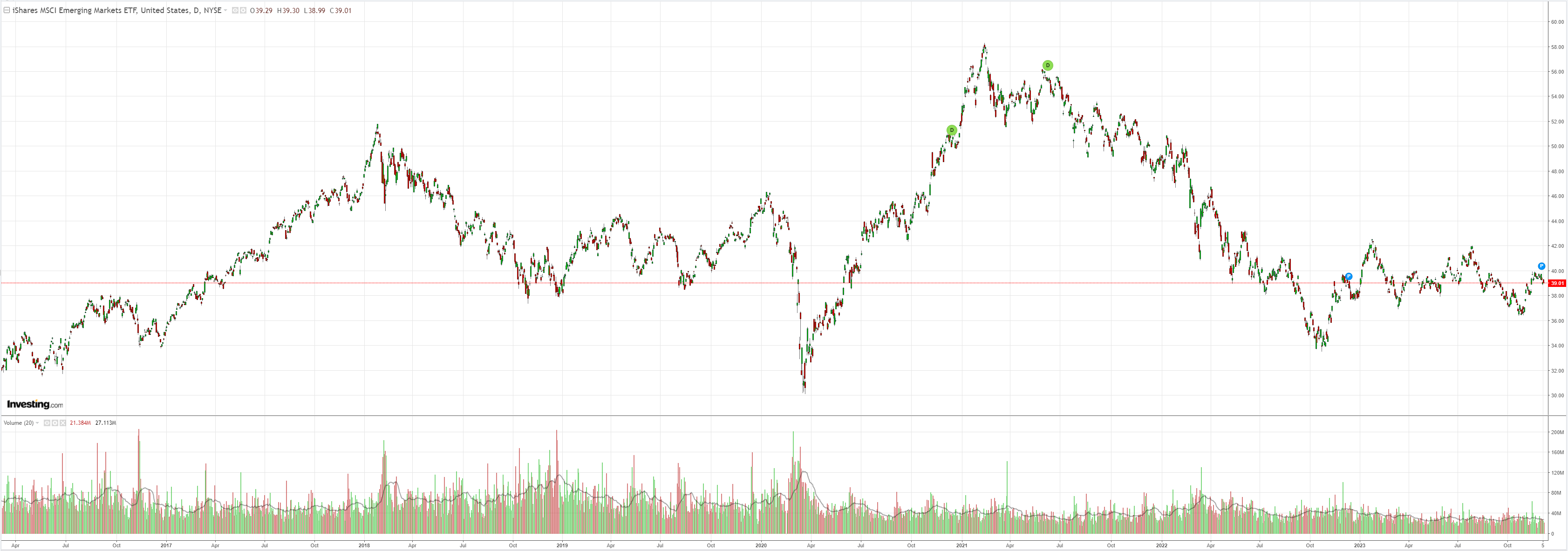

EM is truly, madly dead:

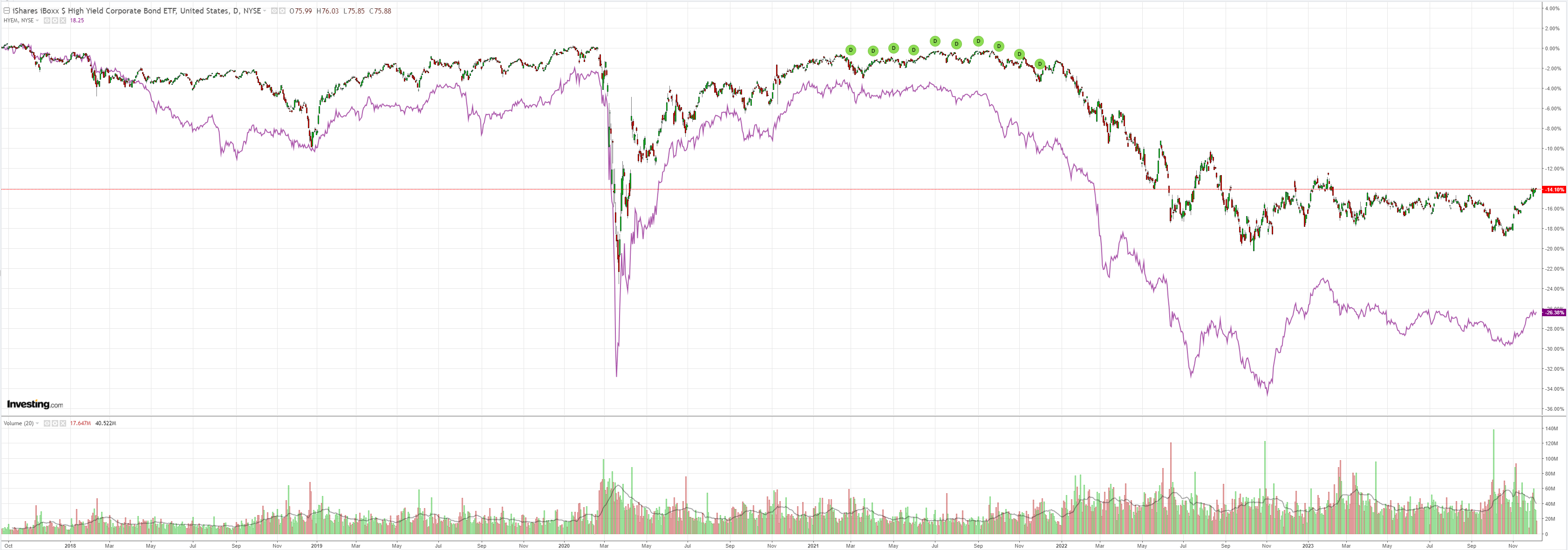

Junk is poised for recovery but what sort of landing it it?

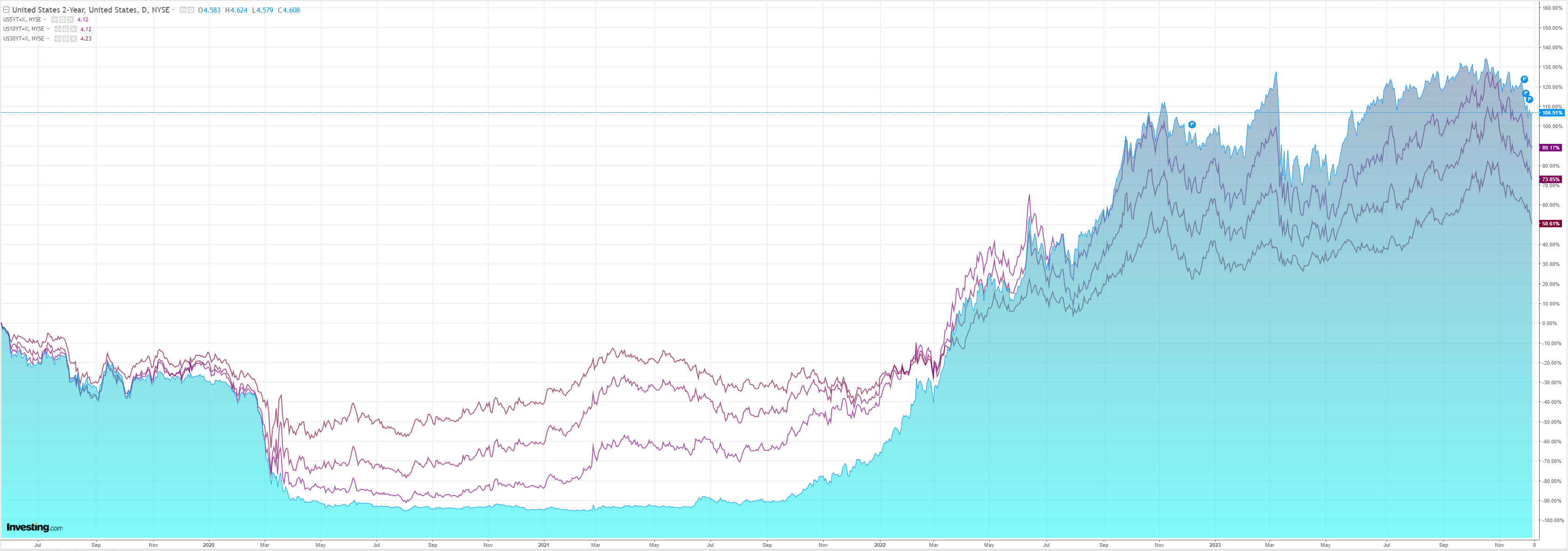

Treasuries are booming:

Stocks are worried that maybe bonds and oil are suggesting worse than a soft landing:

BofA gives us the DXY wrap.

•Aggressive pricing of Fed cuts weighed heavily on the USD in Nov; but recent reprieve suggests over-exuberant expectations

•We look closer at Fed pricing along with other CB expectations & easing of financial conditions ahead of Friday’s NFP report

•Technically, we see near-term resistance DXY levels at 104.55, 105.40 and 106 and support levels at 102.55, 101.75 and 100.55

Dollar takes a breather with Fed pricing in the spotlight

The DXY’s ~3% depreciation in November was its largest monthly decline since last November. The notable and likely aggressive pricing in of Fed cuts for H1 2024 has emboldened USD bears, though recent consolidation suggests the FX market sees Fed pricing as overdone ahead of key employment data this week. Nevertheless, Fed expectations remain front and centre as similar policy expectations for easing elsewhere (ie. ECB) has been a secondary factor for currencies until recently. November also saw the largest easing in financial conditions since April 2020 (in the wake of COVID-related policy easing), introducing a potential complicating factor for the Fed going into next week’s FOMC meeting. Before then, however, Friday’s employment report loomsas a possible source of further confirmation or spoiler to these easing expectations.

The key technical levels to know for the DXY bounceback

As the DXY bounces back after its November selloff, we see near-term resistance levelsat 104.55, 105.40 and 106 and support levels at 102.55, 101.75, 100.55.

The next big test is Friday’s NFP. It’s probably too early to expect clear jobs weakness but a declining trend will be enough to see DXY weakness return.

Goldman has more.

According to the ADP (NASDAQ:ADP) report, private sector employment rose by 103k in November (mom sa), following a downwardly revised October increase of 106k (vs.113k previously).

Employment in the services sector rose 117k, led by a 55k increase in trade, transportation and utilities, and a 44k increase in education and health services. Employment in goods-producing industries declined by 14k, led by a 15k decrease in manufacturing.2. We do not place much weight on the ADP miss because of ADP’s negative correlation with BLS private payrolls since the introduction of the new methodology.

We left our nonfarm payroll forecast unchanged at +238k ahead of Friday’s release.3. Nonfarm productivity was revised up by more than expected in Q3 (+0.5pp to +5.2%,qoq ar) and the year-over-year rate now stands at +2.4%. Since 2019 Q4, labour productivity has grown at an annualized rate of 1.5%.

Unit labour costs—compensation divided by output—were revised down by more than expected (-1.2%, qoq ar), and the year-on-year rate now stands at +1.6%. Compensation per hour increased at a 3.9%annualized rate and a 4.0% year-over-year rate in Q3.

Our wage tracker remains at 4.4 %annualized in Q3 (vs. 5.2% in Q2) and 4.4% year-over-year (vs. 5.0% in Q2).

That kind of “soft landing” result would probably be enough to stabilise DXY for a while longer and push AUD lower.

Anything closer to the ADP result will see AUD roar back.