DXY was soft last night:

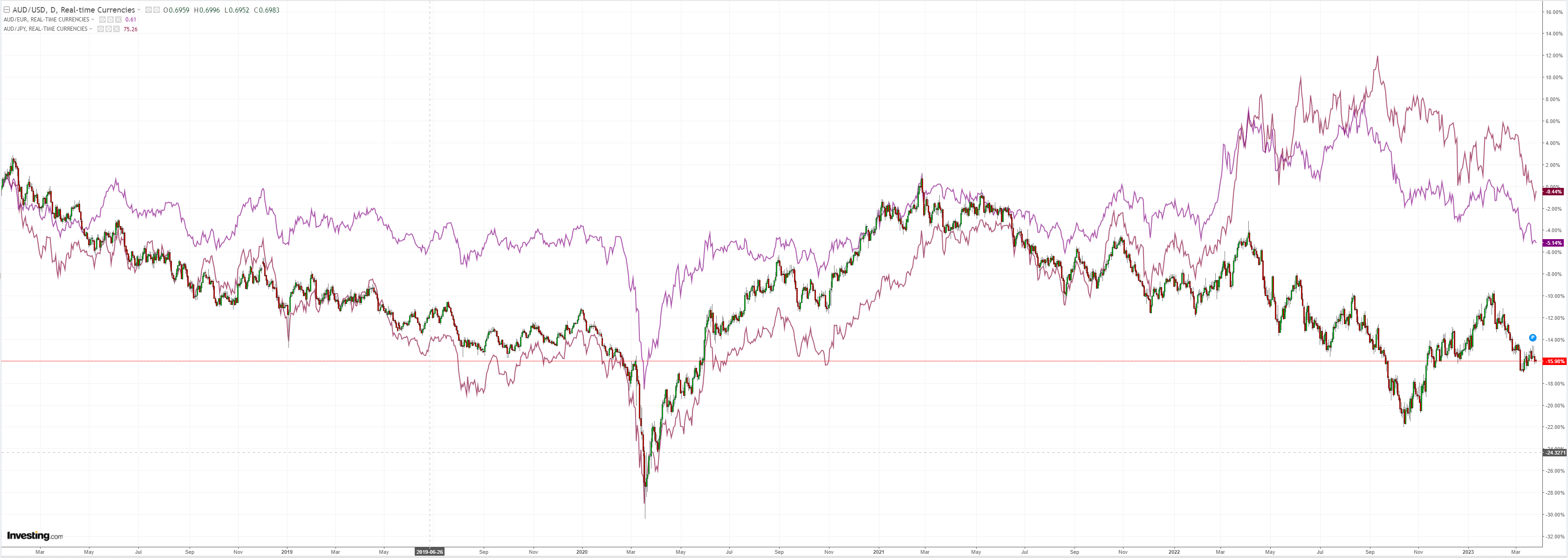

AUD did not benefit much:

Oil is everybody’s pain. Gold fell:

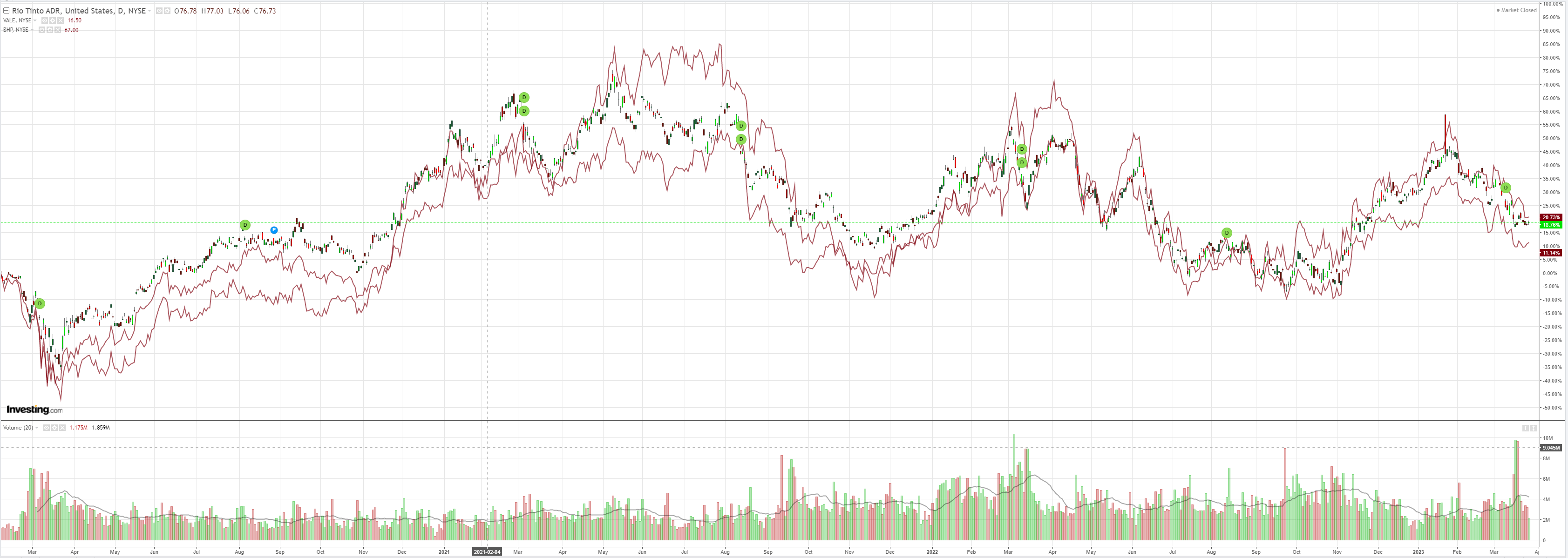

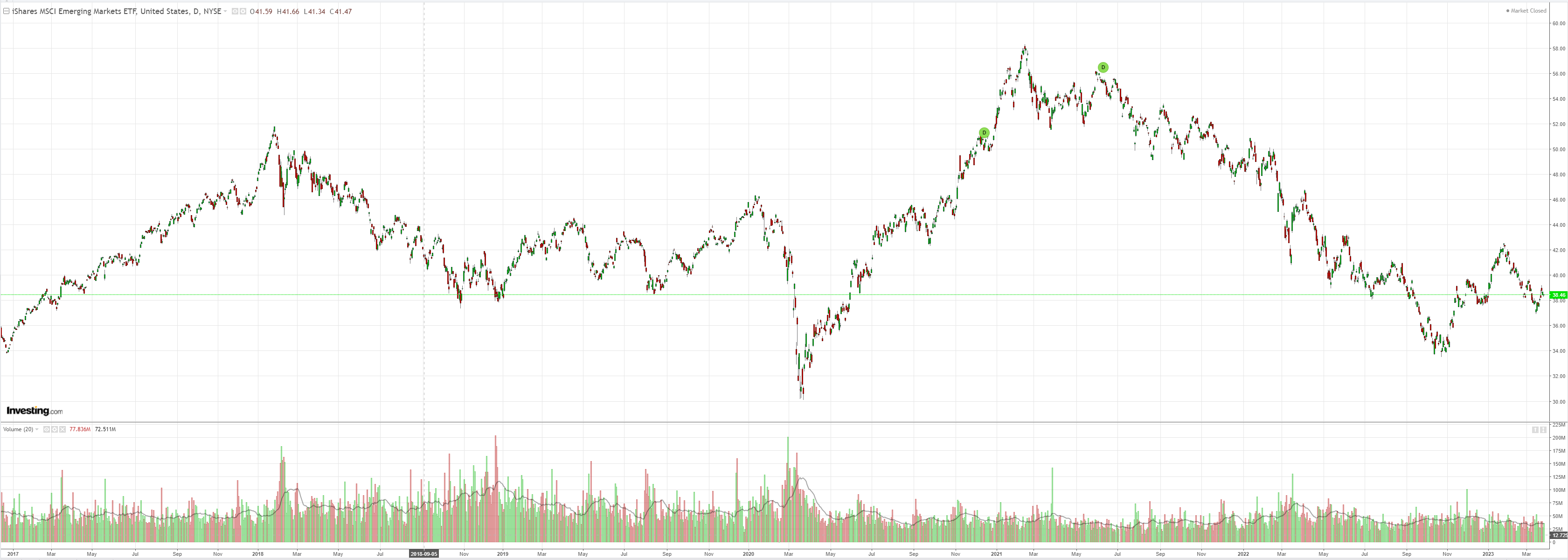

Not much bank stress in commods or EM (NYSE:EEM):

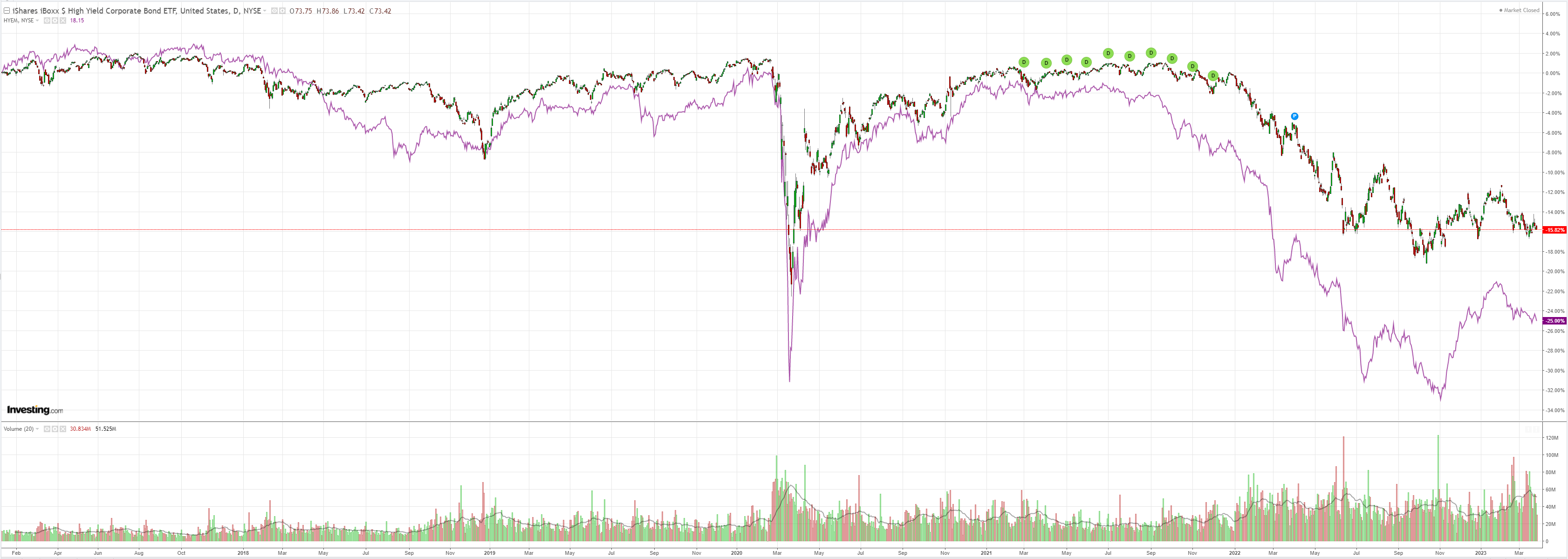

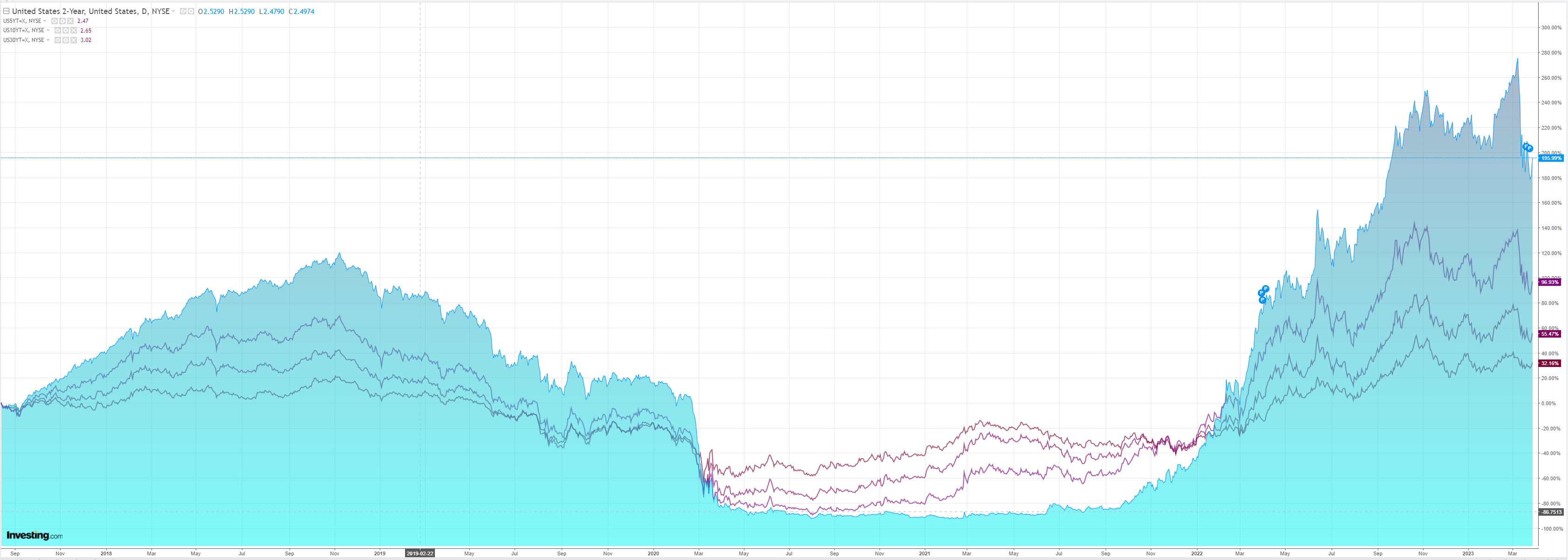

US yields took off as bank fears ebbed:

Stocks did a bit better:

Overall, bank fears eased but the (NYSE:KRE) is not giving up its losses:

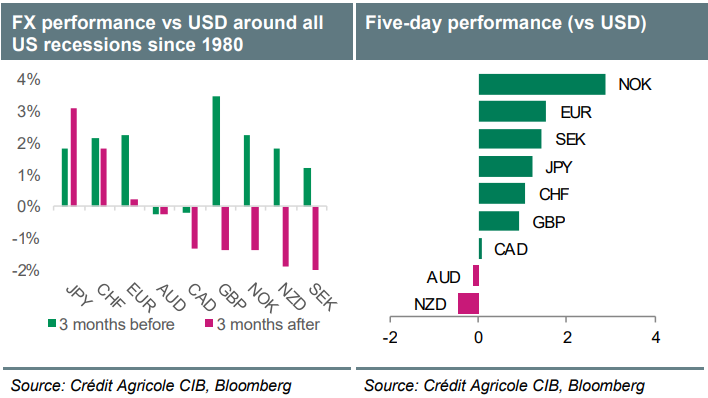

Credit Agricole (EPA:CAGR) has more on late-cycle DXY:

The recent banking sector turmoil has fuelled fears about aggressive tightening of credit conditions and intensifying US recession risks. It has also forced the Fed to deliver a dovish rate hike in March, seen by many as pre-announcing the end of its tightening cycle in May. Our recent historical analysis of FX price action during the past six Fed tightening cycles since 1980 has suggested that investors should not sell the USD before the Fed is actually done hiking because the combination of ongoing tightening and intensifying recession risks gave the USD a boost over the years.

Given Fed tightening cycles tended to peak shortly before the start of US recessions, we also look at FX performances in the 3M (NYSE:MMM) before and after the start of the last six US recessions since 1980. This helps us draw conclusions about the USD’s direction in the next 3M-6M. The results confirm our bearish USD outlook beyond May and into H223, suggesting that the run up to US recessions was negative for the USD on average – because of growing market rate cut expectations or actual Fed rate cuts. In contrast, the recession start tended to be mildly positive for the USD – due its ability to attract safe-haven flows. Our results suggest JPY, CHF and EUR were consistent outperformers over the same period.

It should also be mentioned that perhaps the main difference between a potential US recession in coming months and past downturns could be the Fed reaction function, with sticky US inflation likely to delay any rate cuts in coming months and thus mute any USD losses. We also think that the EUR, JPY and CHF would hold up reasonably well throughout.

Not much to recommend the AUD there.