Forex markets reversed last night as DXY eased but AUD fell. EUR was stable:

The Australian dollar was weak across the board:

Oil and gold firmed:

But base metals struggled. Copper has formed a bearish descending triangle pattern. I expect it to follow iron ore in due course:

Miners tried:

EM stocks too:

And junk

The curve lifted:

Stocks manged a meek bounce:

Westpac has the wrap:

Event Wrap

US housing starts and permits in August were stronger than expected. Starts rose 3.9%m/m to 1.615m and permits rose 6.0%m/m to 1.728m. The gains suggest that the housing construction pipeline will remain solid, but also indicated that supply constraints and labour shortages might be easing.

Sweden’s central bank – Riksbank – kept its policy rate on hold as was widely expected, and forecasts the average repo rate to remain at 0% through to Q3 2024. The tone remained dovish, noting it could still ease if inflation falls. That said, its forecasts for inflation and growth were revised higher.

ECB VP Guindos said Q3 growth will be strong, but added that underlying inflation remains below the ECB’s target and that headline rates are currently influenced by temporary factors. He sees inflation peaking around November at 3.4-3.5% but doesn’t believe the ECB will needs to react to that.

Event Outlook

Australia: The full effect of the current lockdowns is likely to be seen in the August Westpac-MI leading index. RBA Assistant Governor Bullock will provide an address at Bloomberg Inside Track.

Euro Area: September consumer confidence will reflect delta headwinds.

US: Westpac expects the FOMC’s September statement and press conference to highlight the progress the economy has made and confidence in the outlook. No official decision to taper is anticipated, but the tone of communications will emphasise that this decision is only months away. Revised forecasts will be released after the meeting.

Now look. I know there’s a lot going on. Delta, Evergande, debt limit debacles, Melbourne rage, etc. At these times it’s always a good idea to go back to first principles and ask what really matters.

When it comes to economies, markets and forex these days, that answer is liquidity. More particularly, the speed of expansion or contraction of liquidity.

If so, a series of charts show us precisely the path ahead. It is a stronger DXY, weaker EUR and tumbling AUD. Why?

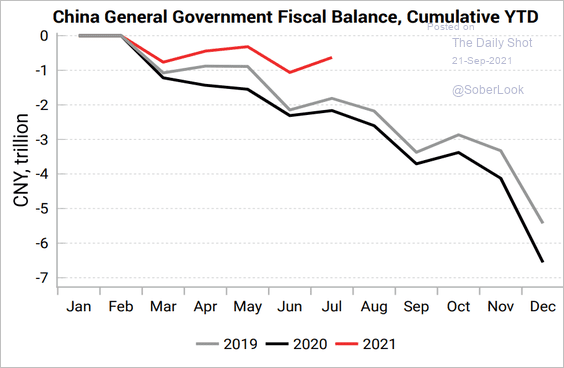

Because China’s fiscal impulse is fading:

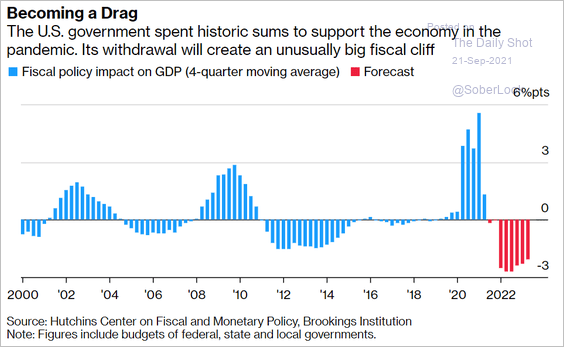

The US fiscal impulse is fading:

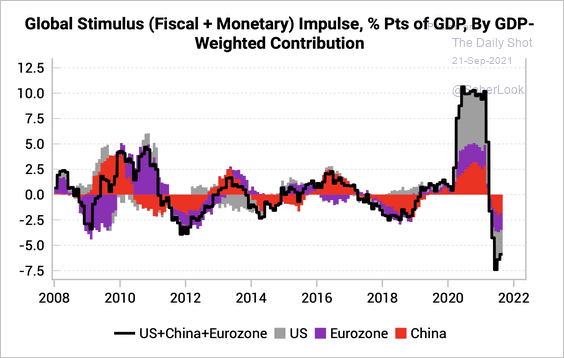

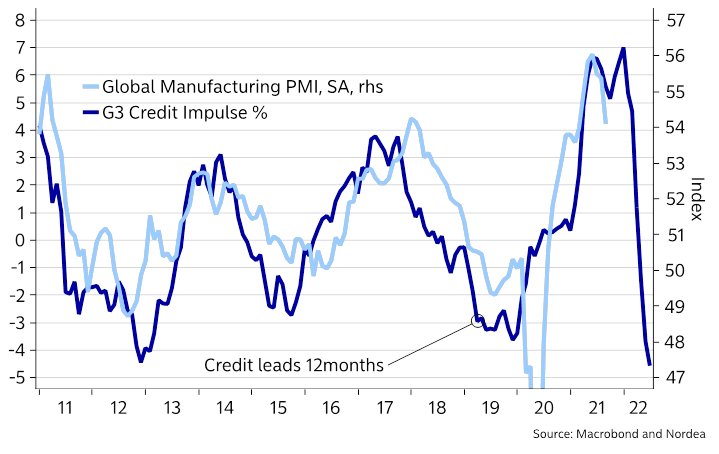

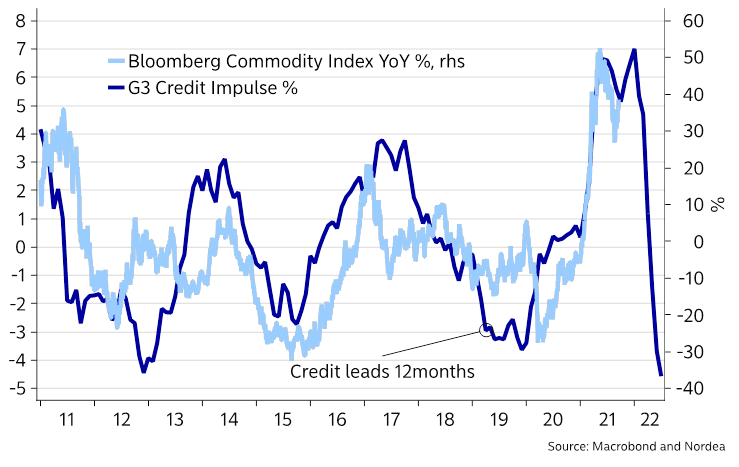

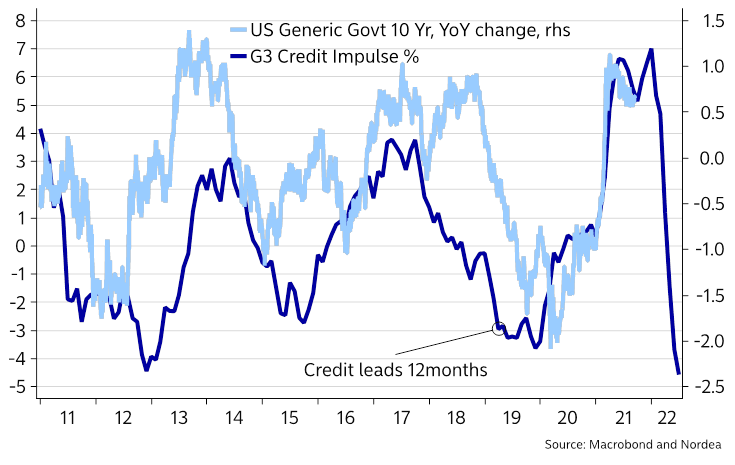

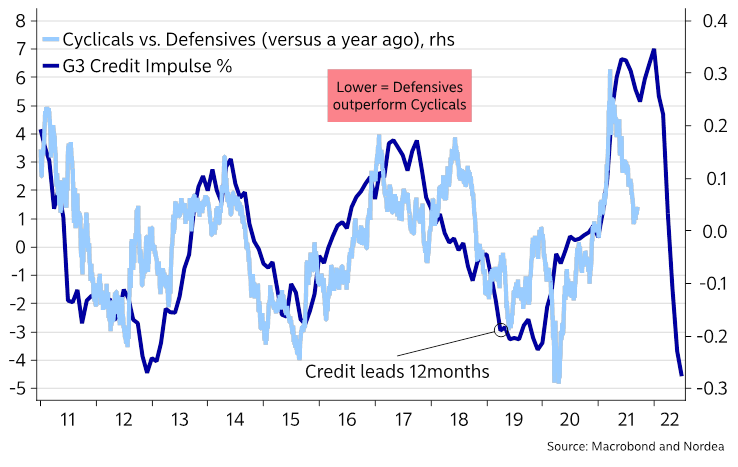

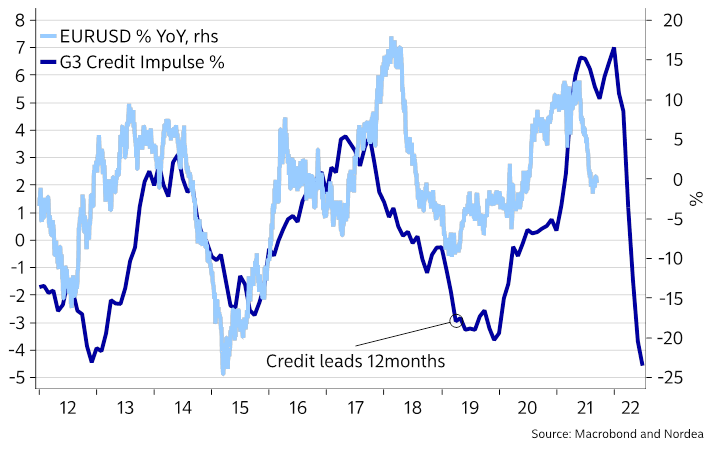

The G3 credit impulse has cratered:

And when this happens we know the result. Global manufacturing slows:

Commodities collapse:

Bonds boom:

Stocks struggle:

DXY surges as EUR is blasted:

And AUD is belted.

The end.