DXY was up again last night:

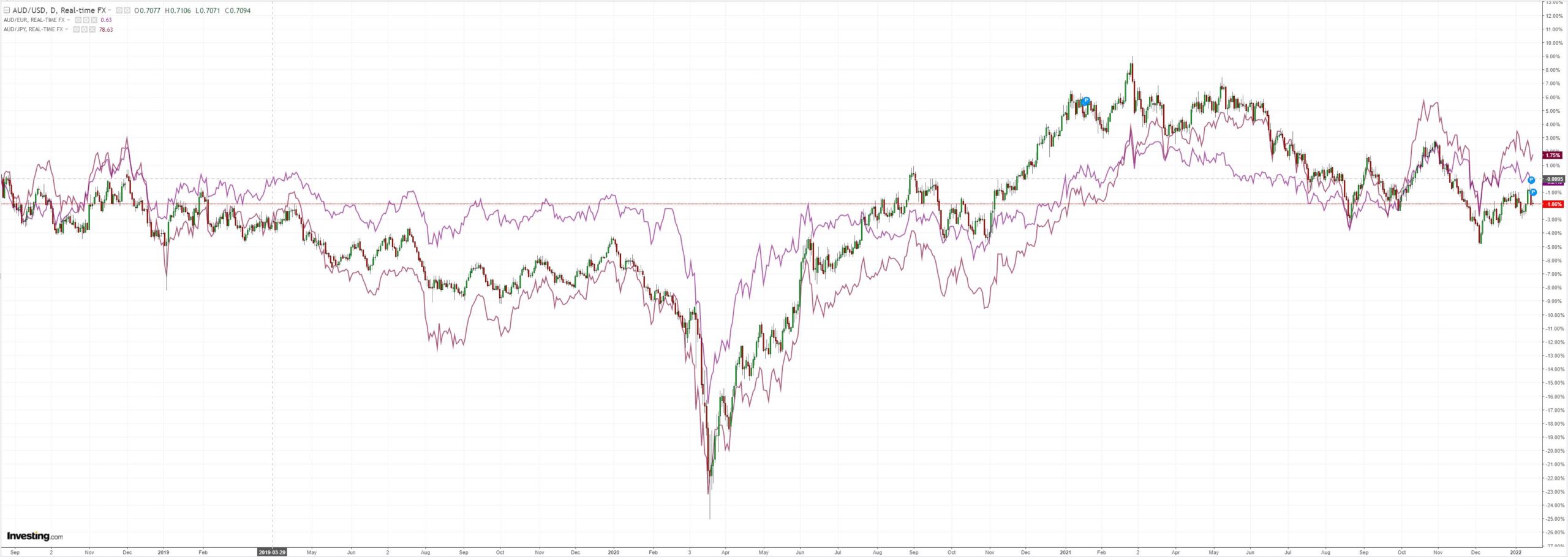

Australian dollar was mixed:

Oil is still hot:

Dirt mixed:

Miners (LON:GLEN) were soft:

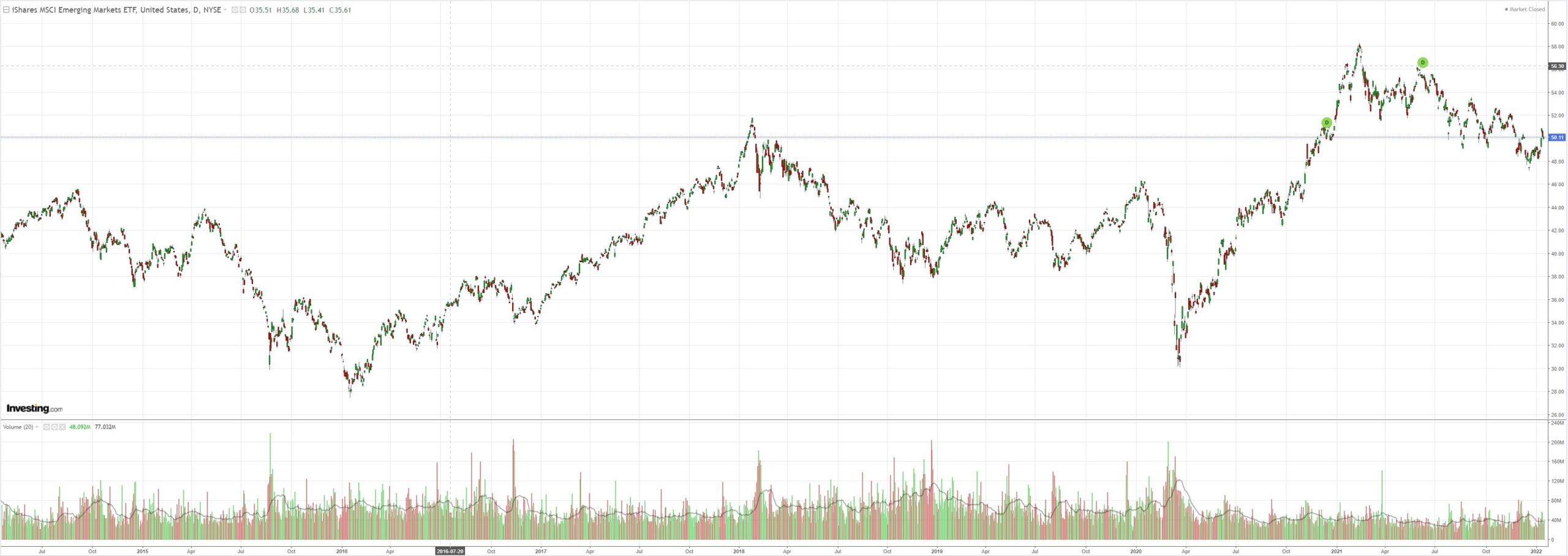

EM stocks (NYSE:EEM) softer:

EM debt (NYSE:HYG) softest:

US markets were closed for Martin Luther King Day. Westpac has the wrap:

Event Wrap

Italian CPI inflation in December was finalised unchanged from the preliminary at 4.2%y/y).

Canadian manufacturing sales rose 2.6%m/m (est. 3.0%m/m, prior revised from 4.3%m/m to 4.6%m/m). The Bank of Canada’s business outlook survey rose to another high, increasing the chances of a more proactive stance at the next meeting on Jan 26th.

The UK is poised to reduce its relatively limited Plan B covid restrictions (which legally expire on 26th), allowing a return to work and greater access to public events into the end of the month. Daily cases have fallen sharply to 84,429, from almost 245,000 on 4th Jan.

Event Outlook

NZ: REINZ housing market update for December should reflect extended buoyancy. The NZIER quarterly survey of business opinion is also released.

Japan: The final estimate of November’s robust industrial production result should indicate that supply chain issues are starting to alleviate across some manufacturing sectors.

Eur/UK: The January ZEW survey of expectations will likely report weakening confidence due to emergence of omicron. Meanwhile, the UK’s economic recovery should see the ILO unemployment rate remain low in the three months to November (market f/c: 4.2%).

US: The January Fed Empire state index will provide a view on manufacturing in NY state (market f/c: 25.0) and the NAHB housing market index is expected to remain stable at a high level (market f/c: 84).

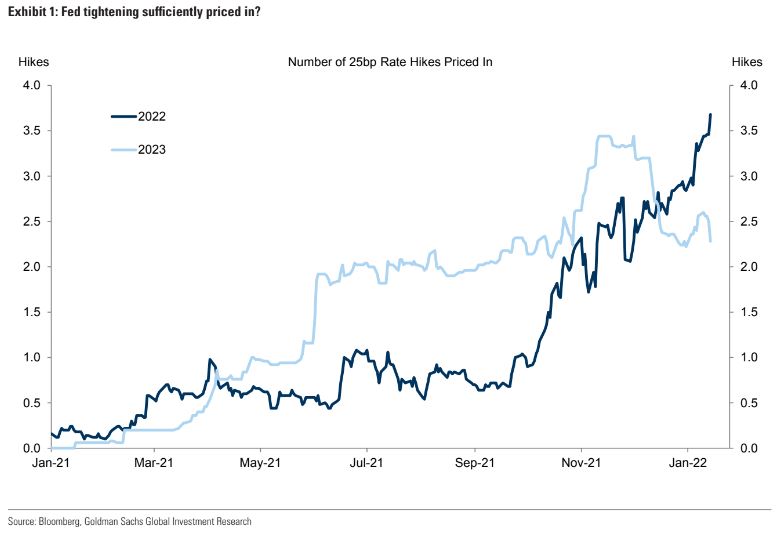

Here’s the chart that is tormenting forex markets. Although US rate spreads have widened, 2023 have fallen away after the death of Biden stimulus:

The big question now is when to discount it. I still think we have another leg of DXY strength as the Fed is pushed to overtighten and risk assets deflate but it will be the last one.