DXY was soft last night and its chart remains frighteningly bearish:

Oil is unequivocal that something is broken:

Copper looks about to follow:

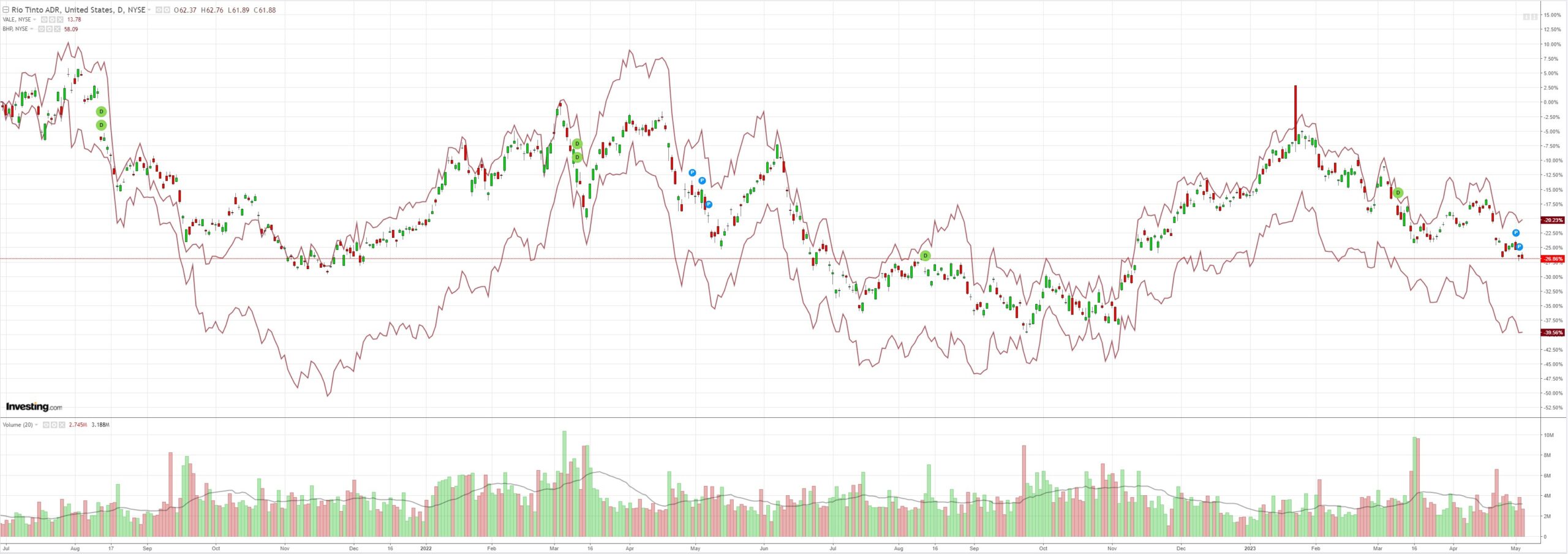

Miners (NYSE:RIO) are trash:

EM (NYSE:EEM) is very unconvincing:

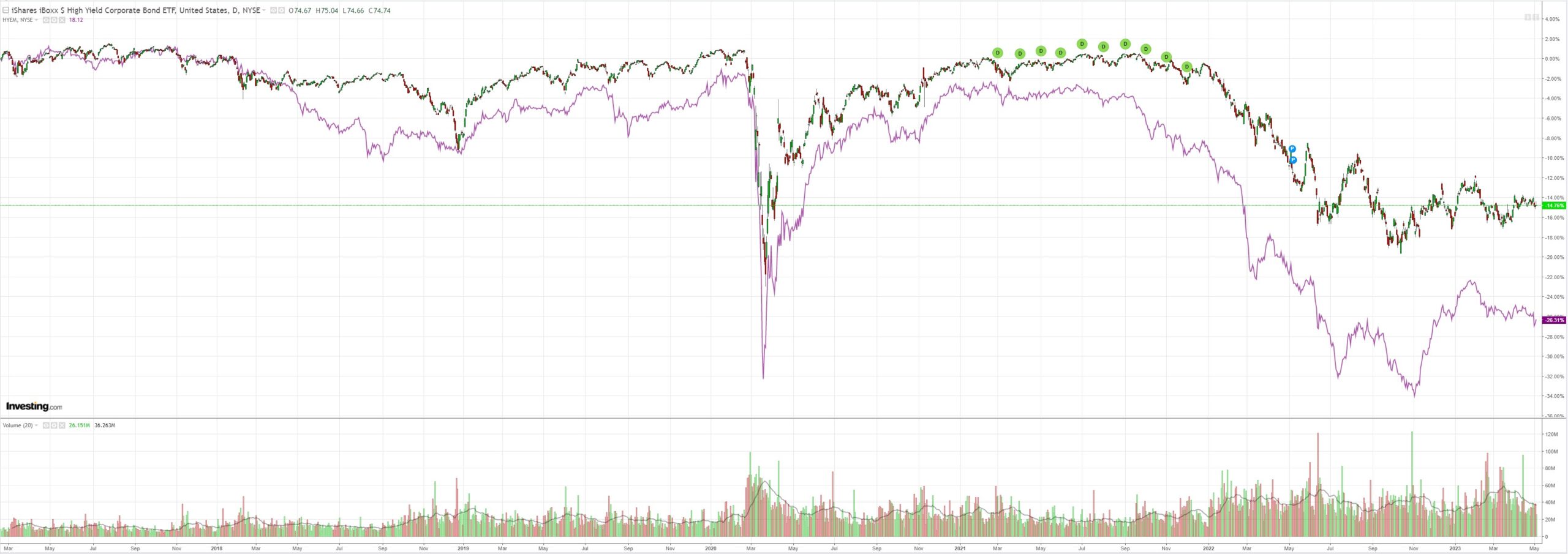

And junk (NYSE:HYG):

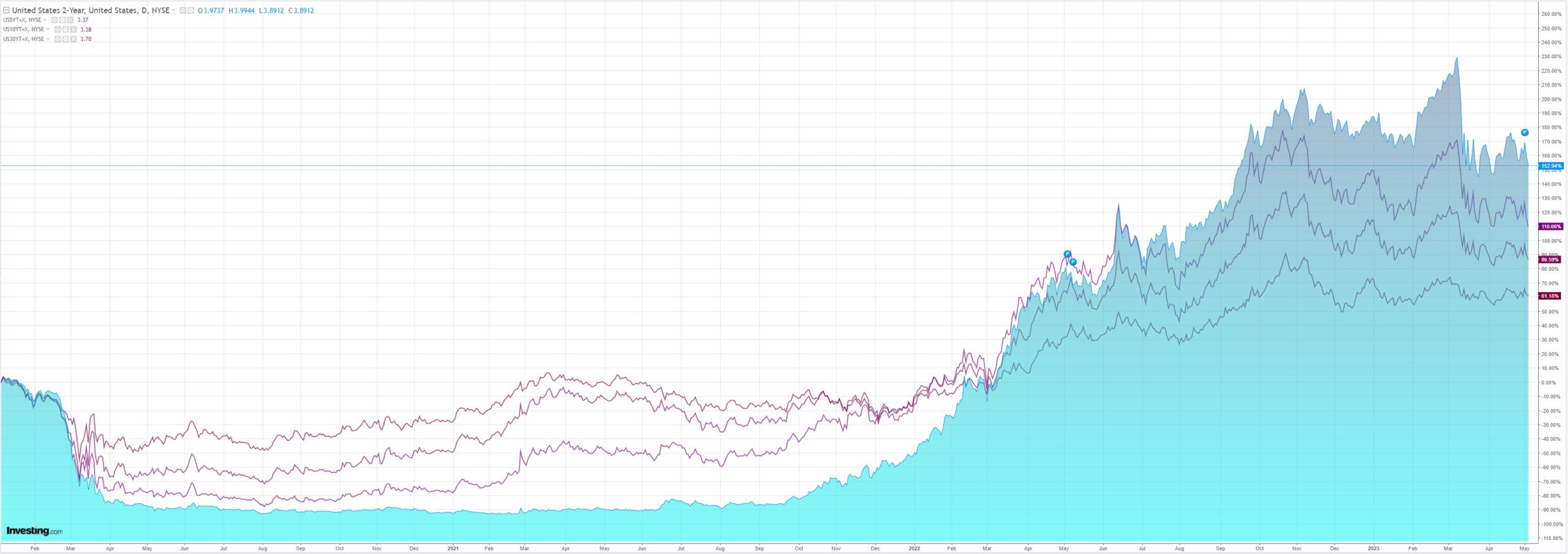

The Treasury curve steepened a little:

Stocks fell a little:

(NYSE:KRE) plumbed new depths:

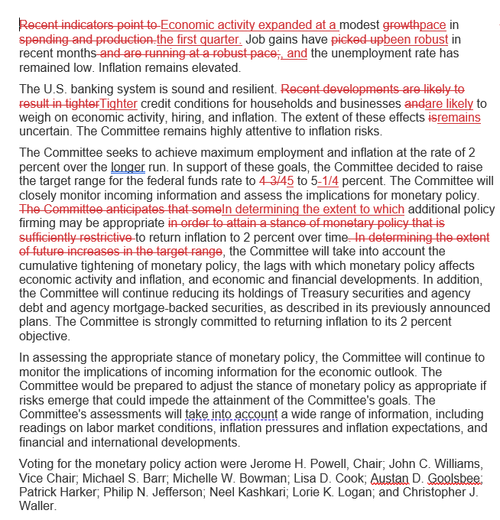

Which is where we meet the Fed, which hiked 25bps and admitted it has broken something:

The shift to “tighter credit conditions for households and businesses are likely to weigh on economic activity” is the key. The Fed already has access to Q1 SLOOS data that will be released soon. It knows what banks are thinking.

The Fed has broken the US regional banking system. It is under pressure from:

- a run on deposits;

- falling margins as they chase substitute funding;

- CRE loan deterioration, and

- deteriorating liquidity.

Soon enough it will be rising bad loans. A credit crunch is the normal response as the segment pulls lending to deleverage and restructures balance sheets.

All the Fed has to do now is not cut and recession is inevitable.

Risk assets will either fall as growth and earnings disappear, or, if they are doing their job, fall ahead of the same to force the Fed lower.

AUD is still in the gun.