DXY firmed last night:

AUD fell:

North Asia no help at all:

Oil is threatening to break:

Making the following ludicrous:

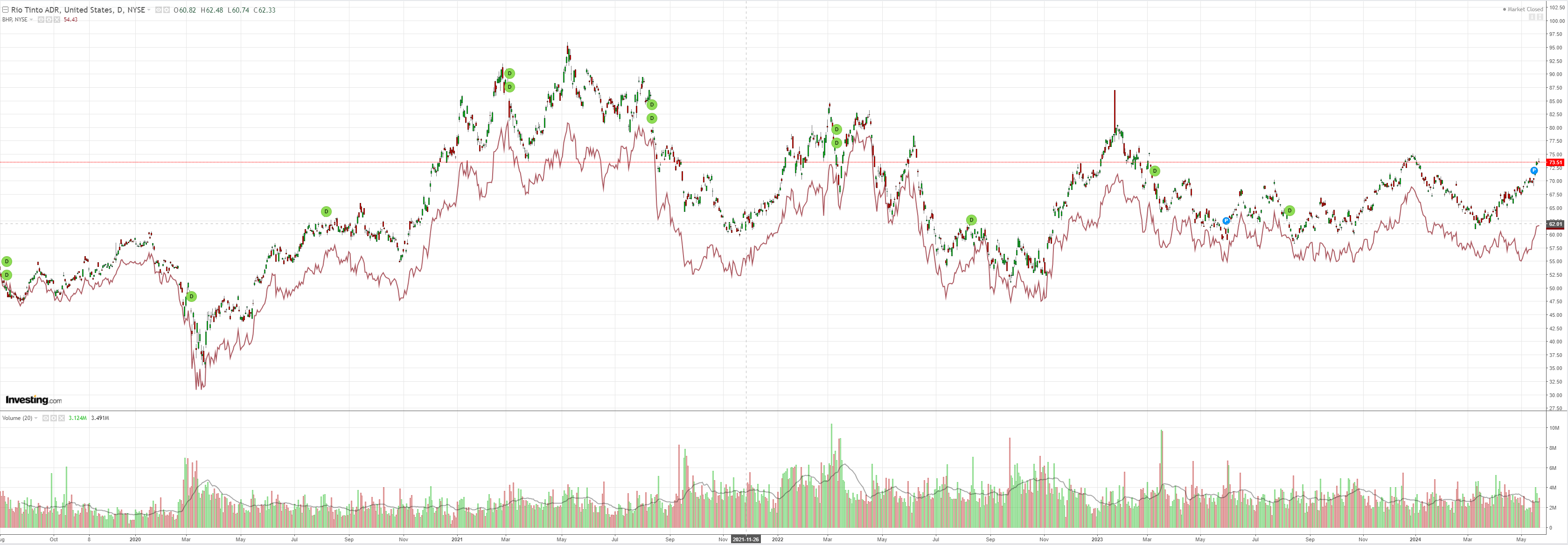

Miners are hanging on:

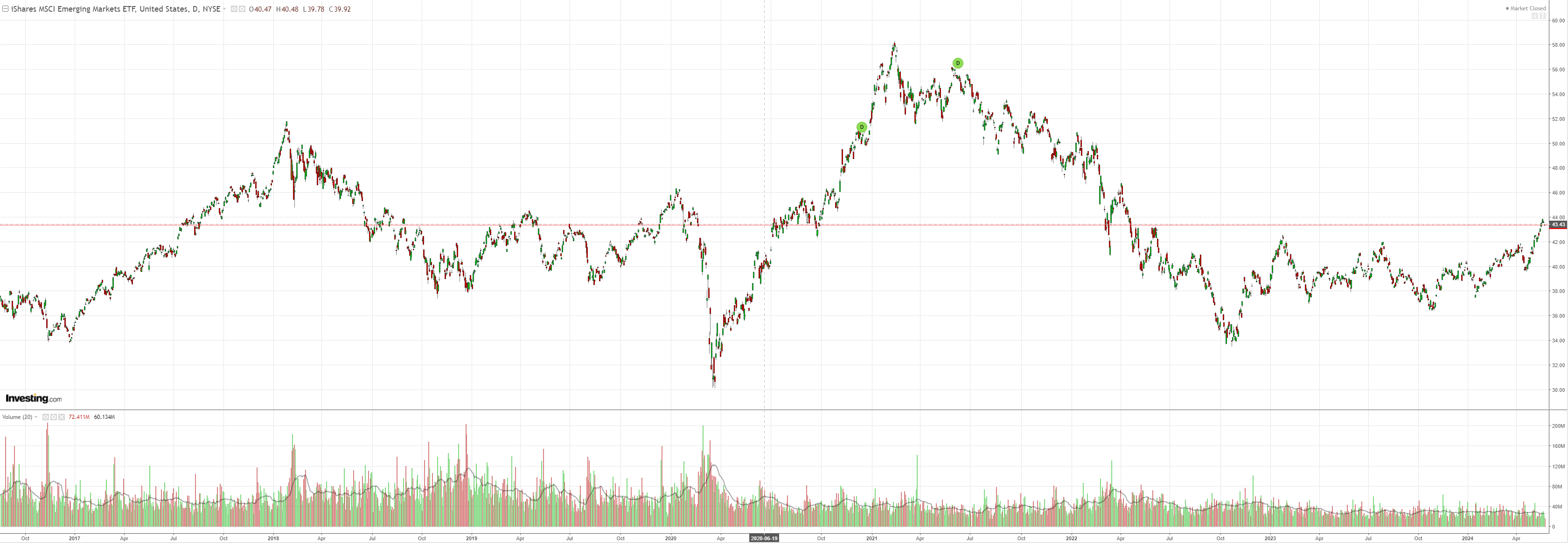

EM stocks sagging:

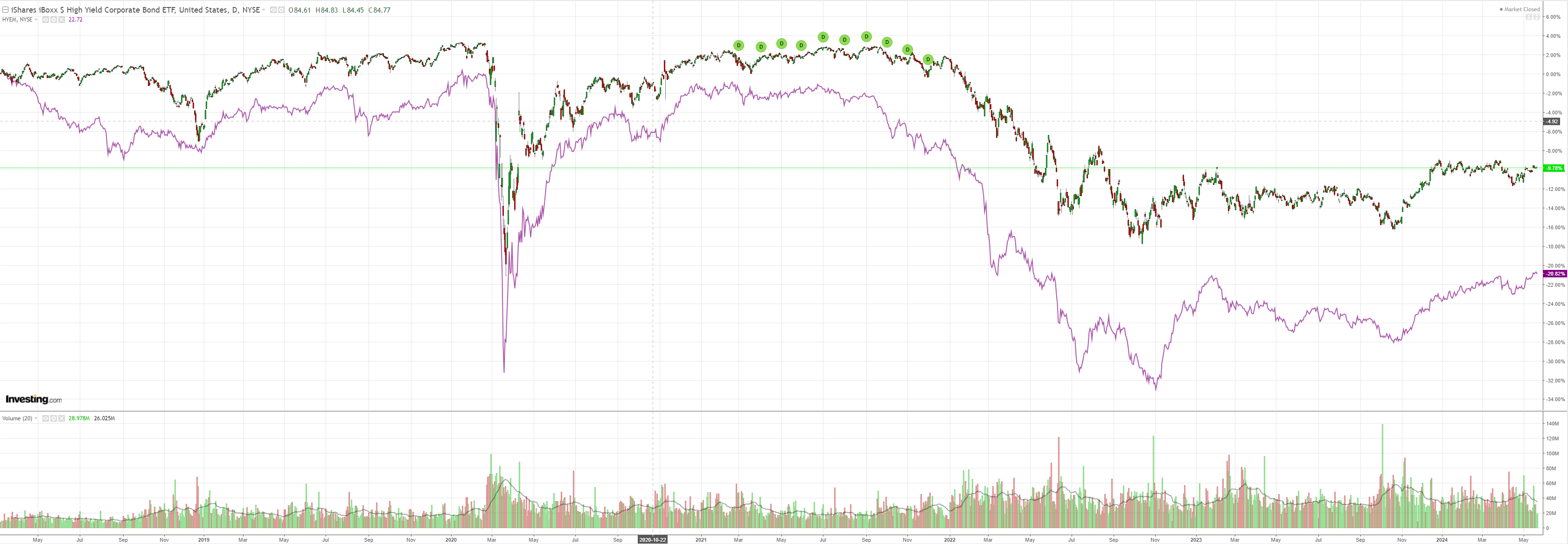

Junk trend is still strong:

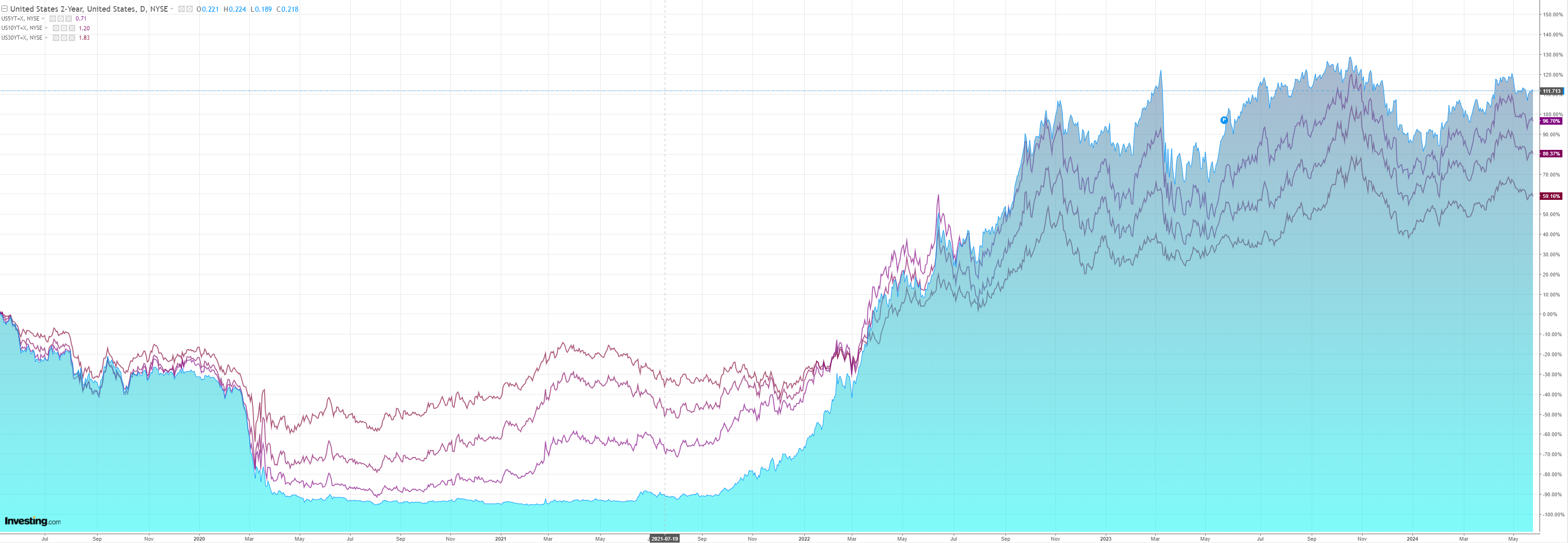

Bonds bid:

And stocks a little:

Overnight AUD weakness reminds me that I am not especially bullish about this move.

So long we sustain the soft landing narrative in the US, we can grind higher but the 64–68 cents trading range still looks strong.

I’m still sceptical about the metals rally. Despite the latest yawnulus, I see no pulse in Chinese property and fading growth, and I can’t see much global acceleration before we get rate cuts across DMs.

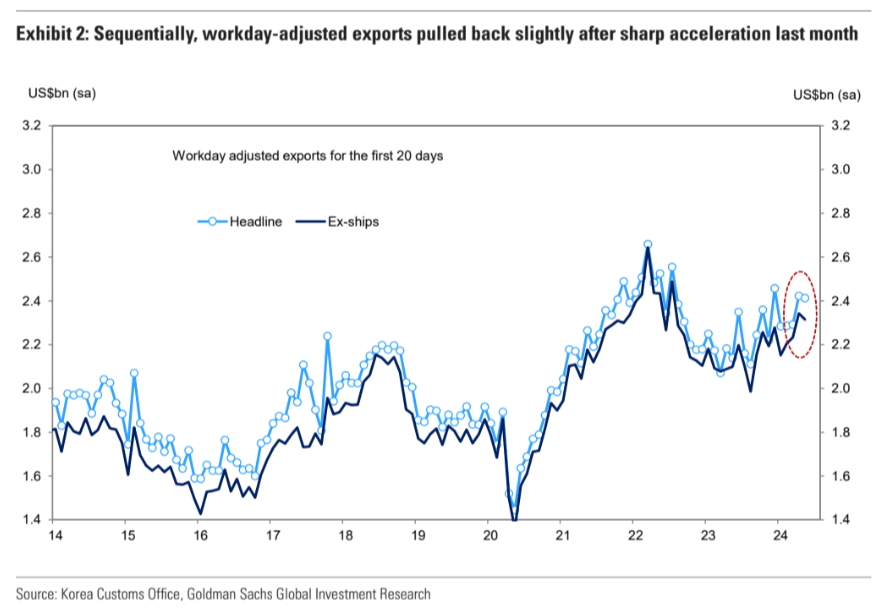

South Korean exports are saying as much:

Korea’s workday-adjusted exports in the first 20 days of May fell 0.4% mom as, pulling back slightly from a strong gain last month.

Without workday adjustment, total 20-day exports dropped 4.6% on negative workday effects, and without volatile ships, more sharply by 8.6%.

While exports of semiconductors and handsets continued to rise modestly, exports of other main products all dropped.

By destination, exports fell mostly across major partners except for those headed to Taiwan on AI-related memory demand.

It’s all feeling rather stagflationary, including the AUD.