DXY is a sinking stone:

AUD held the gains:

North Asia is supportive:

Oil is in all sorts. Gold the winner!

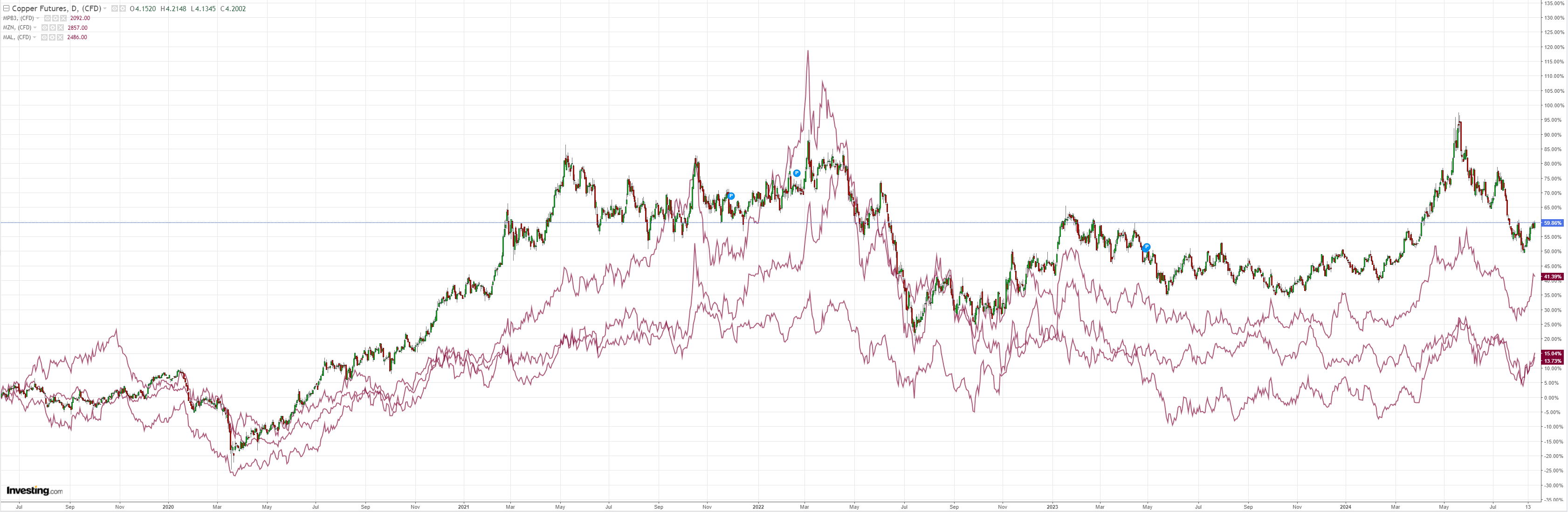

The silly little metals pop:

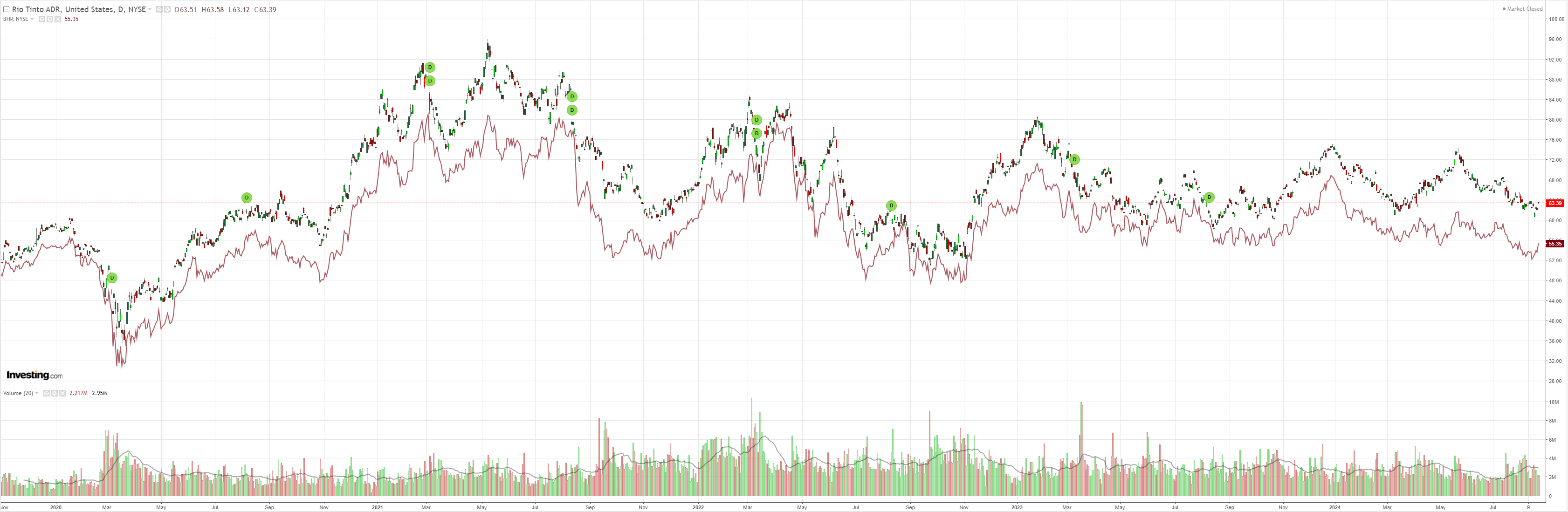

Mining dead cat:

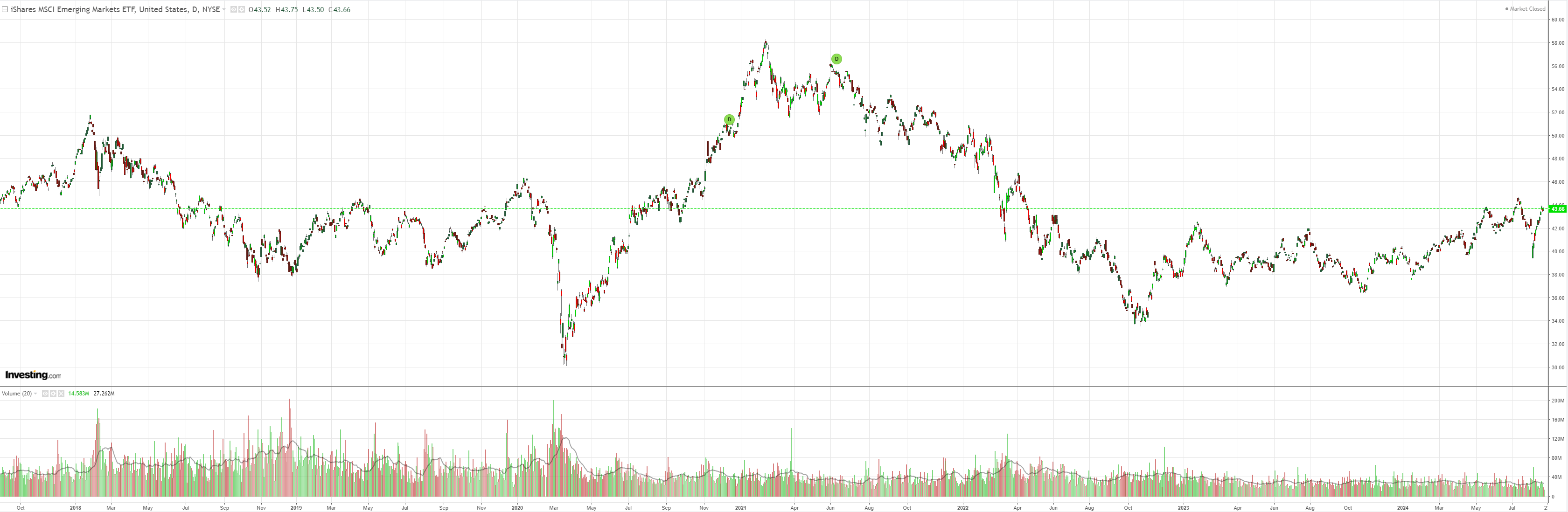

EM is struggling:

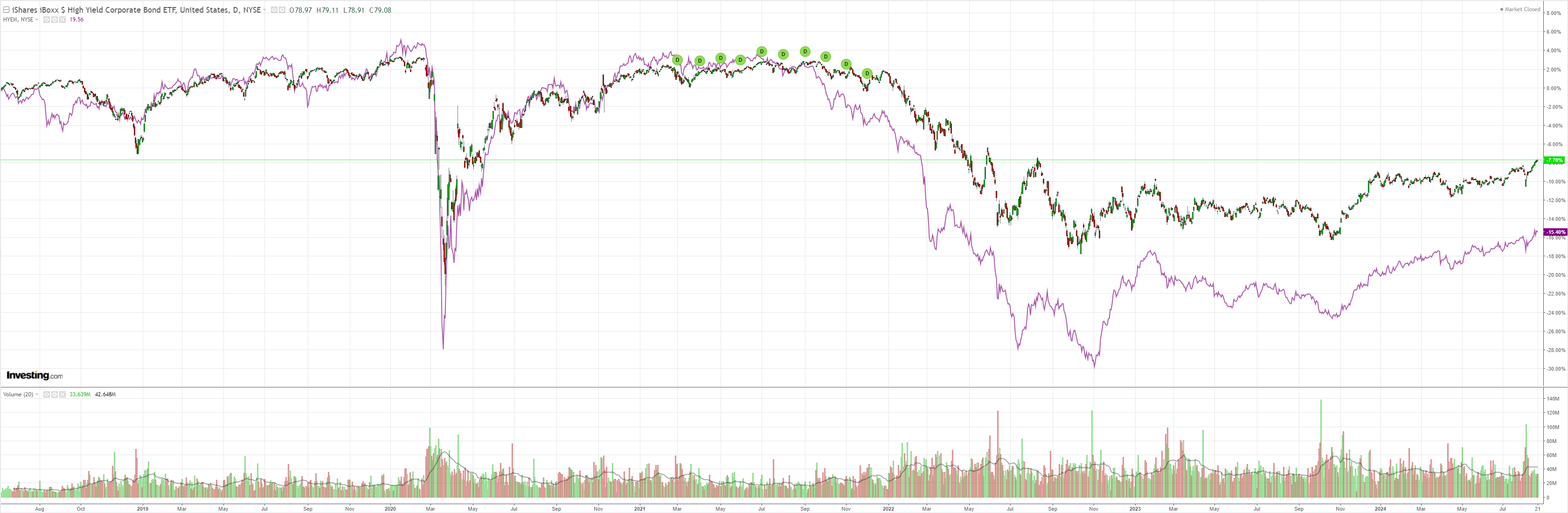

Junk is bullish:

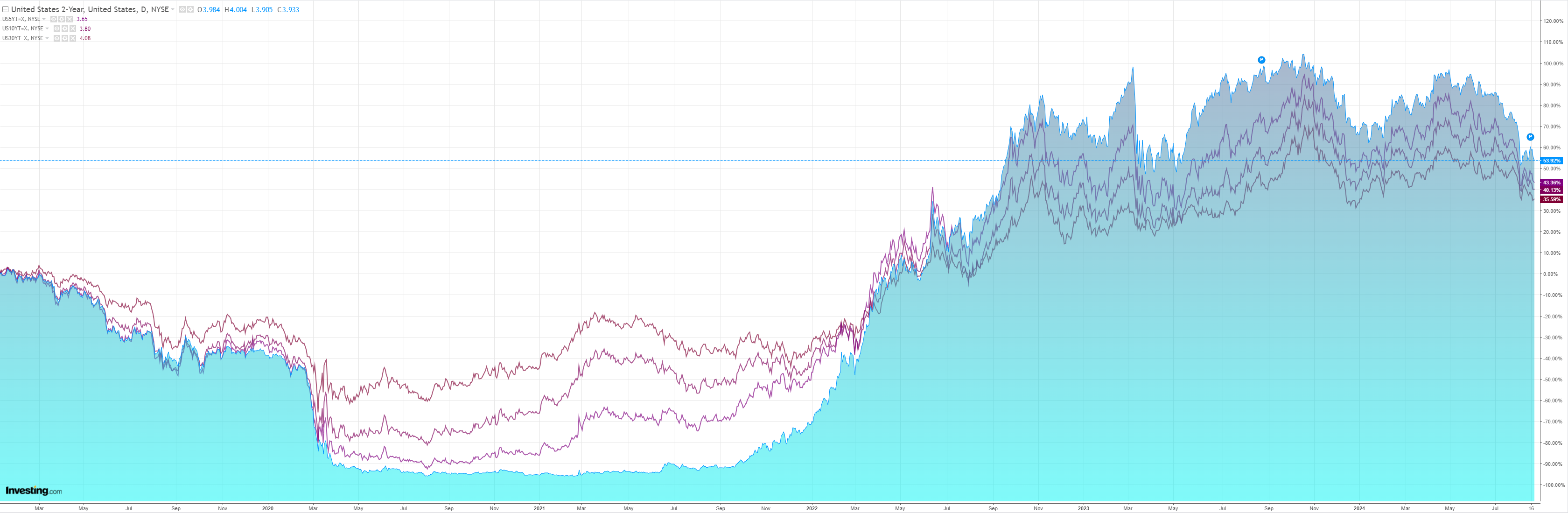

Yields set for breakdown:

Stocks still strong:

The newsflow was dovish. The BLS rounded down US jobs growth by a whopping 880k. And the Fed minutes suggested a September cut is in the bag.

However, although the US has slowed, it can be argued that DXY is still the cleanest dirty shirt versus other FX.

China and Europe are still weaker than the US and it is likely to stay that way as they duke it out over shrinking export returns.

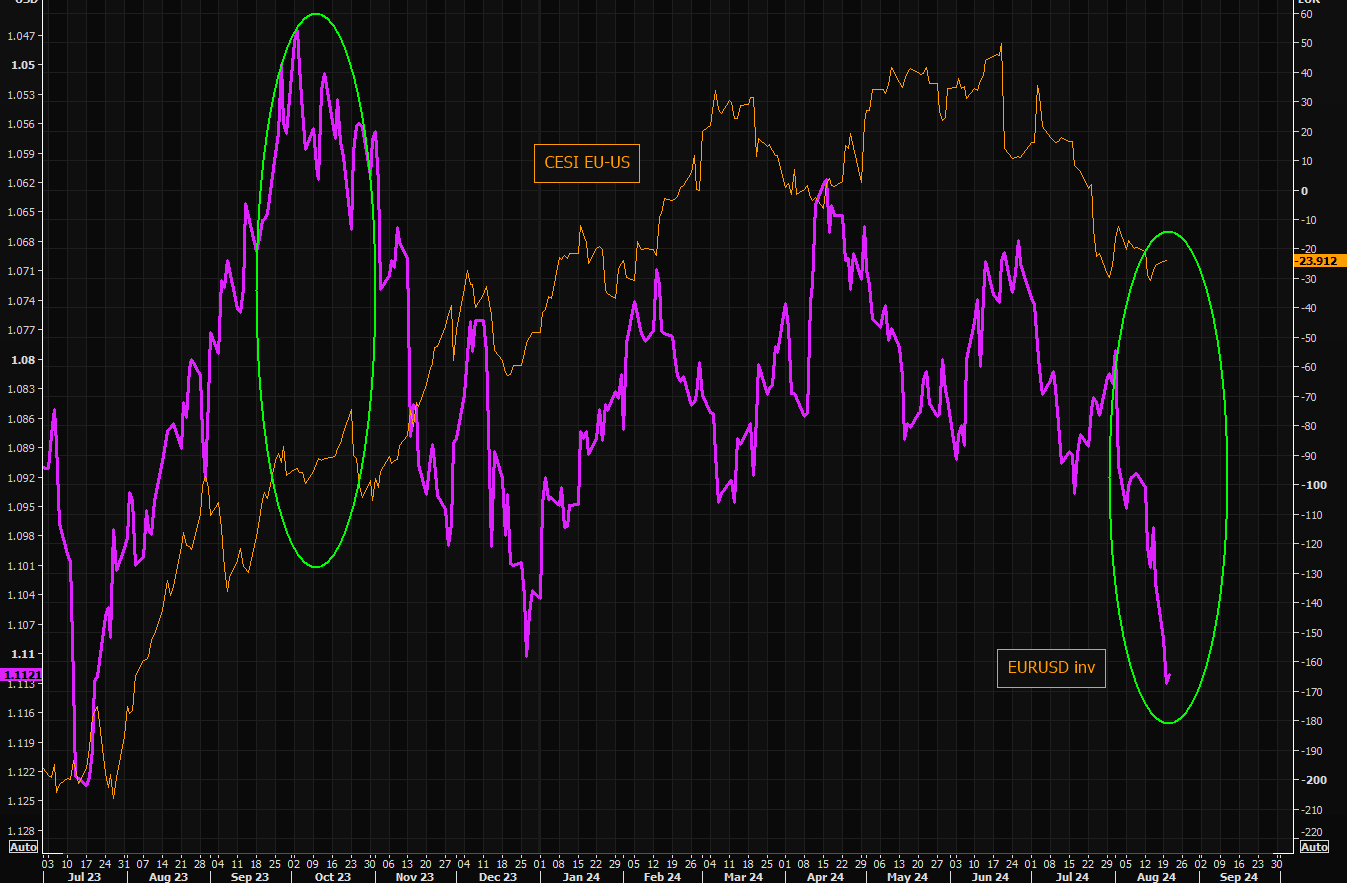

EUR has seriously overshot relative economic surprise indexes versus DXY:

Either the US will keep weakening more than Europe or DXY will bottom out.

AUD will do the opposite and the golden goose will be shot out of the sky.