DXY eased last night:

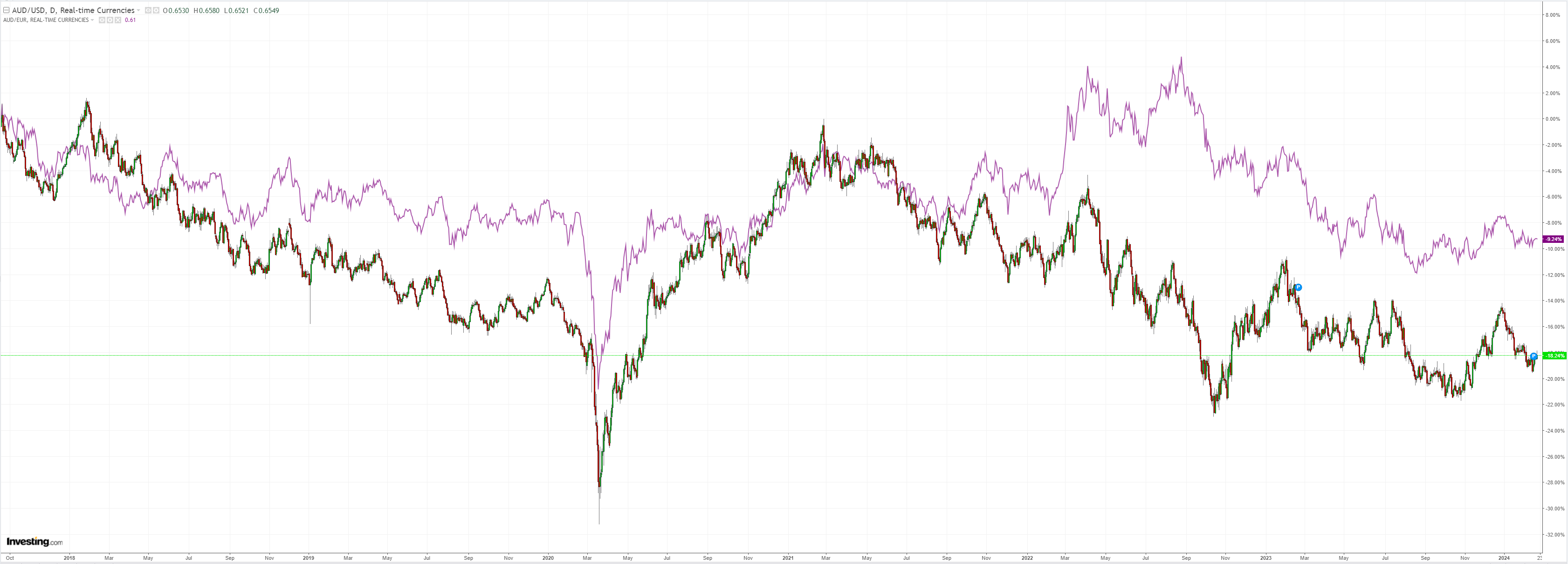

AUD popped:

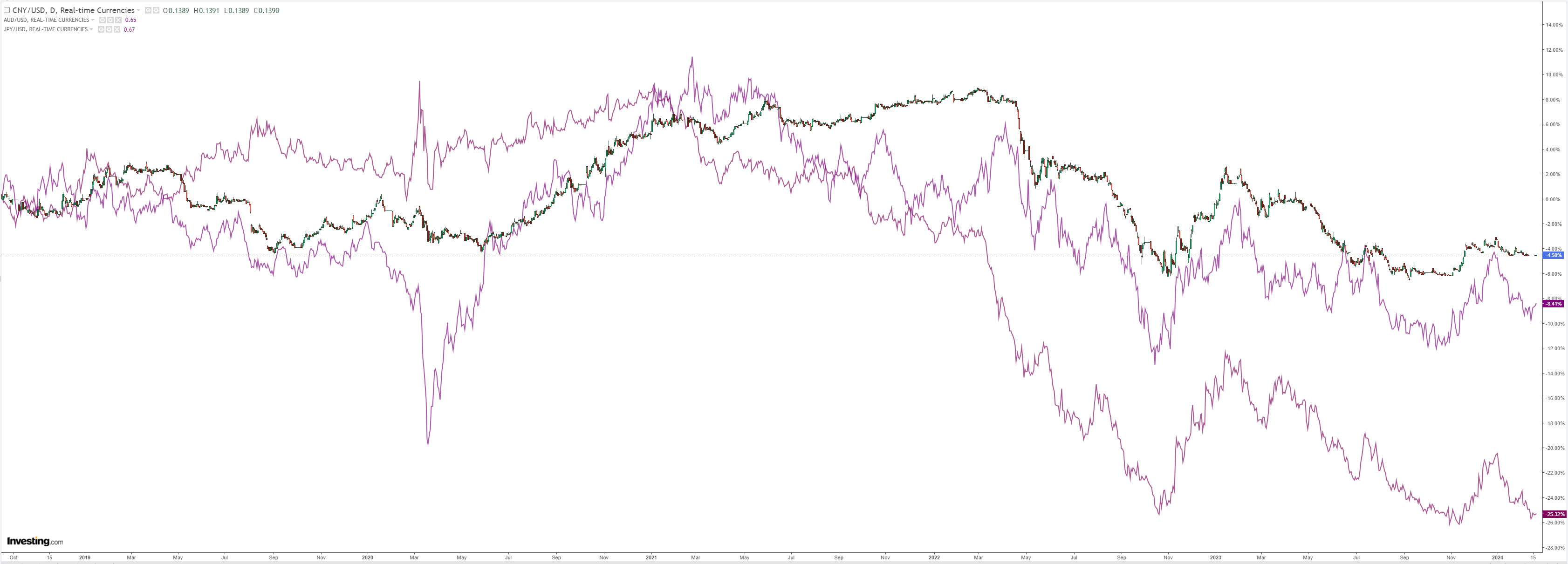

Not so North Asia:

Oil fell:

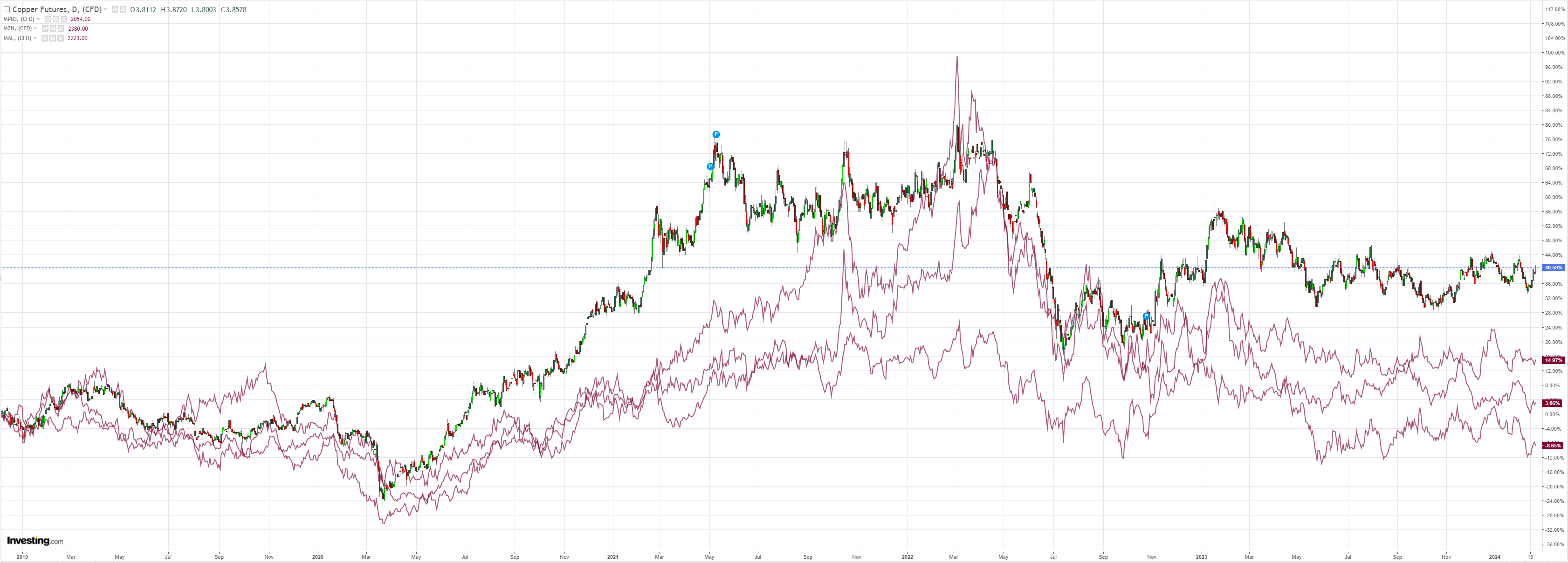

Dirt was mixed:

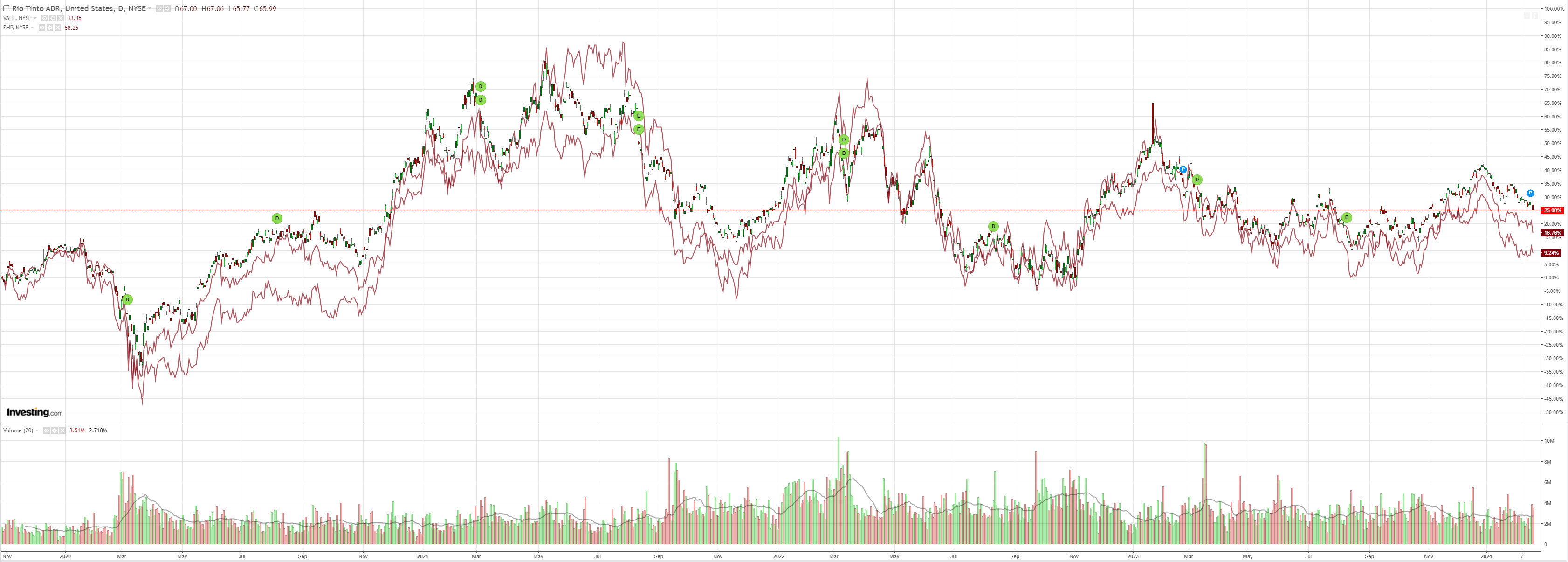

Miners puked:

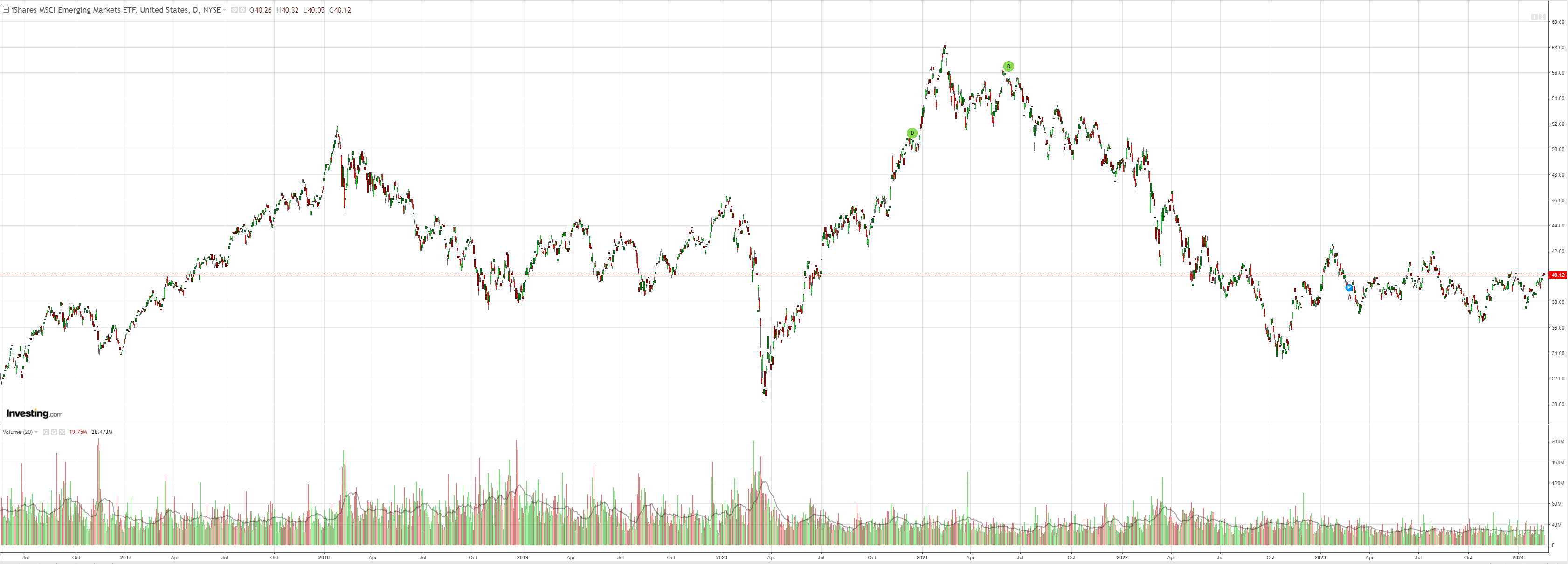

EM yawn:

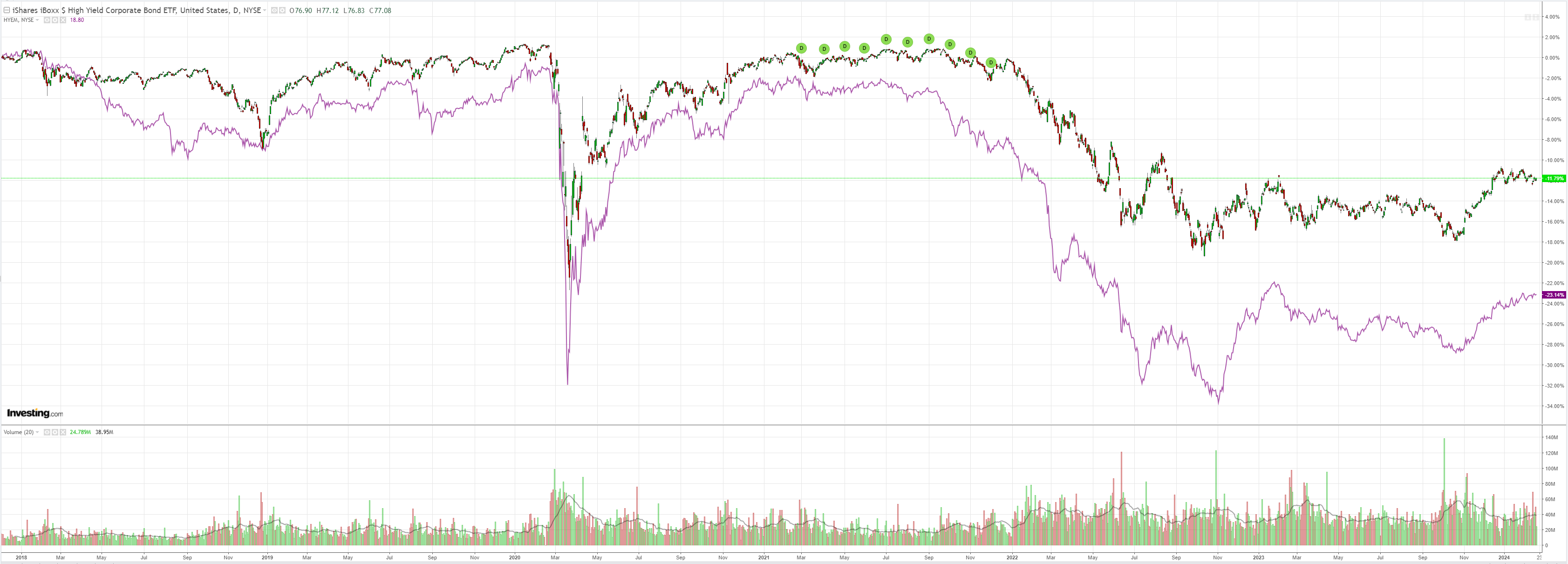

Junk has stalled. Not good for stocks:

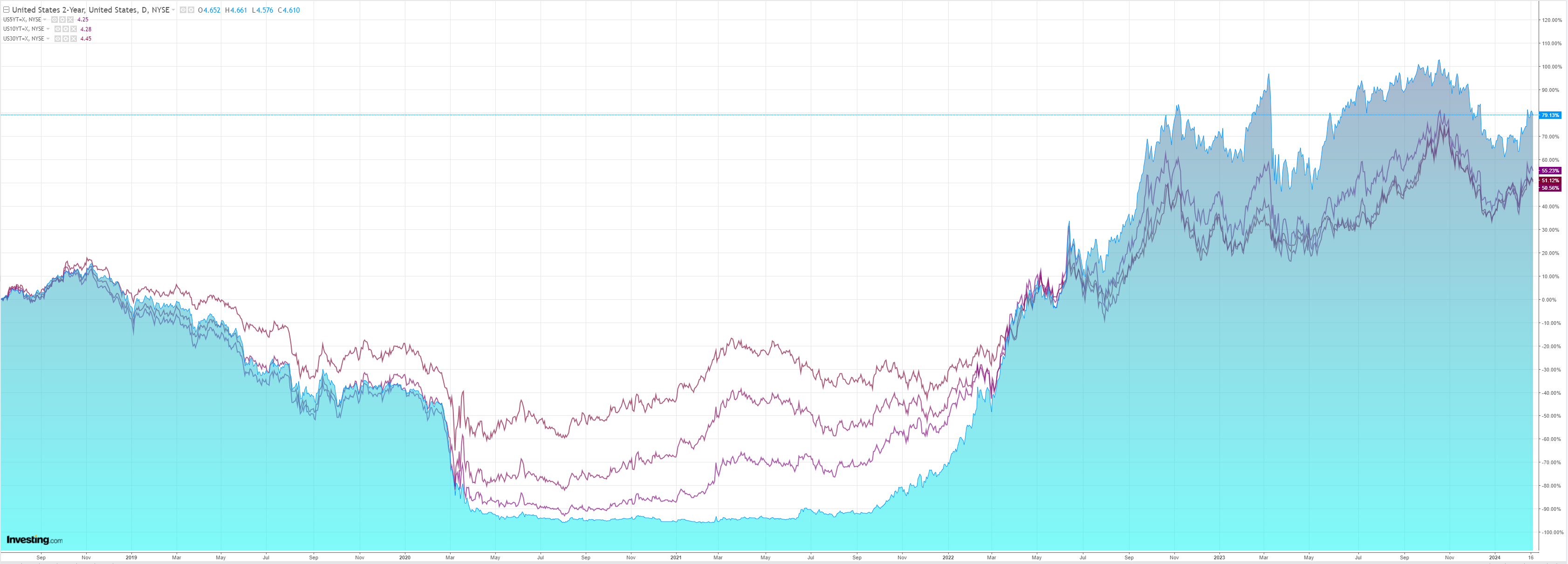

Yields rallied:

Stocks fell:

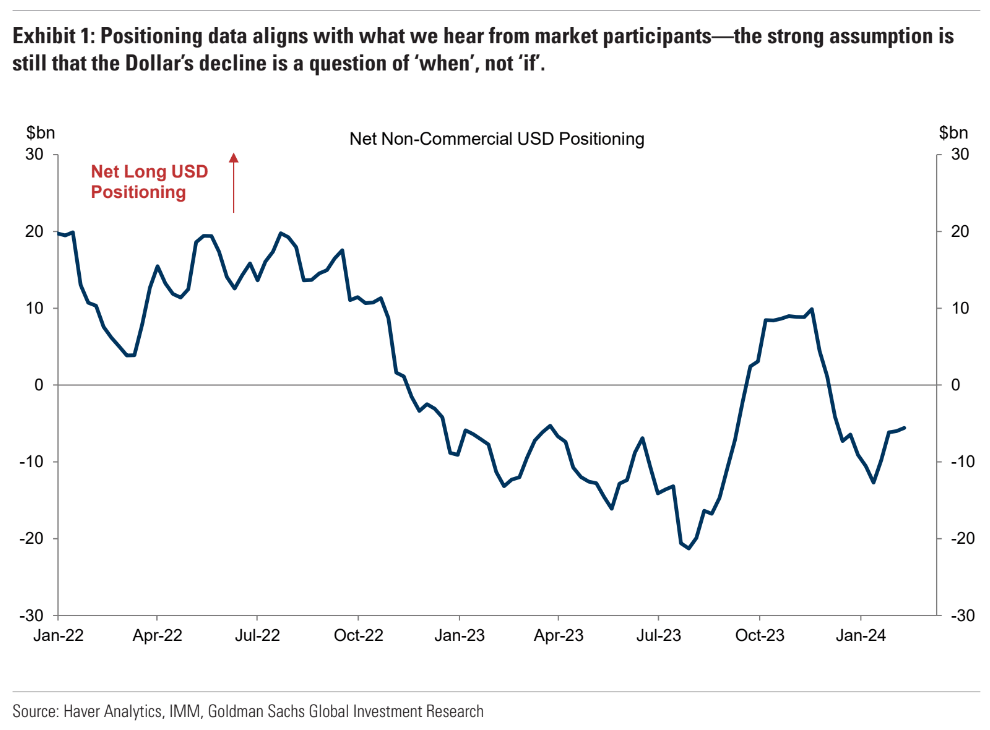

Not much in data to report. Goldman checks out DXY.

USD: Spinning my wheels. Markets priced out another 2024 Fed rate cut this week, but the Dollar barely budged on net.

As we highlighted last week, the same can also be said for the data over the last three months; our economists have revised up their already-above-consensus US growth views significantly (and downgraded Europe) but the Dollar is essentially unchanged over that period on both a broad basis and in the DXY.

What gives? And what might make the Dollar finally ‘give’? We still think the most plausible explanation is that, while US yields have sold off, the rate differential has barely moved because of cross-market spillovers.

This presents some upside risk to the Dollar over the medium term relative to our baseline views.

Our analysis of EM ‘early movers’ suggests there is scope for more divergence deeper into the policy rate cycle. If the latest data ultimately lead the Fed to choose a slower path of rate cuts than its peers, then the Dollar would likely prove even more resilient than in our baseline, but this analysis suggests that would only materialize somewhat later his year.

While our economists expect five Fed cuts this year and six each from the ECB and BoE, we still think that would lead the Dollar gradually lower given its starting point and beta to global growth.

But that becomes a closer call if the FOMC only delivers the three cuts it wrote down in the December SEP.

In addition, the better growth news is not as positive for the Dollar as a hawkish policy shock would be.

We think this helps explain more muted overall Dollar returns, especially against high-beta and high-yielding currencies.

However, we are somewhat less persuaded by the argument that the Dollar is already ‘well-positioned’ or ‘over-owned’.

Positioning data suggests that speculative investors are still net short (Exhibit 1), which aligns with what we hear from market participants—the strong assumption is still that the Dollar’s decline is a question of ‘when’, not ‘if’.

In our view, the Dollar’s high valuation reflects strong capital return prospects, which we still think will prove a hard bar to beat.

In many cases, the Dollar has now reached or slightly overshot our near-term forecasts, but the data clearly suggest we are not yet at the point to start to see that slow erosion that we expect.

We think the risks to our baseline are tilted towards a Dollar that is ‘stronger for longer’, but it will likely take a clearer divergence in policy intentions than we have seen so far to unlock even more Dollar upside, despite the obvious cyclical divergence.

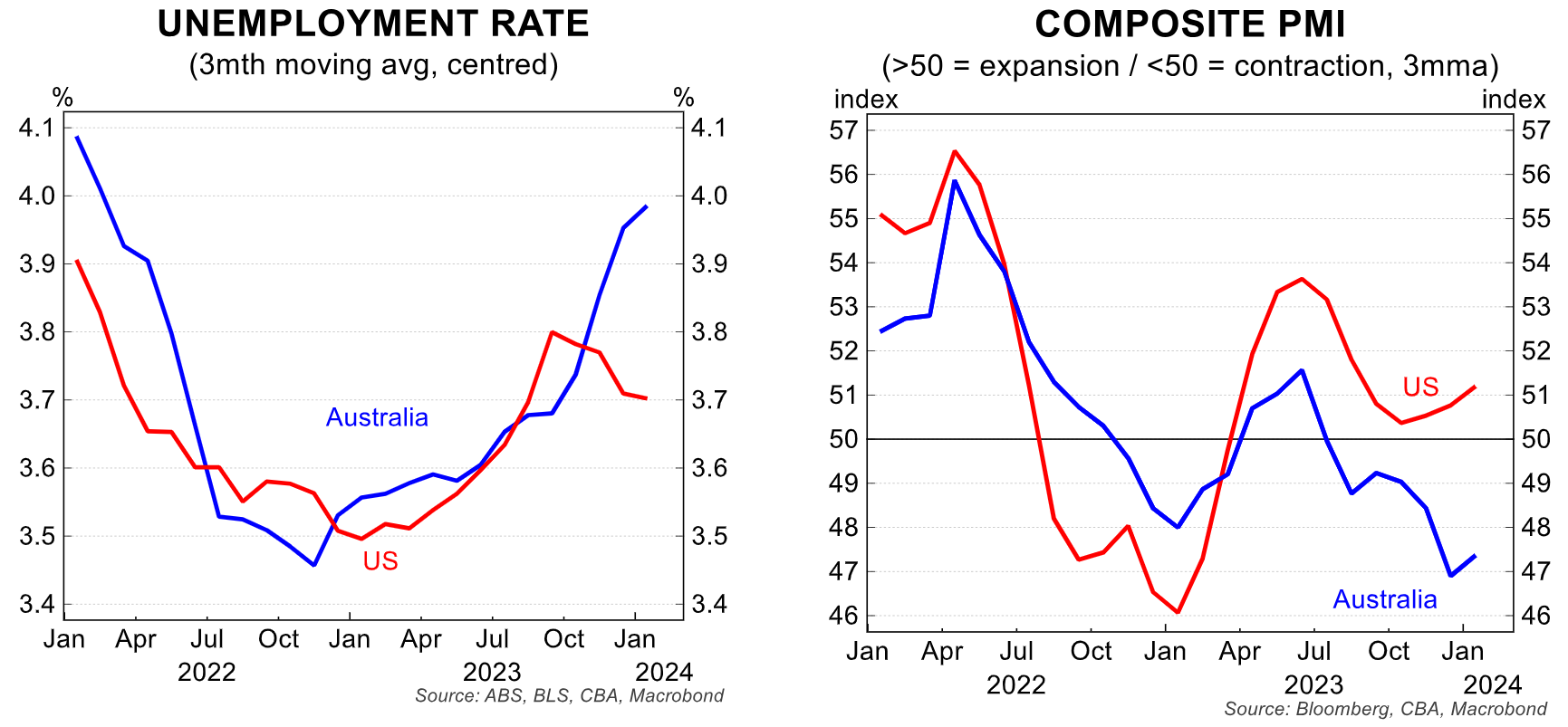

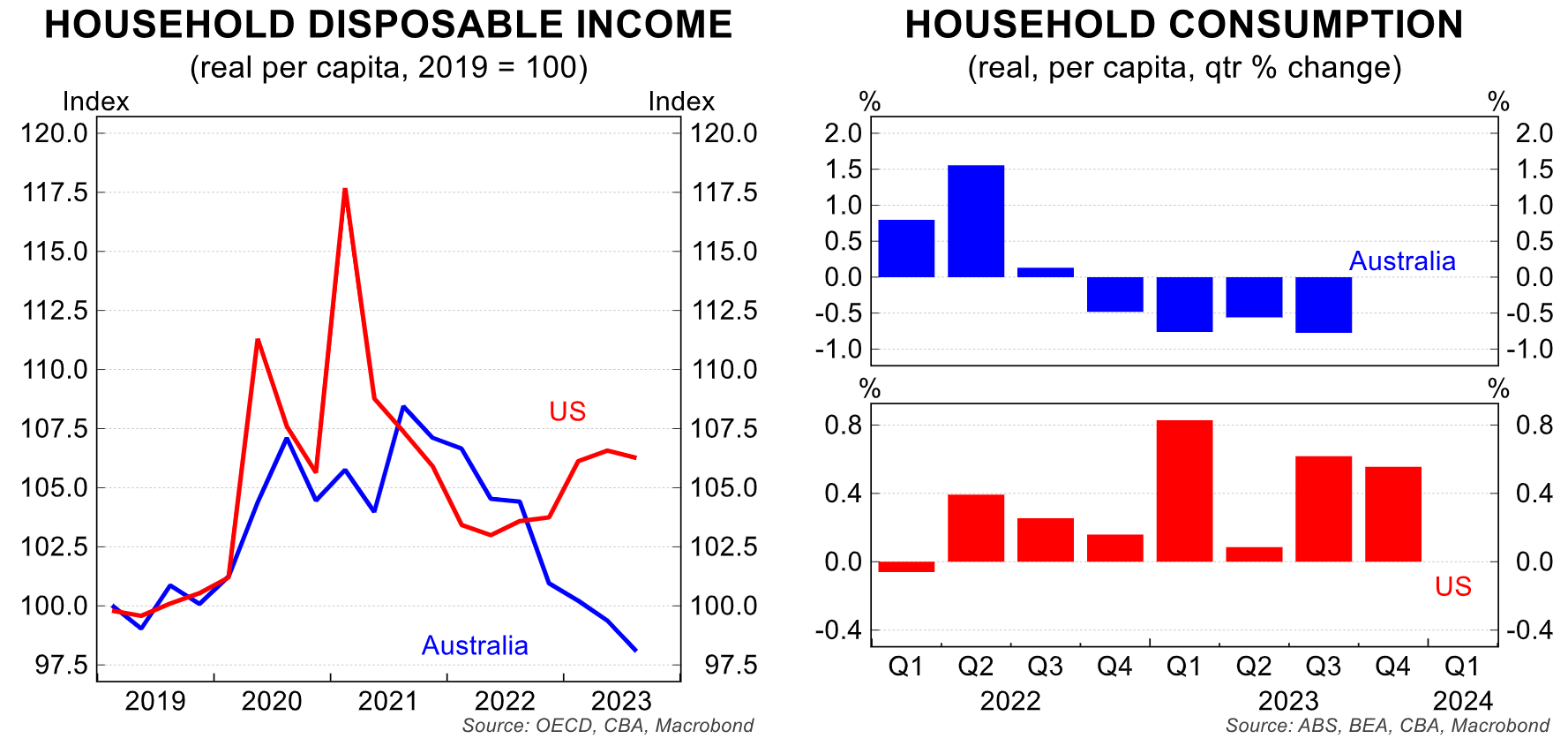

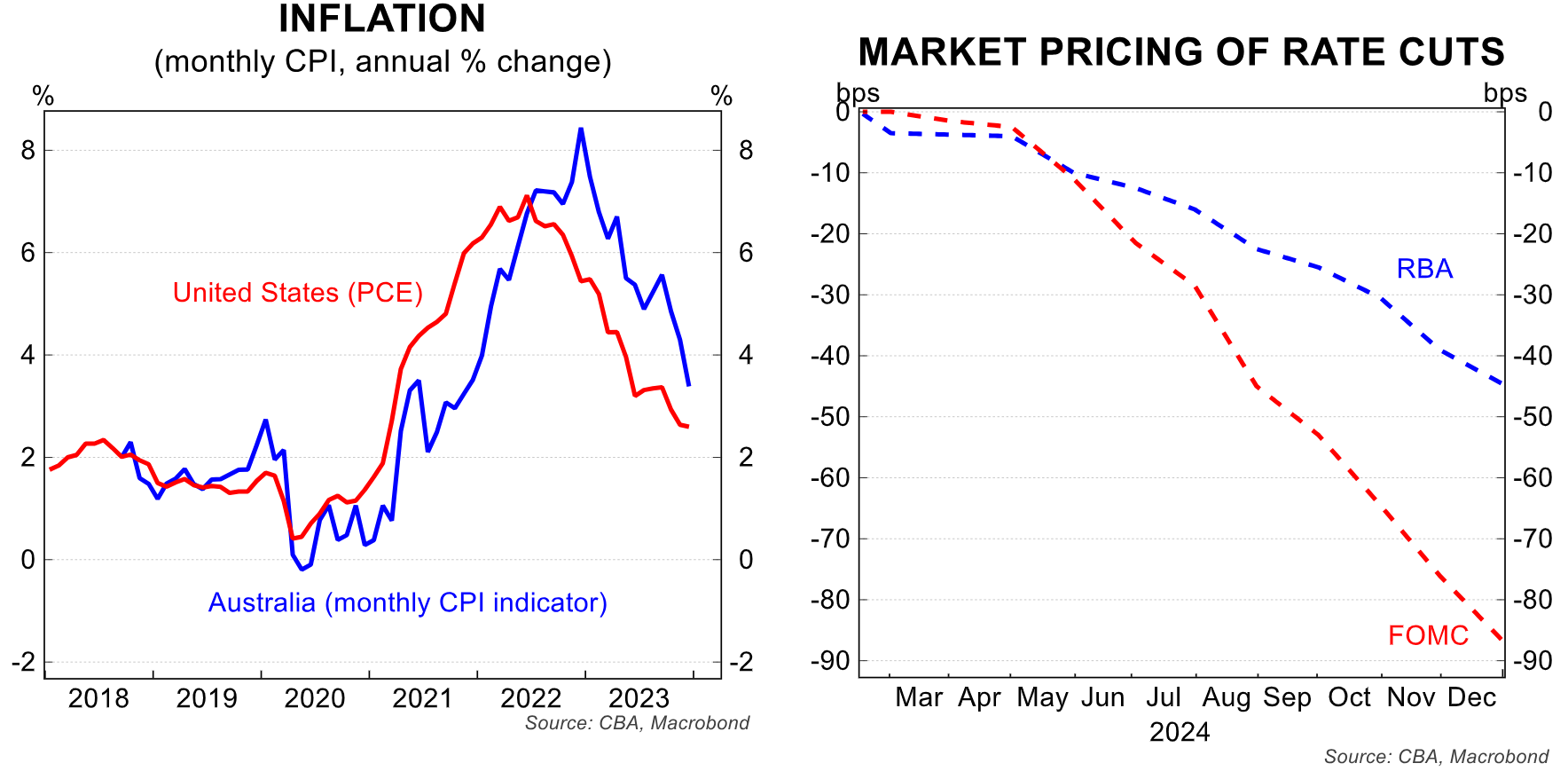

I agree, especially concerning Australia. The local consumer economy is deep in recession, and the RBA is rapidly falling behind the easing curve. The prospects for catch-up cuts in Australia are much stronger than in the US, where the consumer is still flourishing:

That forward rates curves are still more dovish for the Fed than the RBA is ludicrous mispricing.

Hence, more AUD weakness is ahead, but not until we clear the backlog of bears.