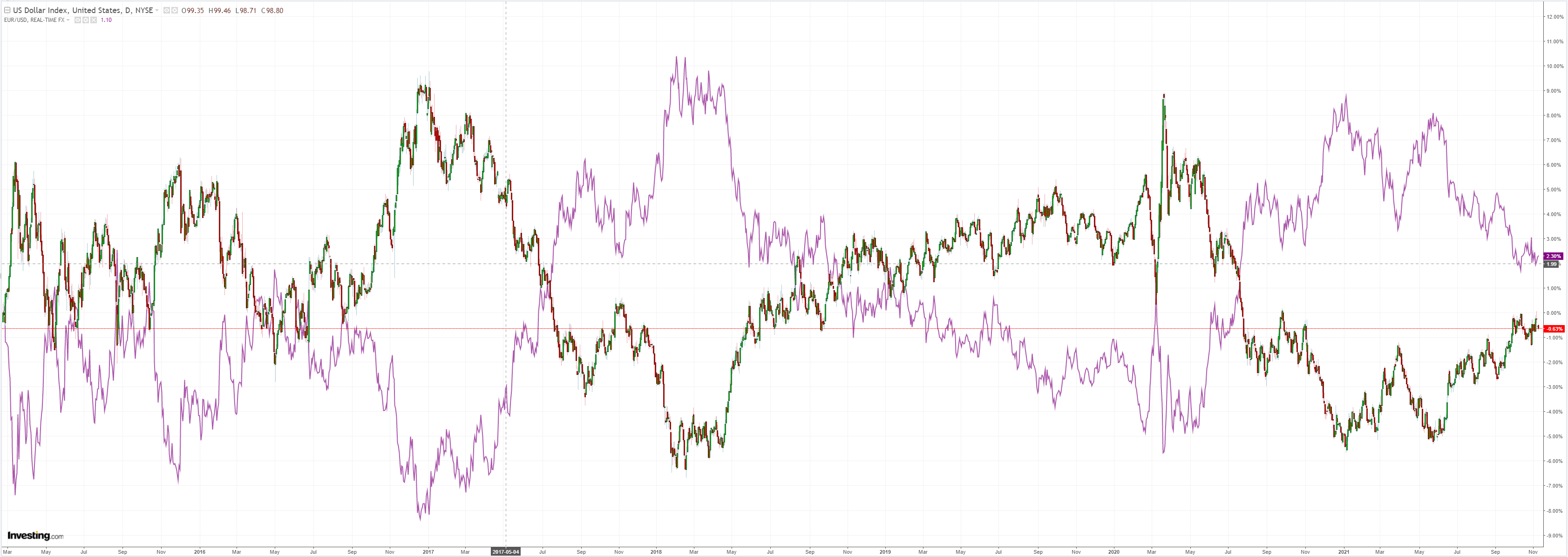

DXY was down a little last night and EUR up:

The Australian dollar tumbled:

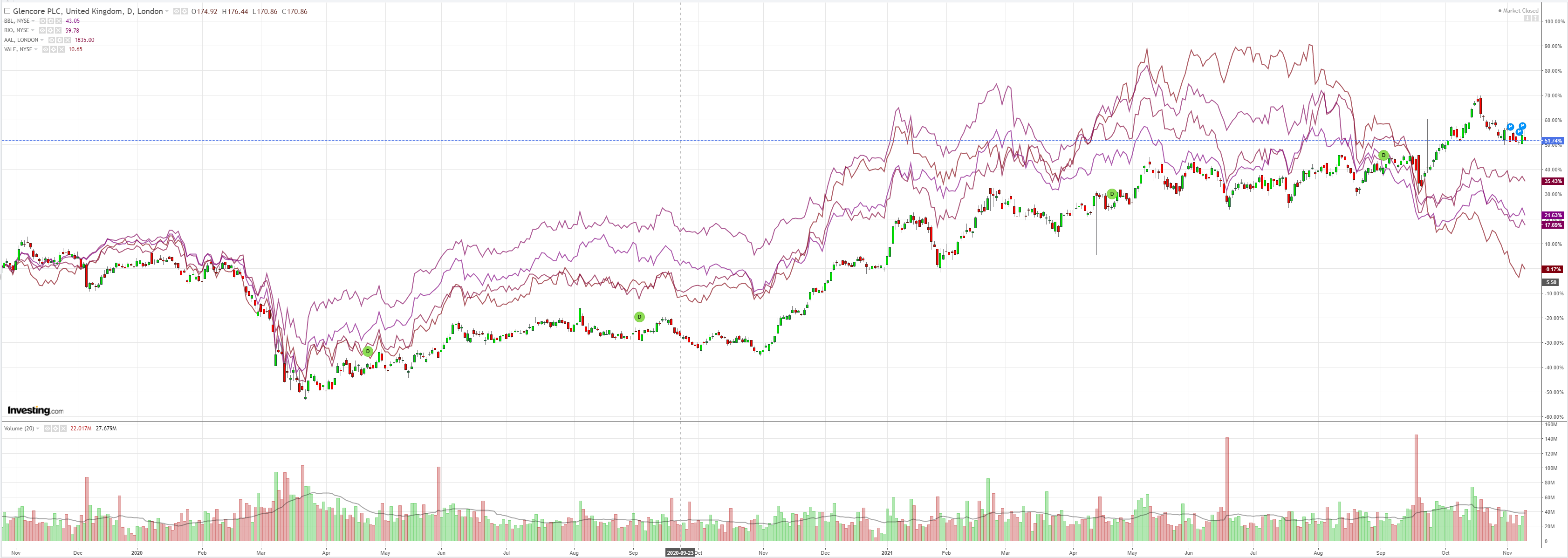

Base metals were mostly soft:

Big iron got creamed with futures:

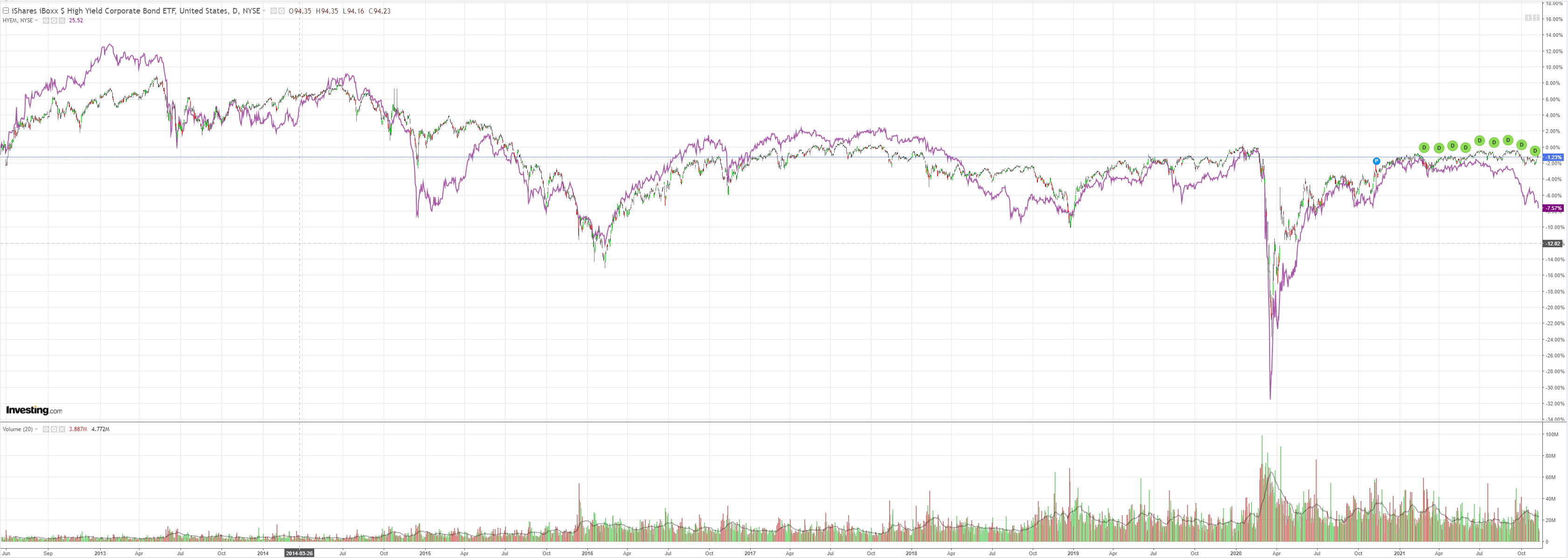

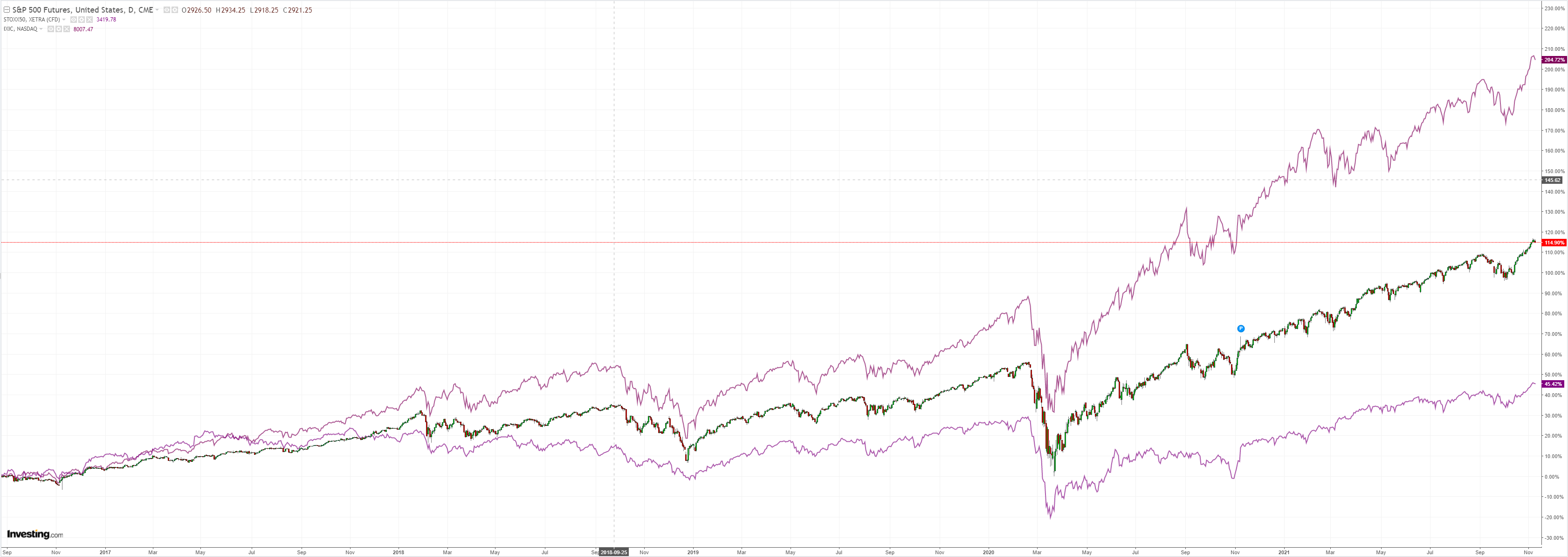

EM stocks are quite unconvincing:

Junk is warning again:

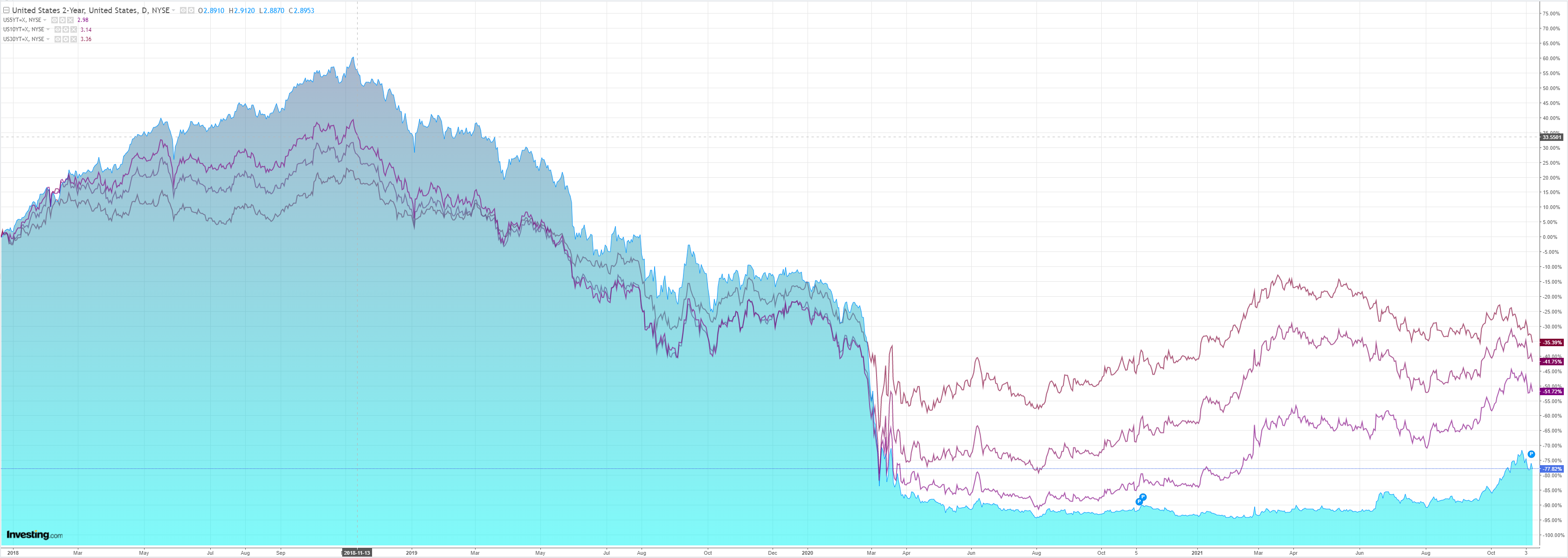

United States 2-Year puked stagflation bigly:

Hot off the press: stonks fell!

Westpac has the data wrap:

Event Wrap

US PPI inflation in October matched expectations at 0.6% m/m and 8.6% y/y, with the ex-food and energy measure steady at 6.8% y/y which is a record high. Large energy price gains in November, alongside worsening supply chain bottlenecks, suggest that the y/y gains will continue to rise into year-end, even as base-effects dissipate.

FOMC member Bullard repeated that the Fed may have to move faster if inflation pressures persist. He forecasts an unemployment rate near 3%, noting the labour market is very tight and will remain so, with GDP growth over 4% next year. Daly expressed a more dovish stance, saying that given the high degree of uncertainty in the labour market and on inflation, the best approach is to hold steady. She warned there might not be clarity until summer 2022. She called inflation “eye-popping” but still expects pressures to wane, and worries that a premature hike in rates might cause unnecessary pain in the economy.

Event Outlook

Aust: WBC-MI Consumer Sentiment could receive a boost from the continued easing of restrictions and rising vaccination rates in November. Weekly payrolls will reveal the strength of the NSW recovery during the two weeks to October 16.

NZ: October REINZ house sales are expected to report a lift as Covid restrictions ease. House prices are likely to maintain the momentum carried through the delta lockdown.

China: The October CPI release will highlight persistent weakness in consumer inflation (market f/c: 1.3%yr) despite robust upstream price pressures (PPI market f/c: 12.4%yr).

US: October’s CPI result is expected to be driven by a lift in core prices (Westpac f/c: 0.5%, market median 0.6%). The gradual downtrend in initial jobless claims should continue. The final release of wholesale inventories for September is also due.

No matter how hard the stagflationistas push, they can’t get the equity market to give up on GAMMA nor Treasuries to sell. For good reason. These PPI numbers are yesterday’s news. What is coming is deflation as supply-side bottlenecks clear through the Xmas lull, the global economy slows via the US and China and commodity prices crash. All made worse by the locked-in taper and a rising DXY.

Importantly, PPIs won’t just fall to zero, they will plunge negative for many months across 2022.

It is all very AUD negative.