DXY was up Friday night as EUR fell:

AUD fell with EUR:

Oil and Gold Futures took off on Ukraine fears:

Copper Futures were hit:

Big miners (LON:GLEN) too:

EM stocks (NYSE:EEM) were bashed:

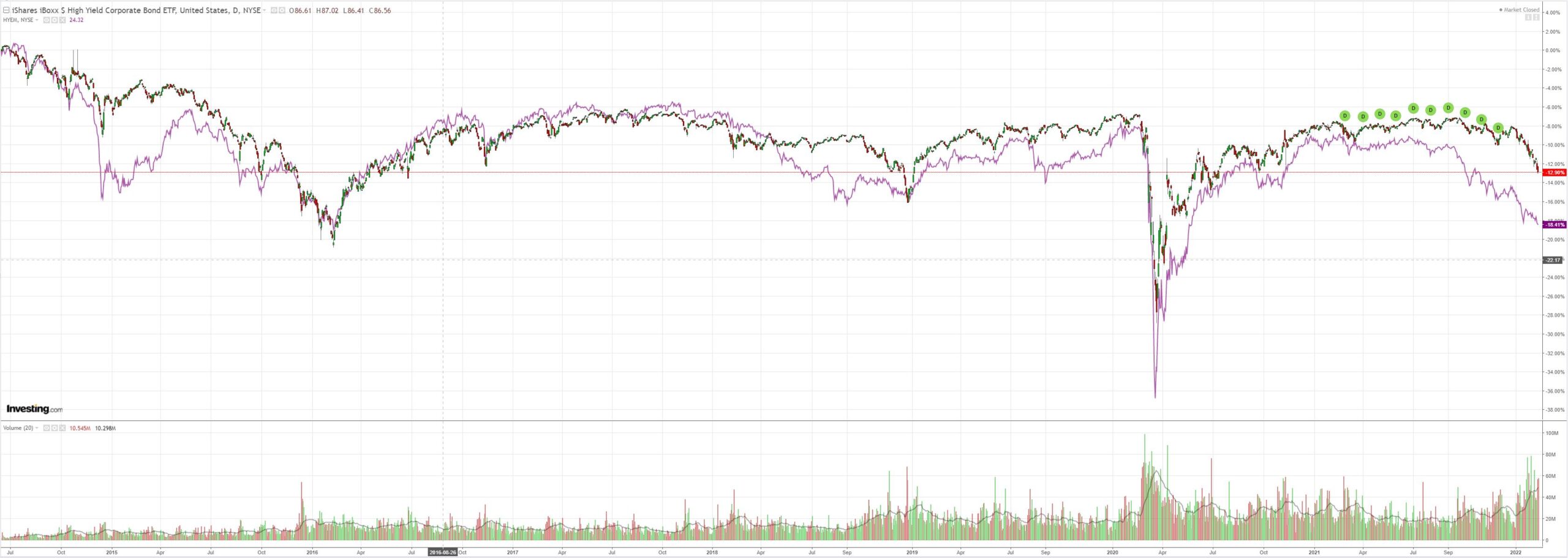

EM and DM junk (NYSE:HYG) is screaming sell everything:

Yields rolled on a safe haven bid:

Stocks were hammered:

Building risk of war in Ukraine and Goldman Sachs (NYSE:GS) adding more Fed rate hikes to the outlook this year was a toxic combination for all risk assets.

The US has warned of an “immediate” threat that Russia will invade Ukraine after President Joe Biden summoned transatlantic leaders to a meeting to discuss the crisis and embassies stepped up warnings for their citizens to leave the country.

“The risk is now high enough and the threat is now immediate enough,” said Jake Sullivan, White House national security adviser, as he urged Americans to leave Ukraine within the next 24 to 48 hours. There was a “credible prospect” of Russia launching an attack before the end of the Winter Olympics in Beijing on February 20, he added.

While the US does not believe that Vladimir Putin, Russia’s president, has yet made a “final decision”, Washington said the country had built up sufficient military capability, including troops and equipment, to make a move as early as next week.

And Goldman:

Following this morning’s strong CPI print, we are raising our Fed forecast to include seven consecutive 25bp rate hikes at each of the remaining FOMC meetings in 2022 (vs. five hikes in 2022 previously). We continue to expect the FOMC to hike three more times at a gradual once-per-quarter pace in2023Q1-Q3 and to reach the same terminal rate of 2.5-2.75%, but earlier.

We see the arguments for a 50bp rate hike in March. The level of the funds ratelooks inappropriate, and the combination of very high inflation, hot wage growth,and high short-term inflation expectations means that concerns about falling intoa wage-price spiral deserve to be taken seriously. We could imagine the FOMCconcluding that even a meaningful risk of an outcome as serious as a wage-pricespiral requires a more aggressive and immediate response.

So far, though, most Fed officials who have commented have opposed a 50bphike in March. We therefore think that the more likely path is a longer series of25bp hikes instead. St. Louis Fed President James Bullard became the firstFOMC participant to call for a 50bp hike earlier today, and we would considerchanging our forecast if other participants join him, especially if the marketcontinues to price high odds of a 50bp move in March.

Watch EM junk debt spreads. That credit is leading all markets lower is bearish. Junk debt spreads led the Fed tightening equity corrections in 2015 and 2018:

And they lead the AUD as well:

Where peripheral debt goes, AUD follows.