The greenback is breaking out as the energy crisis combines with a China hard landing to scatter the risk cockroaches. EUR is near breakdown:

Australian dollar was flattened by the greenback steamroller:

Gold too. Oil fell back:

Base metals were soft:

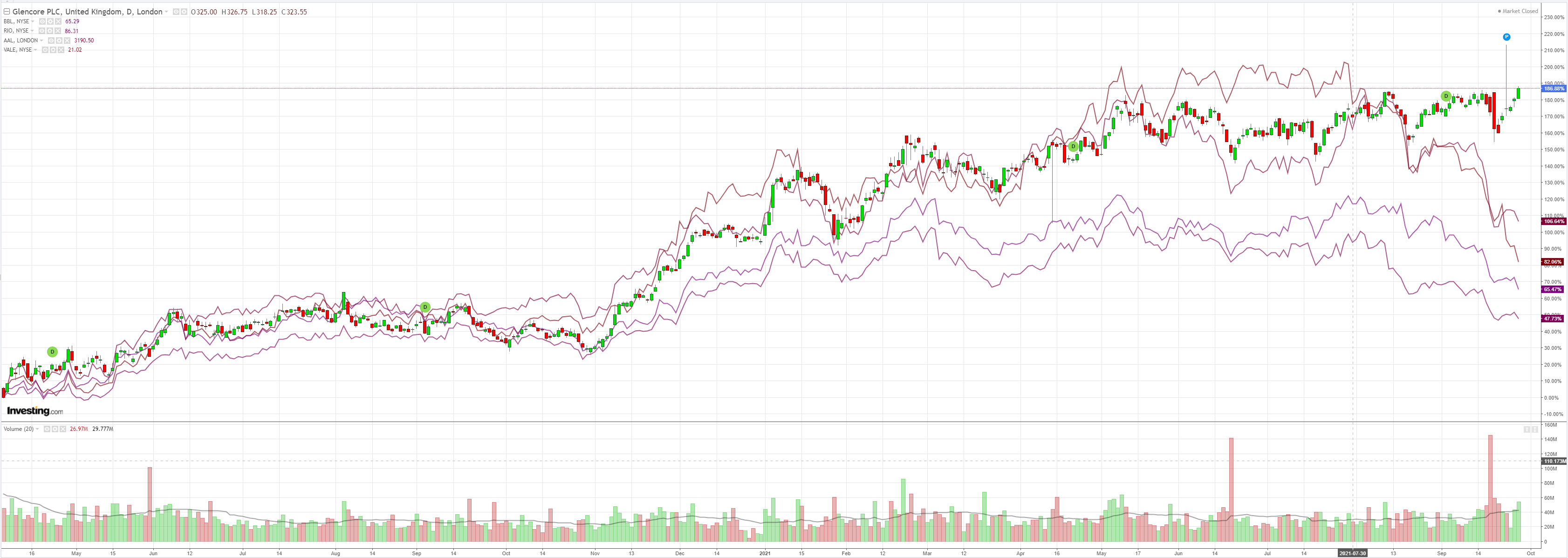

Big miners were slaughtered, ex-coal junkie Glencore (LON:GLEN):

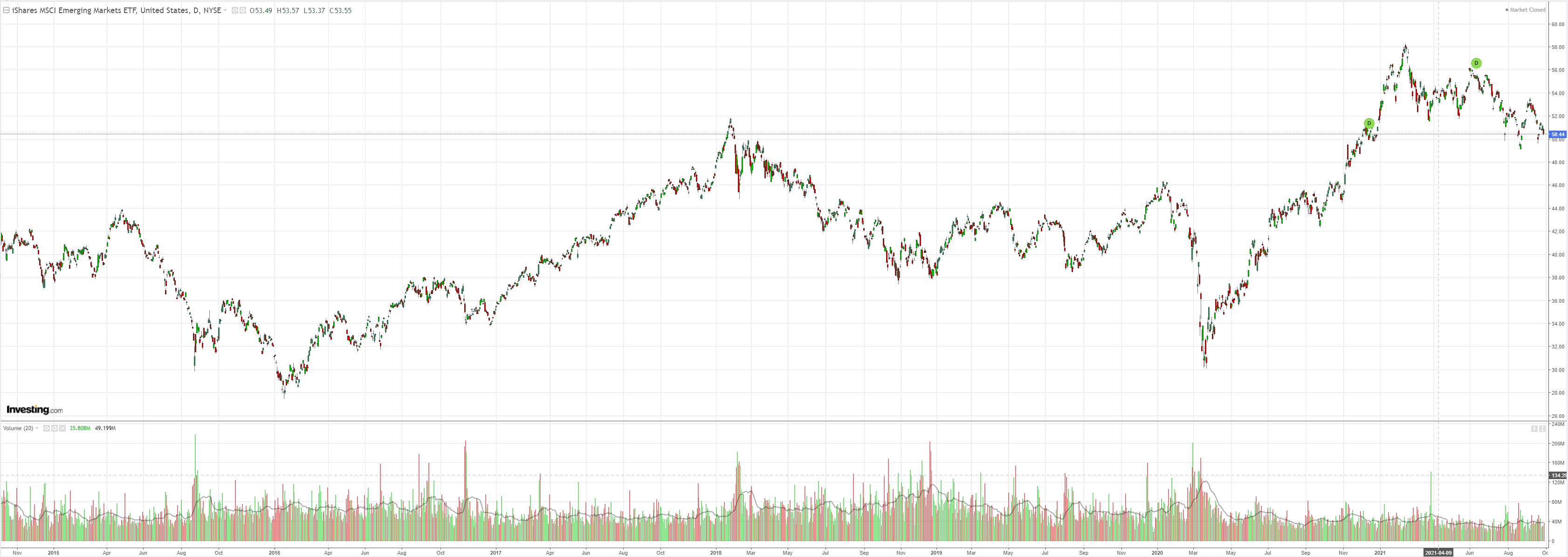

EM stocks are headed for Hades:

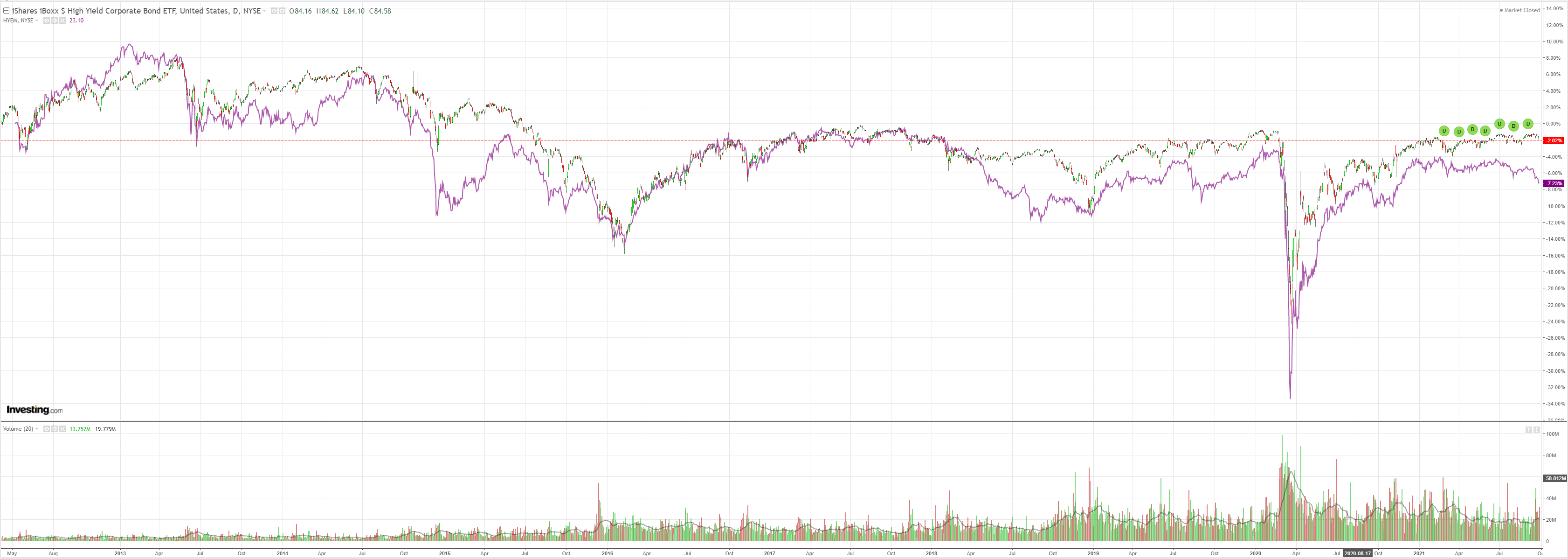

The EM junk “risk-off” siren is wailing:

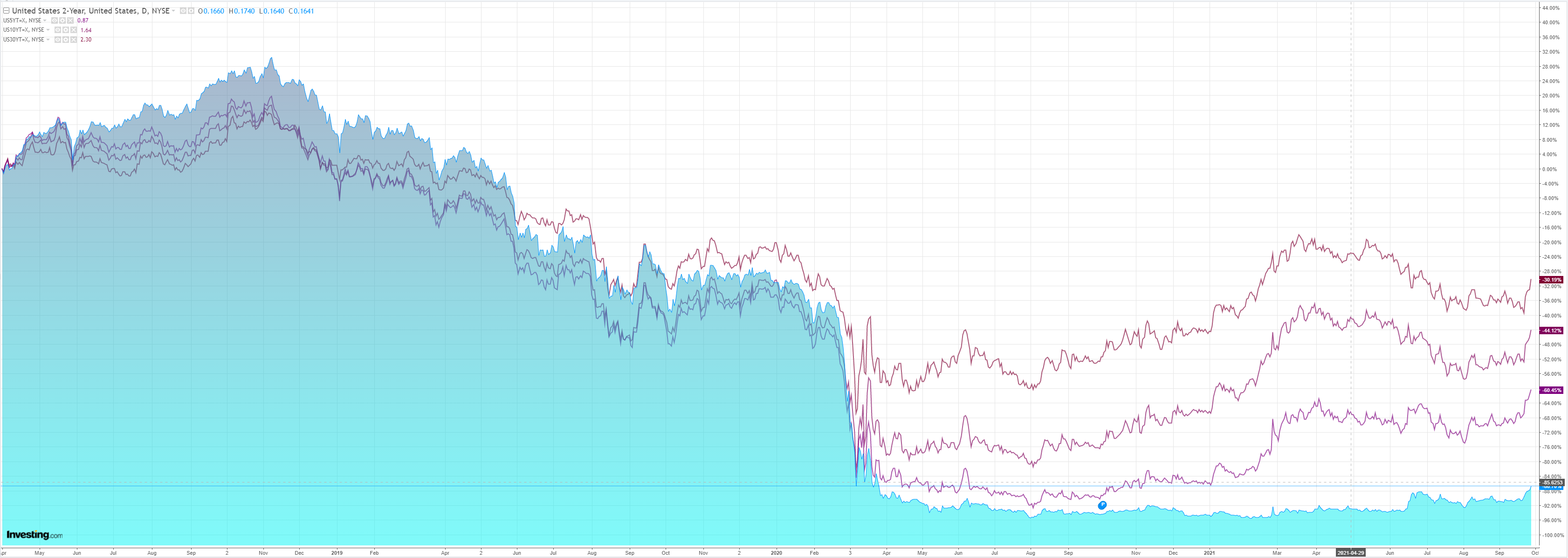

As Wall Street’s energy bubble backs up yields:

Pounding stocks:

Westpac has the wrap:

Event Wrap

In the US, attempts to break the deadlock on the debt ceiling continued with both Yellen and Powell warning of the negative effects on the economy from failure to find agreement. Yellen suggested that the debt ceiling would be hit by 18 October. They both also referred to supply chain bottlenecks leading to more protracted, if still transitory, inflation pressures into 2022.

US Conference Board consumer confidence fell to 109.3 (est. 115.0, prior 115.2). The CoreLogic house price index in July rose 19.95%y/y (est. +20.0%y/y). The Richmond Fed activity survey slumped to -3 (est. 10, prior 9 and July peak of 27), with a notable large decline in new orders to -19 from prior 5 (its first below sub- zero reading since May 2020). Despite the slide in activity and further increases in prices paid, firms remained relatively optimistic.

GfK’s consumer confidence survey for Germany was firmer at +0.3 (est. -1.4, prior-1.1), as was French consumer confidence at 102 (est. 100, prior 99).

Event Outlook

Euro Area: Supply constraints and shipping capacity may be headwinds for economic confidence in September (market f/c: 116.9).

US: Pending home sales in August are due for a slight uptick, with supply still a constraint (market f/c: 1.0%). Further, the FOMC’s Bullard and Bostic will provide their respective views on the economy.

There is nothing good about the market and AUD outlook today. The short-term stagflation represented in the energy bubble is inflating headlong into a giant pincer of pins in the form of a Chinese hard landing and a Fed determined to taper. The three cannot co-exist and, in my view, the bearish forces will win in due course.

For the AUD over the next few months, that means it is either under pressure from a running DXY or under pressure from a deflating energy bubble, or under pressure from both.