DXY finally rebounded as EUR fell:

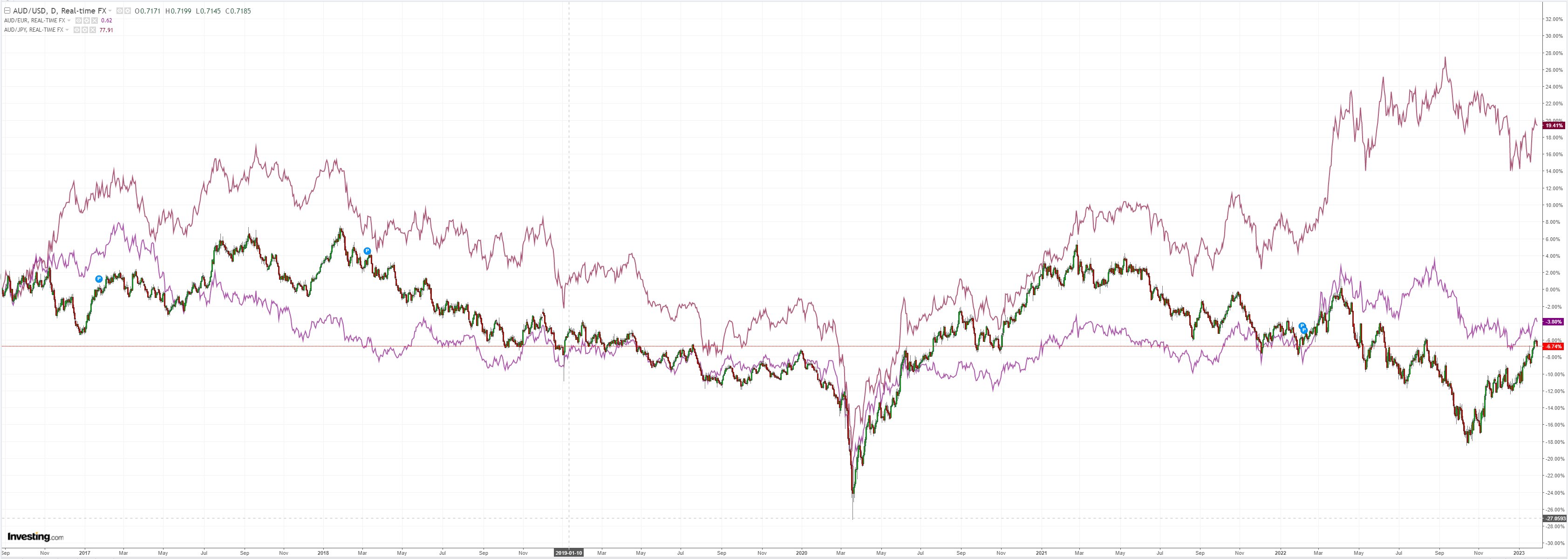

That triggered reversals across all markets. AUD down:

Commods down:

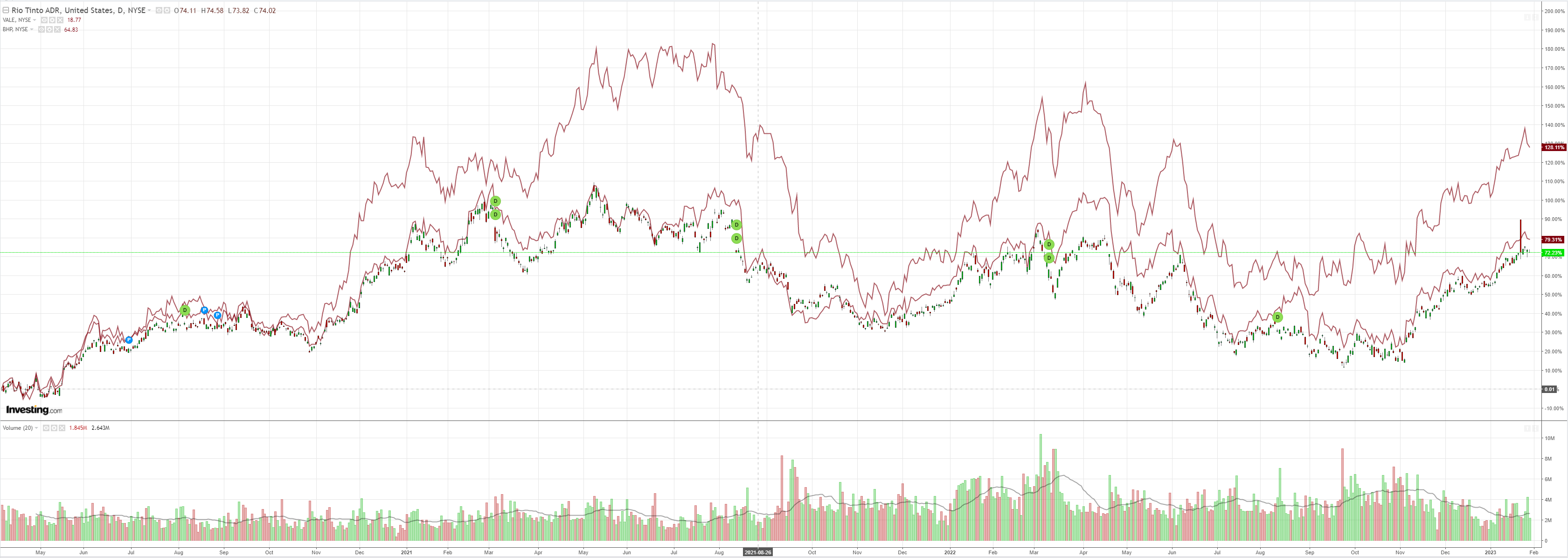

Miners (NYSE:RIO) down:

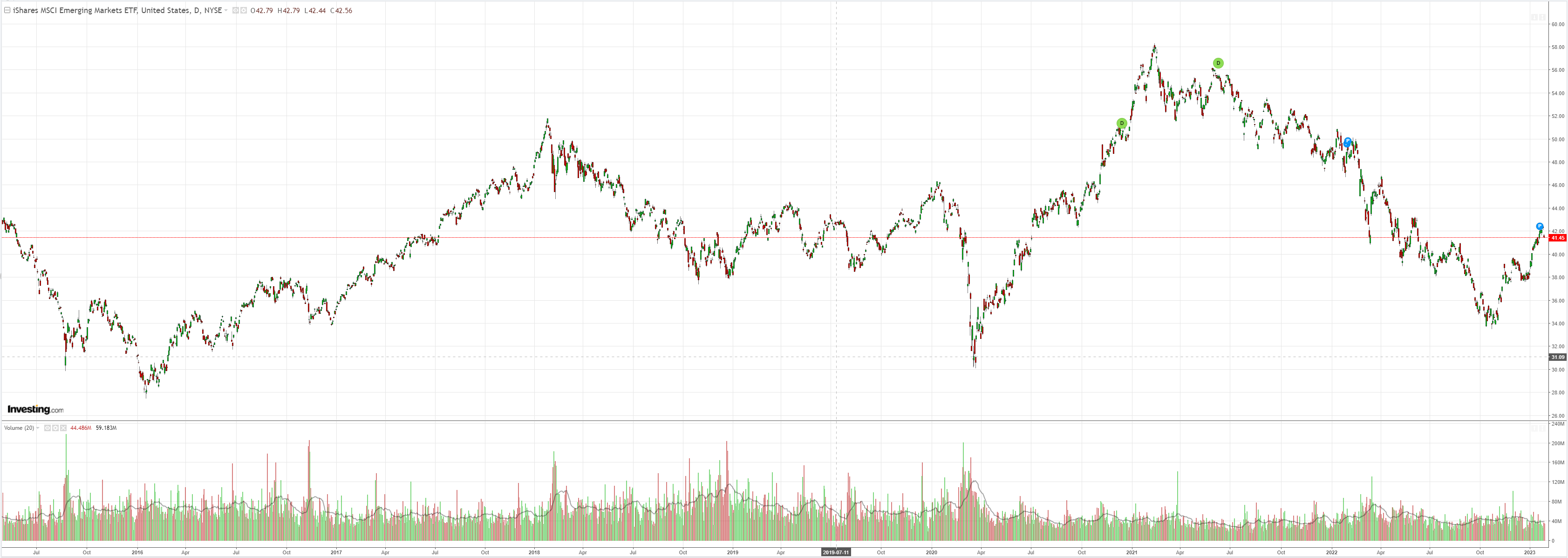

EM stocks (NYSE:EEM) down:

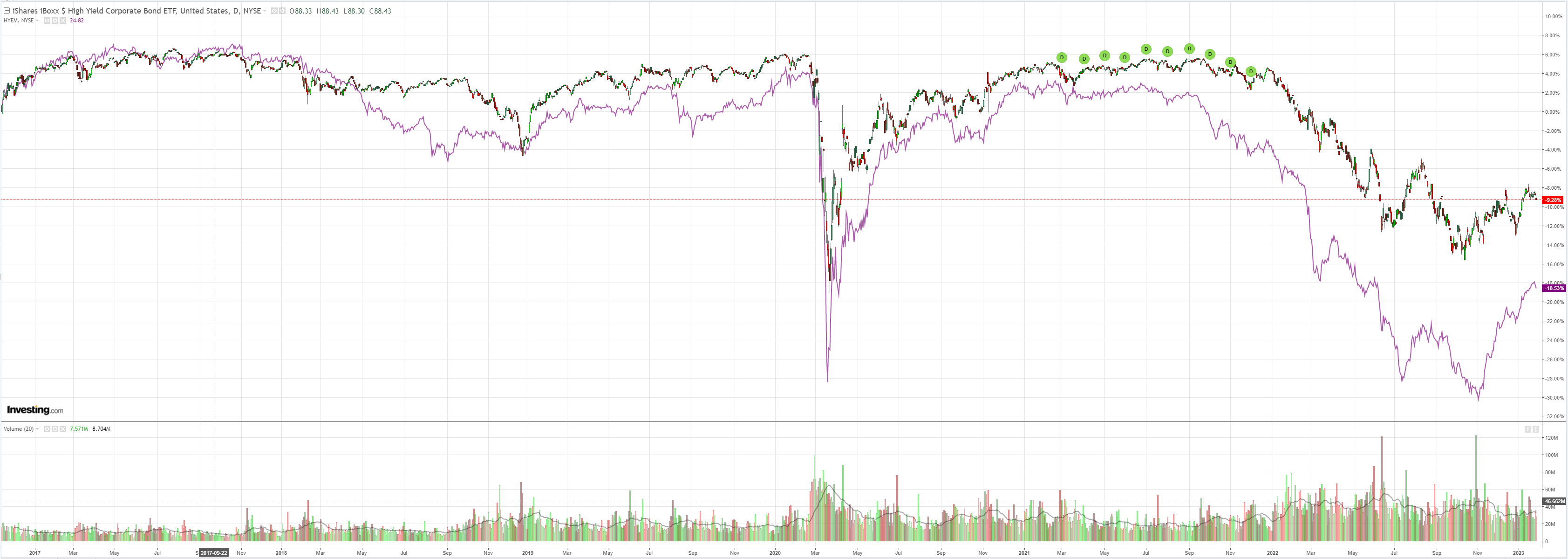

Junk (NYSE:HYG) down:

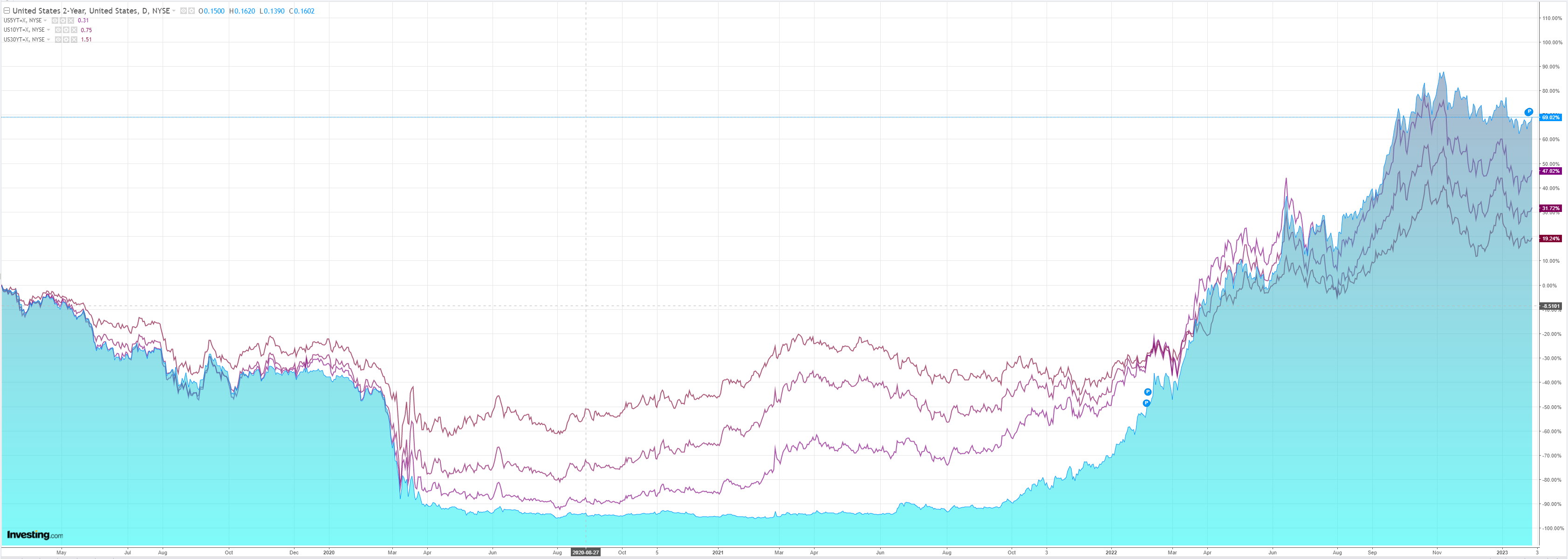

US yields up:

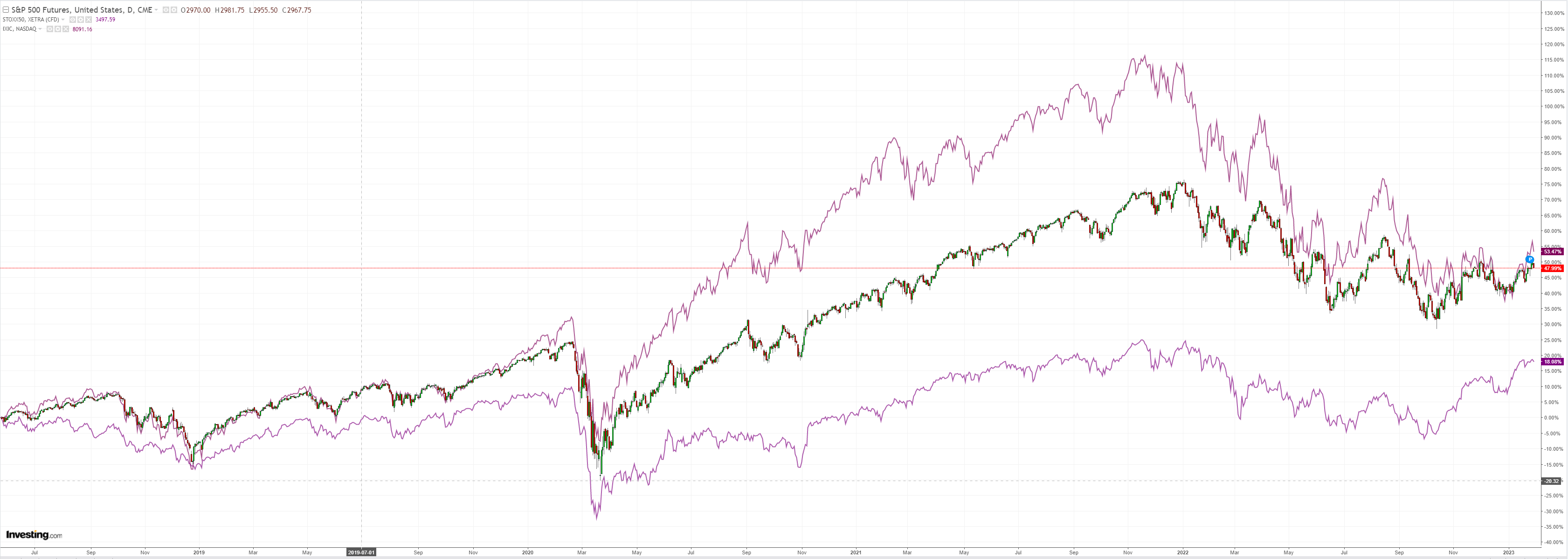

Stocks down:

The approach of the Fed put the jitters through markets. It will probably remain hawkish despite likely reducing its hiking pace to prevent an over-loosening of financial conditions.

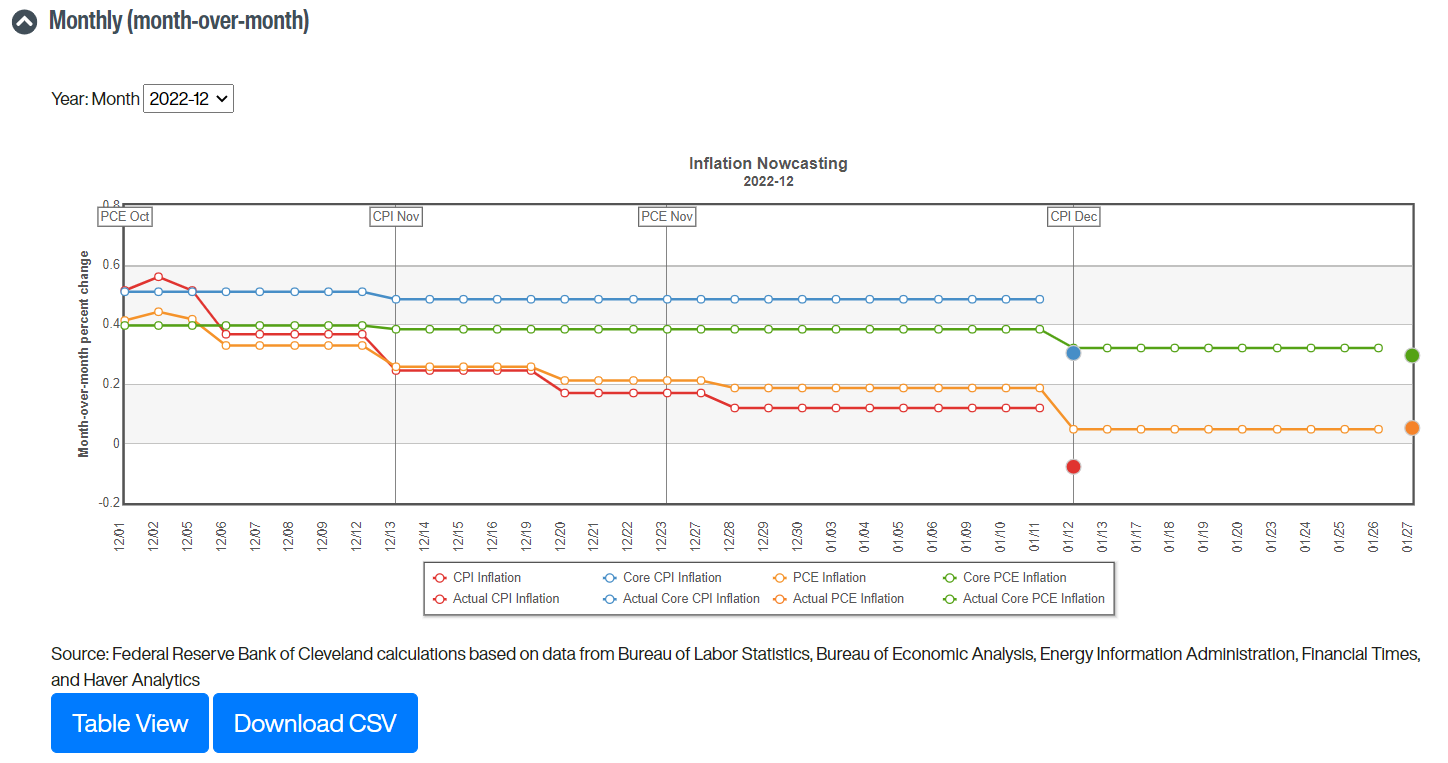

However, inflation is cooling fast. CorePCE has faded to 0.3% per month:

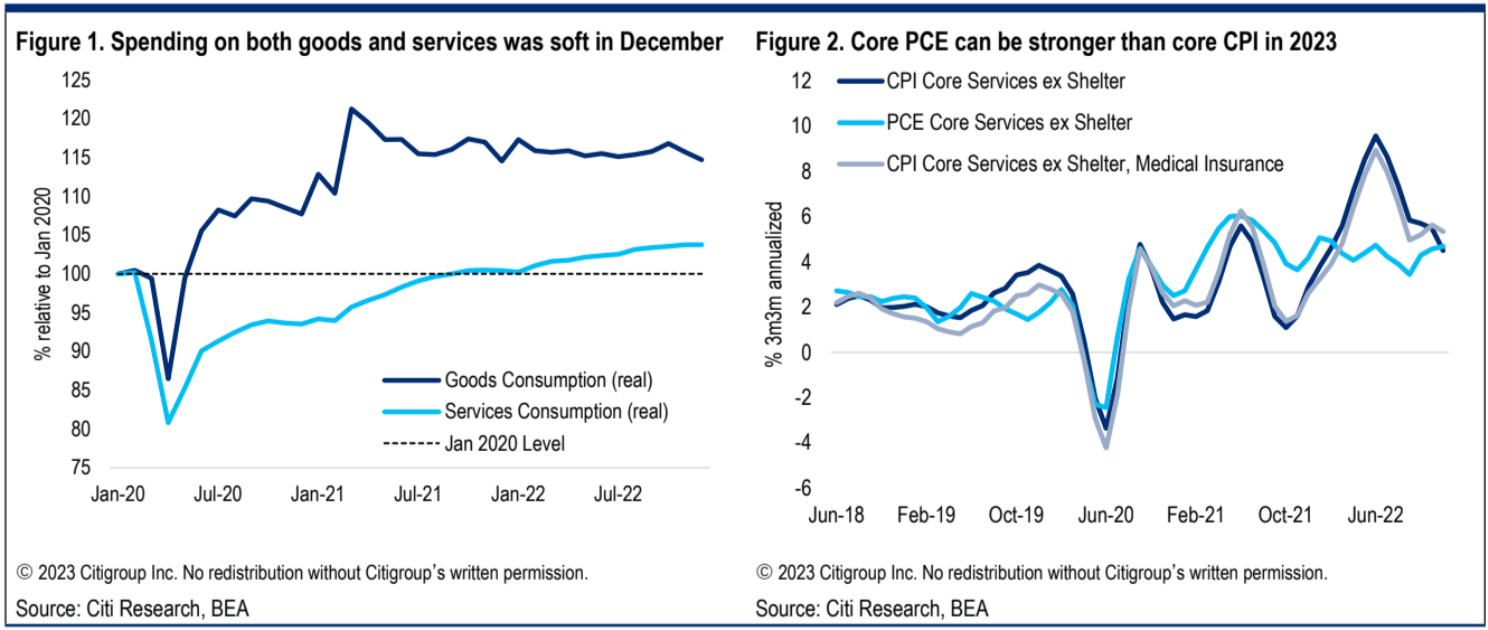

Though Core Services are still sticky:

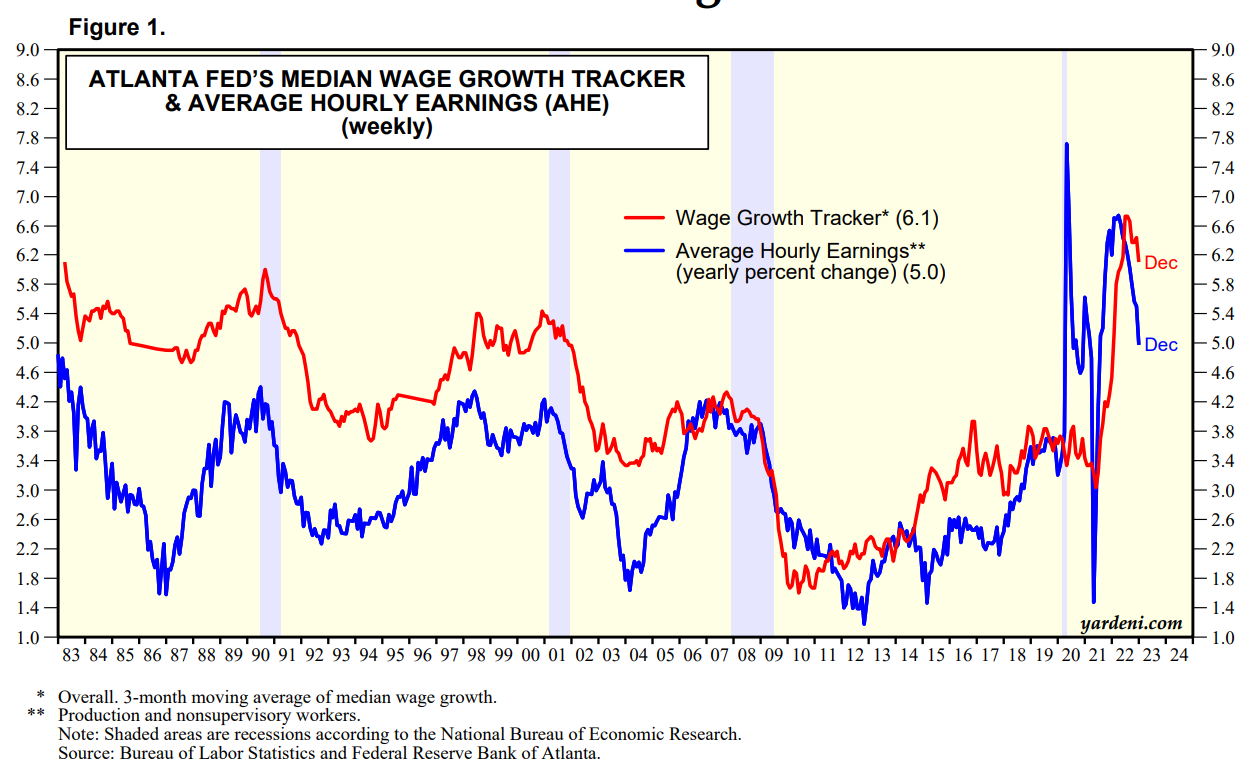

As wage growth is still strong but is also cooling fast:

The market has already rallied on these numbers What will matter for the Fed is how it frames the terminal rate and any easing ahead.

I doubt the dot plot will be dovish yet so that may support a return to AUD weakness.