DXY was pounded last night as the Fed doved up:

AUD and commods to the moon:

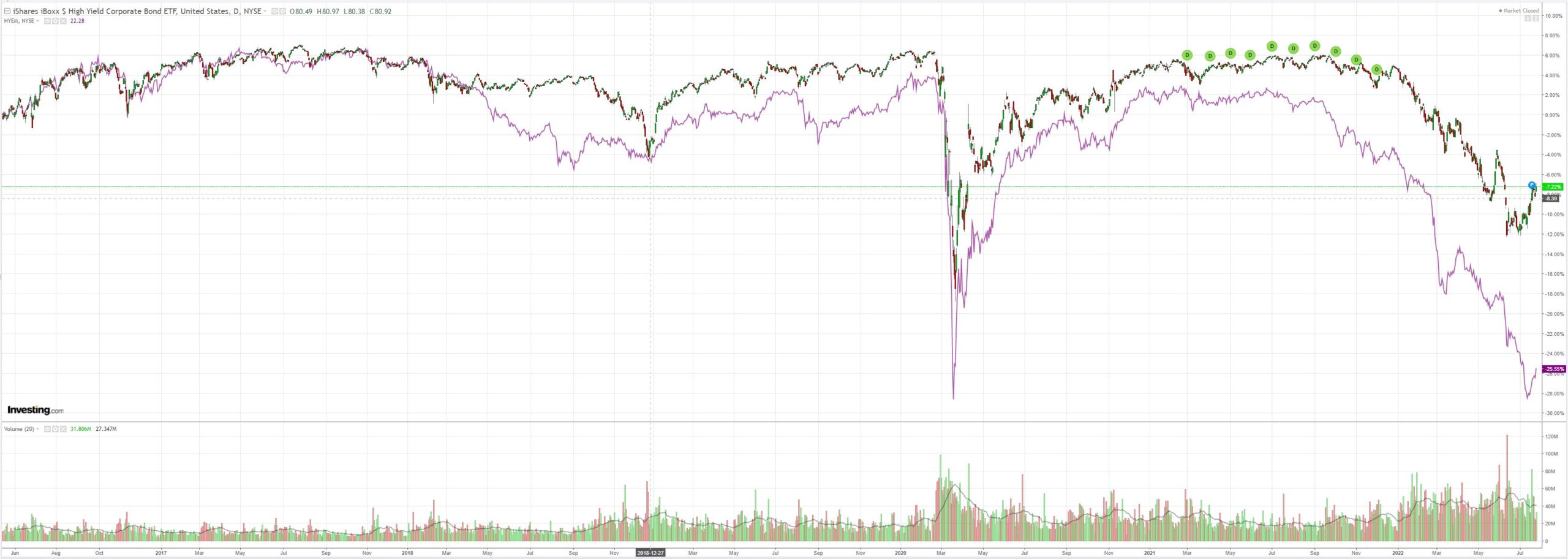

Junk (NYSE:HYG) too:

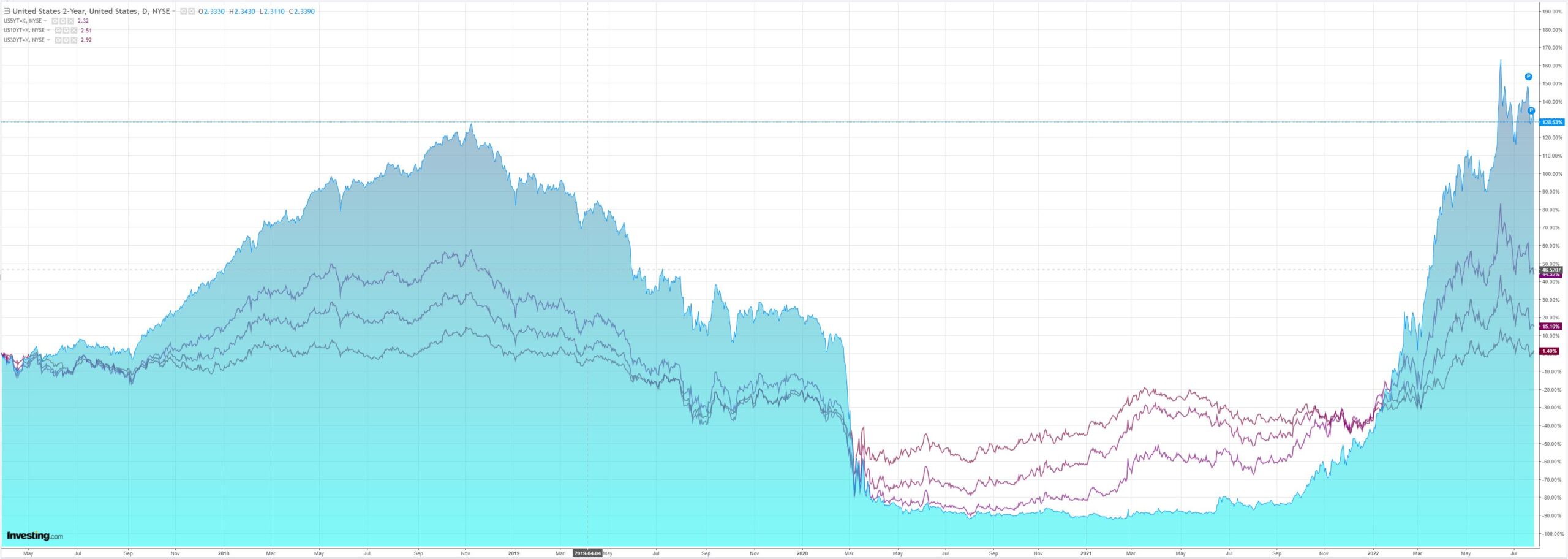

The curve is still inverted:

Stocks yeh!

Westpac has the warp:

Event Wrap

The US FOMC announced a 75bp rate hike to a band of 2.25% to 2.50%, as was widely expected, and signalled further tightening: the Committee “anticipates that ongoing increases in the target range will be appropriate.” The vote was unanimous: 12-0. It also confirmed that the balance sheet will continue to be reduced. There was reiteration that it is “strongly committed to returning inflation to its 2% objective” and it is “highly attentive to inflation.” On the economy, it said “recent indicators of spending and production have softened,” in contrast to June which said “overall economic activity appears to have picked up.”. In his press conference, Chair Powell said it was appropriate for the Fed to move expeditiously and to front load rate hikes, but at some point it will be “appropriate to slow down.” He said there is some evidence that labour demand may be slowing, albeit from very high levels.

Event Outlook

Aust: Card data suggests retail sales should post a solid gain in June, concealing the backdrop of weakening confidence (Westpac f/c 0.6%). A strong lift in export prices is anticipated in Q2 given the strength of commodity prices (Westpac f/c: 8.0%), while a higher AUD likely tempered the lift in import prices from global energy inflation (Westpac f/c: 2.0%). The Federal Treasurer will also deliver a Ministerial Economic Statement to Parliament.

NZ: ANZ business confidence is set to remain low in July as price pressures remain elevated.

Eur: Inflation and energy concerns will continue to weigh heavily on economic confidence (market f/c: 102) and business confidence.

US: The broad-based slowdown in activity growth will produce another lacklustre GDP print in Q2, driven primarily by weakness in consumption (Westpac f/c: -0.5% annualised; market f/c: 0.4% annualised). Initial jobless claims are slowly starting to lift from historic lows (market f/c: 250k) and the Kansas City Fed index should highlight an increasingly fragile manufacturing outlook in July (market f/c: 3).

Honestly, what is the Fed thinking? Does it want to squash inflation or not? The job is clearly incomplete in the US yet here it is reflating markets with hope.

The bear market rally has a new leg in front of it before Chair Powell wakes in fright.