DXY remained firm:

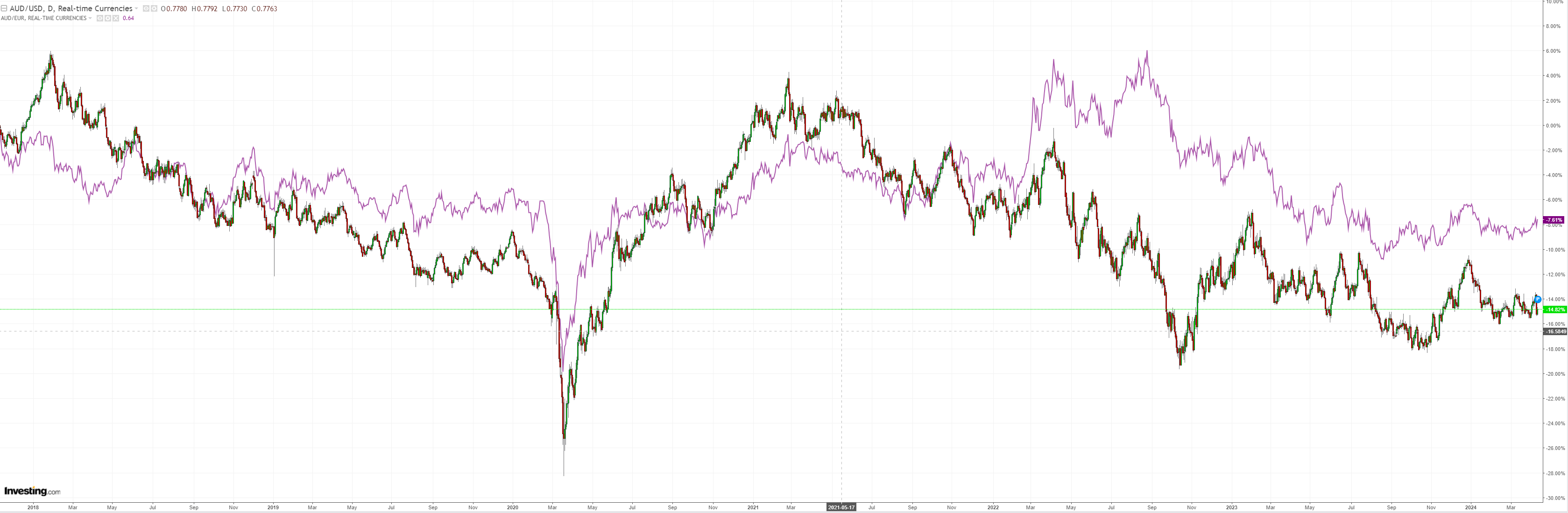

AUD managed to undo a some damage:

No help from North Asia:

Oil is awaiting a new shock. New gold shows no sign of paying attention to old drivers like DXY or real interest rates:

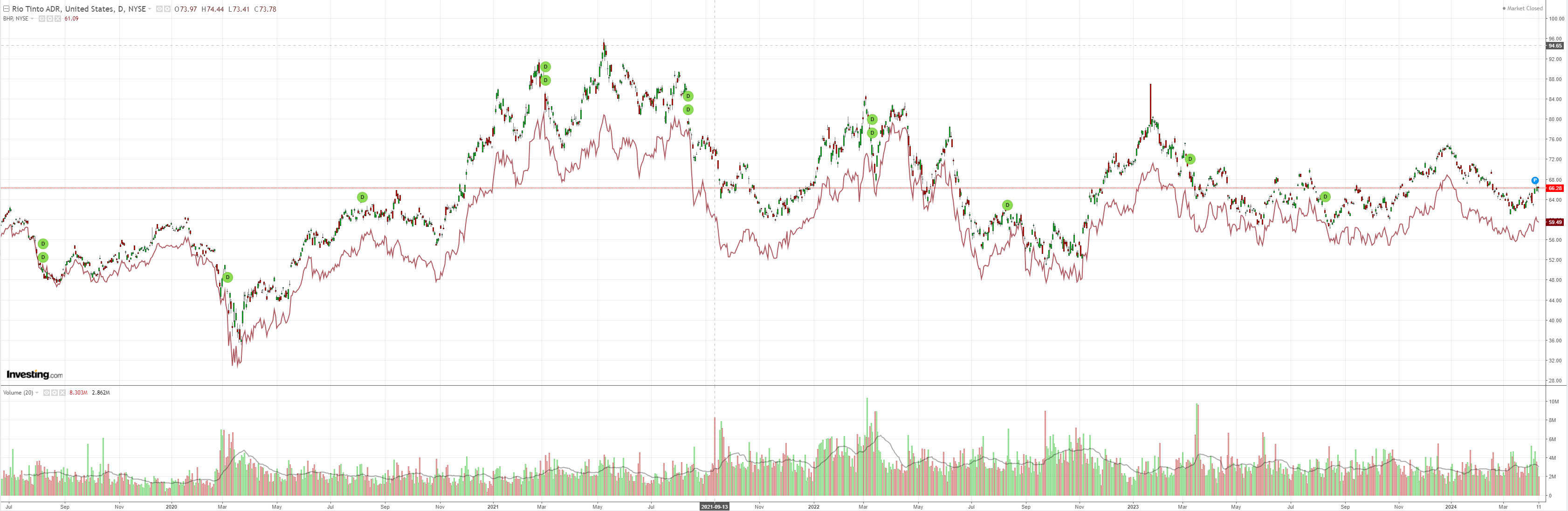

Dirt fell:

Miners too:

EM still poised:

But junk is risk off:

As yields pile it on:

Stocks ignore!

Stocks pounced on an in-line US PPI, alleviating fears about the coming PCE.

But oil was stirring within the bowels of the PPI, so it is an ongoing watch, not least as we wait for the next Middle East domino.

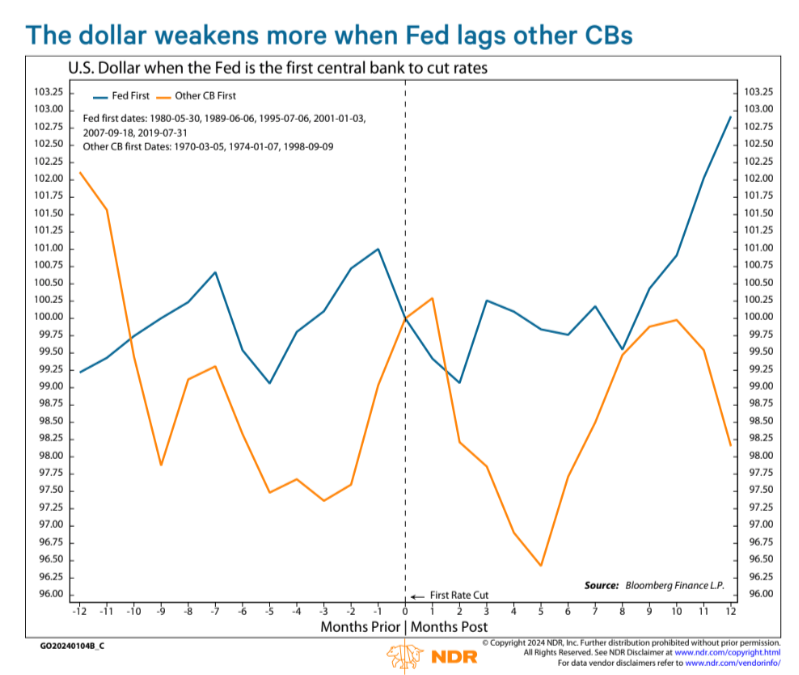

It still seems to me more likely than not that the FEd will now follow rather than lead the easing cycle. Ned Davis offers are counter-intuitive conclusion:

- While U.S. inflation is accelerating, elsewhere in the world it’s surprising to the downside, suggesting other major central banks could cut rates first.

- The good news is that equities still rise and the dollar tends to weaken in these instances, as long as the Fed eventually follows.

- A more worrisome development would be if the Fed increases rates while other parts of the world are easing policy.

It makes sense that DXY tends to fall when the ‘rest of the world’ growth is deemed to be strengthening versus the US.

Hence, if the global easing cycle is led by the ECB, Canada, Australia, and New Zealand with a trailing Fed, then those currencies will outperform.