DXY held on last night but is under pressure:

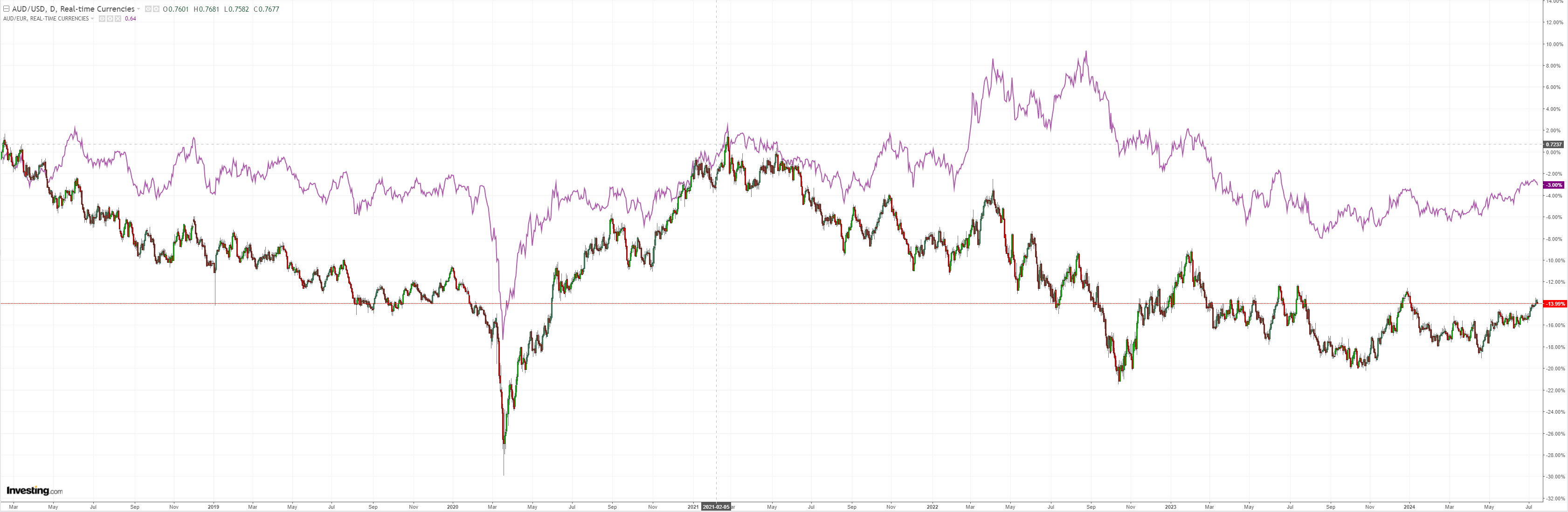

AUD pulled back:

With North Asia:

Commods were hosed:

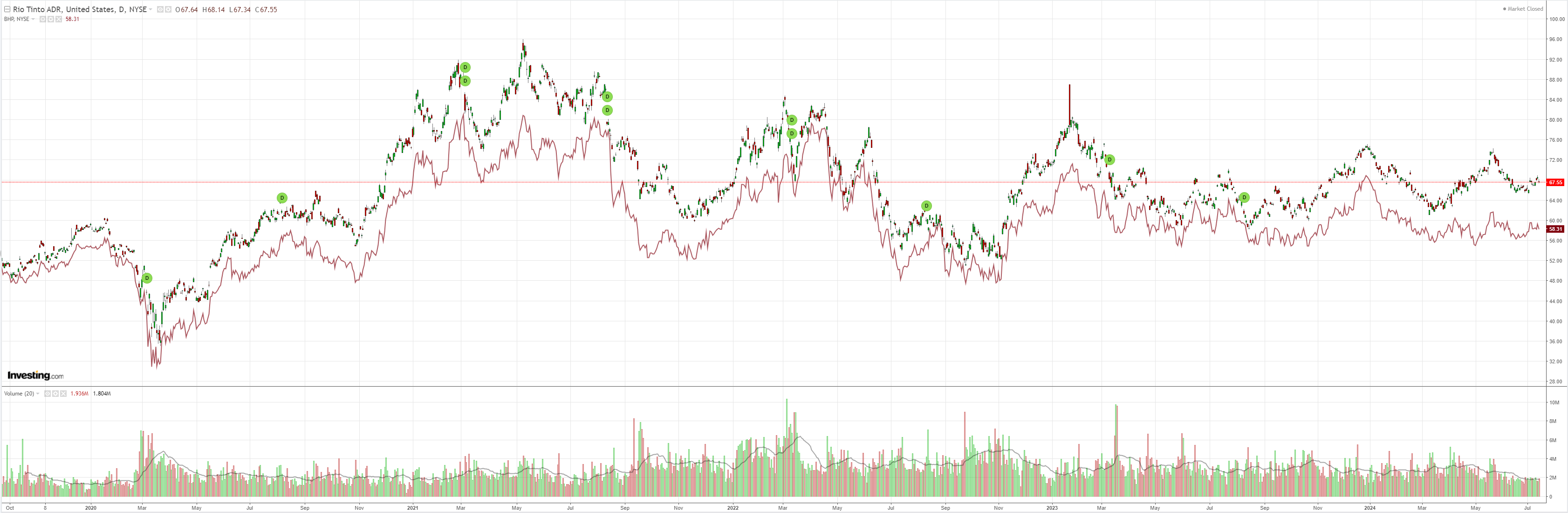

Miners too:

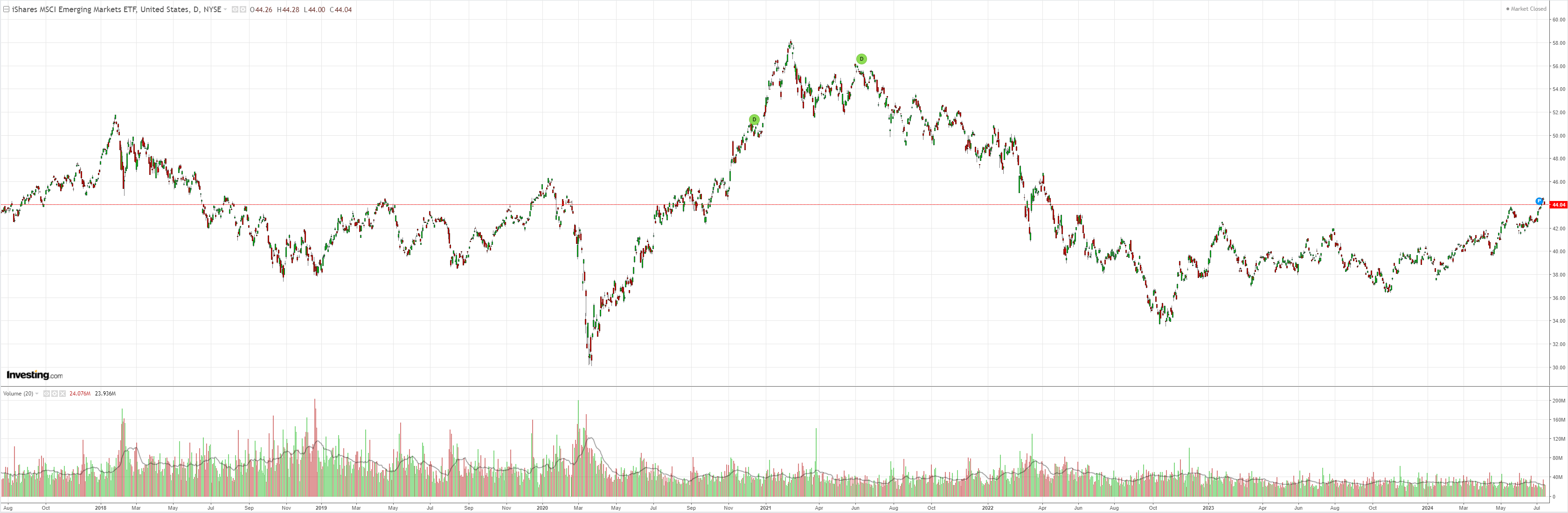

EM flamed out:

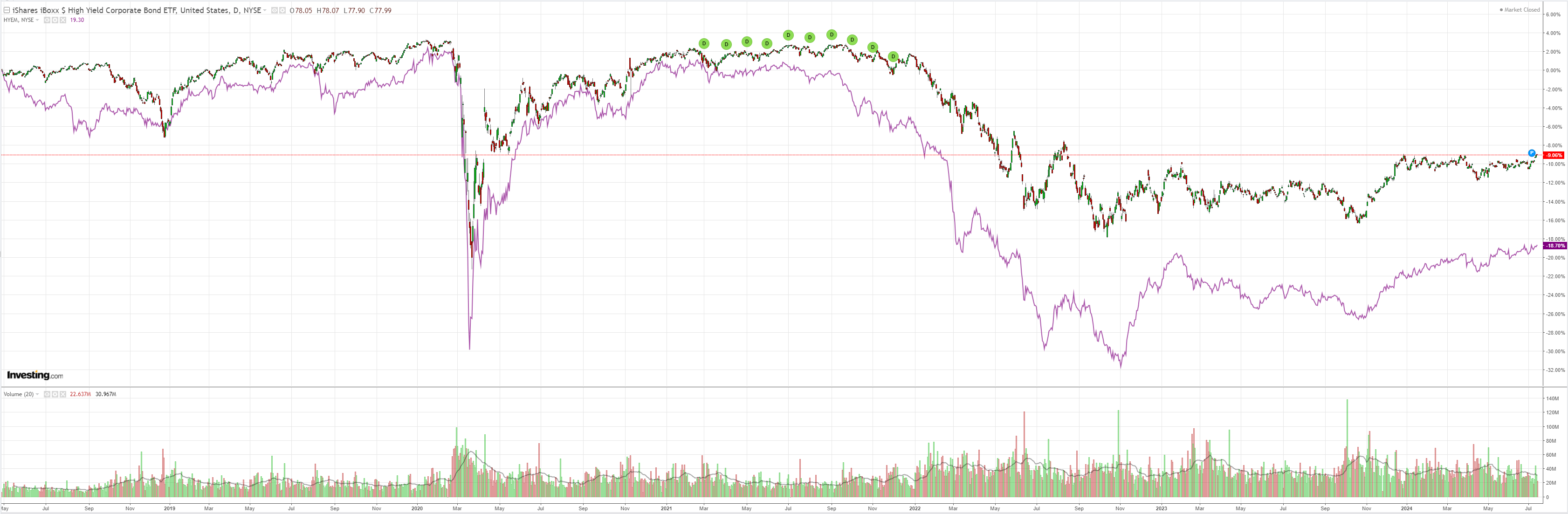

But junk is offering risk marginal support:

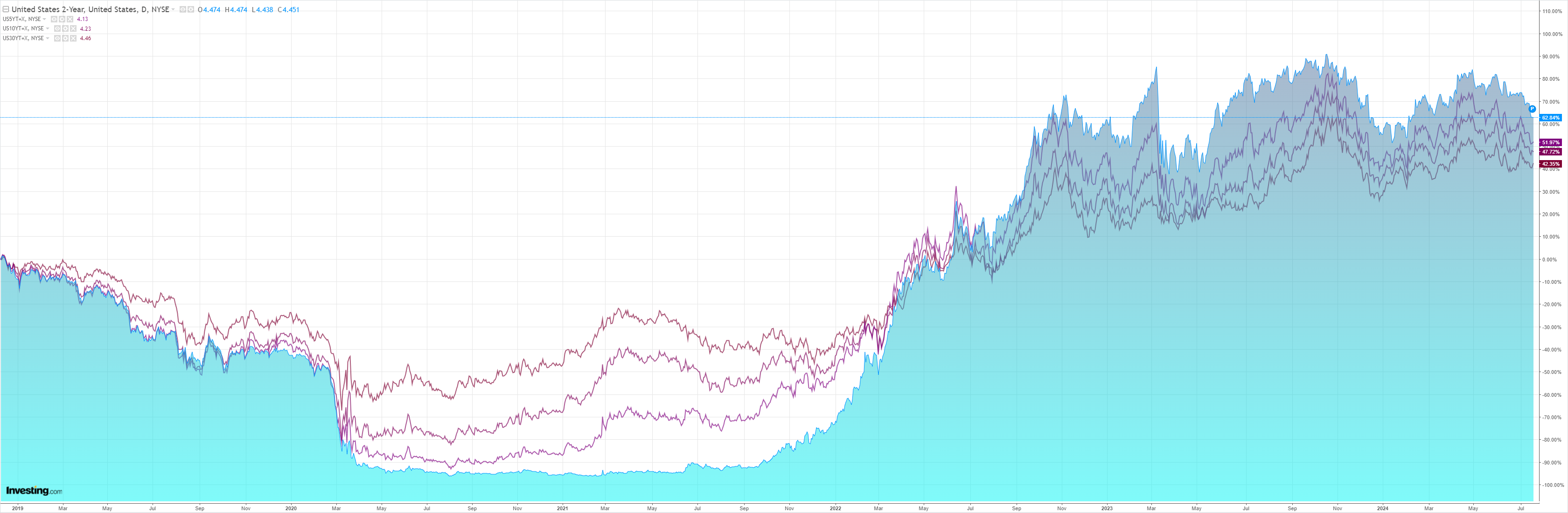

Amid the bull steepening:

Which is aiding stocks:

It still looks to me like AUD can go higher. Fed cuts loom, perhaps as early as July though more likely September. Morgan Stanley (NYSE:MS) wraps it:

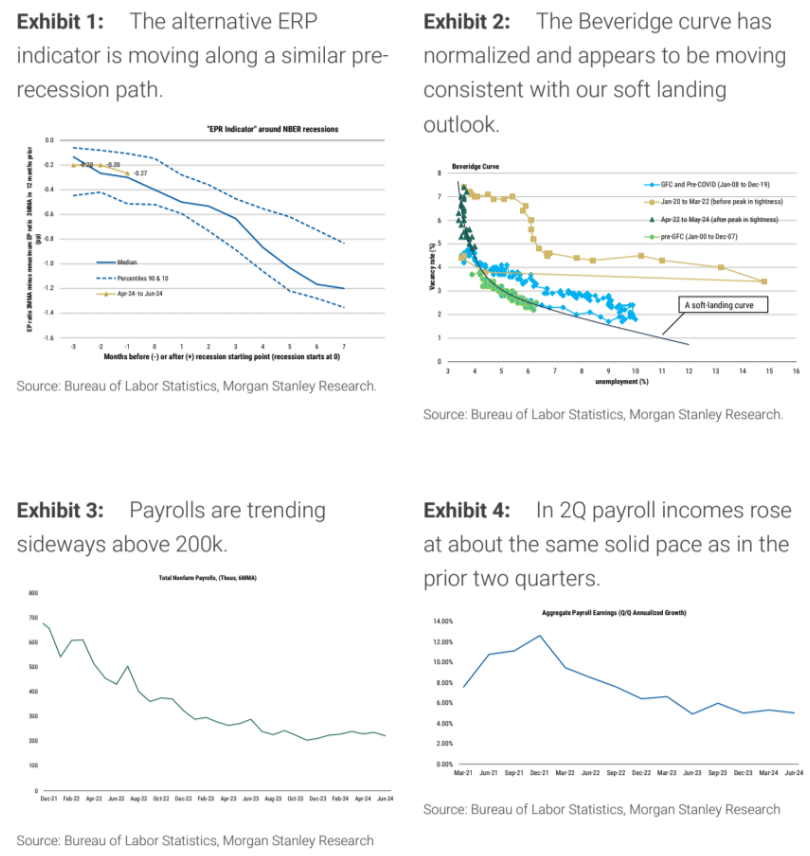

Does the loss of momentum in the economy point to an approaching recession?

It’s a legitimate question given cooling in the labor market and consumer spending this year.

To be sure, GDP growth is tracking half a percentage pointlower than wherewe pegged it in our mid-year outlook.

I see the slowing as orderly, however, and my optimism may be anchored in myconfidence that the Fed will act to support continued expansion.

The reflexivity between monetary policy and financial conditions/the economy matters.

I have written recently about my belief that ChairPowell can dart nimbly around the incoming data.

In testimony this week, he has said as much.

We have long called for three rate cuts this year, starting in September, and market expectations continue to move in that direction.

We’d watch increasing softness in the labor market for a sign that the Fed might accelerate to head off a recession.

That is my view which makes me bullish on AUD in the short term.

However, the Trump election is bearish AUD. His China tariffs will land on an economy ill-prepared for an external shock.

I see a China growth scare cooling off the AUD rally before long.